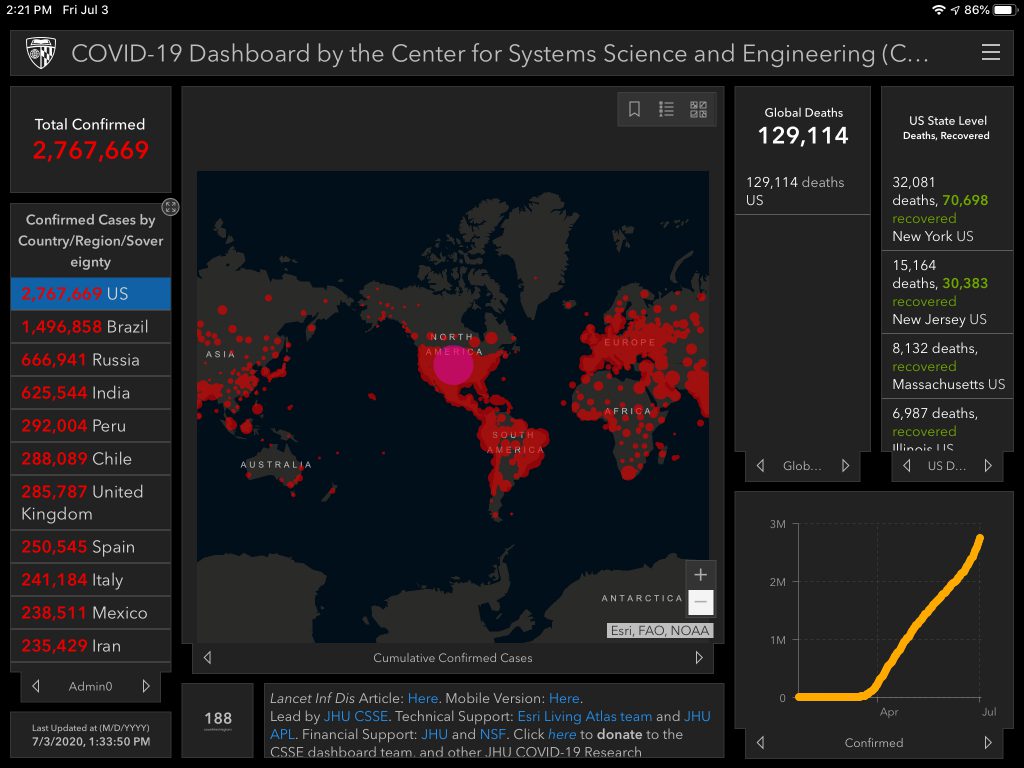

June-July 2020 Edition of Corona Crash or Everything Bubble Pop?

I created this series to serve as a set of living artifacts. This is the 3rd post in the series. I’m striving to capture major current events and financial market action from the lens of a retail investor in the US. It’s essential to understand how one feels and behaves during times of economic uncertainty and market volatility. What better way to do that then keeping a log here to reference in the future? This is not investment advice!!!

2018–2019

2020

February-March

April-May

June

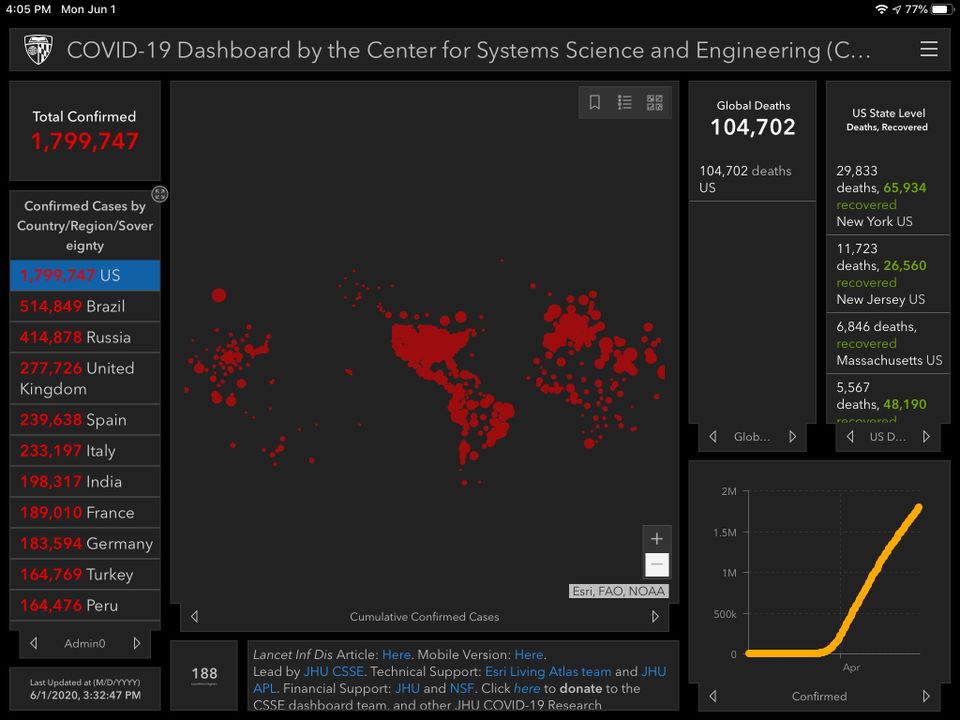

June 1

Monday. Major indexes closed green, led by the Russell 2k up .9%.

Permanent Equity published Open Data Resources, a collection of data sets from sources like Apple, Opentable, US Census Bureau, FRED, and USDA. It includes housing activity, mortgage applications, rail traffic, digital ad revenue, labor stats, mobility trends, and a lot more.

I published my May Health Review. Gotta stay healthy!

Last night, peaceful protesters were once again disrespected and taken advantage of by a small group of looters across the country. The National Guard has been activated in at least 21 states at this point. I don’t intend for this series to turn political (I hate politics), but leadership matters. The right words from the right people can have a positive impact. Barack Obama published How to Make this Moment the Turning Point for Real Change. An excerpt: “So let’s not excuse violence, or rationalize it, or participate in it. If we want our criminal justice system, and American society at large, to operate on a higher ethical code, then we have to model that code ourselves… aspirations have to be translated into specific laws and institutional practices — and in a democracy, that only happens when we elect government officials who are responsive to our demands… So the bottom line is this: if we want to bring about real change, then the choice isn’t between protest and politics. We have to do both. We have to mobilize to raise awareness, and we have to organize and cast our ballots to make sure that we elect candidates who will act on reform.”

Questions on my mind:

- Physical distancing is the most critical tool for slowing the spread of COVID-19. When can we expect to see updated Coronavirus models that incorporate the mass gatherings taking place in major cities? How dramatic will the changes be? If there was a decent likelihood of having to slow reopening efforts or even rollback, are we pretty much guaranteed to have to do so in many cities in a few weeks?

- Superspreaders (5-10% of infected) drive 80% of infections. How many superspreaders are both protests and riots creating (police, protestors, rioters, bus drivers, press, etc.)? How will contact tracing attempts work?

- As Michael Lebowitz tweeted, we’re seeing the worst riots since the 60s, worst economy since the 30s, and worst pandemic since 1918. How long can the stock market maintain current valuations, let alone climb higher?

- It seems inevitable that at least three other officers involved in the killing of George Floyd will be charged with crimes. They were complicit. Will that happen? How many more days until then? Will Chauvin see more serious charges soon?

- What will bring the evening riots to an end?

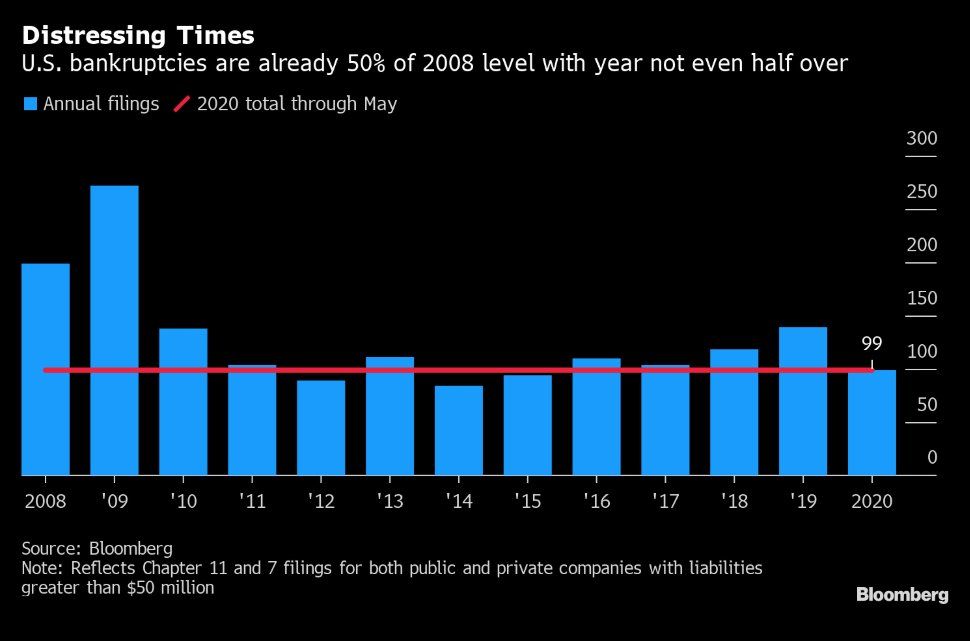

June 2

Tuesday. Feels like Friday already. June already feels like its been 60 days long. Major indexes closed green, led by the Dow Jones up 1.1%. Energy was the leading sector, closing up 2.8%.

