Insurtech areas of interest

It's a shockingly exciting time in the world of insurance. Like many sectors, COVID-19 was a digital transformation accelerator for the industry. Many insurers stepped up to the plate and faced the unprecedented challenges posed by the pandemic.

Insurance is big business. About $7t in gross written premium was generated in 2022, with estimates of at least $80t in cumulative global spending on insurance over the next decade by consumers and businesses.

Given insurance's critical role in society and the economy, innovation momentum through the next decade is paramount. As we advance, we think there will be a focus by insurers to:

- Prioritize customer centricity.

- Reduce operational costs.

- Improve operational efficiency.

- Prioritize prevention.

Costanoa investments

Costanoa Ventures has been excited about insurtech for a while. Spearheaded by our partner Mark Selcow, we've led or co-led several early-stage investments. Most of our investment activity focuses on infrastructure. A few of our portfolio companies include:

- Glow – Business insurance for SMBs; first product is Workers Compensation sold directly to businesses.

- Noyo – Data infrastructure for insurance, with an initial focus on distribution and enrollment. Noyo enables accurate and fast enrollment and a data platform for core activities including billing.

- Lively – Innovative benefits products, with an industry leading HSA at the center. Lively helps employers and individuals manage health expenses, improving financial outcomes.

- Shore – Reinsurance platform to help new insurance products come to market faster, and investors gain access to the hard to reach insurance category.

- Assured – P&C Claims automation and analytics platform. Enables adjusters to resolve claims faster and a better policyholder experience.

- Liferaft – A software-based Health & Life Insurance company, helping employers get affordable, customized coverage to their budget and needs.

Areas of interest

The rest of this post will highlight some of our areas of interest. They include:

- Parametric

- Embedding

- Personalization

- Categories of Risk:

- Climate

- Cyber

- Crypto

- Commercial

Parametric

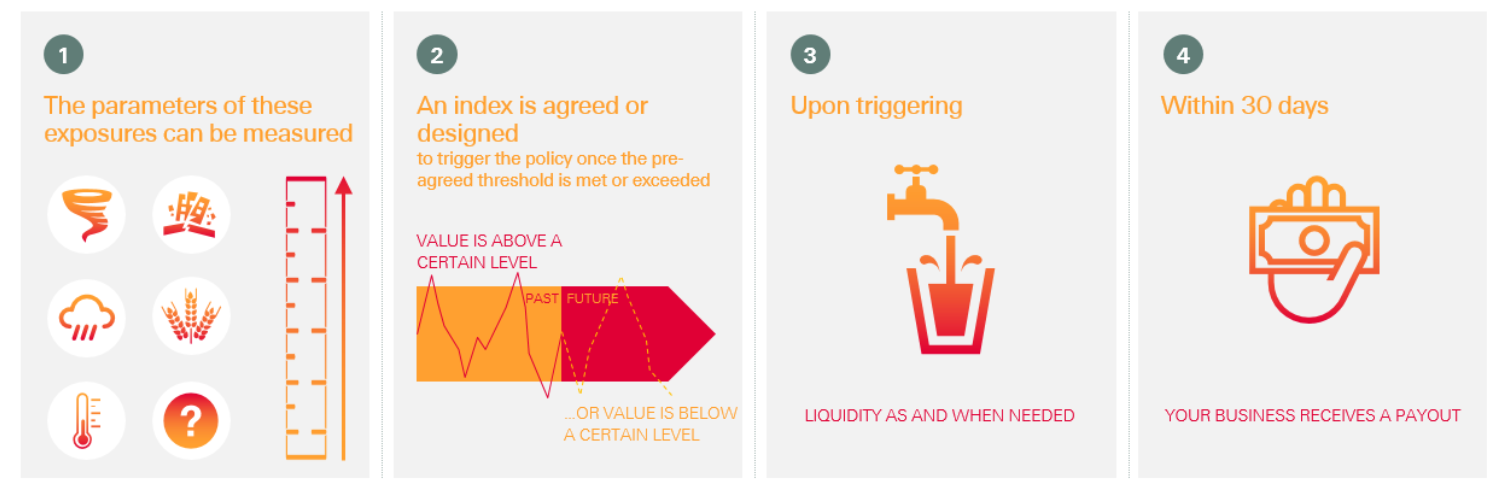

With traditional insurance products, customers typically pay a premium in return for a promise to cover losses from an incident. Payment is made sometime after an investigation, loss assessment is completed, and the amount is intended to make the policyholder whole again. Parametric insurance is simpler, despite the name.

