Cross-Border Payments

"TAM that is so large, it almost does not merit discussion." That's a quote from this beastly Credit Suisse report, and it's out of context. It's never even really true. But I want to get you in the right frame of mind for this post.

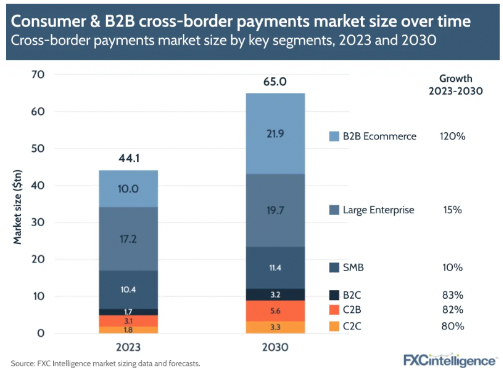

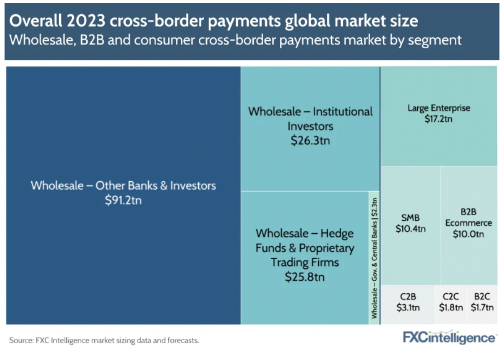

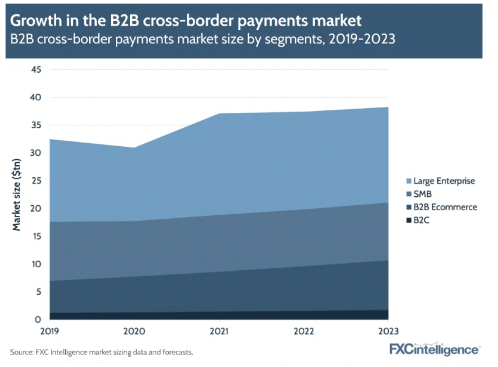

It's big by many different dimensions. Trillions big. FX Intelligence says, "B2B cross-border payments industry is expected to have a market size of $39.3tn for 2023 and grow 43% by 2030 to reach $56.1tn."

The twitter-sea of armchair quarterbacks love to dog on the builders and investors for the manias. They're not completely wrong. But as a builder at heart and newer venture investor, I prefer to highlight successes and areas ripe for innovation. It's rare that an area will fit both. Usually a space becomes so saturated without logical room for new entrants, or everyone races to the bottom as the commoditization phase sets in. But a rare area that fits both are B2B payments, and more specifically, cross border B2B payments. I highlighted a bit of this when touching on Wise and Western Union in my post titled Competitive Advantage, but want to expand below.

There are many ways to slice and dice the breakouts from the last ~20 years, and the opportunities ahead – vertical vs. horizontal, global vs. regional vs. local, software-first vs. payments-first, infra-first vs. app, etc. There's no reason for me to bother because FT Partners crushed that in this B2B Payments report.

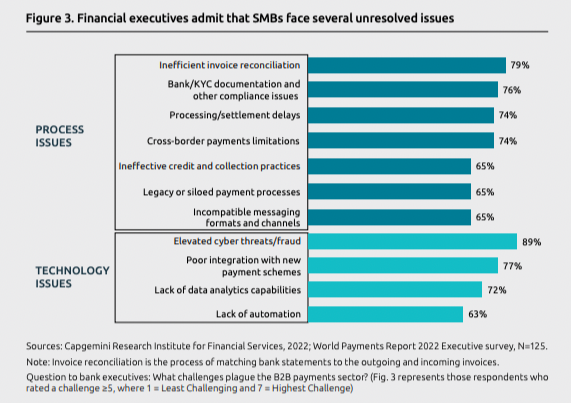

As far as opportunities go, the future is still bright. Better serving SMBs is one particular area with significant room for improvement and growth. This Visa report says, "when it comes to cross-border payments and foreign exchange (FX) – which typically represent 8%-14% of overall bank payments revenue⁴ – small businesses often don’t have the infrastructure in place to process complex payments, making it more difficult for them to handle cross-border payments... B2B cross-border payments are expected to increase by 30%, reaching $35 trillion by 2022." There's no shortage of content expanding on this opportunity, like from BCG, Capgemini, McKinsey, and Finastra.

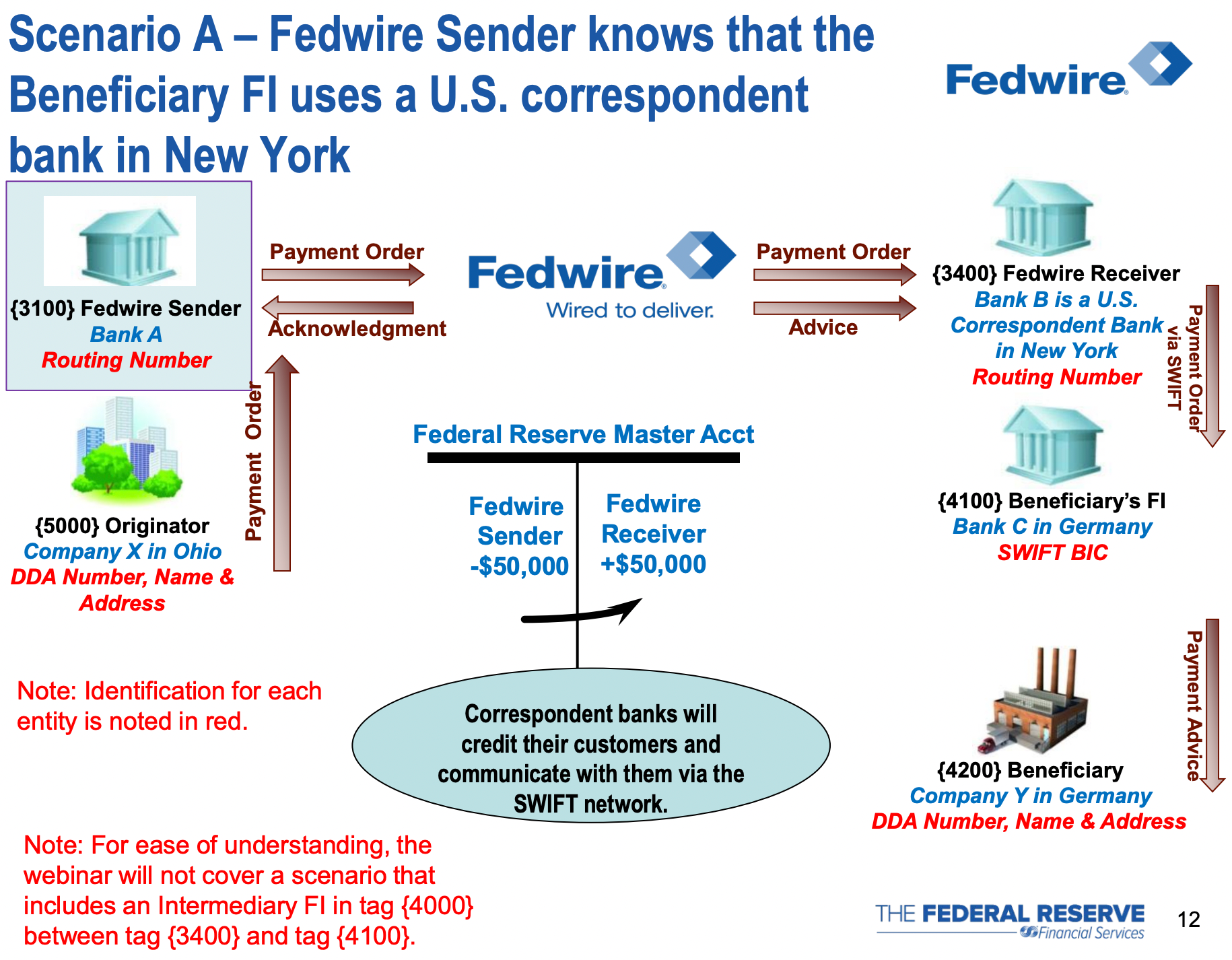

As for wires specifically, SWIFT is an international messaging system to and from financial institutions that basically passes fund transfer instructions (doesn't handle settlement). A real-time gross settlement (RTGS) systems allow individual payments to settle on a transaction-by-transaction basis, with finality. Fedwire is the primary RTGS system in the US. It was implemented in 1918 (in a different form) and is the oldest RTGS system globally. It also has the most participants.

