Personal Finance Kick

My sole purpose with this post is to provide transparency into how I’ve saved money. My goal is to help my peers realize why and how they should start saving ASAP. At a minimum, read some of the material I recommend. This is not a ‘how-to’ guide. This should serve as an example and a motivator.

If you don’t feel like reading this in its entirety then just read this and fund an account with Wealthfront.

PHASE 1: GET STARTED

I began interning for Bill Me Later while attending Loyola College in Maryland as a full time student during my sophomore year. I was working about 30 hours a week while attending school full time. I wasn’t making that much money but it wasn’t too little.

My Actions:

- Cashed each of my paychecks and spent the money during the weekends and on housing utilities.

Advice: If you’re still in college, get an internship. It was one of the most impactful decisions of my life. Also, don’t spend every dollar you make just because you aren’t sure what else to do with it.

PHASE 2: EVOLVE

I transitioned to a part time employee during my senior year after we were acquired by eBay/PayPal because I was working enough hours. This enabled me to take advantage of tuition reimbursement among other benefits. I also started making a little more money. At this point, I felt a desire to become financially responsible and knew I couldn’t keep cashing and spending my paychecks.

My Actions:

- Opened a Mint account to understand how much I was earning and spending, and what I was spending on.

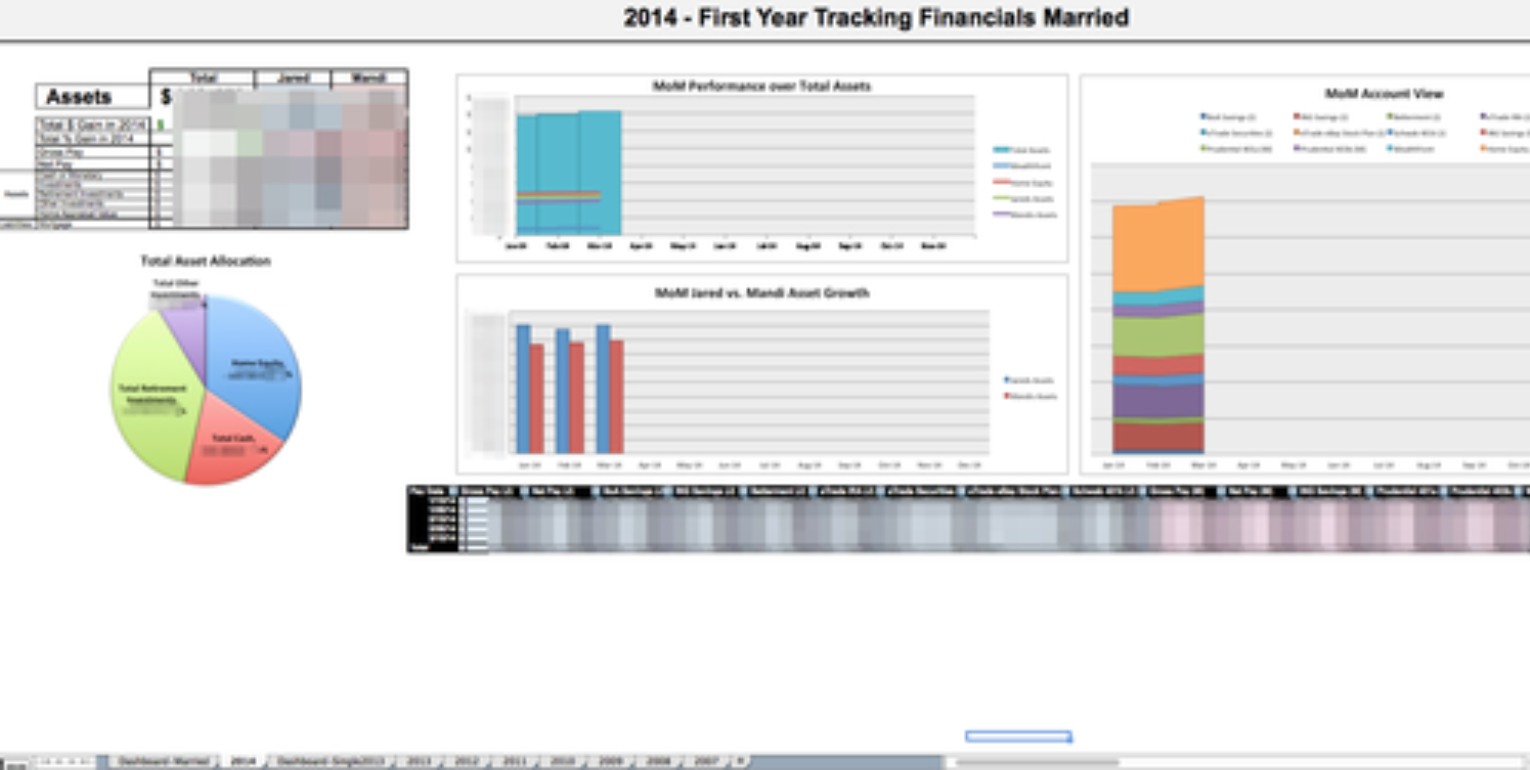

- Created a spreadsheet to track my financial situation, updating it every single paycheck, which I still do to this day.