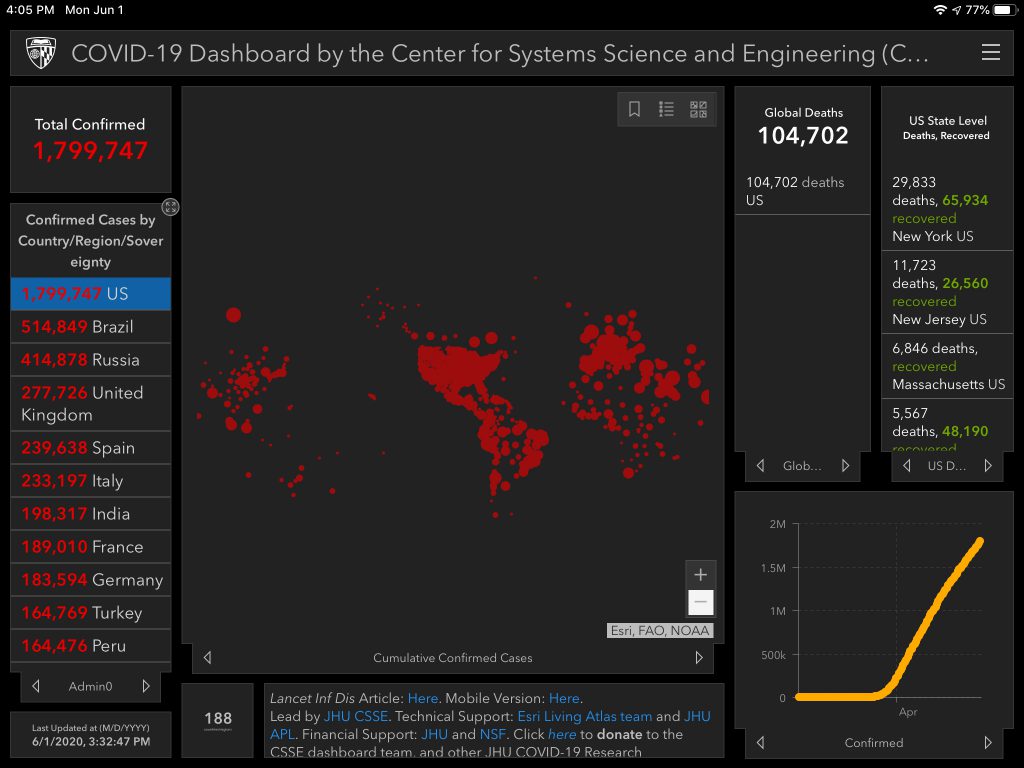

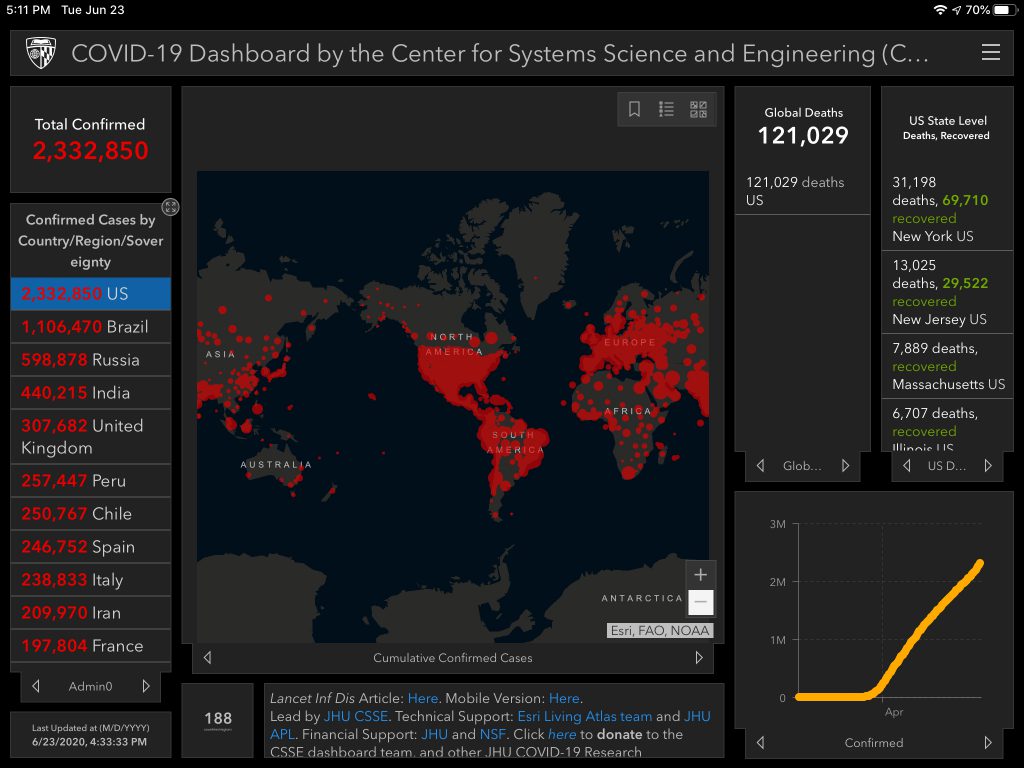

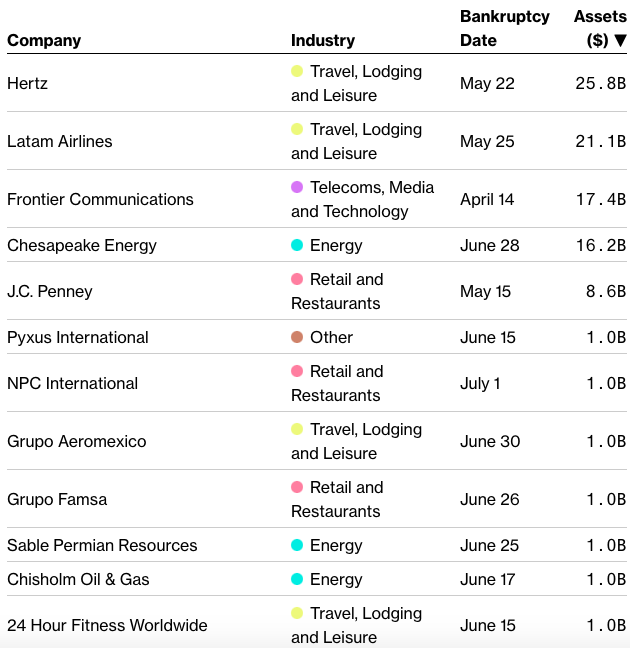

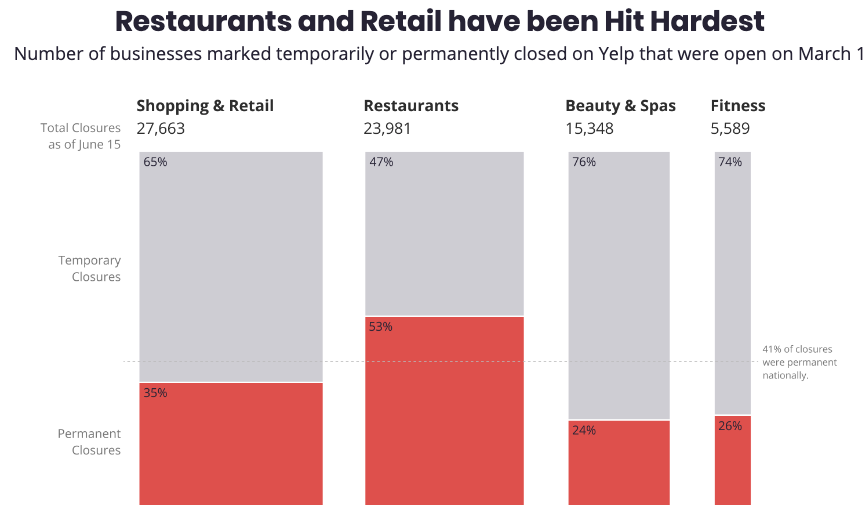

According to Bloomberg, bankruptcies (with liabilities > $50M) are already at 50% of 2008 levels, and it’s only the beginning of June:

Riots continued again last night following a day of peaceful protests. Around 6:30 pm, Trump kicked off a theatrical display of sociopathic behavior. It wasn’t just theatre though. He led the deployment of tear-gas, rubber bullets, and military personnel on peaceful protesters before the curfew. The reason: to walk across the street for a photo-op at the church– where he awkwardly and superficially posed for cameras while waiving a bible. Bishop Mariann Edgar Budde of the Episcopal Diocese of Washington said, “Let me be clear. The President just used a bible, the most sacred text of the Judeo-Christian tradition, and one of the churches of my diocese without permission as a backdrop for a message antithetical to the teachings of Jesus and everything that our churches stand for. And to do so, as you just said, he sanctioned the use of tear gas by police officers in riot gear to clear the church yard. I am outraged. The President did not pray when he came to St. John’s. Nor, as you just articulated, did he acknowledge the agony of our country right now. And in particular, that of the people of color in our nation…” More worrisome than his behavior was his speech, where he basically threatened war against the American people. He said, “If a city or state refuses to take the actions that are necessary to defend the life and property of their residents, then I will deploy the United States military and quickly solve the problem for them… I am also taking swift and decisive action to protect our great capital, Washington, D.C. What happened in the city last night was a total disgrace. As we speak, I am dispatching thousands and thousands of heavily armed soldiers, military personnel and law enforcement officers to stop the rioting, looting, vandalism, assaults, and the wanton destruction of property.” This morning, Trump tweeted, “(thank you President Trump!).” I don’t think he could be any less presidential.

It seems like we haven’t heard from Dr. Fauci or the Coronavirus Taskforce in a while. Supposedly Dr. Fauci hasn’t spoken with Trump since mid-May. It’s as if the administration is wishing the pandemic away, but that’s not how it works. It’s here, and it’s spreading.

June 3

Wednesday. Like the other days this week, major indexes closed green. The Russell 2k led, closing up 2.4%.

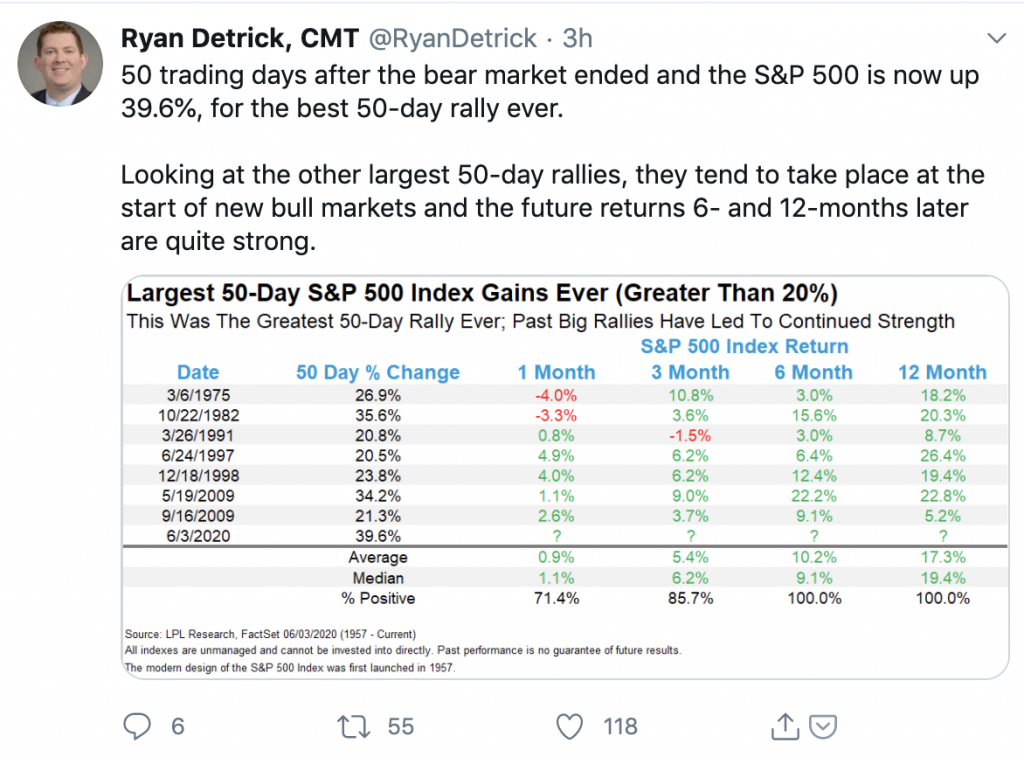

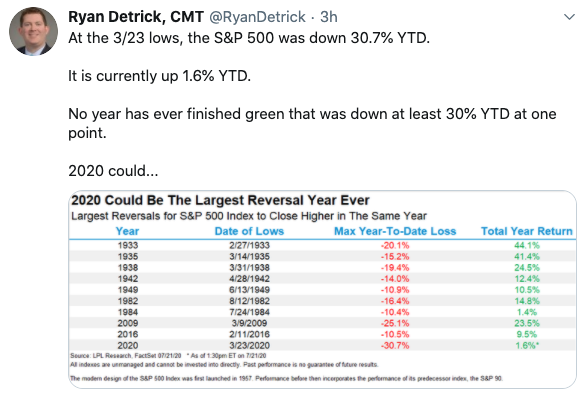

Ryan Detrick called attention to this being the best 50-trading-day rally, ever.

The charges against the Minneapolis officer who killed George Floyd were upgraded to 2nd-degree, in addition to the original 3rd-degree murder and second-degree manslaughter with culpable negligence charges. And they brought charges against the other three officers who were at the scene (with aiding and abetting murder). But as we’ve seen with previous cases, charges are one thing, convictions are another. Hopefully, justice is ultimately served.

Former Defense Secretary James Mattis wrote, “Donald Trump is the first president in my lifetime who does not try to unite the American people—does not even pretend to try. Instead, he tries to divide us… We are witnessing the consequences of three years of this deliberate effort. We are witnessing the consequences of three years without mature leadership… We must reject any thinking of our cities as a ‘battlespace’ that our uniformed military is called upon to ‘dominate.’ At home, we should use our military only when requested to do so, on very rare occasions, by state governors. Militarizing our response, as we witnessed in Washington, D.C., sets up a conflict—a false conflict—between the military and civilian society…”

Current Defense Secretary Mark Esper said, “The option to use active-duty forces in a law enforcement role should only be used as a matter of last resort and only in the most urgent and dire situations. We are not in one of those situations right now… I do not support invoking the Insurrection Act…”

June 4

Thursday. Major indexes closed red for the first day this week. The S&P 500 closed down .6%. Gold is up about 1%.

I chuckled at this chart from Quoth the Raven showing how the Dow increased 37% since March:

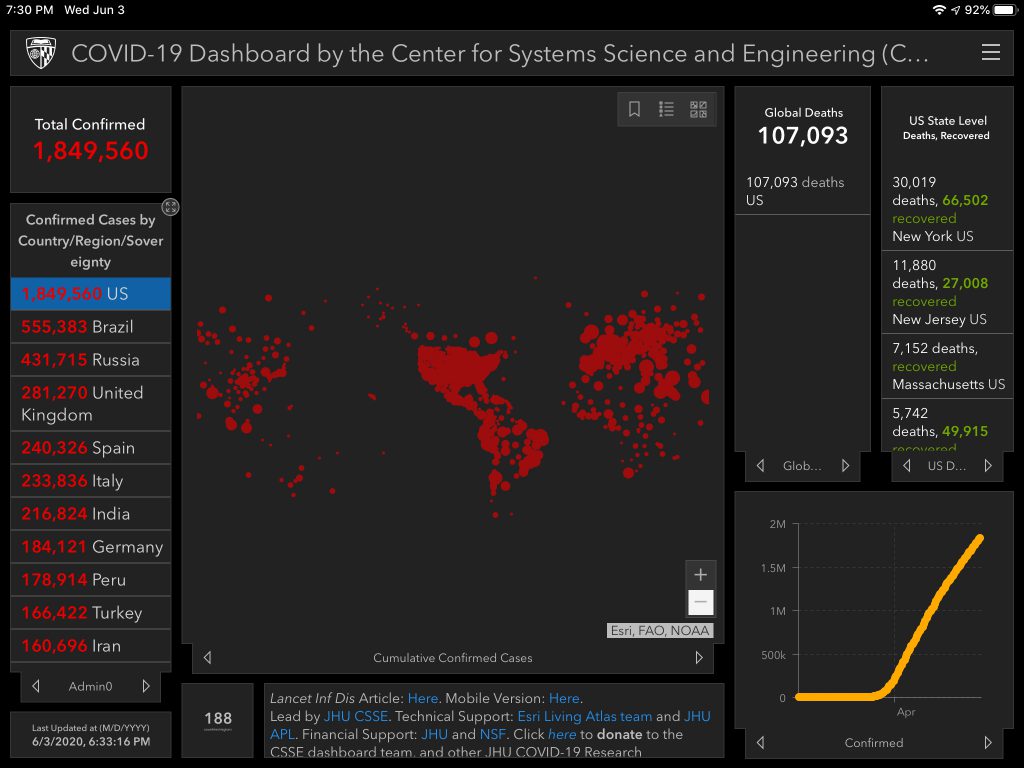

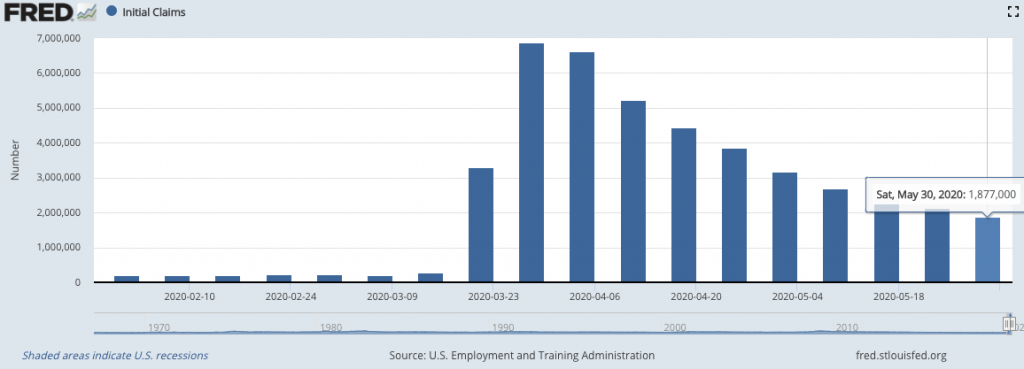

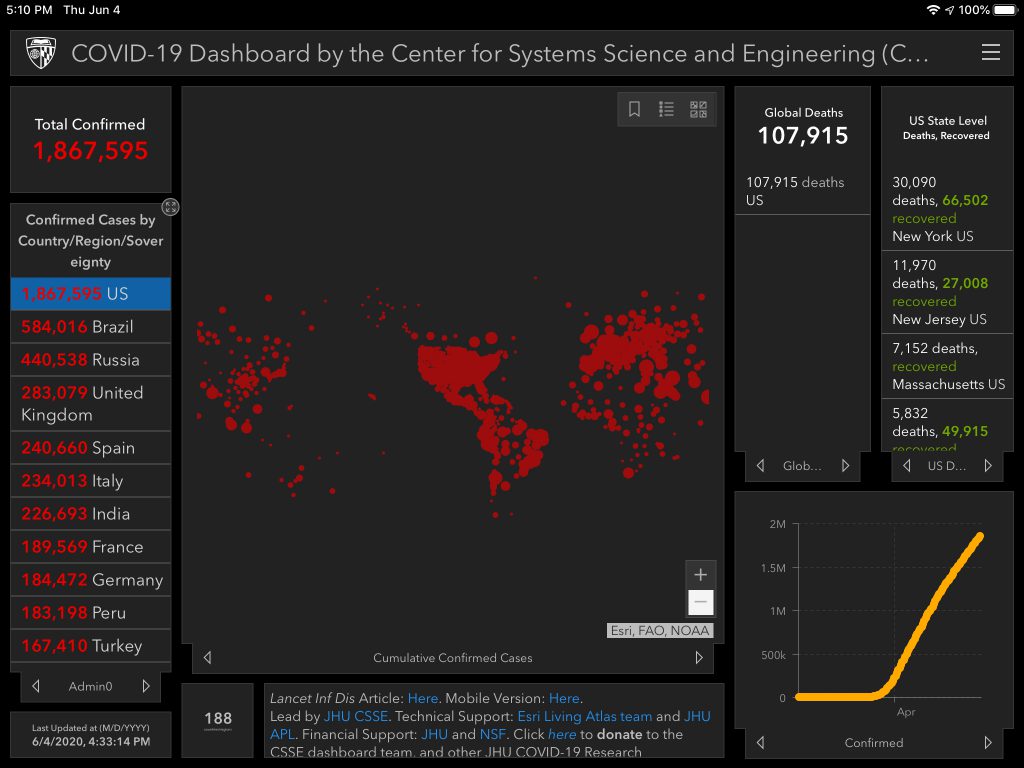

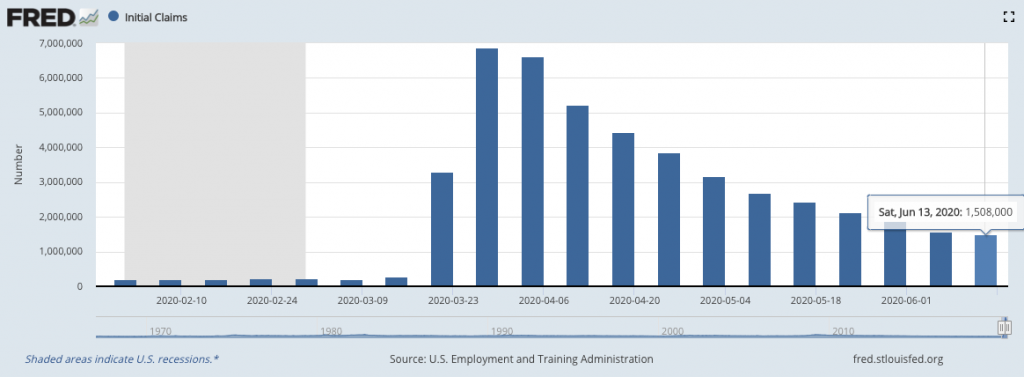

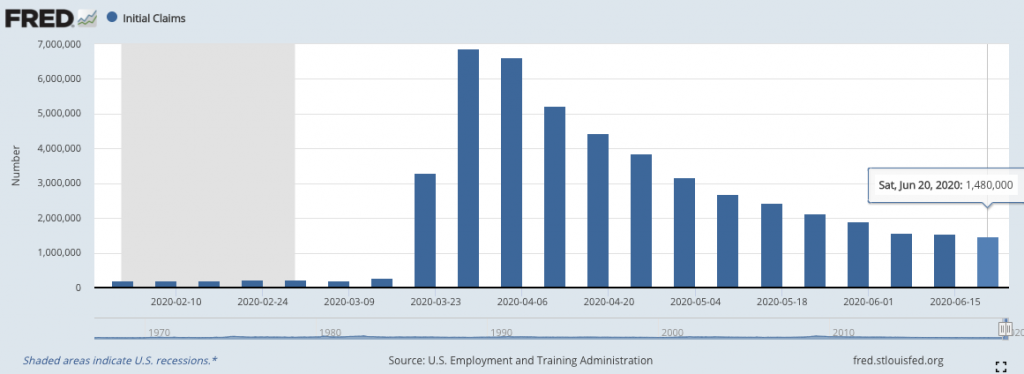

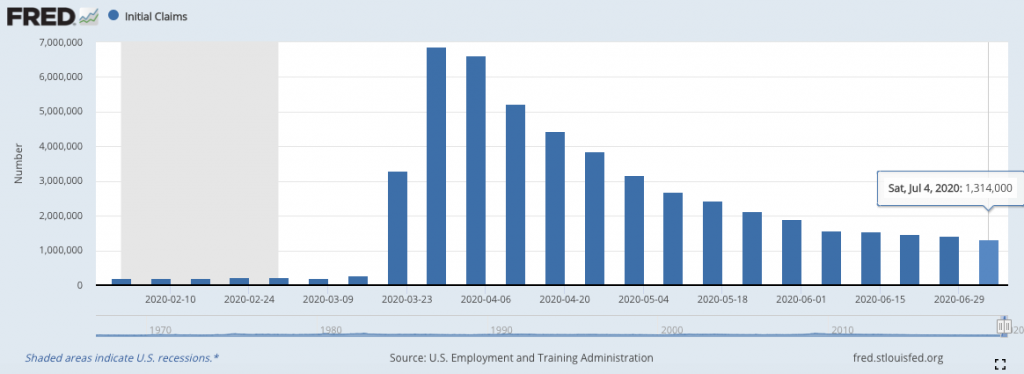

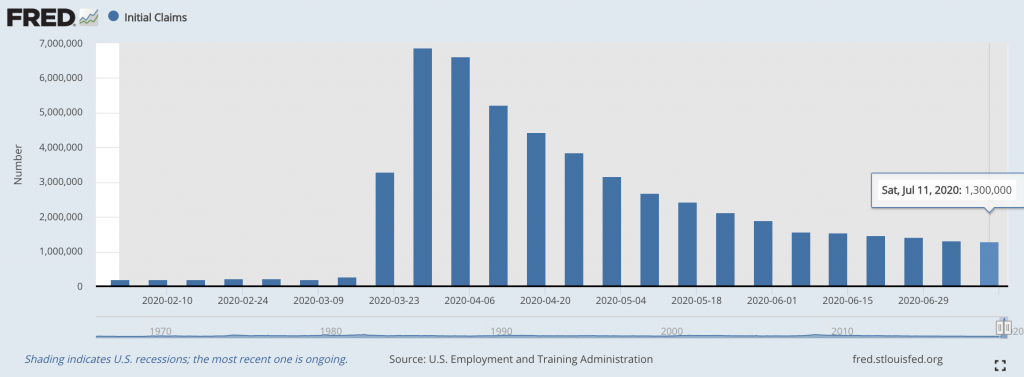

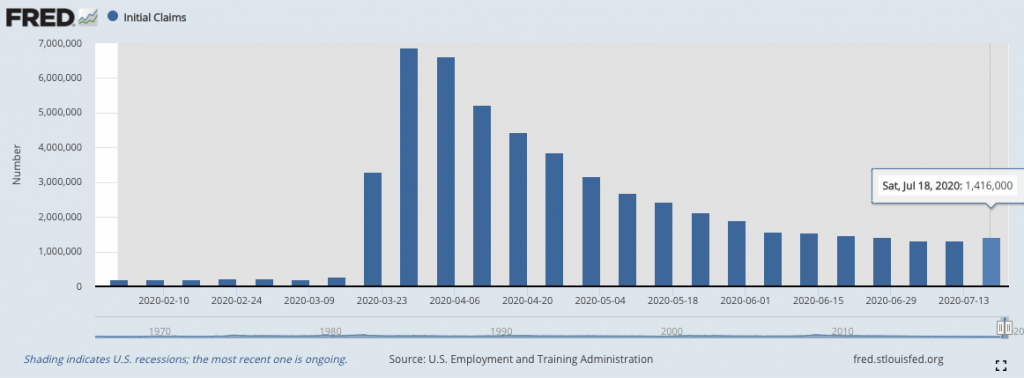

Jobless claims rose another 1.87M. The total for the last 11 weeks is 42M. For context, the entire GFC of 08-09 saw just over 37M.

Check out #8CANTWAIT, a site that identifies 8 policies that can decrease police violence by 72%. You can also try to see if your city is in the available data set to see how they conform to the policies as of today.

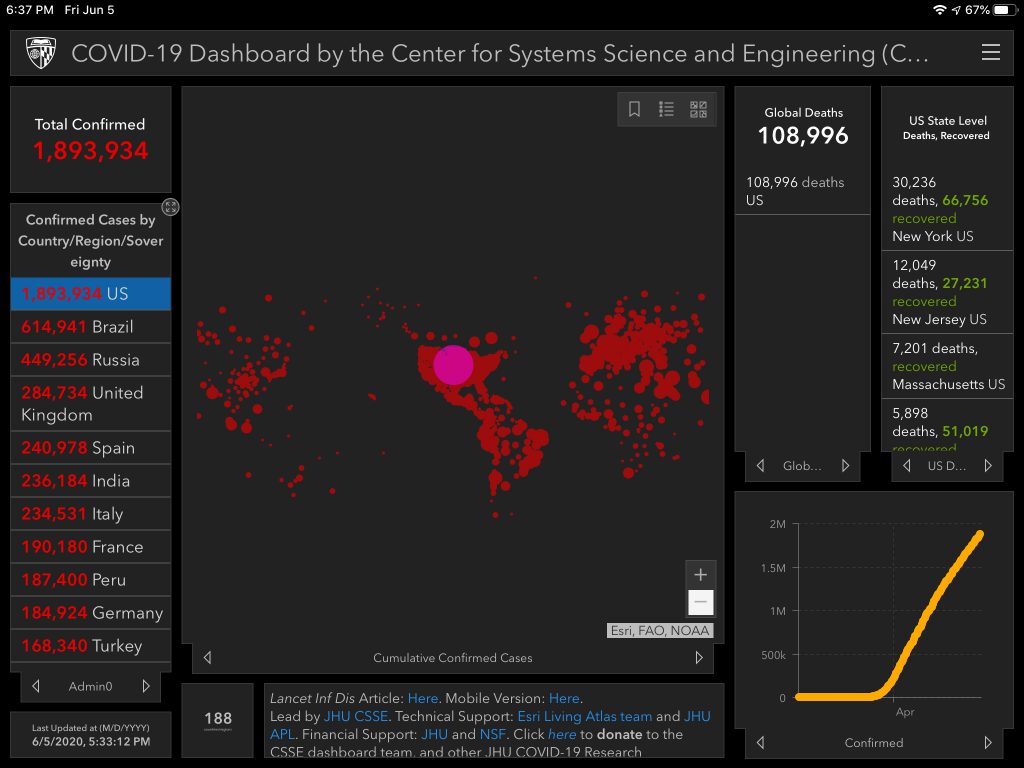

June 5

Friday. 4 of 5 trading days were green this week. Stocks ripped. Russell 2k closed up 3.9% today. Energy was the leading sector, closing up 7.4%. $IWM finished the week up over 8%, $INDU up 6.5%, and $SPX up 4.65%. Don’t forget— civil unrest, a pandemic, and murky China relations. So…. wtf?

Part of todays rally was likely fueled by the May jobs report, showing 2.5M jobs added and unemployment sliding to 10.3%.