- It settles over one quadrillion dollars each year.

- Averages $4t/day in transfers ($6t+ w/ CHIPS).

- 2004-2021 data sampling suggests average daily payment values fluctuated between $3m-$7m, w/ median daily value closer to $30k.

Fedwire can be accessed by certain entities & member banks eligible for a Fed Reserve Account. FIs often use a combo of SWIFT and Fedwire or CHIPS. For instance, a US FI may get a SWIFT message from a foreign FI, map it to a Fedwire message, and then it gets passed along. Foreign-to-domestic Fedwire transfers are the highest direction by volume, and similar in transaction value to domestic-to-foreign transfers.

And as a small note that I believe will take up more mind share and volume in the future... stablecoin usage has increased in recent years for non-trading related activities, and are less of a percentage than fiat counterparts.

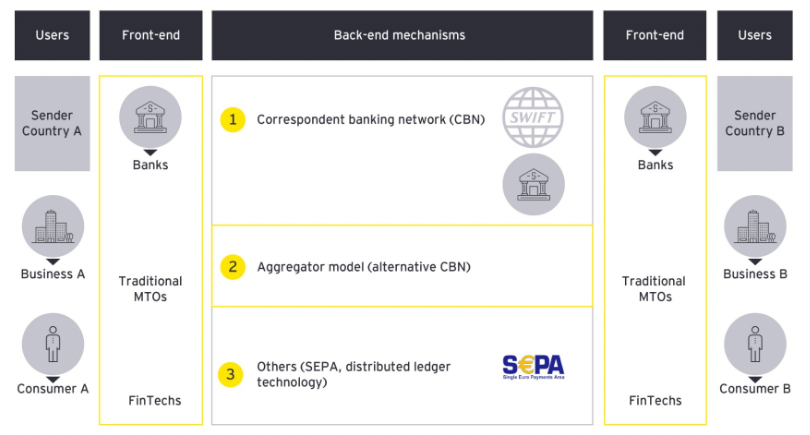

Here are the high level typical structures of a B2B cross-border payment from EY today:

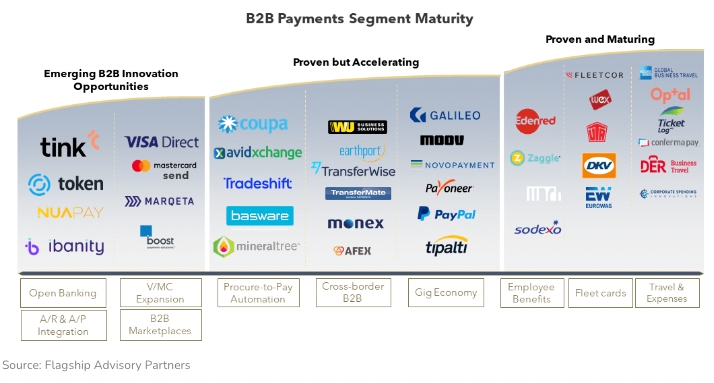

Most structures are filled with inefficiencies. Flagship Advisory highlights the opportunity in this excerpt:

"The vast majority of cross-border B2B payments still flow through traditional correspondent banking, typified by high costs, often slow speeds, and lack of traceability. Fintechs such as Banking Circle and Currencycloud are attacking correspondent banking with new, rapid virtual global payment and account networks. Other fintechs such as TransferMate are focused on developing and distributing end-user propositions for cross-border payment users (in particular innovating the technical toolkit and integration with B2B software platforms). In parallel, fintechs are also addressing the unique needs of the rapidly growing (17.5%*) gig economy (i.e., distributed workforces). The gig economy cannot be well served by traditional banking networks that underserve cross-border needs, particularly for small businesses. Fintechs such as Payoneer and Transpay have introduced a range of easy-to-use and fast propositions for global payments, exploiting new technologies such as virtual cards and Visa/MasterCard original credit transaction (OCT) technologies. Lastly, fintechs have served as a proven ground for automating workflows in the procure to pay processes, addressing inefficiencies in these processes, which tend to be manually intensive. Fintechs such as Tradeshift and Basware offer possibilities to automate the entire procure-to-pay processes by digitizing the interfaces across procurement, ERP, invoicing and reconciliation systems."

There's ample opportunity to disrupt the status quo by disrupting the actual underlying structure.

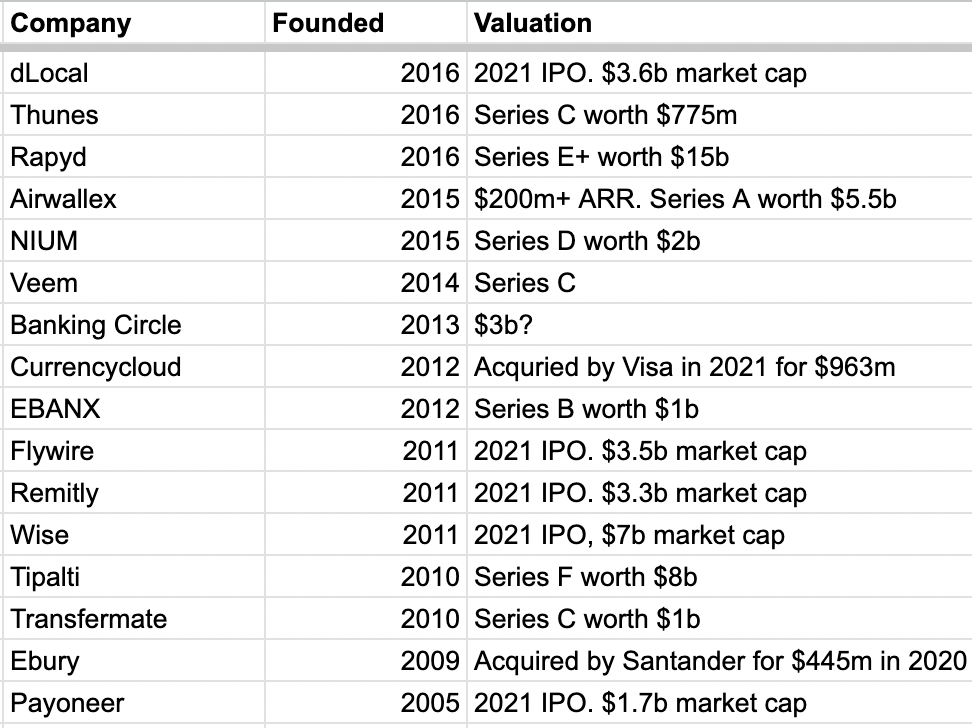

Here's a peek at some of the modern breakouts. Let's congratulate and celebrate them instead of honing in on the failures or hype from fintech and the greater startup ecosystem that so many prefer to focus efforts on.