It's a transparent solution where the payable amount is pre-calculated, and payment is sent immediately following a triggering event, regardless of any physical loss is incurred. Weather events (certain magnitude of earthquake or flood, temperature, snowfall, wind speed, etc.) are the most prominent triggers. It can and will continue to be used for many other applications – for example, pandemics, power plant outages, cyber attacks, and regulatory decisions. The parameters or index must be objective and independently verifiable. Popular indexes include the US Geological Survey earthquake magnitude and Singapore National Environmental Agency Pollutant Standard Index.

Parametric insurance is a useful tool for insurers because it reduces claim management costs, and is useful for policyholders because it:

- Is highly customized.

- Provides immediate payouts.

- Complements traditional insurance policies, filling gaps and exclusions.

- Is transparent and confidence-inspiring, removing the need for a long, uncertain investigation. There's far less fine-print.

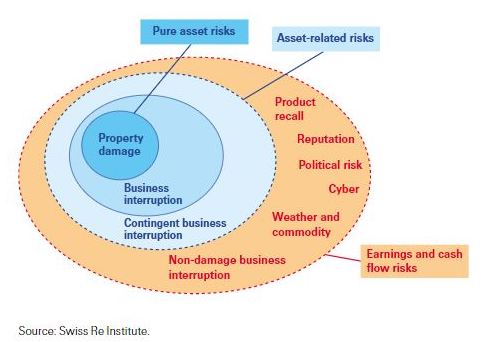

Non-physical damage business interruption

A really interesting and valuable application of parametric insurance is for NDBI (non-physical damage business interruption). Let's highlight a few examples.

- A kink in a supply chain at a 3rd party is disrupted due to a weather event, disrupting a business that didn't experience any direct physical damage.

- A destination with a beach or golf course becomes less attractive due to a storm, impacting the businesses that would have benefited from the visitors had they not canceled their trip (even if the storm didn't damage their property).

- A retail store loses sales due to a pandemic (often excluded in most BOP).

- A convenience store is robbed (also often excluded under certain conditions such as if it takes place during riots).

- A pharmaceutical company facing losses because a supplier halts production following a regulatory shutdown by the FDA.

Looking ahead

Climate change and digitization are two long-term trends that create a unique set of challenges in the future. Thankfully, challenges create opportunities. Companies must be armed with alternative approaches to traditional underwriting and coverage. Parametric insurance is flexible and precise, remaining a massive opportunity over the next decade.

We're excited to invest in enablers of parametric insurance for applications like NDBI and beyond. Here are some of the things piquing our interest:

- Solutions to push the boundaries of what's coverable (such as within income loss), helping accelerate the creation of new indexes to broaden applicability.

- Automation to streamline claims, monitor triggers, confirm triggers, and handle payouts.

- Sensors and satellite imagery to collect real-time data and associated infrastructure to make it usable, observable, and insightful.

- Programmatic creation and underwriting enablers to increase awareness, availability, and personalization of parametric insurance to buyers. And so it can be distributed through embedded channels as a hybrid policy along with traditional insurance, making parametric a common feature in the future vs. a stand-alone product.

- Tools to reduce basis risk, so payouts correspond as closely as possible to the loss sustained. This could be technology and procedures for deploying things like flood sensors. It could also be dynamic pricing and mechanisms to monitor potential losses to decrease the risk of over or underpayment.

Embedded and Personalized Infrastructure Enablers

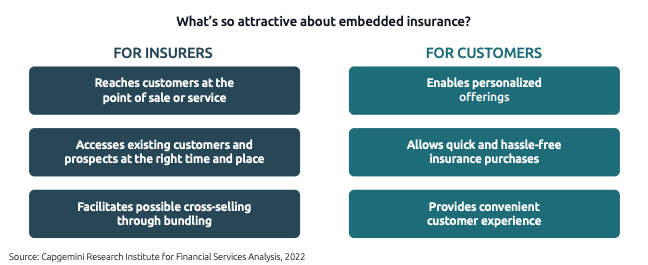

The word "traditional" comes up a lot in insurance. You'll often hear things described as the traditional way of distributing or as being a traditional product. Traditionally, insurance is largely distributed through agents and brokers, often involving face-to-face meetings. It's paperwork-heavy, impersonal, inflexible, and sometimes described as unfair. But digitization and mobile have accustomed us to instantaneous, personalized experiences – especially for younger generations. And we love holistic shopping experiences and one-stop shops. Through embedding and personalizing, insurers can improve their operational efficiency and customer experiences by going beyond risk-transfer obligations.

While embedded insurance isn't a new concept (or one that lived up to its hype over the last 5 years), we still think it's a massive opportunity. Big tech and product manufacturers have recently begun selling embedded insurance products. Revolut has been offering insurance through partnerships with Chubb and Allianz. Amazon ran a trial with Next to offer quotes and the ability to purchase SMB insurance for Amazon Business Prime members. Insurify and Toyota Insurance Management Solutions partnered to provide drivers with a frictionless way to compare and buy insurance when purchasing or leasing a Toyota vehicle.