June 7

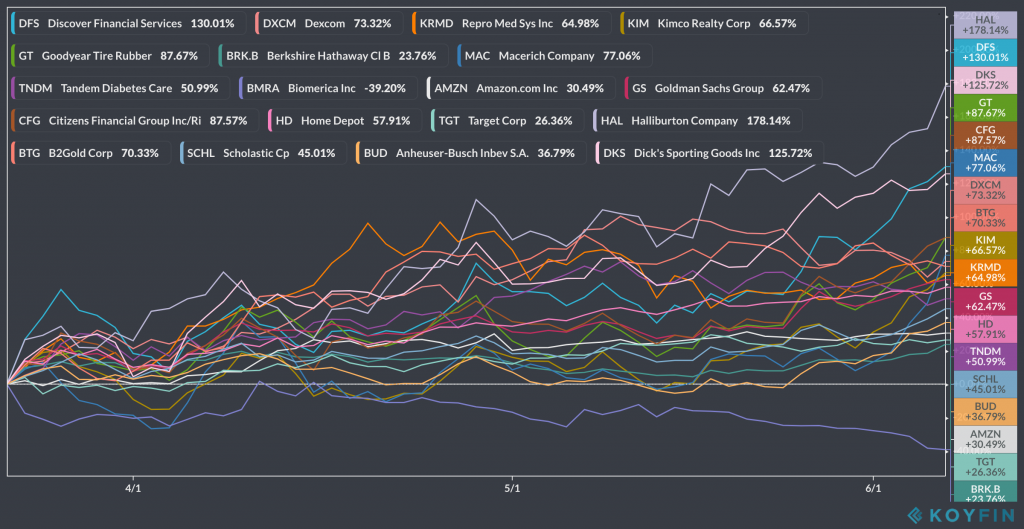

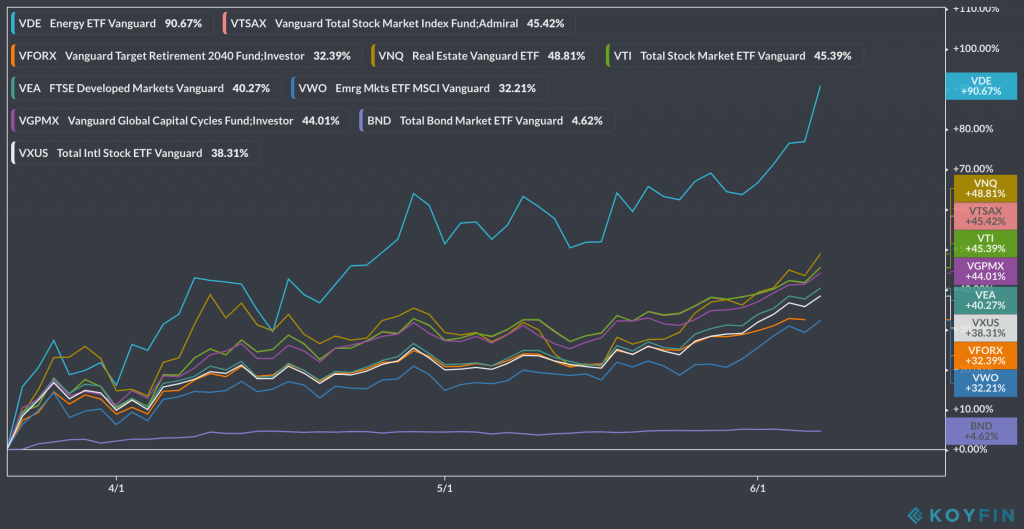

Sunday. I thought I’d look back at the performance since the March bottom of stocks & funds that I own or watch-to-own. Such a face-ripping bounce.

Some questions on my mind:

- How long can this rally last?

- In the hypothetical case that Coronavirus disappeared, would current valuations be warranted? Or aren’t we due for a severe pullback due to the speed of the rebound? We can’t go back and undo what happened. We can’t prevent inevitable bankruptcies from happening in the foreseeable future, so what needs to be true for current valuations to make sense and hold?

- What’s going to happen as PPP borrowers begin to need to repay?

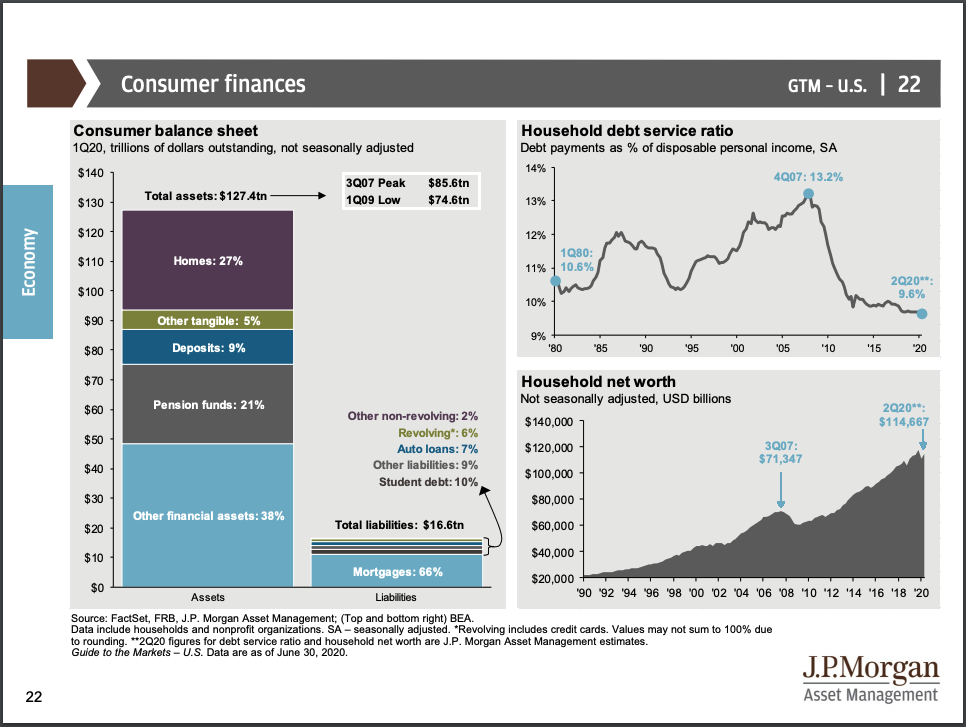

- What’s going to happen when the mortgage forbearance period is up for many borrowers?

- Is it just my personal bias and personality speaking, or does it seem like the likelihood of encountering a new unknown-unknown is high? If true, does that mean the impact will be less jolting since it’s expected?

- What’s going to happen with residential real estate in different markets? Are we going to see a surge in new home sales in areas like Florida? Will this be an ongoing trend?

- Is the Trump administration getting what they want by not holding Coronavirus Taskforce media briefings? Have Americans ‘moved on’ from Coronavirus?

- Who is leading the Coronavirus charge in the US? Is it a person, a body, a taskforce? How are they operating? What progress are they making?

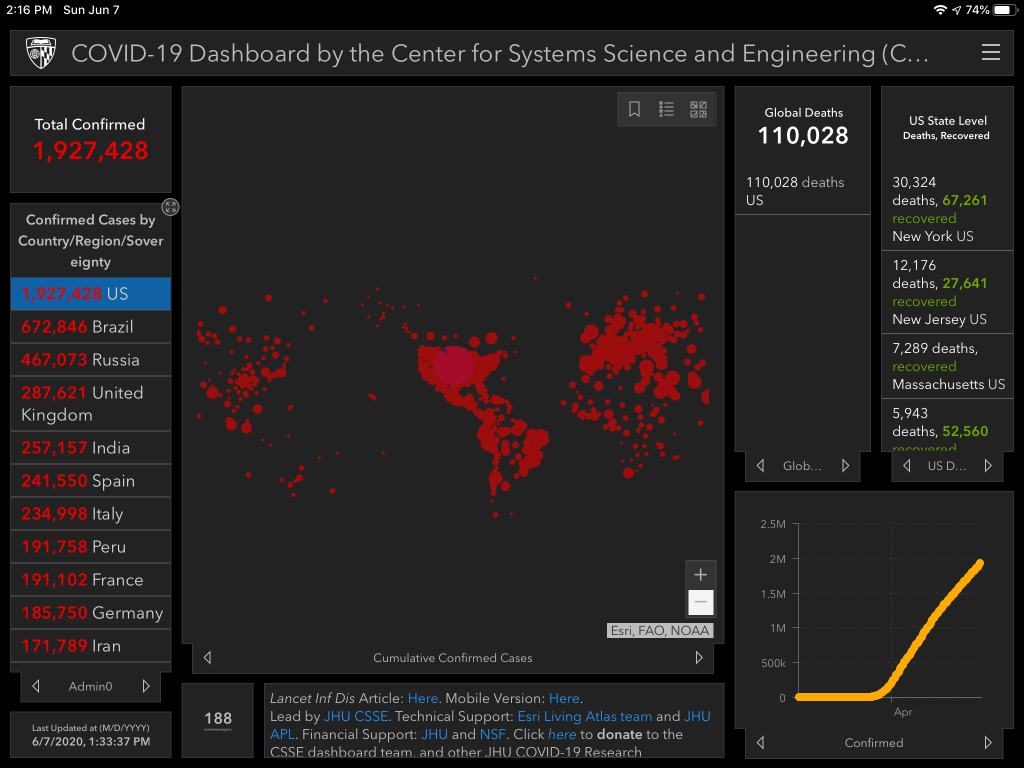

- Will positive cases, hospitalizations, and deaths start to increase over the next two weeks following a month of ‘reopening efforts’ + large public gatherings?

- Are we closer to being able to ‘trust’ the testing numbers coming out of most states, and the tests themselves?