I stuck with modern, focused companies, obviously excluding actual banks, WU/Convera, Corpay/Fleetcor, OFX, Visa, Mastercard, SAP, etc. FX Intelligence has mapped the full landscape:

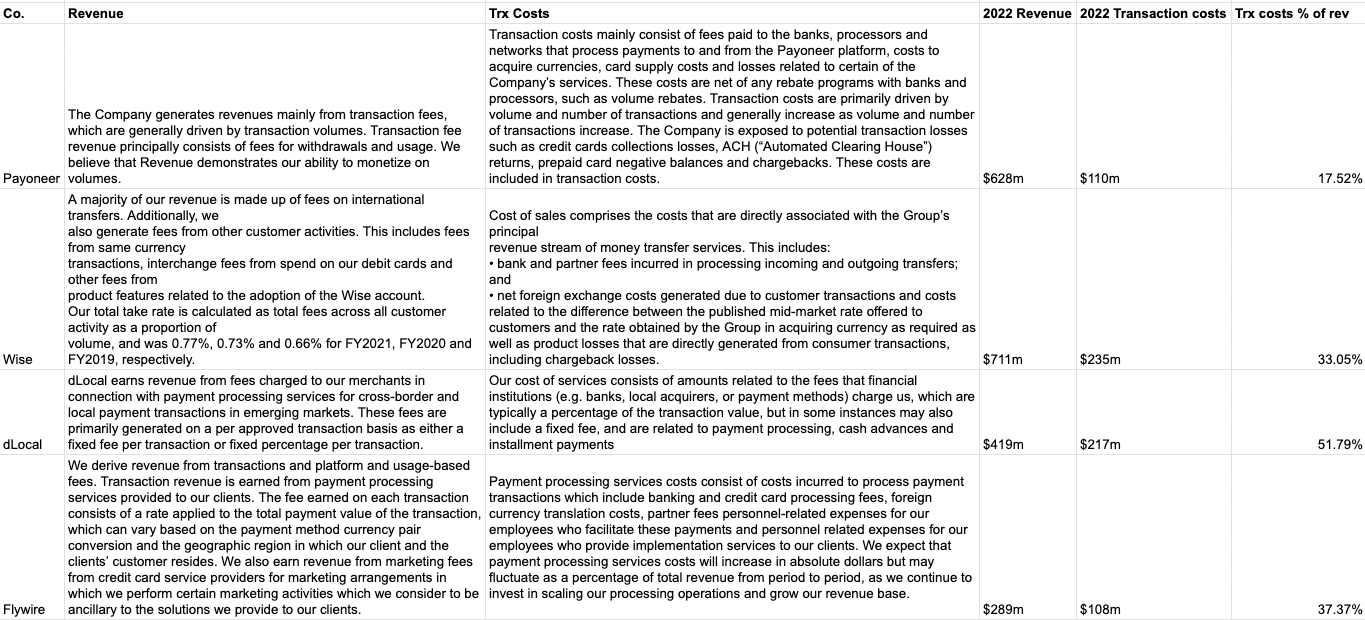

Payoneer, Wise, dLocal, and Flywire

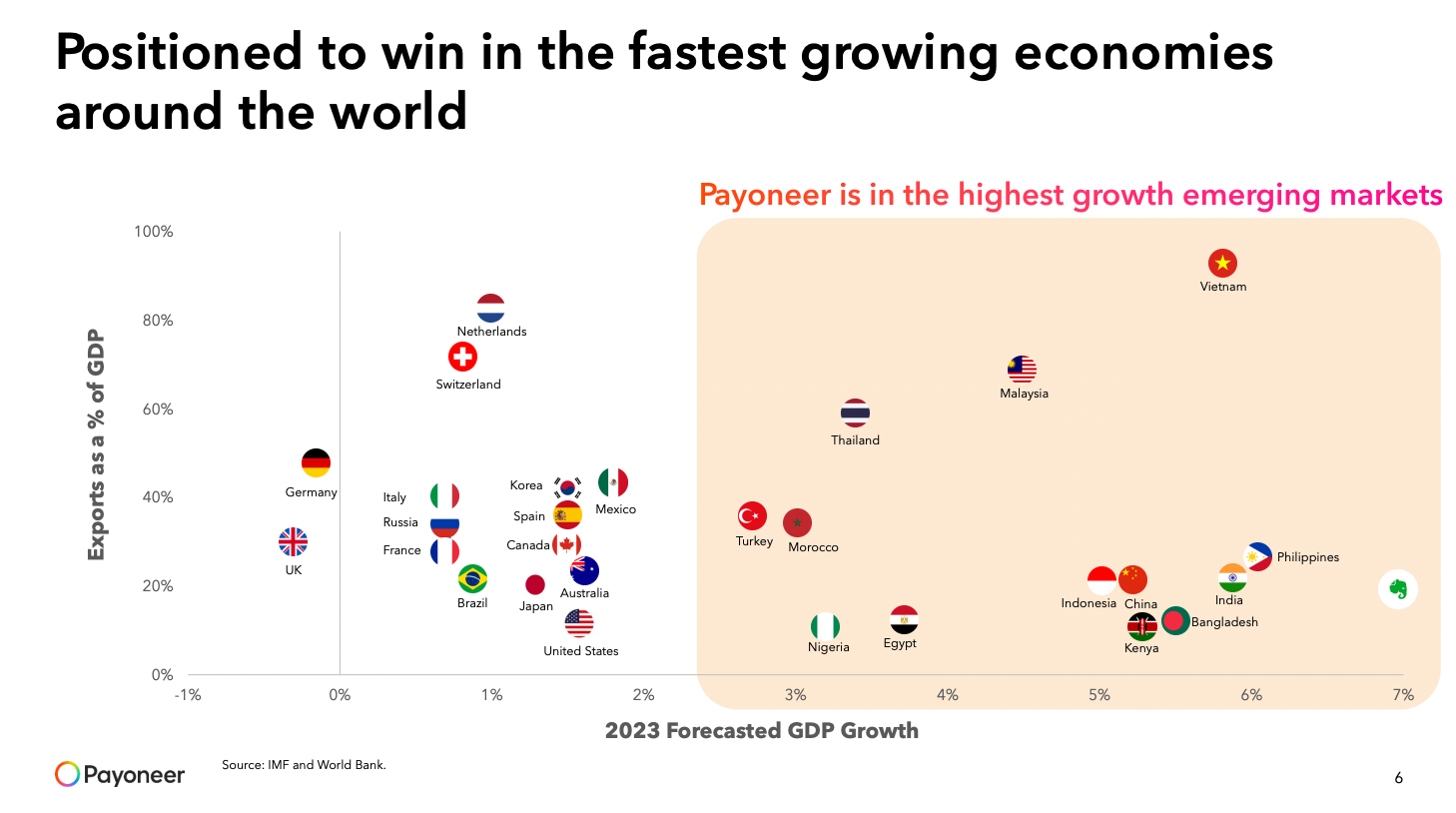

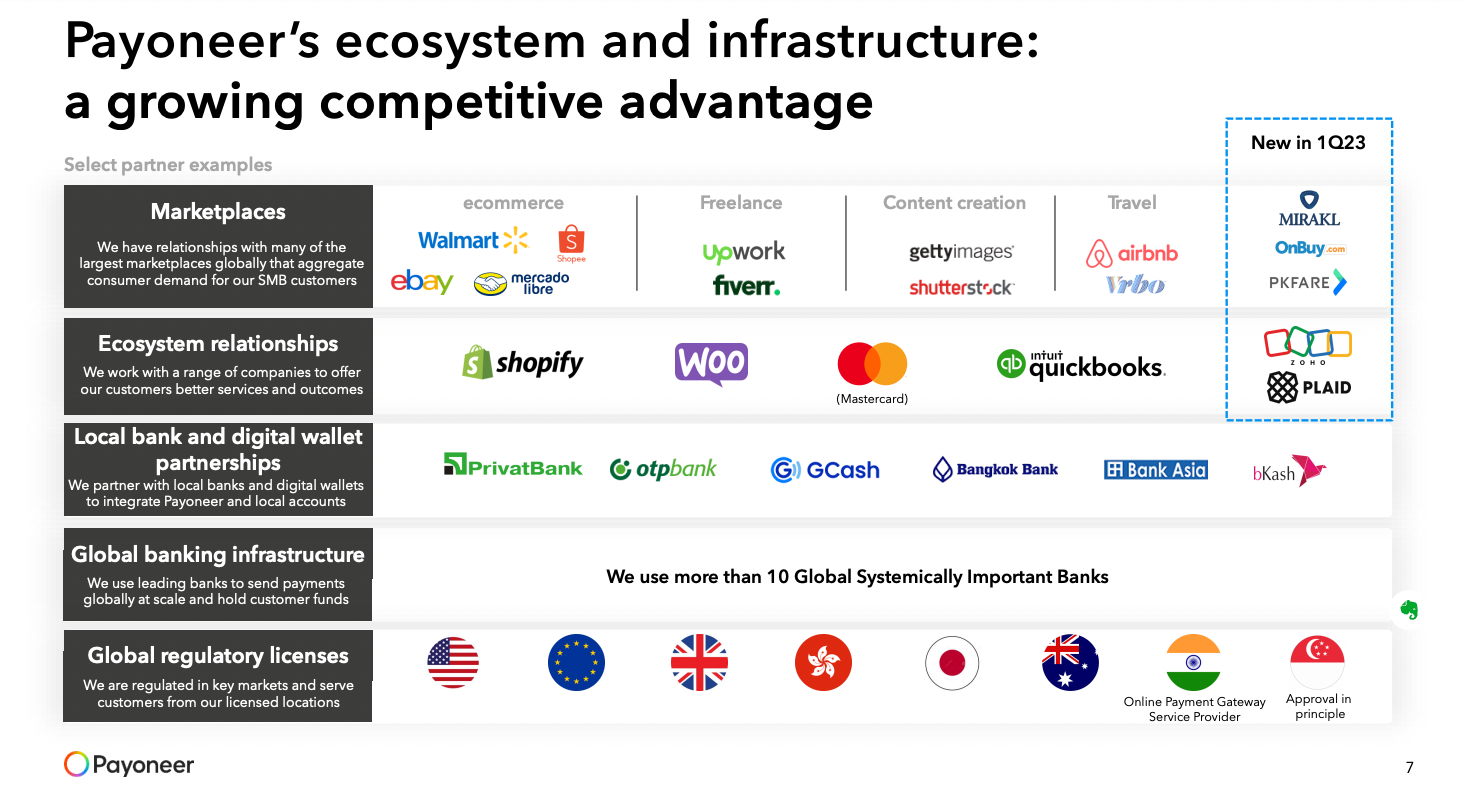

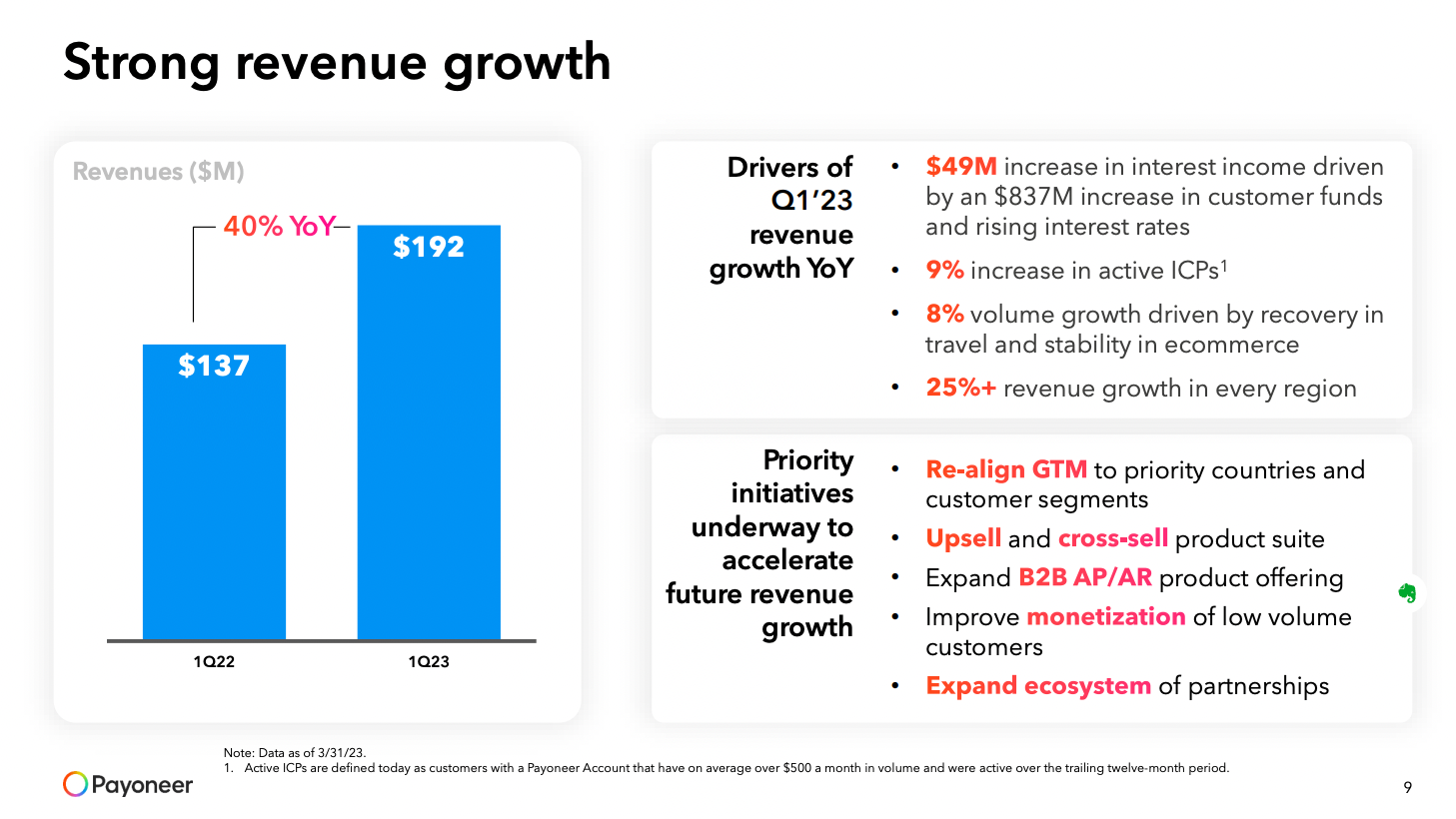

Payoneer

"Our platform enables enterprises to make Mass Payouts to the entire world using a broad set of localized payment methods in addition to be able to pay Payoneer small business customers. We enable our small business customers to get paid from marketplaces and their B2B customers into their Payoneer Global Multi-currency Account. We provide additional services to our customers, focused on helping them manage and grow their business... Cross-border trade (i.e., transactions where the merchant and consumer are in different countries) is an important source of our revenue and profits. Cross-border transactions generally provide higher revenues and operating income than similar transactions that take place within a single country or market."