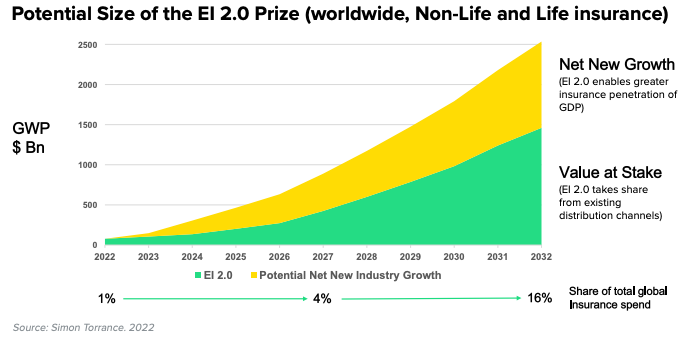

Simon Torrance estimates embedded insurance could grow from 1% today to 16% of the total global insurance distribution (~$1.5t of gross written premium) over the next ten years – $500b in the US alone, $200b in Europe. Even more interesting, it could contribute to growing market's overall size, adding another $1t in net new gross written premium.

Aside from better products and experiences for buyers, lower customer acquisition costs, and higher margin revenue streams for insurers, growing the market means more protection for consumers and businesses, helping close the protection gap worldwide. This societal impact is really exciting.

Embedded + Personalized

The embedded opportunity gets really interesting when combined with hyper-personalized products. Embedding may be the key to unlocking these types of offerings. Insurance is essentially a set of data problems. To create uniquely valuable personalized products, underwriters need access to real-time data about their customer and the surrounding environment. The relationships through embedded models can help with this data problem. This could expand the range insurers are willing to cover and make customer offerings more attractive.

I'm not envisioning a world where we replace all humans with bots. The "bionic advisor" model seems plausible, integrating humans and digital customer experiences to deliver better products and services than before.

Looking ahead

We're excited to invest in enablers of the future of insurance which we think will look like some combo of the following:

- Policy recommendations and on-demand purchasing through relevant embedded channels and at the right moments.

- Personalized, holistic insurance policies. Perhaps it's effectively and efficiently bundling traditional and less traditional (like parametric and/or usage-based).

- Transparency. Clear about pricing and exclusions in a way that's personalized for the end buyer.

- Extending beyond risk-transfer responsibilities. Providing personalized risk assessments and ongoing risk mitigation techniques, shifting from payers to effective preventers.

- Automated by default. Streamlined and fast. From the initial buying experience to the claims experience to payouts.

- Bionic advisor-ready.

- Real-time.