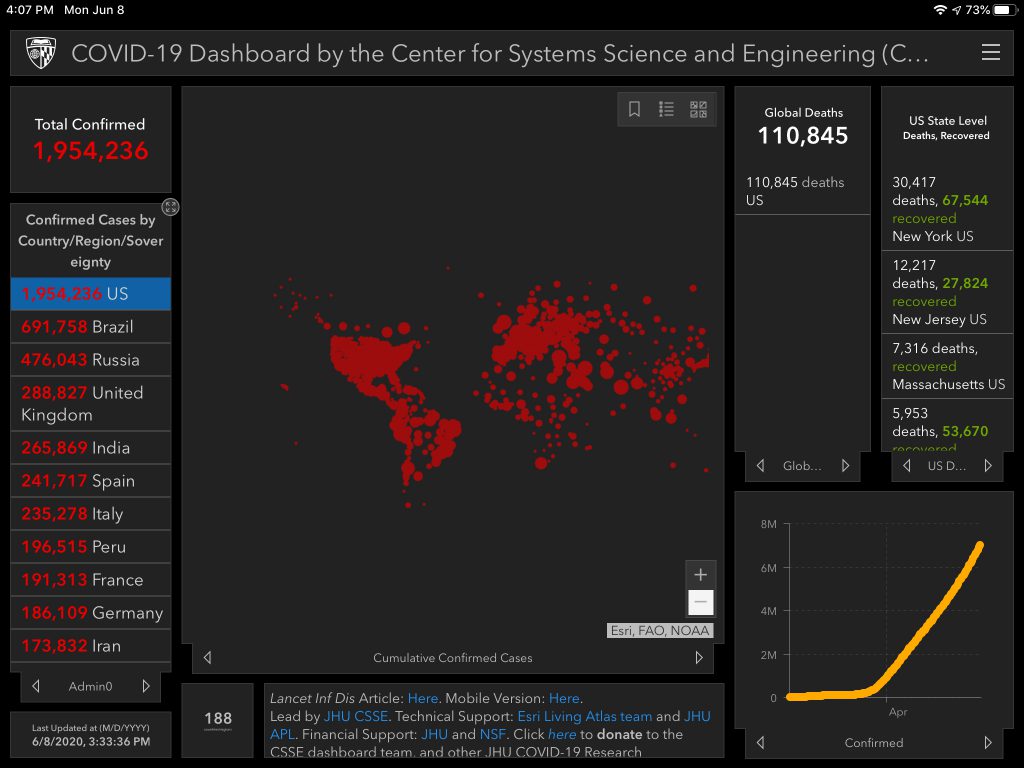

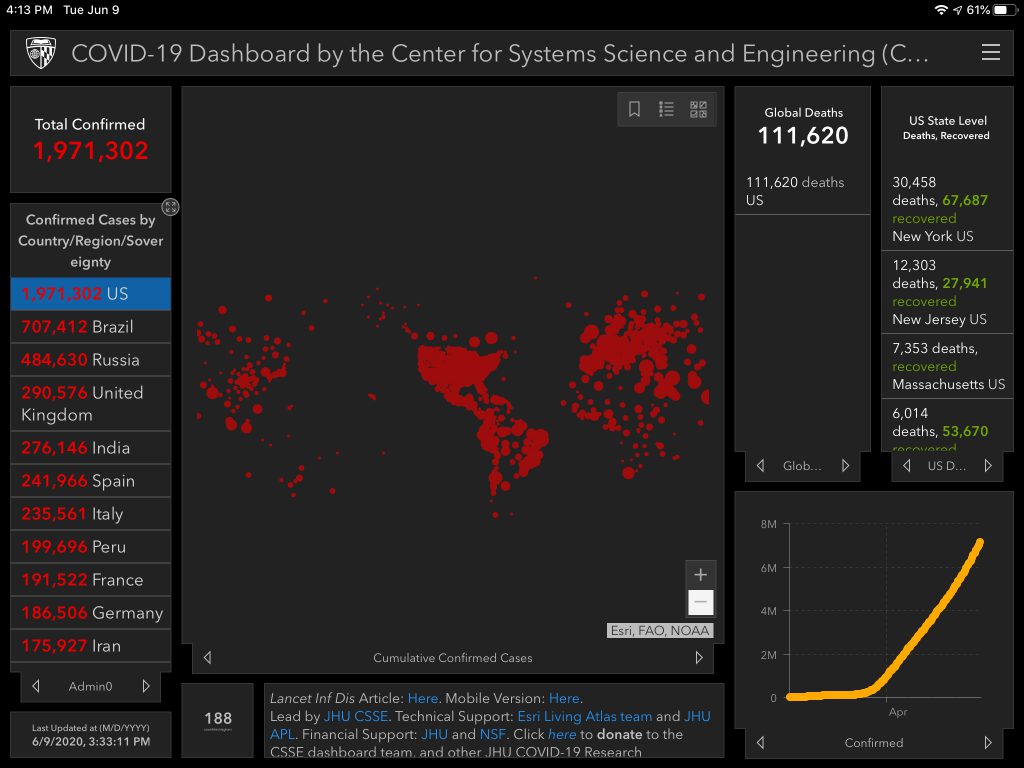

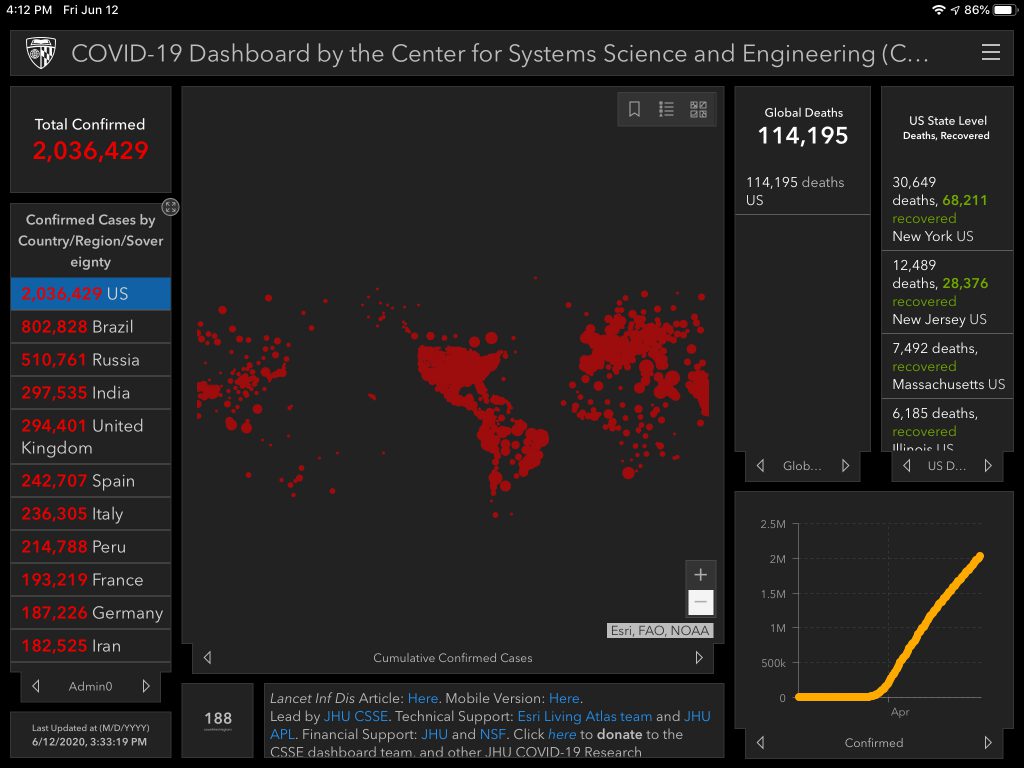

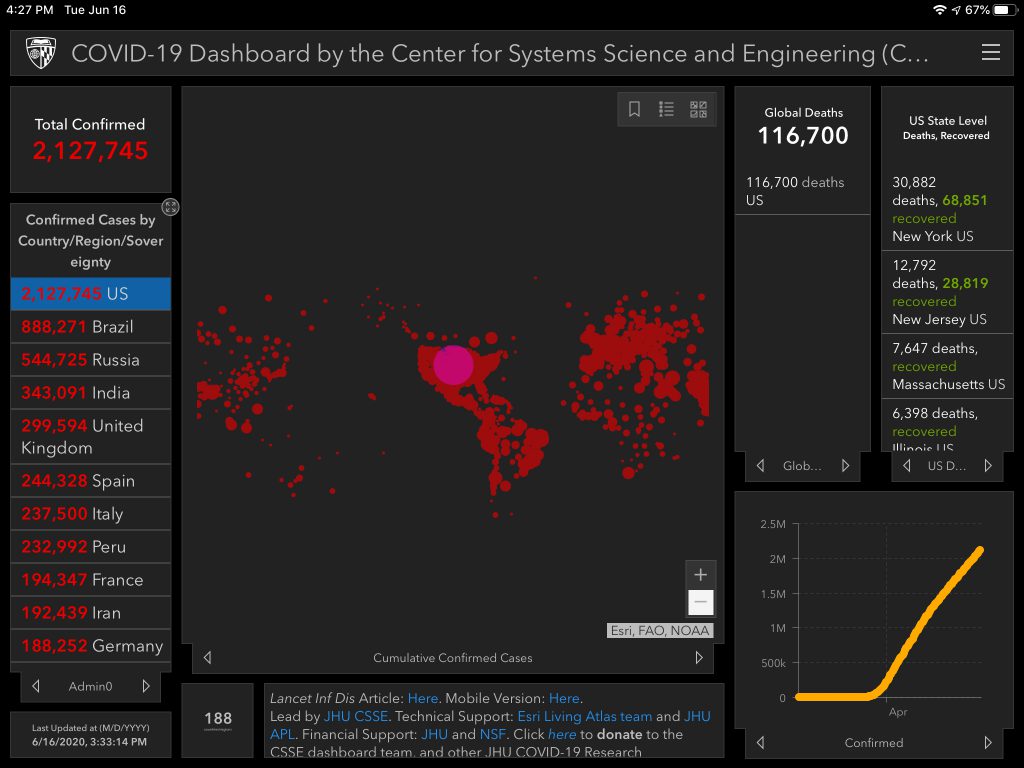

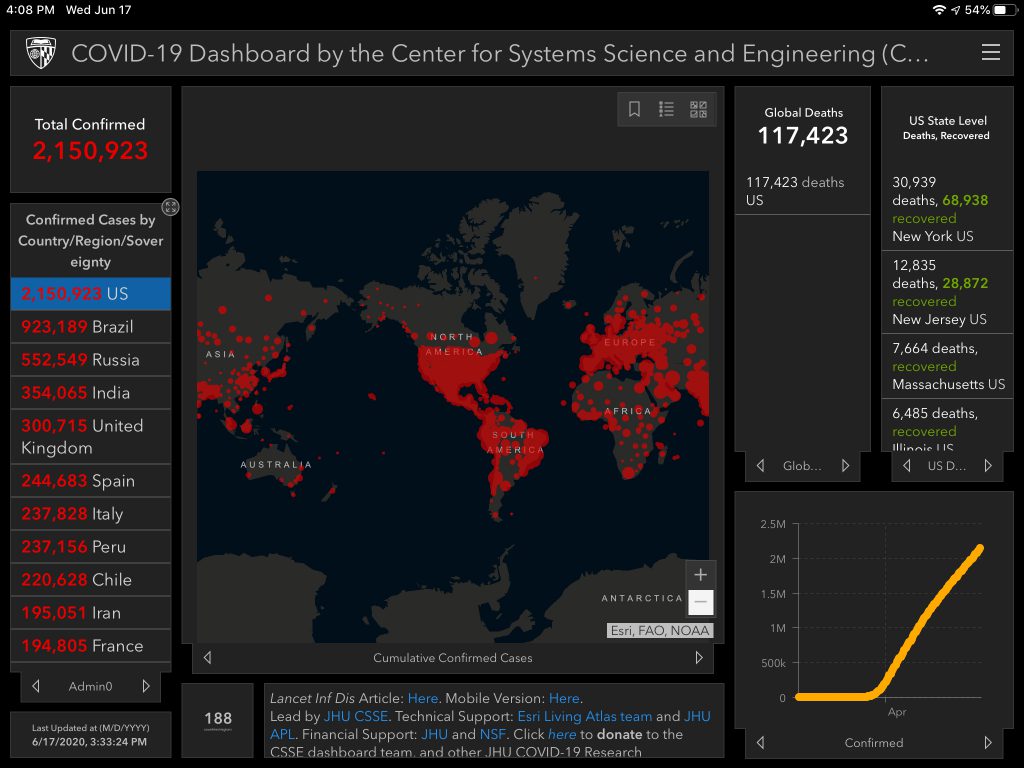

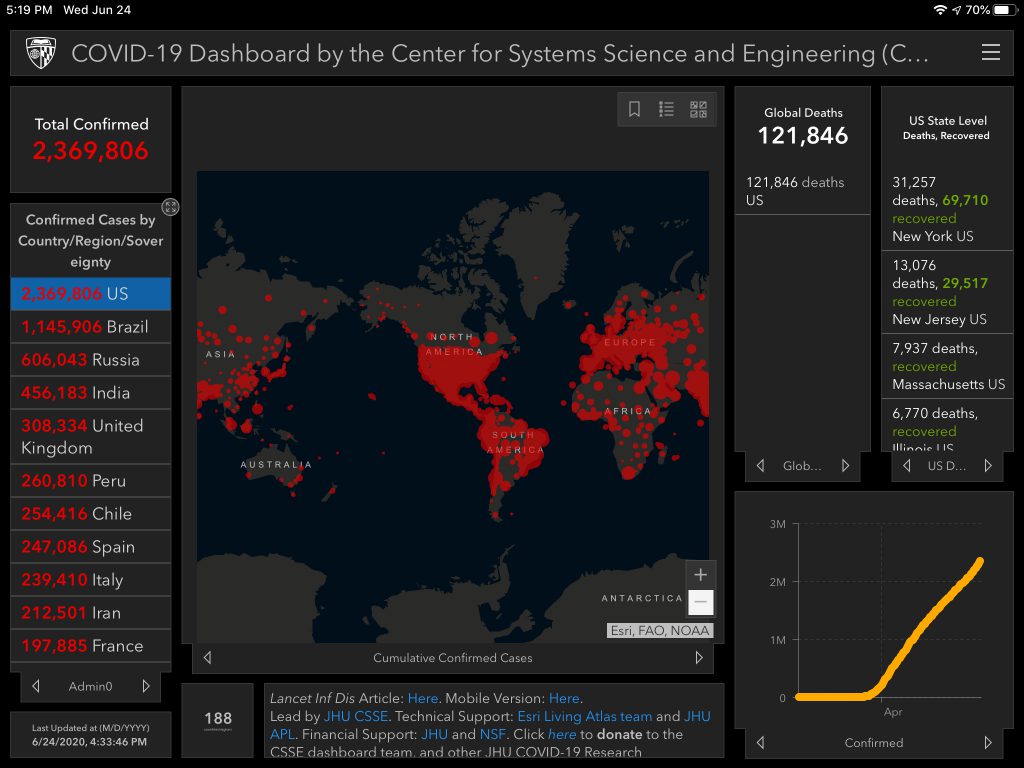

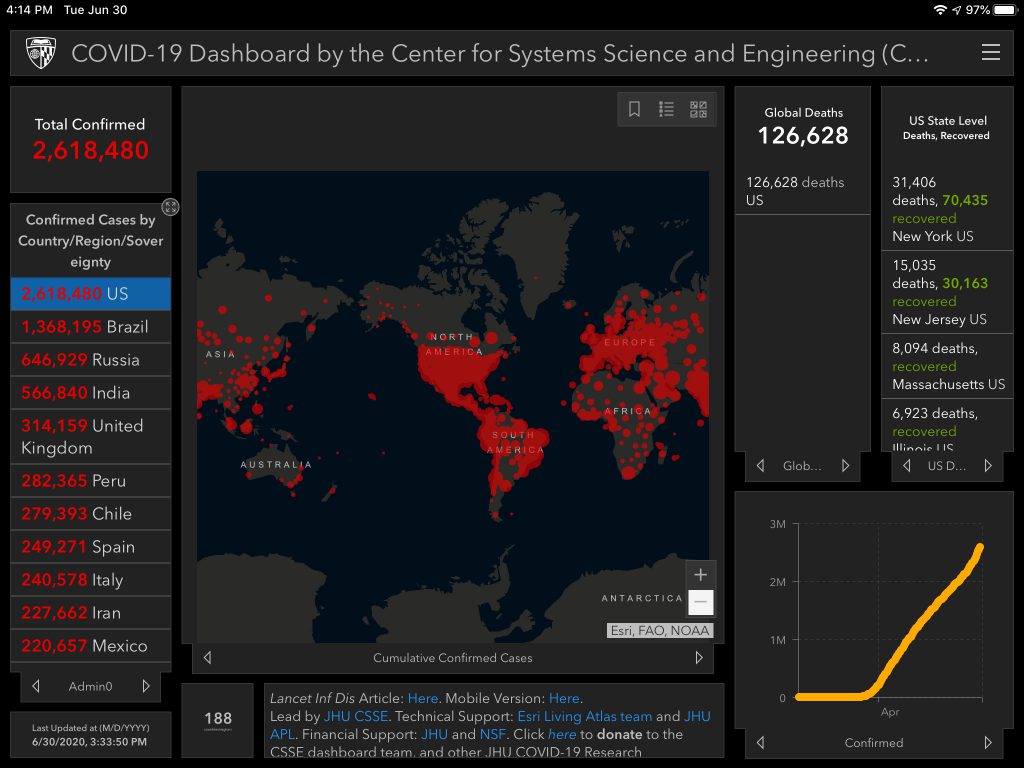

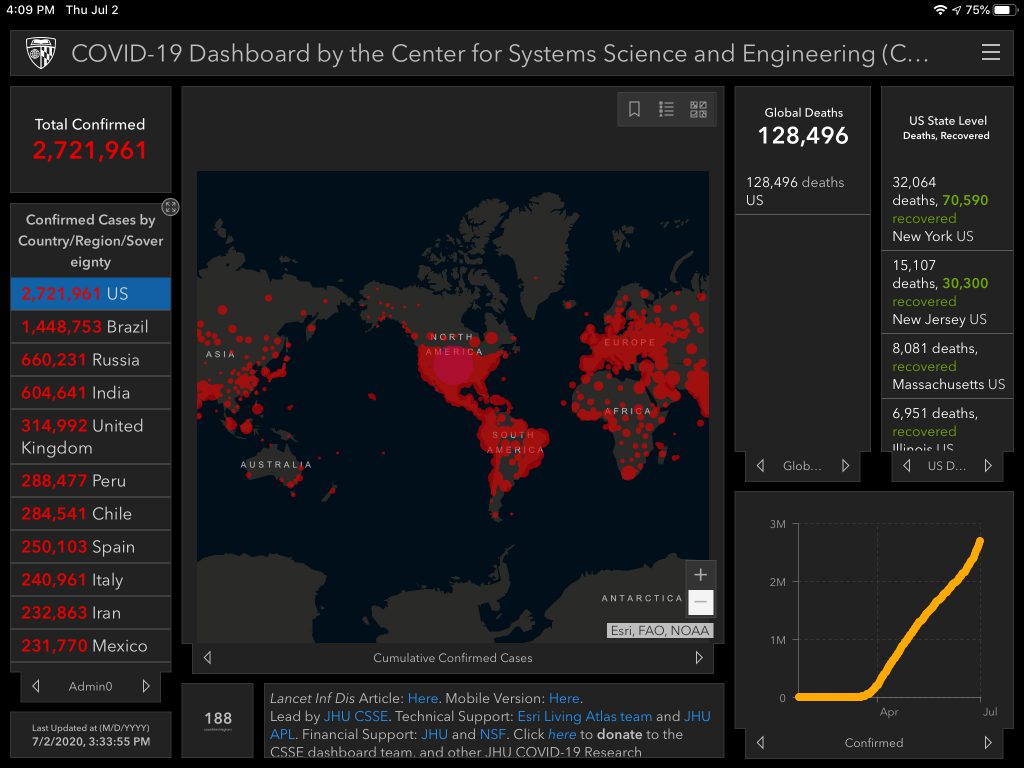

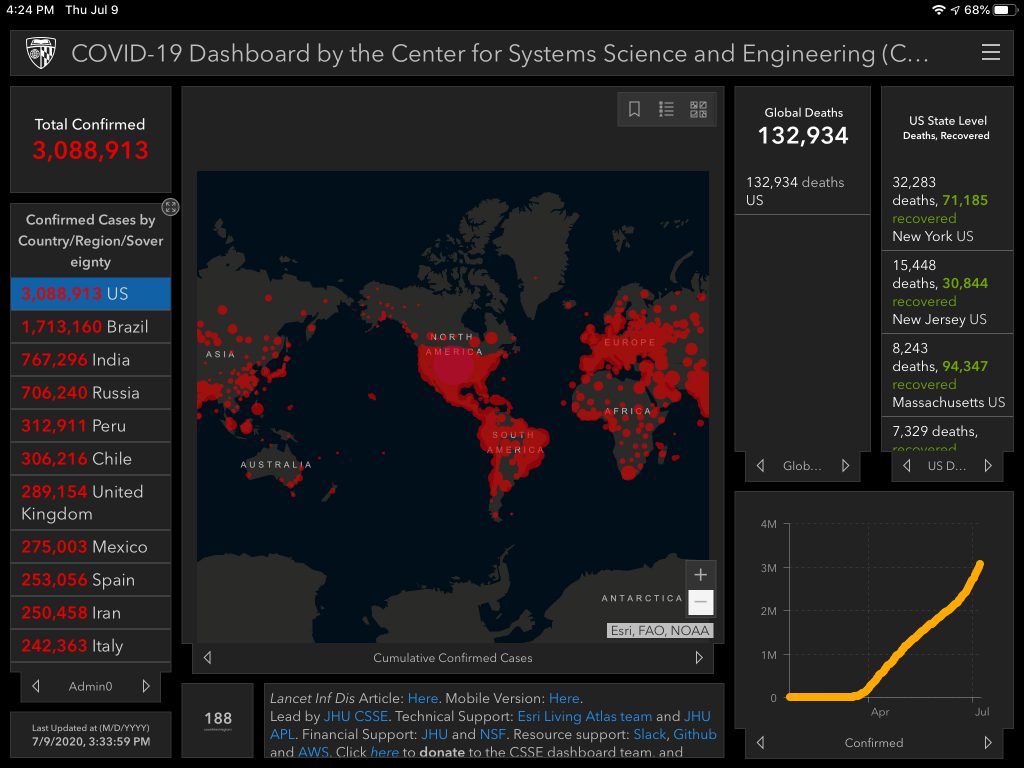

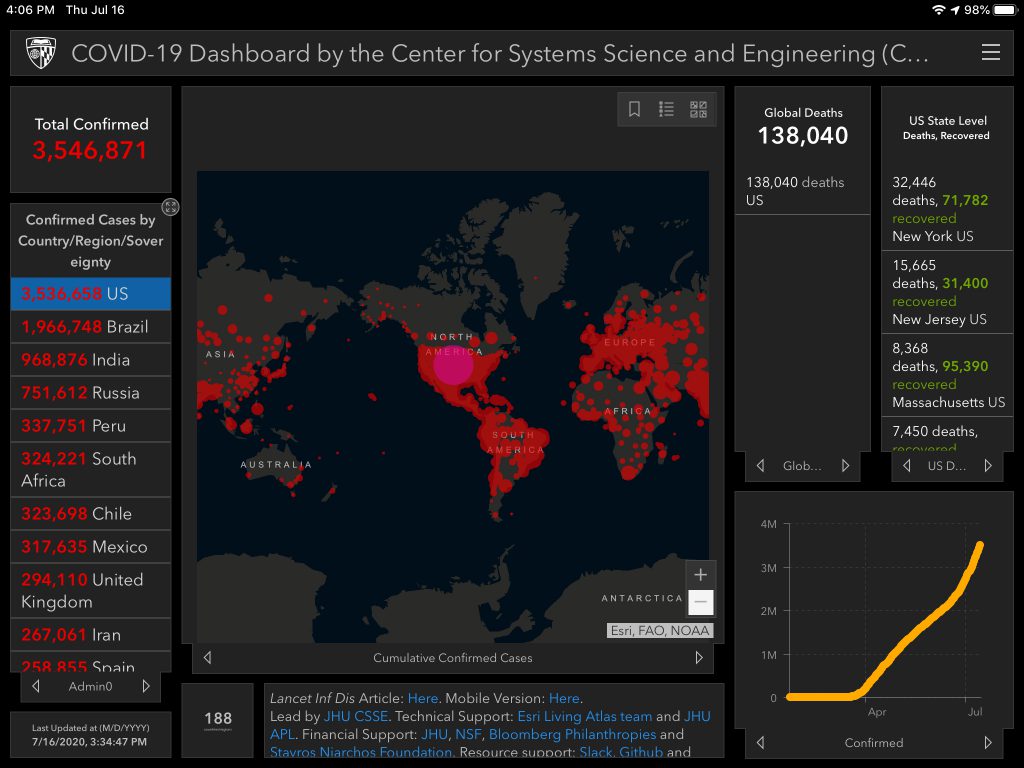

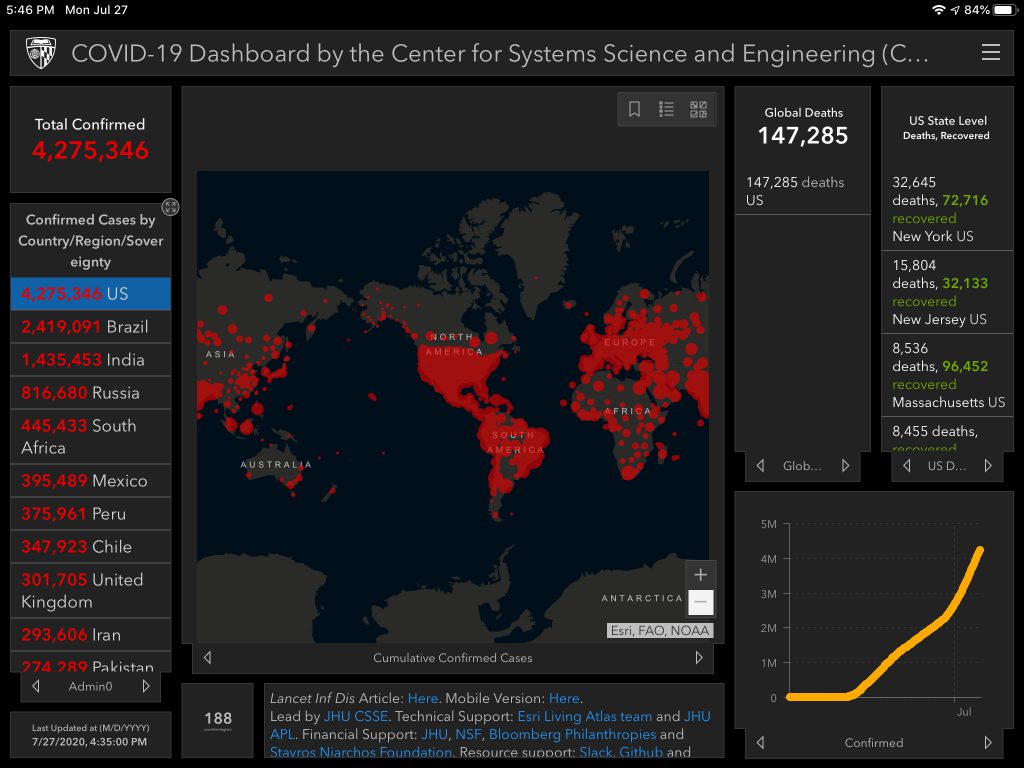

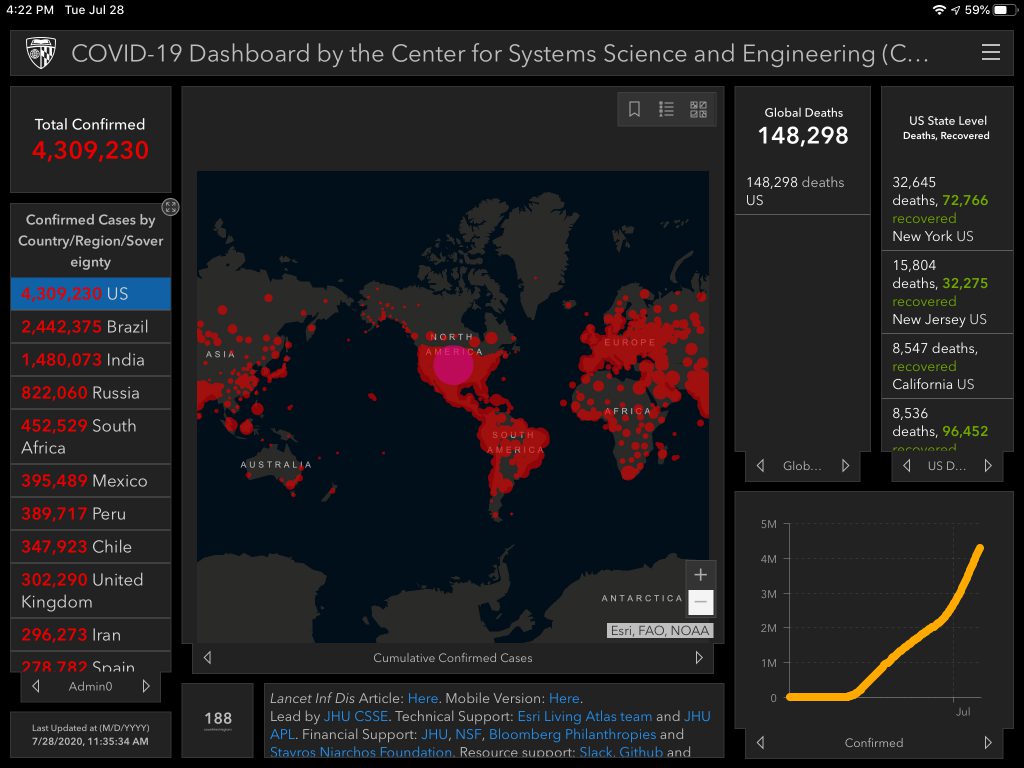

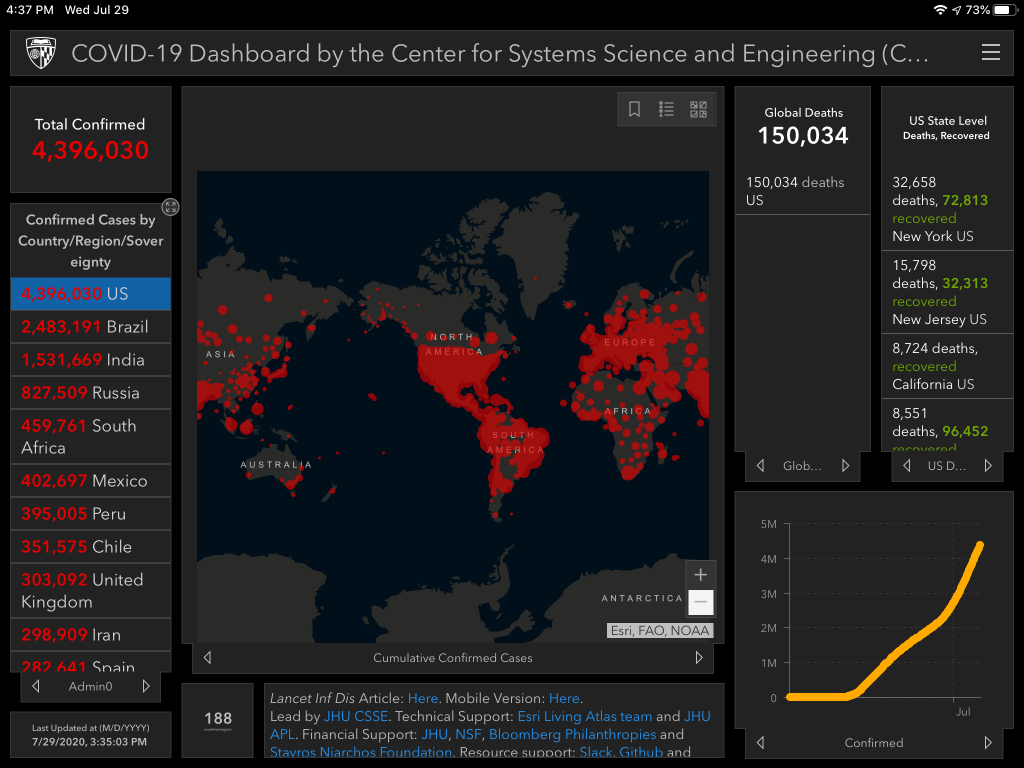

The global COVID-19 death count crossed 400,000.

June 8

Monday. Green all around. The Russell 2k led the major indexes, closing up 2%. Energy was the leading sector, closing up 4.5%. The S&P 500 finished the day up 1.3%, pushing it positive for the year. What a rebound.

I’ve shied away from logging my portfolio performance in these posts because of how personal it is, but I’m changing my mind because of how useful it’ll be when looking back on these posts in the future. I’m pleased with my performance, especially given my ongoing transition to a defensive stance. My investment portfolio is now comprised of over 35% cash & alternatives. -14% is the most I was ever down this year (on March 23), compared to US Stocks $VTI which dipped to -31%. I know I slept a lot better at night than I would have at -30%+. And so far YTD, I’m +10% despite caring more about losing less than beating the market, which coincidentally just broke even on the year.