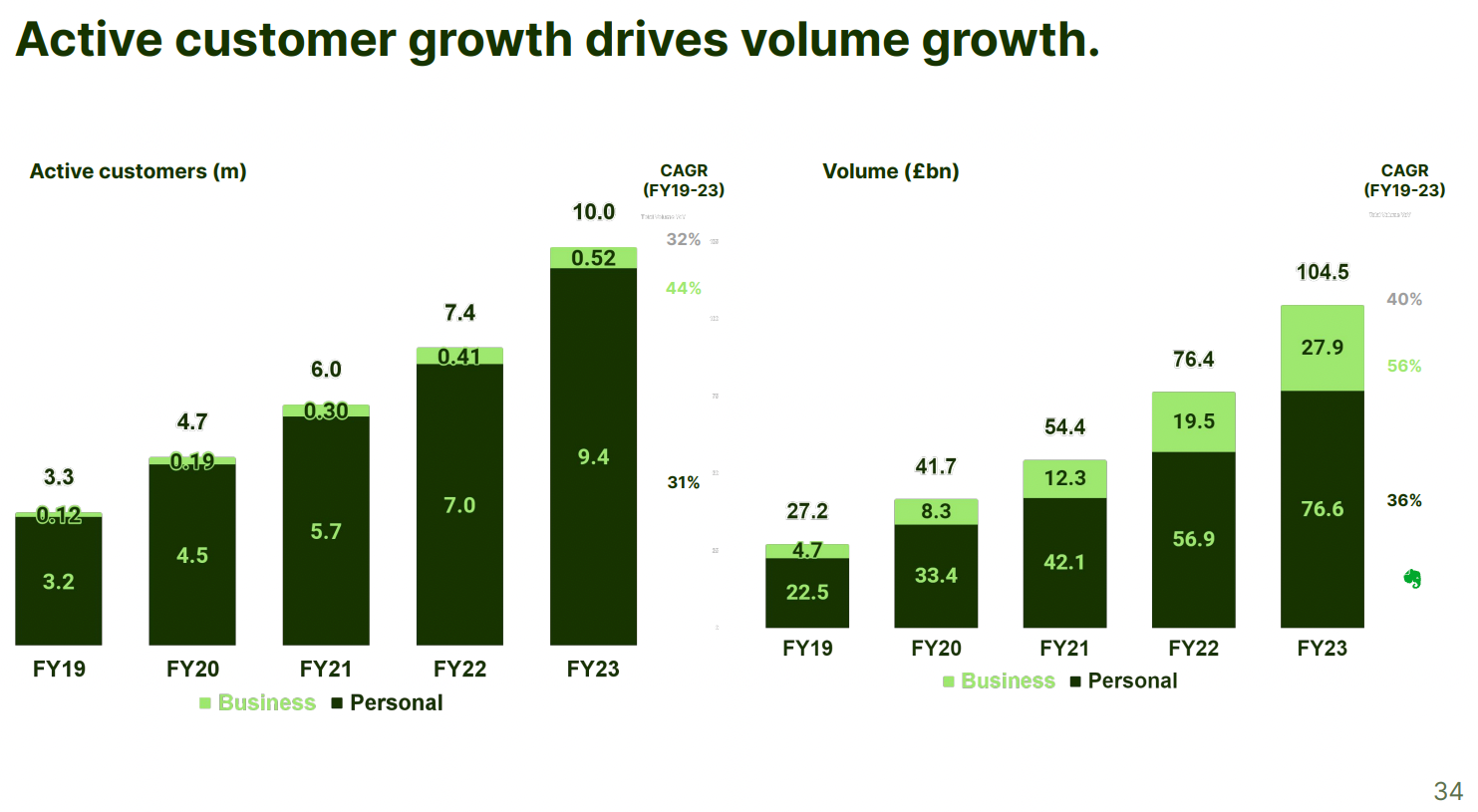

Wise

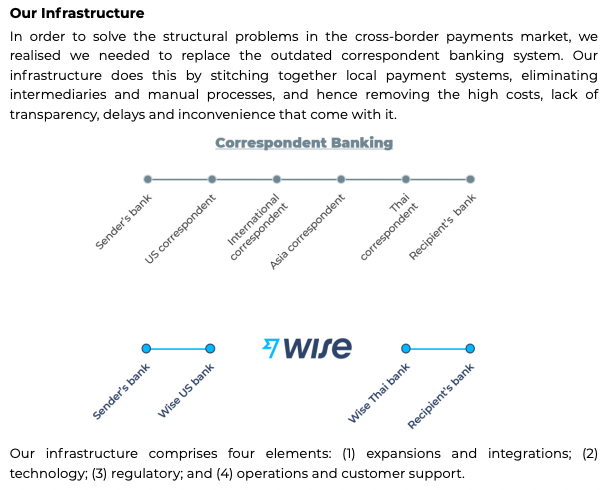

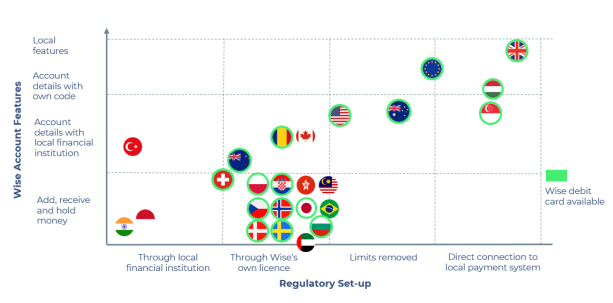

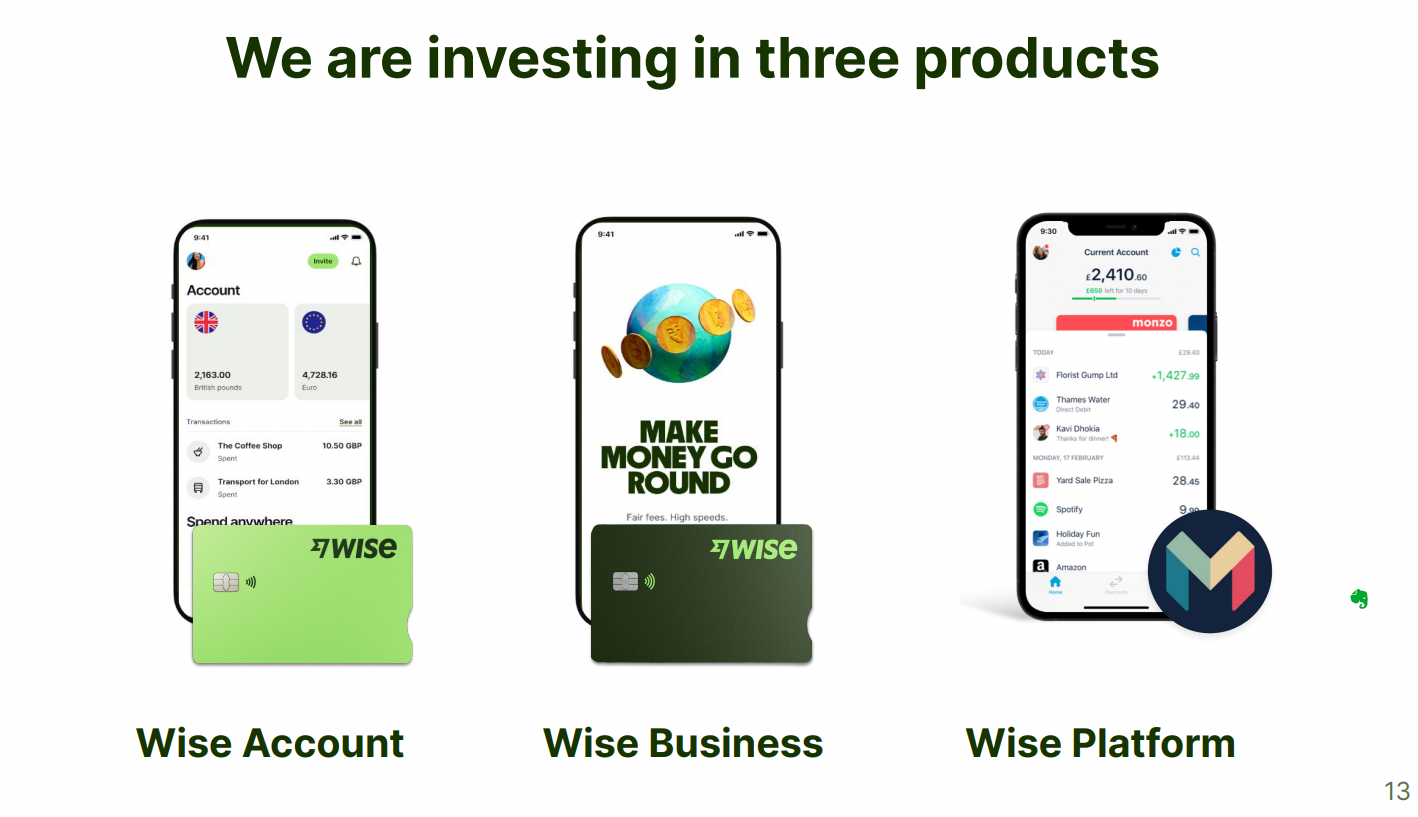

"Over ten years we have developed a network of local bank integrations around the globe that replaces this old, outdated system. Our infrastructure is made up of direct and indirect integrations with local payment systems globally, worldwide regulatory and compliance coverage, payments