Climate Risk Innovations

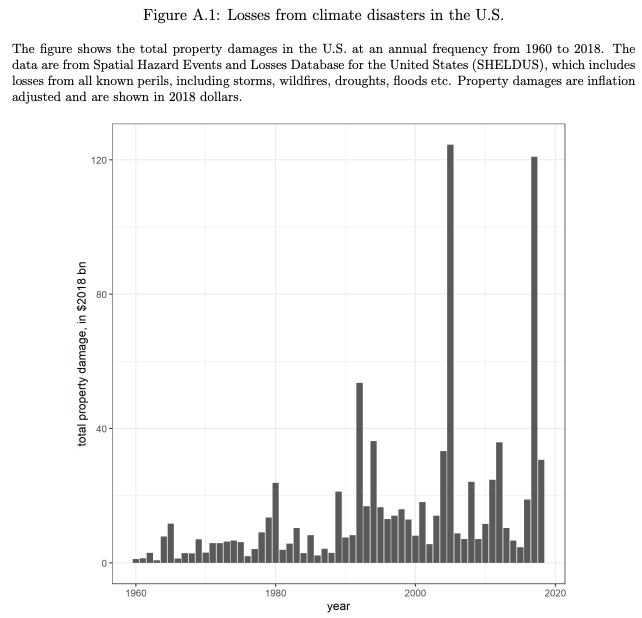

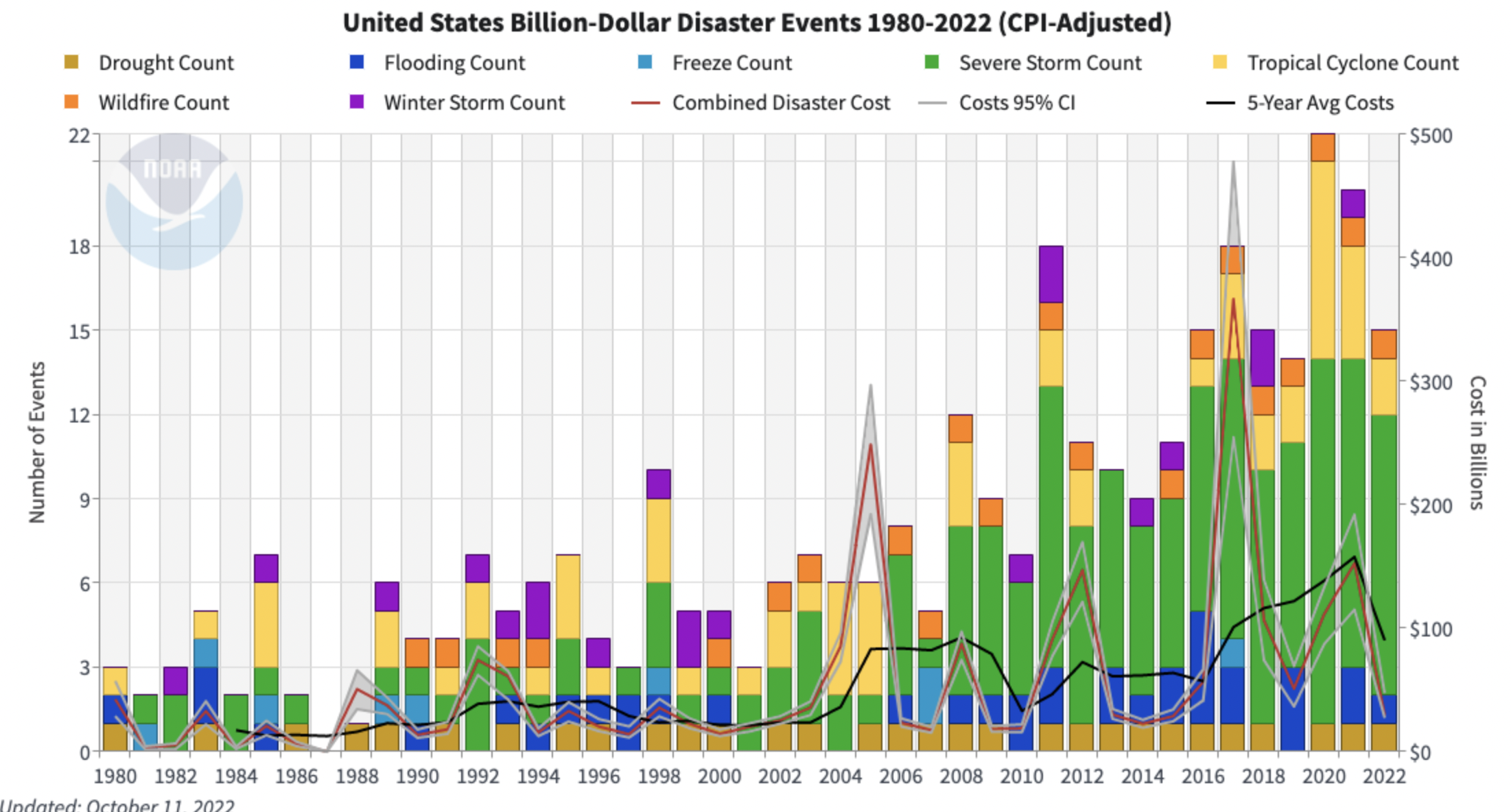

The insurance sector plays a critical role in our society and economy following natural disasters, which have been growing in severity and impact at an unprecedented rate. The US saw more than $600b in property damage losses from natural disasters in the last 20 years, double the previous four decades combined. Insurance serves as a critical risk mitigation and protection tool. Climate events such as hurricanes and wildfires comprise much of the damage. About $120b in homeowners insurance premiums are paid annually while insurers sell about $15t in coverage, making it one of the biggest P&C (property & casualty) markets.