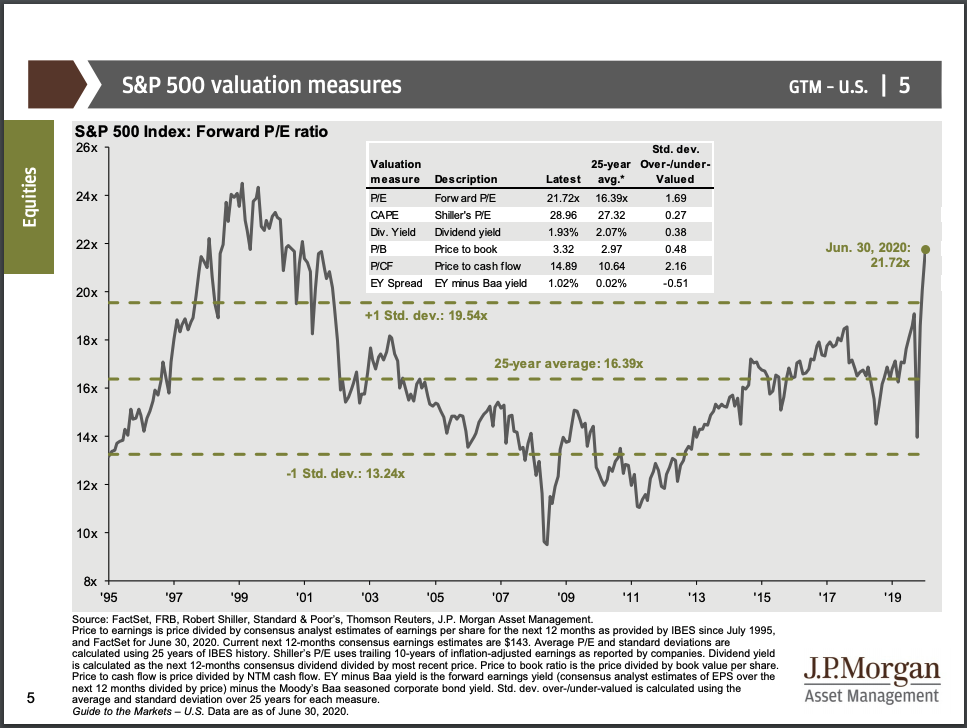

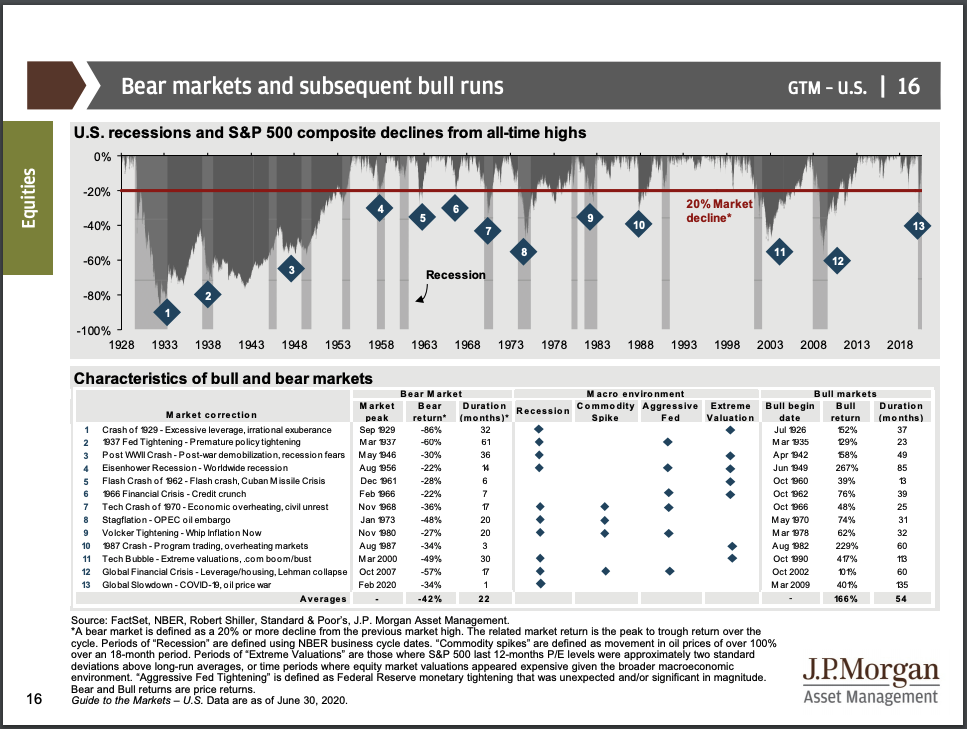

I got around to reading GMO’s Q1 2020 investor letter. An excerpt: “Investing always involves making decisions under uncertainty. We seldom feel we know what the market will do in the near term. We do not feel we know what the short term will bring here, either. While many stocks appear to us to be overvalued today, overvalued stock markets are nothing new. What is new is the meaningful possibility of a disastrous economic outcome combined with a substantially overvalued stock market. The disaster scenario is by no means a certainty. But it is plausible enough that we want to invest in a way that mitigates the losses should it occur…”

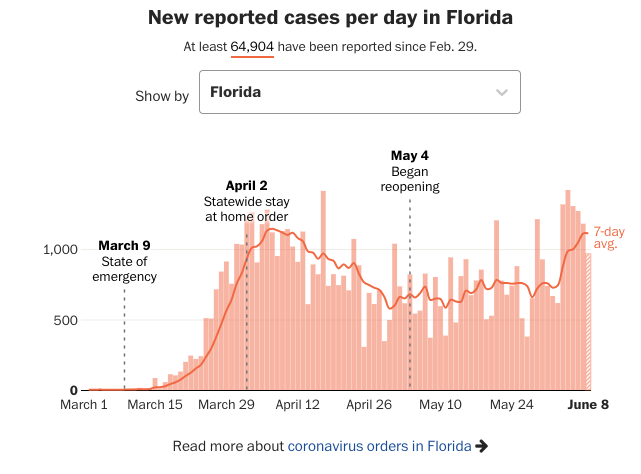

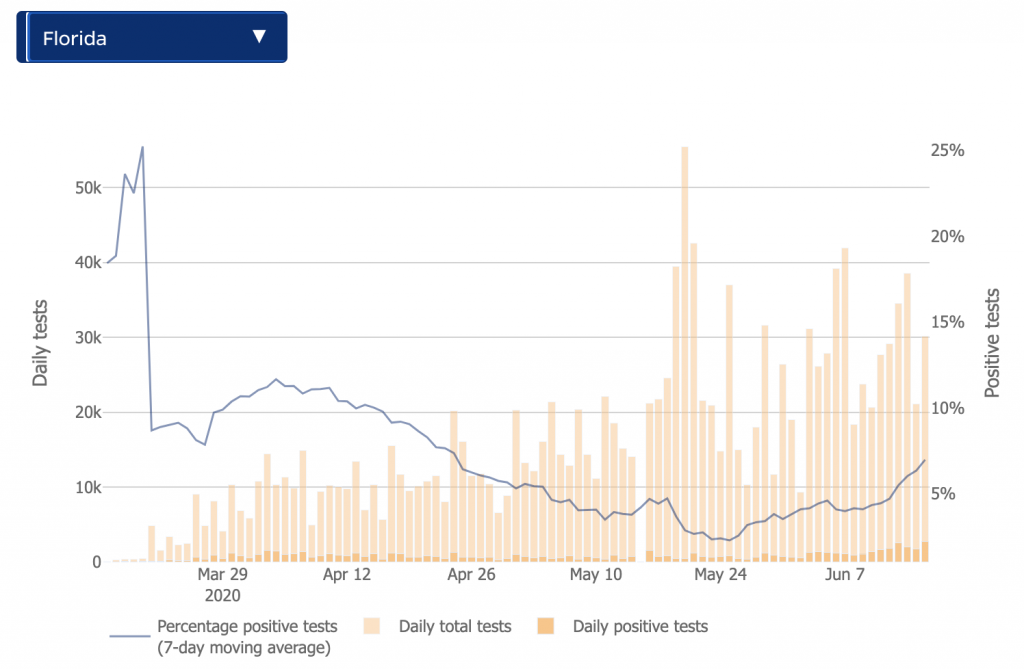

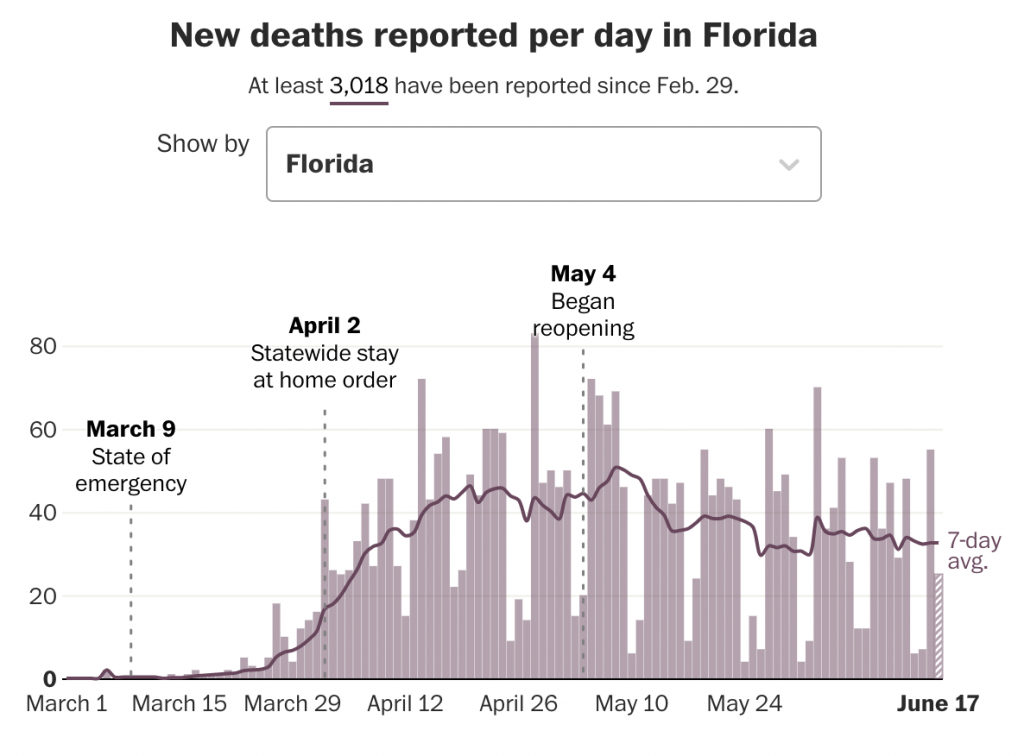

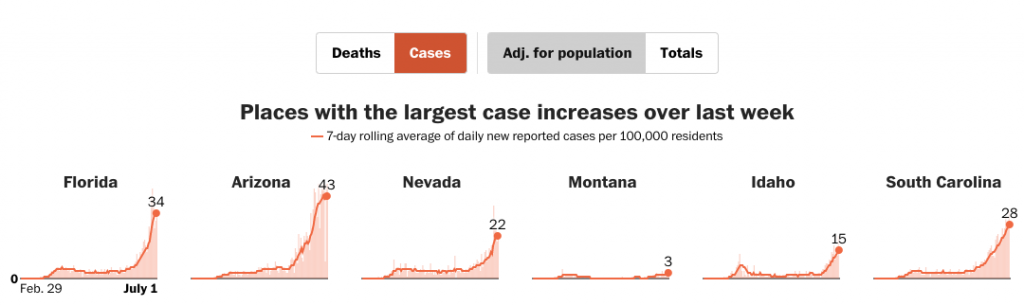

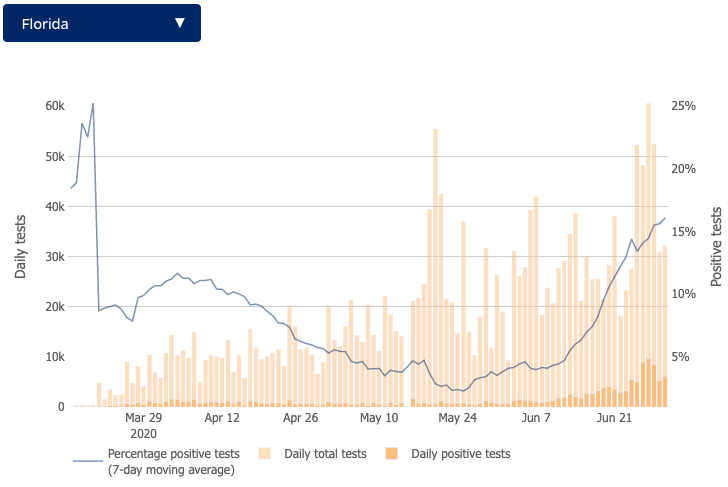

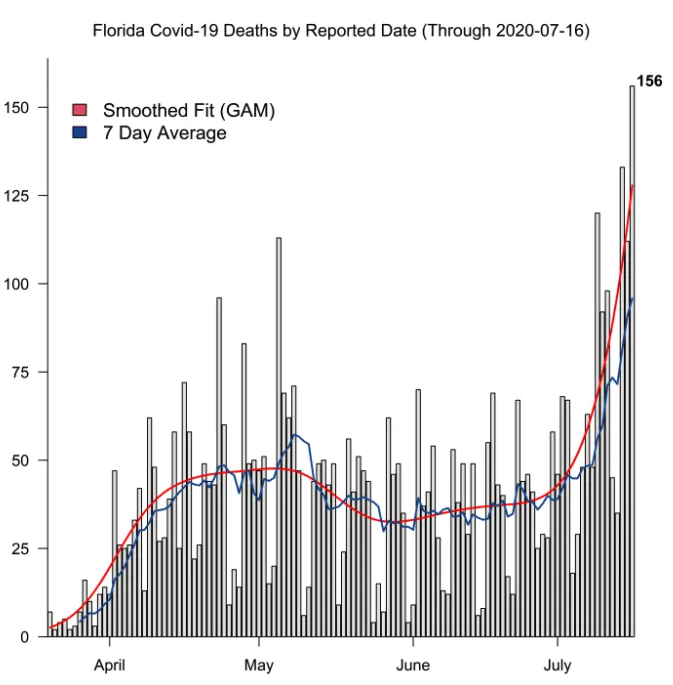

The Washington Post Coronavirus page is quite helpful. It has interactive charts to visualize data like the 7-day average for US deaths (which has been trending down). But the same can’t be said for new cases, and we know cases precede deaths. See the image of Florida below, showing a rising 7-day average. Fortunately, their Total Tests Reported chart highlights that FL has been increasing testing, which likely largely explains the increase in positive cases. But we still have to wonder if the 7-day average of FL deaths will remain flat or increase over the next two weeks? If it grows, at what rate? There’s still so much uncertainty.