- Read the book, I will Teach You To Be Rich. It’s super easy to read and super informative. Teaches you about choosing credit cards, bank accounts, investment accounts, budgeting, and saving automation.

- Bought some mutual funds through a financial advisor, paying 1% annually for his services.

- Started contributing to my 401k (account with Charles Schwab).

- Opened an ING Savings Account which was paying ~2% interest at the time.

- Got the Bank Of America Visa World Points credit card and negotiated a lower interest rate and higher credit limit.

Advice: Open a Mint account if you can’t easily state how much you make on average and how much you spend. If you don’t have a credit card or understand how to choose a good one and even lower your interest rates, or have a checking account, or a savings account, or investment accounts (taxable and retirement), then read I will Teach You To Be Rich because it’ll take you one night and will be the best $14 you ever spent. It should be required reading in high school. At a minimum, always contribute the amount that your company matches on your 401k.

PHASE 3: GROW UP

I graduated in the summer of 2009 and transitioned into a full-time employee with Bill Me Later/PayPal. Not much changed besides the amount of money I was making considering I was already contributing to my 401k, adding to my savings account, and paying off my credit cards (all thanks to the book I had read a few months earlier). I saved as much as possible that year so I could try to buy a house at the end of 2010 at 23 years old.

My Actions:

- Terminated relationship with financial advisor and moved my mutual funds into an eTrade brokerage account to manage on my own.

- Bought my first house. Got a great deal on a foreclosure and went with a 5/1 arm.

- Got the American Express Starwood Preferred Guest credit card.

Advice: Buying a house was one of the best financial decisions I ever made, considering it appraised 3 years later for 25% more. I wouldn’t have been able to do this if I didn’t save in the prior year, or if I lived in many other cities besides Baltimore. Living in Baltimore was a conscious decision that has played a big role in my ability to save money. And no, it’s not as bad as The Wire (best show of all time) makes it out to be. Now I’m better prepared to live in more expensive cities when the time comes. When you’re our age, buy a house that you can easily afford in a desirable area.

PHASE 4: STRATEGIZE

2013 was the year I decided to take a bigger interest in my finances by defining a savings and investment strategy. This required me to do some research to develop an understanding of some theories, some history, and to search for people I want to be like and emulate.

My Actions:

- Got married (not really going to help you but it certainly impacts your personal finances in one way or another).

- Refinanced my home with Quicken Loans (who was fantastic to work with).

- Read the book, A Random Walk Down Wall Street by Burton Malkiel who is also the Chief Investment Officer at Wealthfront.

- Read the book, The Elements of Investing by Burton Malkiel and Charles Ellis.

- Read the book, The Four Pillars of Investing, by William Bernstein.