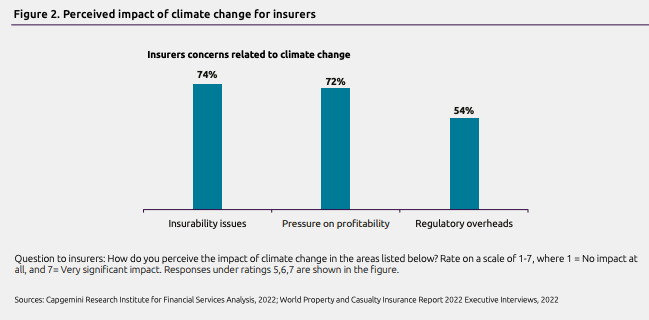

Impact to insurance companies

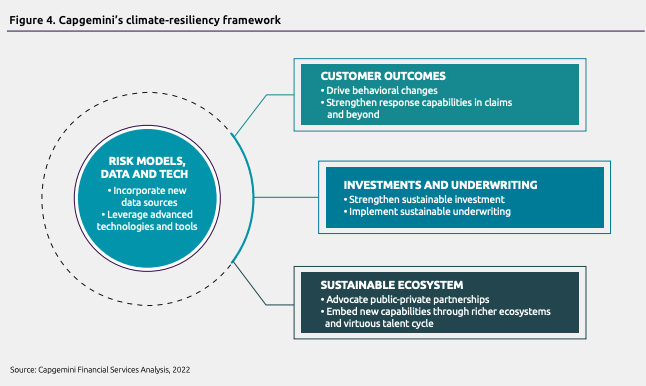

Climate risk poses significant challenges to insurance companies. Every risk involves uncertainty, but climate-related risks compound due to the speed of change, the magnitude of physical damage, global supply chains, and irregular nature. There are physical risks (like the effects of a flood) and transition risks (like the cost of adapting to new regulations). Many insurers rank climate change as their top priority, but many still need to develop resiliency strategies by focusing on preventions instead of exclusions.

Looking ahead

The unprecedented rate of natural disasters is the new norm, creating massive challenges and opportunities in the insurance market. Here are some of the things piquing our interest when it comes to climate risk:

- Methods to expand the awareness and availability of parametric insurance for weather events and providers who can step up to handle the supply as demand inevitably increases.

- Tech-enabled risk mitigation and prevention solutions, including advisory and risk engineering services such as pre-construction advising, data-powered behavioral nudges and safety reminders.

- Climate risk modeling innovations involving synthetic data, ai, and other enablers, given the lack of underwriting data, loss history, and underwriting pattern recognition.

- Innovations and schemes leading to pricing model efficiencies, especially for vulnerable populations. P&C is becoming harder and more expensive, especially in certain states. And studies have found that households in lower-risk states are disproportionately bearing the risks of those in higher-risk states.

- Methods to support effective and efficient modeling for insurers to meet their evolving disclosure requirements and to help them test impacts to cash flows from various climate scenarios over short and long-term time horizons.

Cyber Risk Innovations

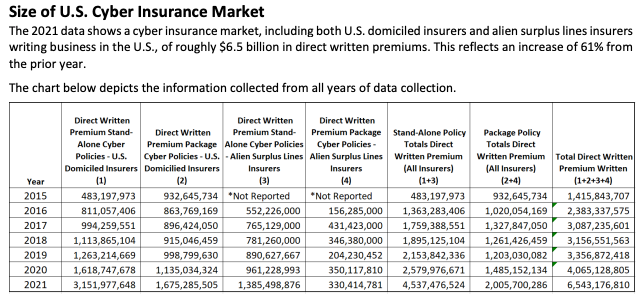

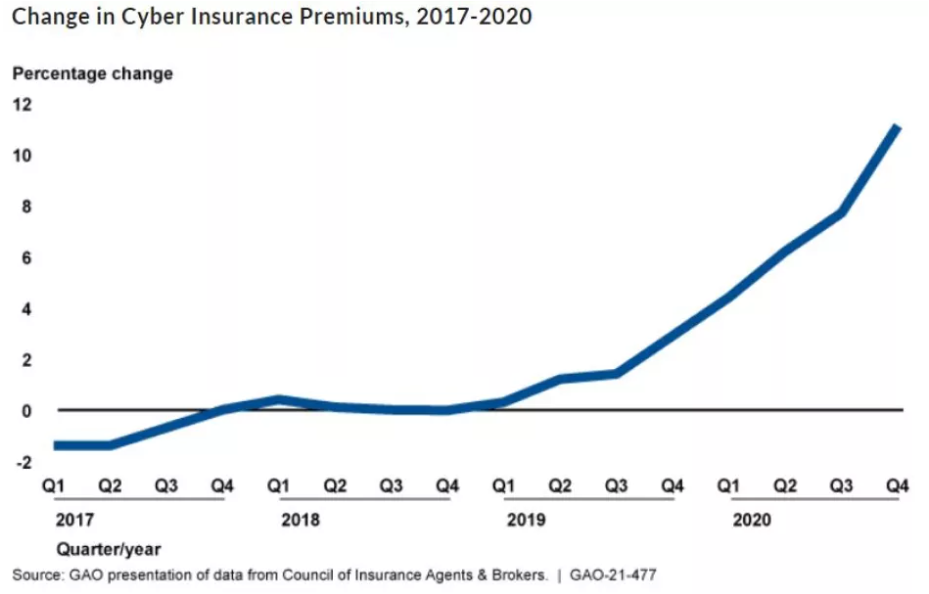

Cyber risk is a challenged yet fascinating area of insurance due to the rapidly evolving threat landscape, claims volume, and prices. Ransomware frequency was up more than 200% in 2021 compared to 2019. Cyberattacks cost the global economy over $1t a year, and Munich Re estimates cybercrime damage will reach at least $10t by 2025. Breaches are inevitable and cyber insurance is growing increasingly important for all types of organizations.