technology over API and full-service customer support and operations. Combined, this infrastructure solves the main pain points facing our customers:

• Price: Our prices are on average up to eight times cheaper than leading traditional UK banks.

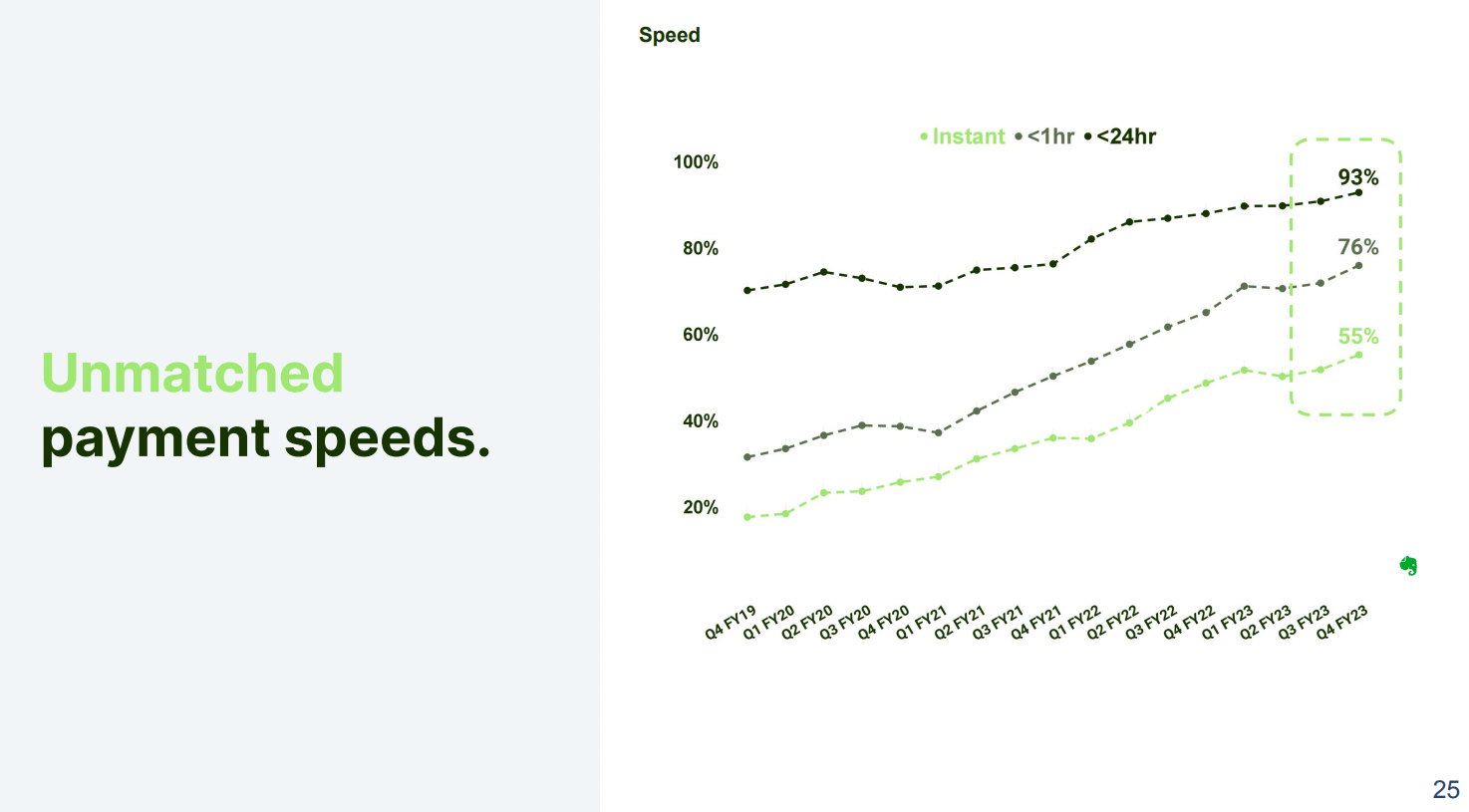

• Speed: Over 38% of transfers are delivered instantly and about 83% in less than a day.

• Convenience: The Wise experience is fast, intuitive and simple.