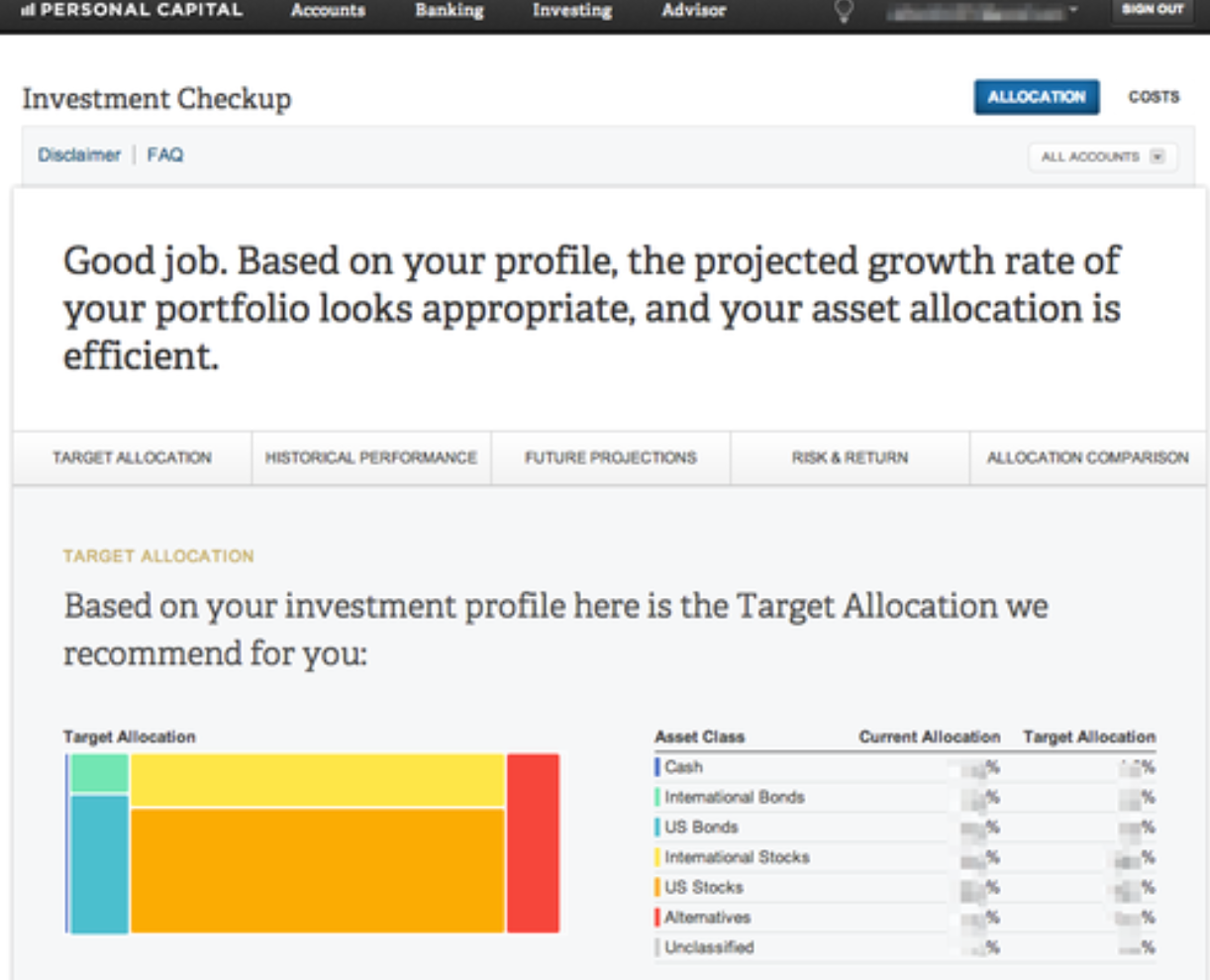

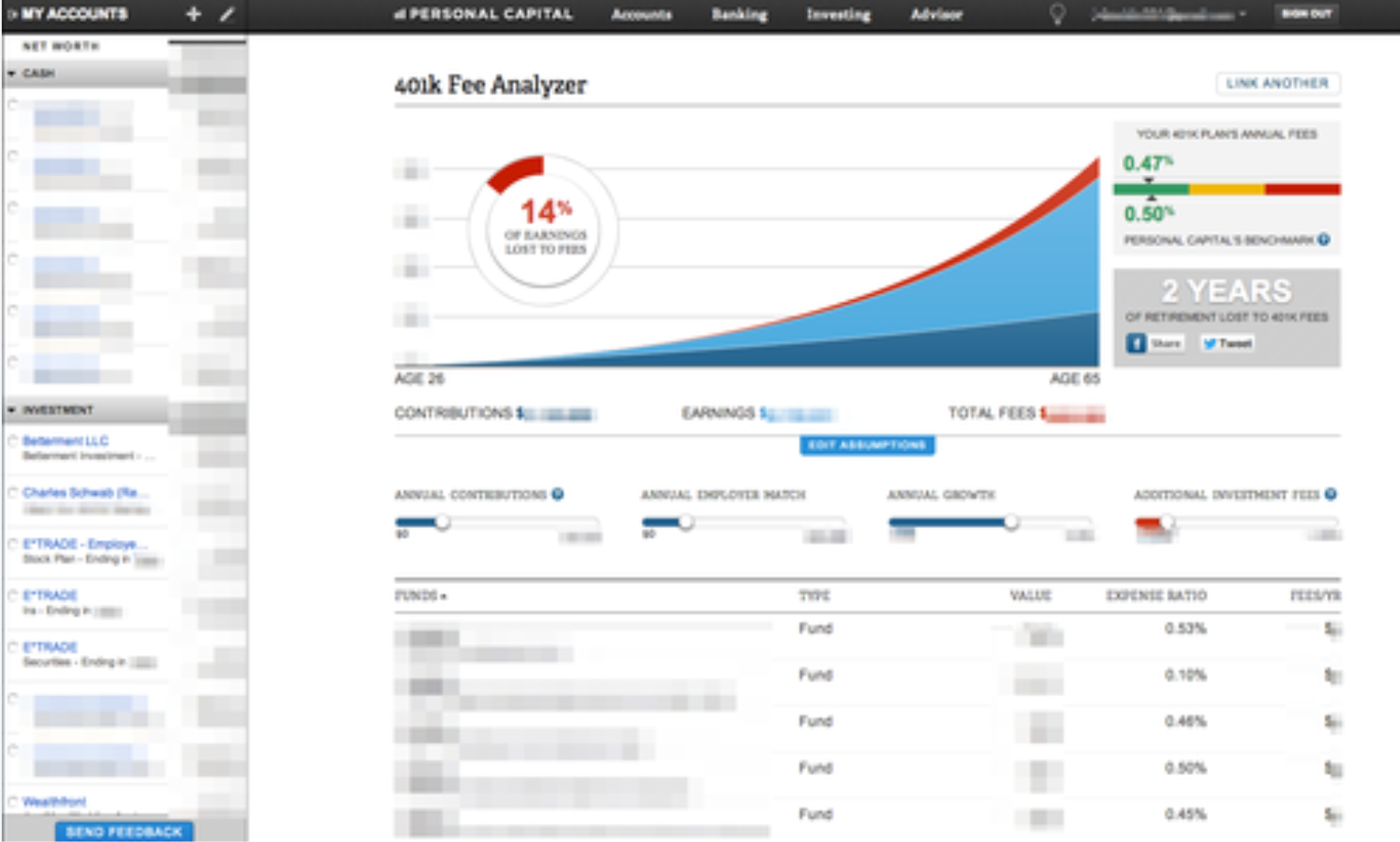

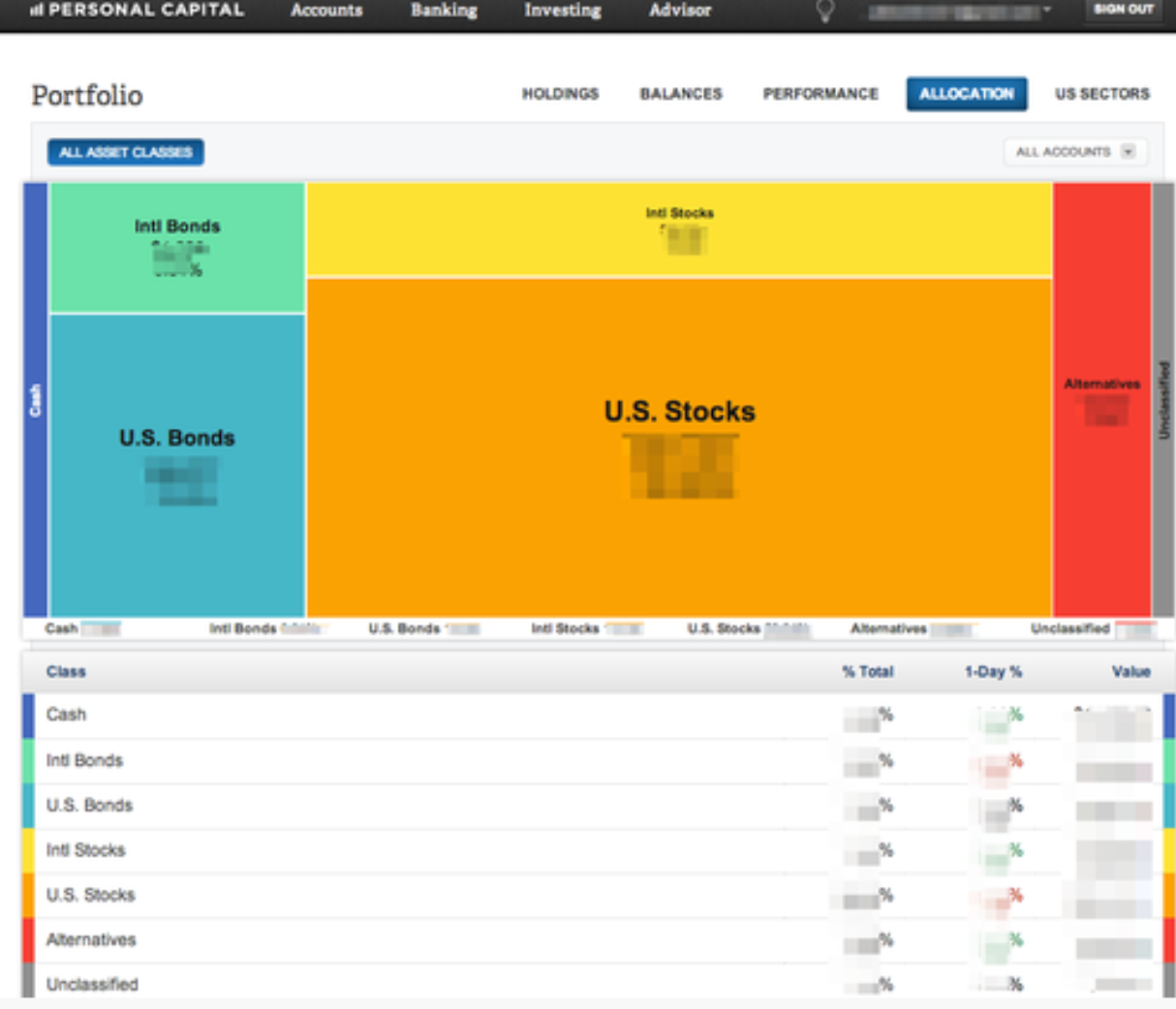

- Connected my accounts (and my wifes) to Personal Capital to help me understand what expenses are associated with funds I’m invested in, and how many years of retirement I could be wasting. Does a great job of showing our entire portfolio.

- Updated my spreadsheet that I started in 2007 and have updated every pay period since then to include my wifes assets as well so we can track past earnings and forecast going forward.

- Opened a taxable investment account with Wealthfront. I’ve become a huge fan of the product but more-so of the company.

- Opened a taxable investment account with Betterment. I primarily opened this because I wasn’t sure if I was ready to invest the $5,000 minimum with WF. Since then though, I’ve begun to send more WF’s way and will continue to do so going forward. If you can’t afford the $5k minimum for WF then this is a good alternative.

- Got the United Mileage Plus Explorer credit card.

- Combed through our existing allocation settings in all of our retirement accounts and reallocated based on what I think is best for us, and focused on reducing or eliminating funds with high expenses, diversifying, thinking about retirement goals, and enhancing our savings strategy.