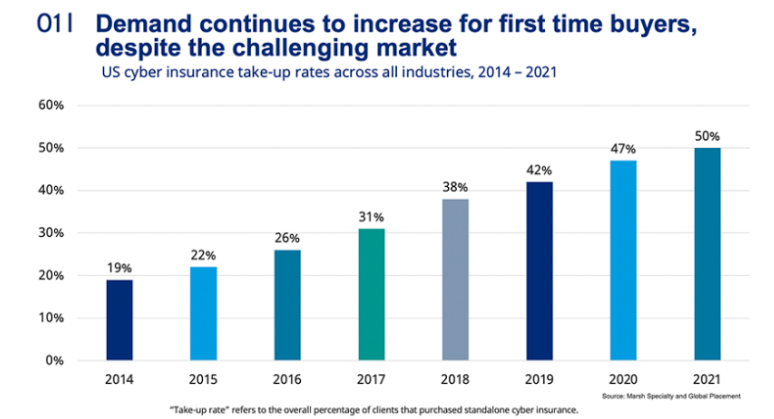

Unfortunately, cyber suffers from limited insurer appetite and a significant protection gap. Demand has grown exponentially over the last decade.

This younger, immature sector faces critical challenges. Cyber event and historical loss data is limited due to the nascency and evolving threat landscape. This makes it difficult to quantify risks and effectively price. Therefore, cyber risk prices don't correctly reflect the risk being insured. There's also a severe awareness and education issue amongst small and medium businesses in particular to underestimate their risks. And many who are aware of the risks still opt against insurance because of the belief that coverage has too many exclusions. Lastly, insurers are concerned about the potential for aggregated losses where many businesses simultaneously make claims, posing potential solvency risks to insurers.

Cyber insurance has catapulted into the fastest-growing US property & casualty market segment while also being relatively concentrated. Every industry is susceptible to digital attacks – financial, healthcare, energy, government, education, critical infrastructure, etc. Insurance will play a key role in mitigating the impacts of digitization as more organizations, and critical infrastructure is compromised.

Looking ahead

The cybersecurity insurance market is filled with challenges, making it a really exciting area to build and invest in. It seems like traditional insurers like Chubb, Beazley, and Hiscox of stepped back from cyber risk but some cyber-specific providers like Cowbell, CFC, At-Bay, Coalition, Blackswan, Corvus, and Resilience have stepped in. Despite multiple players, the rapidly rising demand creates room for new, innovative MGAs or tech enablers for the existing providers. Here are some of the things piquing our interest when it comes to cyber risk:

- Risk mitigation and prevention solutions.

- Improvements to the cyber insurance broker experience.

- Advancements in automation and the effectiveness and efficiency of security posture reviews and scans to help understand and price risk appropriately – decreasing premiums for those with great cybersecurity postures, or increasing and proactively pushing for improvements.

- Vertical-specific specialization. Threat landscapes, operations, and business models necessitate specialization. A software platform company with many API integrations and customers is vastly different than a b2c retailer which is unique from a pharmaceutical manufacturer.

- Solutions to improve industry-wide cyber event and historical loss data to help entrants effectively predict the probability of loss and improve pricing.

- Tools to help insurers collect and leverage real-time cyber threat data for continuous adjustment of underwriting, vulnerability scanning, improving predictive models and inform reinsurance purchase decisions.

- Distribution models to help cyber illiterate business owners understand and obtain cyber insurance for risks they likely don't realize they're susceptible to (hacks, website defacement, etc.). For instance, distributing through SaaS providers who end-businesses already trust and use for other areas of their operations.

- Capital pool schemes to help address unlikely cyber catastrophes that could lead to aggregated losses, leading to more comfort writing cyber insurance and less reliance on reinsurers. This includes public-private risk sharing and defi for alternative sources of capital capacity.

- Specialists help to augment and support insurers. Carriers need help to support their end-to-end cyber insurance lifecycle. Service providers that insurers can leverage for education, assessing potential customers, preventive controls, forensic skills, and support.

Crypto

As bystanders and industry participants know, the crypto industry is in the thick of it right now. For those of us who have been in the space for 5-10 years, it was apparent that it veered off path since COVID in the long-running zero interest rate environment. But we also know that the technology and principles can and will be used to enable real innovation in various markets over the next decade.