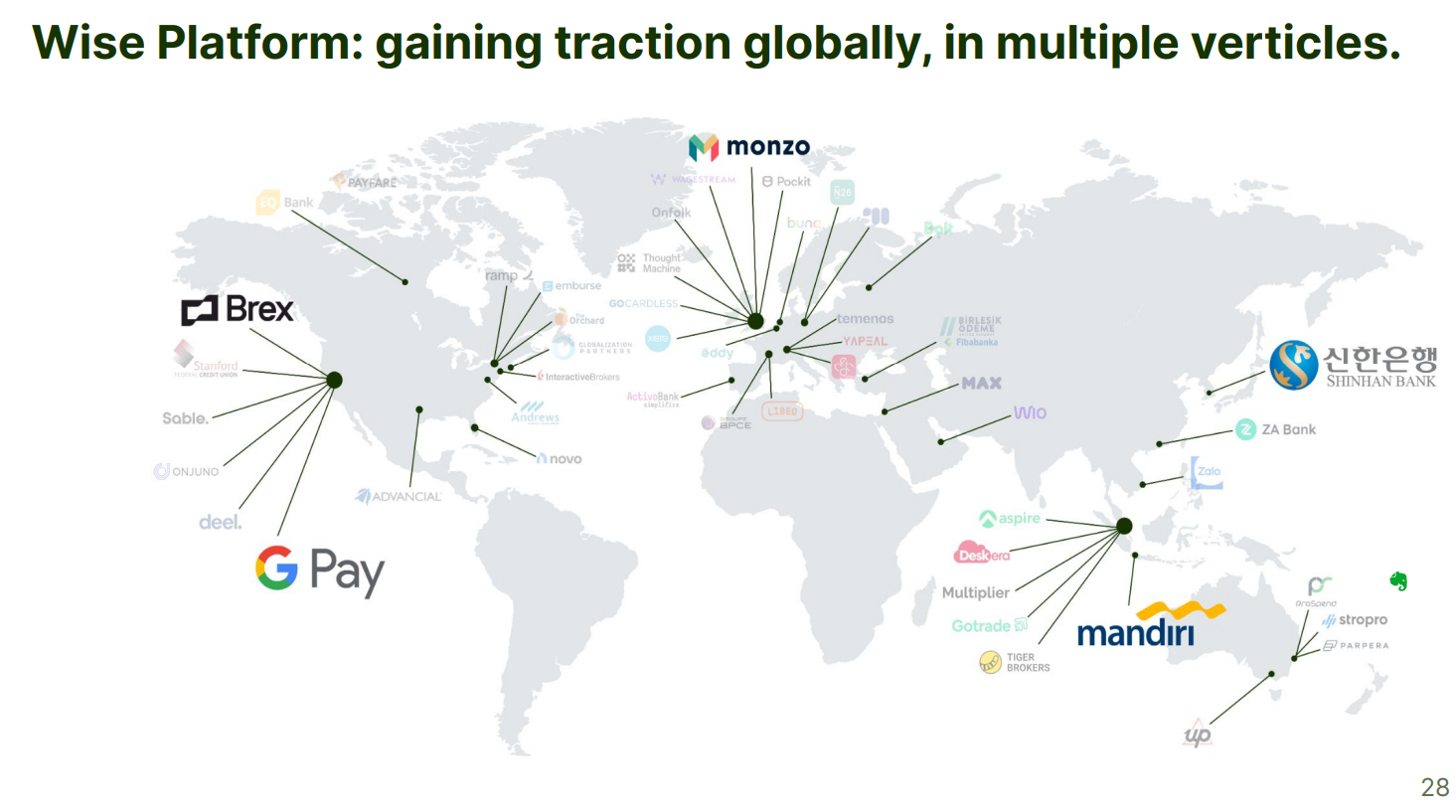

• Transparency: We empower customers with up to the minute price comparison content, and by lobbying governments all over the world to change outdated laws. So, whilst born in 2011 as an international transfer service for people, we have now expanded to become a global cross-border payments network which replaces traditional international banking for ten million personal and business customers. People use Wise to send money across borders, get paid like a local in 30 different countries and spend money in 176 countries around the world. Businesses use Wise to take their businesses global, and operate on an international scale. Banks and enterprises use Wise Platform to pass on the benefits of Wise’s faster, cheaper international transfer service to their own customers."

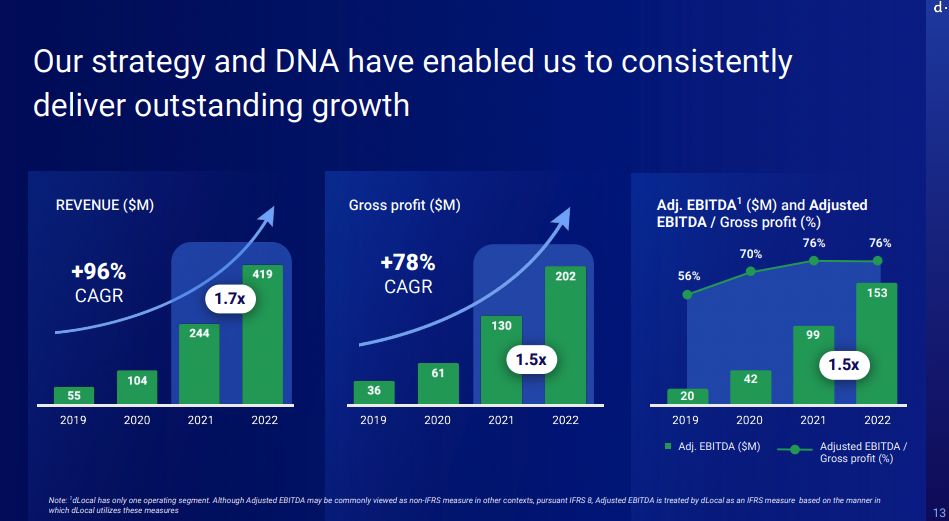

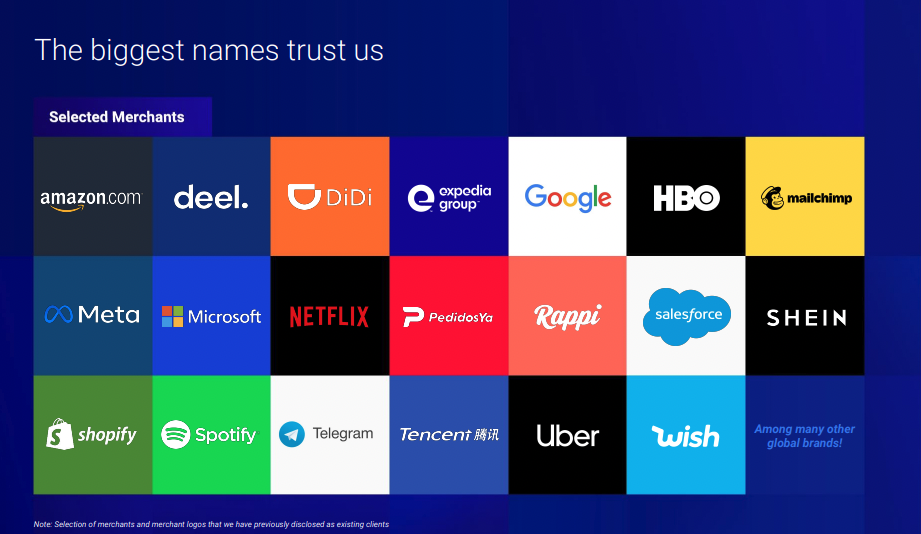

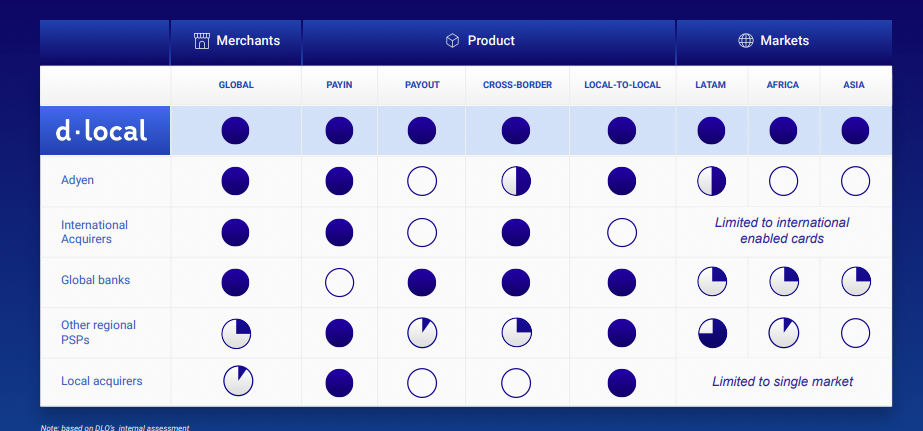

dLocal

"dLocal is focused on making the complex simple, redefining the online payments experience in emerging markets. Through one direct API, one technology platform, and one contract, which we collectively refer to as the One dLocal model, we enable global enterprise merchants to get paid (pay-in) and to make payments (pay-out) online in a safe and efficient manner. Merchants on our platform consistently benefit from improving acceptance and conversion rates, reduced friction, and improved fraud prevention, leading to enhanced potential interaction with nearly 2 billion combined internet users in the countries we serve (excluding China). Our proprietary, fully cloud-based platform has the ability to power both cross-border and local-to-local transactions in 29 countries as of the date of this prospectus (which includes seven new countries where we have recently made our services available but have not yet processed volume). Our solutions are built to be both payment method-agnostic and user friendly. We enable global merchants to connect with over 600 local payment methods (some of which are financial institutions) across our different geographies, thus expanding their addressable markets."