Advice: Read any of the three books in my first few bullets of this phase. I highly recommend A Random Walk Down Wall Street but if you hate reading, you can go with the shorter book, The Elements of Investing. Then, go to Wealthfront and start following their blog. Follow some of their employees or COO, Adam Nash, on Twitter or Quora. Finally, fund your Wealthfront account and start adding to it monthly. But be sure not to pull out when the market dips; that’s the time to keep investing.

Some screen shots for those who need visual stimulation…

Final Words

Someone much smarter than me said, “Humans are emotional, and markets can shift frequently and unpredictably. Most individuals underperform the market by 3-4%, and most of that is market timing errors – buying when the market is high, and selling when it’s low. The right answer is to not let your emotions get the best of you. Invest as much as you can, regularly, and without fail. Never defer saving due to market timing. If you are young, time is on your side.” That’s similar to what Burton Malkiel expresses in his book as well as the theory behind Wealthfront.

It makes total sense and that’s why I’m such a fan of the company’s mission and I believe they’re staffing properly to execute against it. So much so that I’m trusting them to help grow a percentage of my savings. The comfort and ease of setting it and forgetting it is why I think it’s a good lot for you to park your money if you’re new to this world as well.

Bonus

Not related to saving but some of my other favorite financial services include BillGuard for keeping safe, PayPal for easy check out and alternative credit, Venmo for sending and receiving with friends, WEPay which we used for wedding gifts, Credit Karma for staying on top of my credit reports, and Shopify for easily creating and running storefronts.

*Data in the screen shots of my spreadsheets are just examples. They don’t include real personal data.

*My views are my own and are in no way related to those of my employer, PayPal or eBay.

UPDATE (11/6/14) – Add the book ’Stop Acting Rich: …and Start Living like a Real Millionaire’ to your reading list. Read it before you buy a house or your next car. You don’t accumulate wealth by earning more; you do it by saving more. Learn that most people who drive BMW’s and live in $1mil+ homes don’t actually have a million in net worth. They’re pretending. 3x more millionaires live in <$400k homes than $1mil+homes and more drive Toyotas than BMW’s. The price of your house and the neighborhood you choose will dictate your lifestyle. It’s the most important financial decision you’ll ever make.