When it comes to insurance in crypto, one can think about it in three ways:

- DeFi as an alternative scheme and source of (re)insurance capacity, like Ensuro for non-crypto use cases.

- Crypto-native insurance solutions for on-chain use cases, like Nexus Mutual, insuring against protocol exploits or smart contract bugs.

- Traditional insurance for digital asset service providers and services, like Lloyds and other traditional insurance providers covering Coinbase and Kraken with digital asset storage protection.

DeFi has a lot of promise as an enabler of alternative sources of insurance capacity, especially for reinsurance. It efficiently aggregates capital from global participants, provides real-time transparency, and has primitives that can be used for incentivizing participation by capital providers, claim managers, and customers. Shore Crypto and Ensuro are two startups exploring this space. Flight disruption product, Koala Flex, is embedded in flight booking services like Ulysse. Koala leverages Ensuro for insurance capacity. Assuming they pass KYC related compliance checks, liquidity providers across the globe can provide capital into an Ensuro pool, earn a yield on it, protecting trip buyers from trip cancelation costs.

Looking ahead

Crypto is in its infancy, as-is leveraging blockchain technology and ethos for insurance solutions. But it's an intriguing area to explore and a critical piece to unlock future growth and participation. Here are some of the things piquing our interest when it comes to cyber risk:

- Novel solutions leveraging defi to provide alternative sources of (re)insurance capacity, including tools and models to help figure out appropriate pricing, payouts, yield, and other parameters.

- Enablers of protection for primitives that actors frequently interact with like hot wallets, smart contracts, and bridges.

Commercial

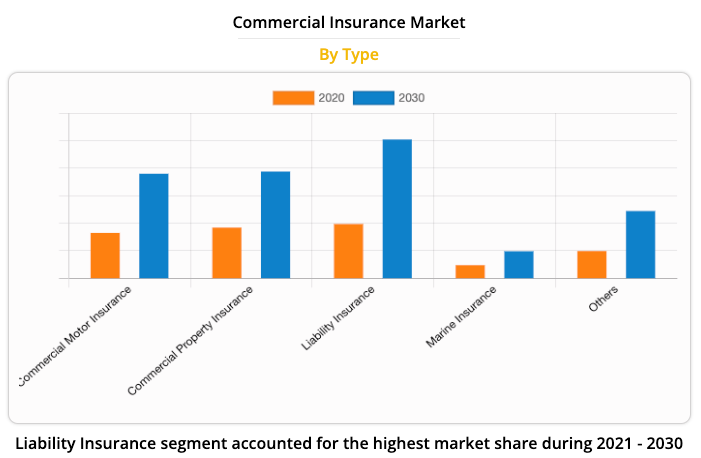

Commercial insurance protects businesses from losses associated with damages to property, employee injuries, theft, data breaches, and employer liability. The global commercial market is projected to reach $1.5t+ by 2030, up from ~$700b in 2020.

Many of the commonly heard policy types fall under commercial insurance:

- Property

- General liability

- Commercial auto

- Works comp

- Business interruption

- Cyber

All classes are expected to grow over the next ten years.

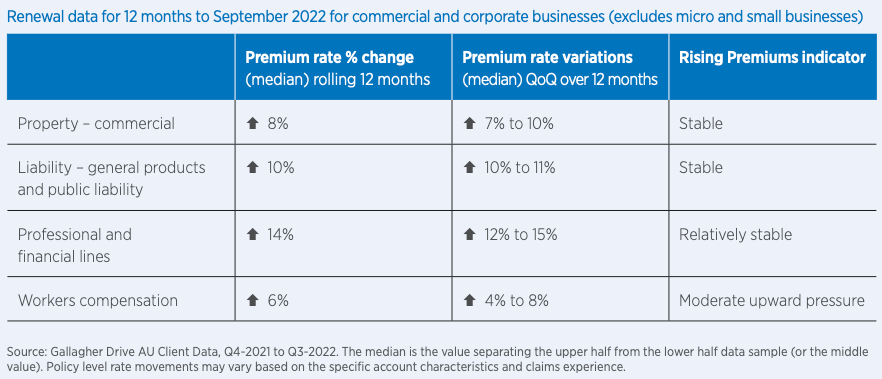

We're currently in the "hard" part of an insurance market cycle. Some insurers failed to keep pace with losses even as they hiked rates prices, and low interest rates made it challenging to offset weak underwriting with investment income. Looking forward, rates for many commercial lines are expected to stabilize, which is good for customers.