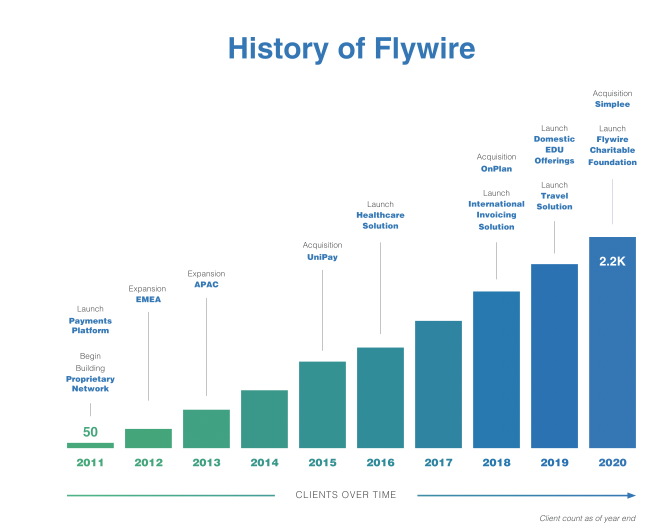

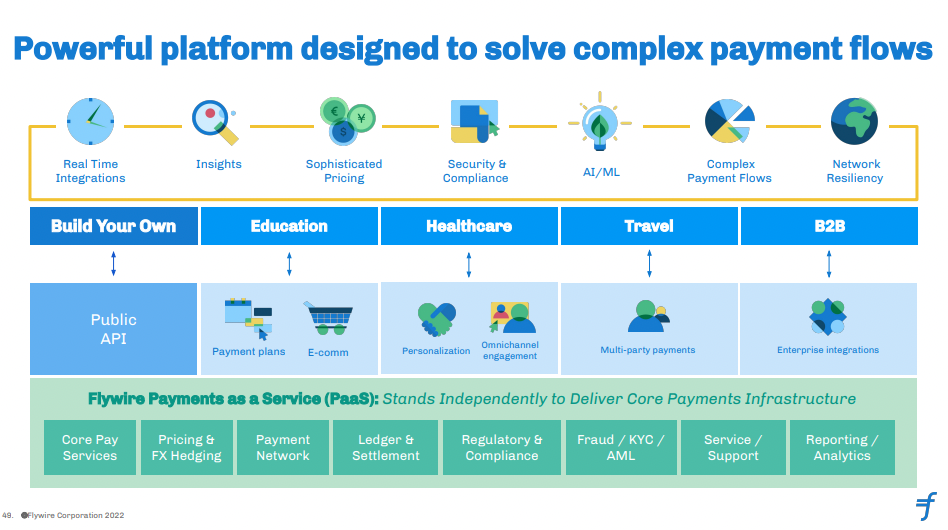

Flywire

"Flywire is a leading global payments enablement and software company. Our next-gen payments platform, proprietary global payment network and vertical-specific software help our clients get paid and help their customers pay with ease—no matter where they are in the world... There have been substantial strides made in payments technology in the retail and e-commerce industries; however, massive sectors of our global economy—including education, healthcare, travel, and business-to-business, or B2B, payments—are still in the early stages of digital transformation. We estimate the annual addressable volume for these sectors alone to be approximately $11.7 trillion... "

These are merely the tip of the iceberg in the massive b2b and cross-border payments space. The immense market size offers an abundant opportunity for those daring enough to dive in, especially in serving the underrepresented SMBs.

Further reading

- Credit Suisse: Payments, Processors, & FinTech

- FTPartners B2B Payments

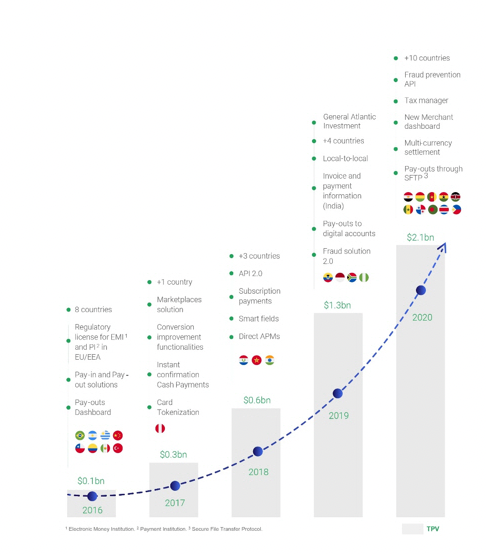

- dLocal 2022 investor report

- dLocal s1

- Wise fy23 investor report

- Wise public co. registration doc

- Payoneer q123 investor report

- Payoneer s1

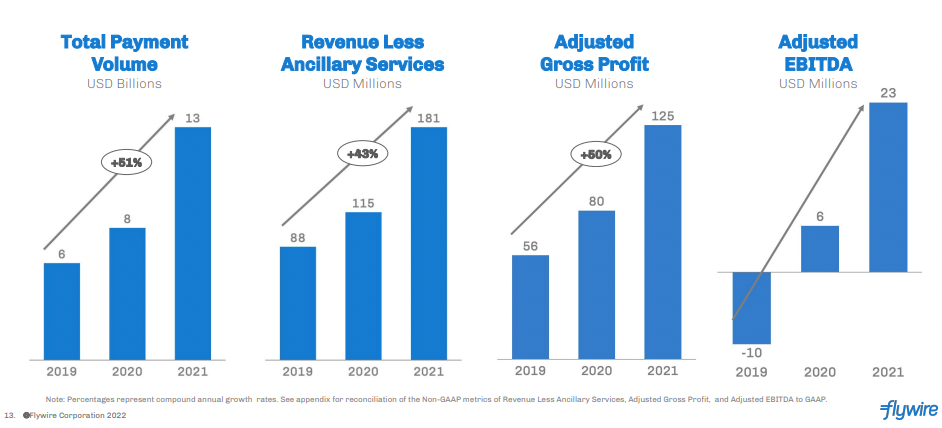

- Flywire 2022 investor report

- Flywire s1

- Remitly q123 investor report

- Remitly s1

- FX Intelligence: How big is the B2B cross-border payments market? 2030’s $56tn TAM

- FX Intelligence: Cross-border payments 100 market map

- Visa: Small business, big cross-border opportunity

- EY: How new entrants are redefining cross-border payments

- Finastra: Connected Corporate Banking

- Flagship Advisory: B2b payments a greenfield for fintech

- McKinsey: How transaction banking works

- BCG: Global payments 2021

- Capgemini: Paymens 2022, winning with SMBs

- Fedwire stats

- Fedwire funds service international wires

- Global trends in large value payments

- Circle stablecoin report