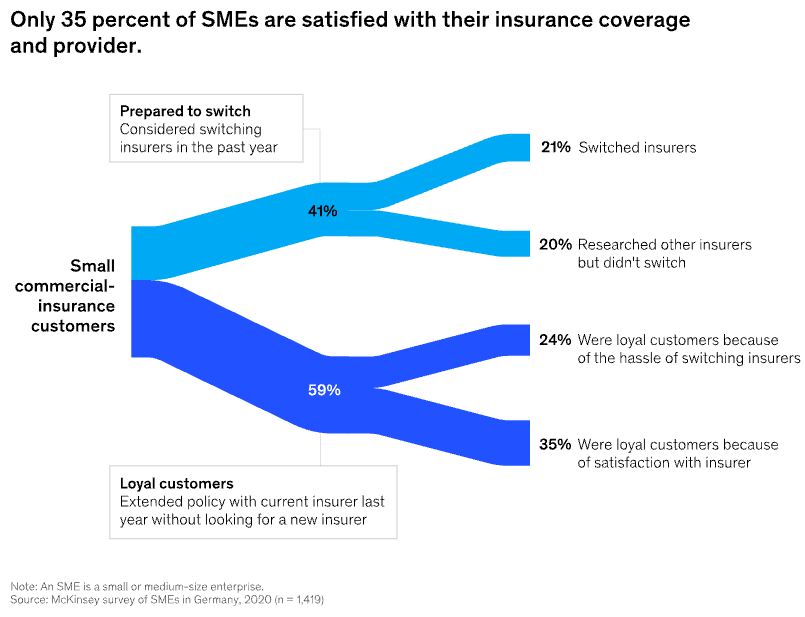

SMEs (small and medium businesses) are generally underinsured or need to be better served. They often overpay or underpay and obtain policies with exclusions, leaving them unexpectedly without payouts. They usually buy the bare minimum of what landlords require, and the bundled offerings are often far from optimized and personalized. There's a lot of opportunity to deliver better products and improve customer satisfaction.

Looking ahead

Commercial insurance customers are an essential segment to continue innovating for, given the size of the commercial market and the critical role businesses play in our economy. There are ample opportunities to price and deliver more tailor-made solutions that protect against emerging threats. We look forward to meeting with founders targeting this segment of customers.

Closing

As discussed throughout this post, it's a very exciting time for tech-enabled innovations across the insurance market. The sheer count of emerging categories and modern approaches, combined with advancements in digitization across the industry, makes it a logical place for entrepreneurs to build and investors to invest.

Although we highlighted our interest in embedded distribution and personalization, modern methodologies like parametric, and areas of risk across climate, cyber, crypto, and commercial, it's worth mentioning that we're thinking about many other areas as well. They include:

- Opportunities to leapfrog the status quo in emerging economies like Brazil, Nigeria, and Indonesia.

- General benefits area given all the changes in labor dynamics.

- Stodgy categories like M&A indemnity and errors and omissions.

- Innovations around schemes and captives.

- Beneficiaries of long-term trends around longer lifespans and pressure on medical costs.

Insurance is a large and growing market filled with challenges and opportunities. Like most markets, we expect venture investing into insurtech to slow down for some time compared to recent years. However, at Costanoa, we're even more excited to invest in early-stage insurtech startups over the next decade than we were in the last.

Feel free to message me on Twitter or LinkedIn to chat all about insurtech or just to say hi 👋.

Reference Material

- General/Other

- FT Partners: January 2023 InsurTech Market Update

- Insurtech Market Size, Share & Trends Analysis

- Deloitte: 2023 Insurance Outlook

- PwC Insurance Reimagined, 2025 and Beyond

- SOSA: The Future of Insurance

- Capgemini Top 2023 Trends in Property and Casualty Insurance

- Net Interest: Insuring the Unknown - Embedding

- InsTech London: to Embed, or not to Embed

- How and why insurers should increase investment in 'Embedded Insurance 2.0' - Parametric

- Swiss Re: Parametric Insurance. Innovating Together - Climate

- Moody's Analytics: Climate change – the biggest risk multiplier for the insurance industry

- Capgemini How Insurers can Lead Climate Change Resiliency

- Finance and Economics Discussion Series: Pricing of Climate Risk Insurance - Cyber

- GAO Cyber Insurance Report to Congressional Committees

- HBR: The Cyber Insurance Market Needs More Money

- Munich Re: Cyber Risk and Insurance

- NAIC Report on the Cyber Insurance Market

- Marsh: Shifting cyber insurance market gives cause for cautious optimism - Commercial

- Gallagher: Business Insurance Market Conditions 2023 Outlook

- Commercial Insurance Market Industry Analysis and Forecast 2021-2030

- McKinsey: Small and medium-size commercial insurance