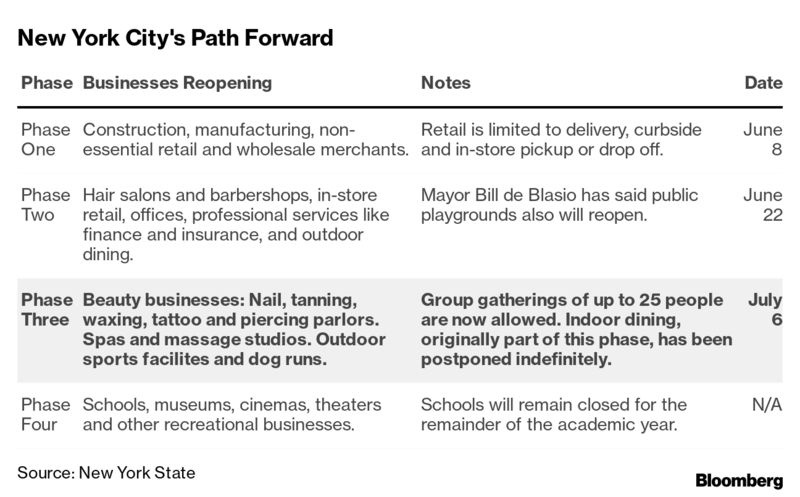

NYC began Phase one of its reopening plans today, following about 80 days of stay-at-home orders. Salons, offices, and indoor dining won’t come until Phase 2, but nonessential workers in construction and manufacturing are now allowed to start working again. Also, retail stores are now allowed to open if they do curbside or in-store pickup.

June 9

Tuesday. The Nasdaq 100 $NDX crossed 10,000 today for the first time. It closed up .7% at 9,971. The Russell 2k closed down 1.8%, Dow down 1%, and S&P 500 closed down .8%. Gold is up about 1% on the day.

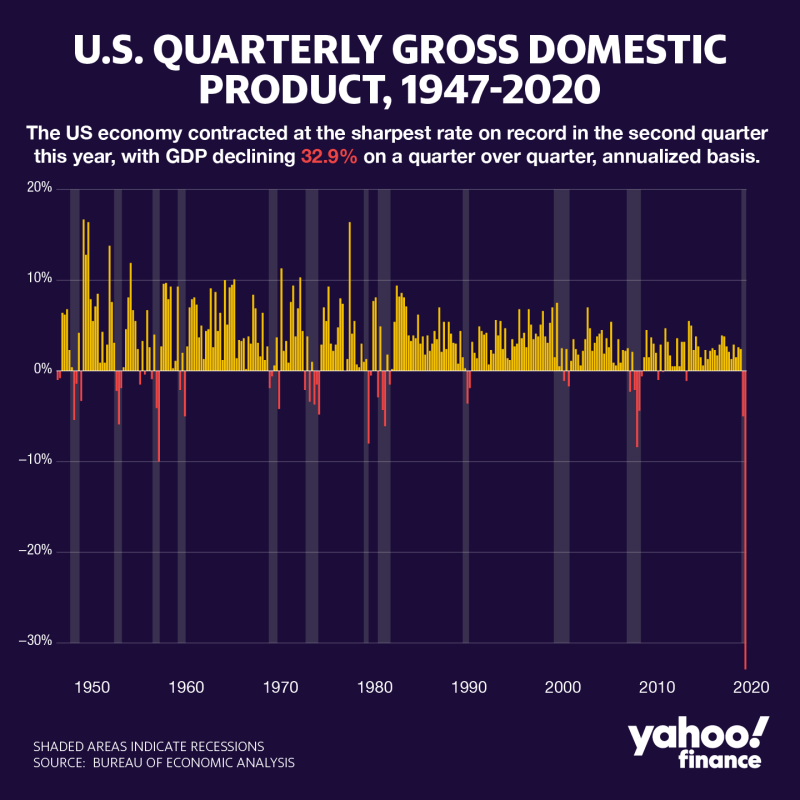

I listened to Patrick O’Shaughnessy’s Invest Like the Best podcast episode #177 with GMO’s Jeremy Grantham, An Uncertain Crisis. An excerpt: “This has created an almost uniquely risky environment. So the uncertainties remain completely for us, but they also dominate Mom and Pop’s portfolio and management attitude, don’t they? This is not as knowable. The future is even less knowable than normal. And the near certainties have disappeared. This market is in the top 10% of all-time P/E’s, and the economy is not in the top 10%, it’s in the bottom 10% of all-time economies. That’s a splendid mismatch carried on the broad back of the FED. If you’re a fundamentalist and you’re patient, you don’t like that combination of being in the highest 10% of P/Es and the lowest 10% of economic certainties. Nobody knows what’s happening in the economy. We all know we’re going to have a wipeout in our earnings, and we all know we’re going to have a wipeout in unemployment, and we all know it’s going to go on longer than we thought… Almost anyone with a brain is more nervous about the economy in terms of the length of how the effect will be felt in terms of peak levels of earnings setback and unemployment. So we’re more pessimistic than we were at the very day the market hit its low. This is all once again carried on the broad back of paper being thrown at the system.”

There’s a new bubble brewing– the bankruptcy bubble. Hertz stock skyrocketed 95% since filing for bankruptcy in May. JC Penney is +160% since filing. Whiting Petroleum is +830%. Chesapeake Energy shot up 180% since beginning bankruptcy plans, and GNC rose 106%.

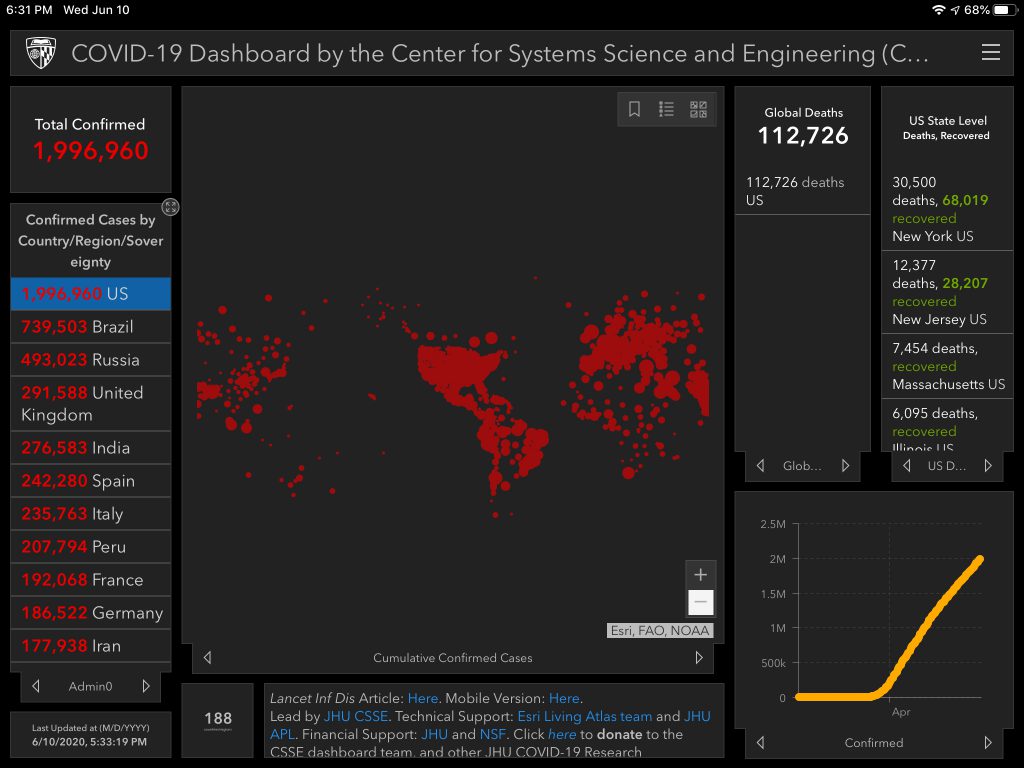

Global COVID-19 cases crossed 7 million.

June 10

Wednesday. The Nasdaq 100 closed above 10,000 for the first time today, after crossing the 10k mark mid-day yesterday but closing slightly lower. It’s up 8 of the last 9 trading sessions. The S&P 500 closed down .5% and the Russell 2k down 2.7%. Tech was the only green sector today, closing up 1.7%. Tesla closed above $1,000 today for an ATH. I continued selling a bit more today– some $VTI, $VEA, and $VWO.

Fed Chairman Jay Powell held a press conference and released this FOMC statement. They provided updated economic projections for 2020– predicting a 6.5% drop in GDP. He said, “The path ahead for the economy is highly uncertain and continues to depend to a significant degree on the path of the pandemic.” Their updated economic projections show no plans of rate hikes in 2020, 2021, or even 2022. Powell added, “We’re not thinking about raising rates — we’re not even thinking about thinking about raising rates.”

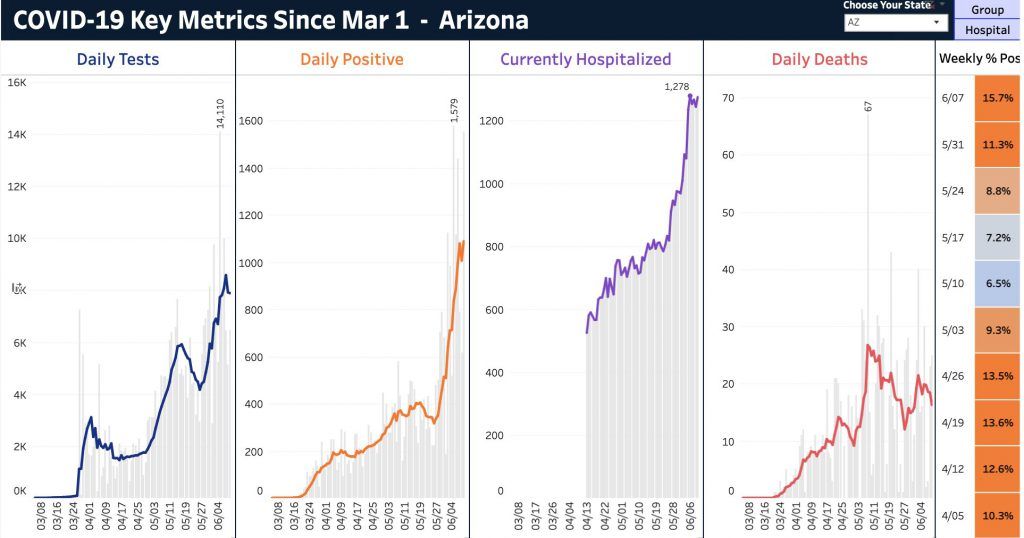

According to covidtracking.com, Arizona, and South Carolina are on an unfortunate trajectory. Many states are seeing rising trends in positive cases, but they’re proportionate with their increase in tests. The image below of Arizona is concerning because of the hospitalizations, and then likely rise soon in deaths.

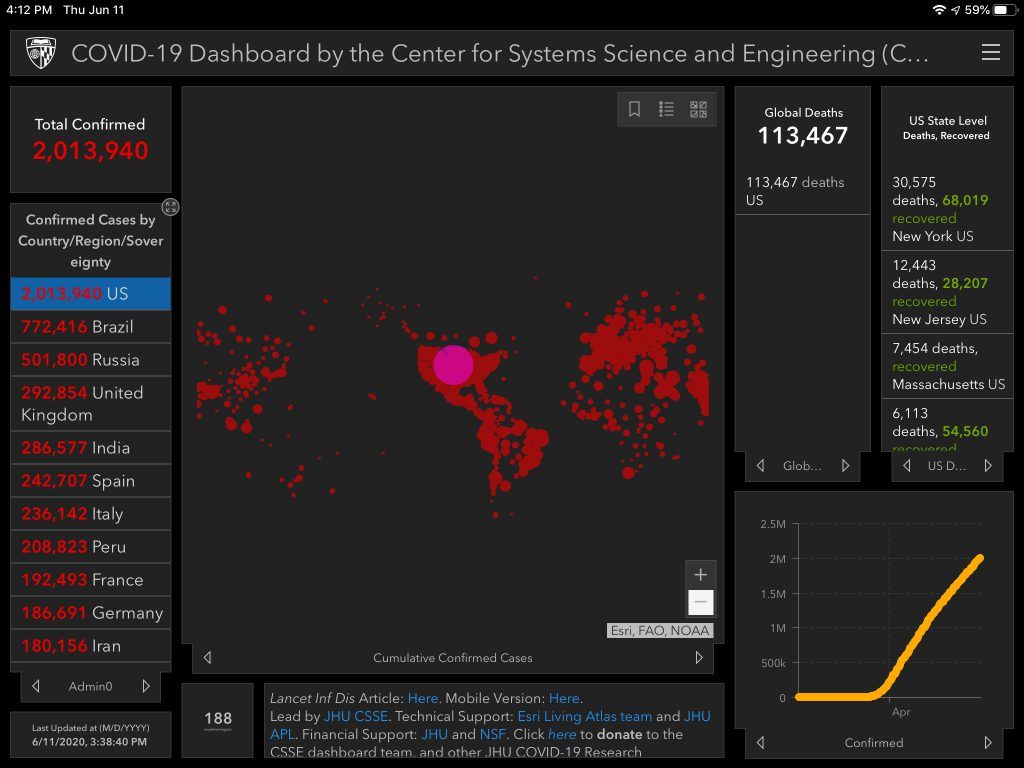

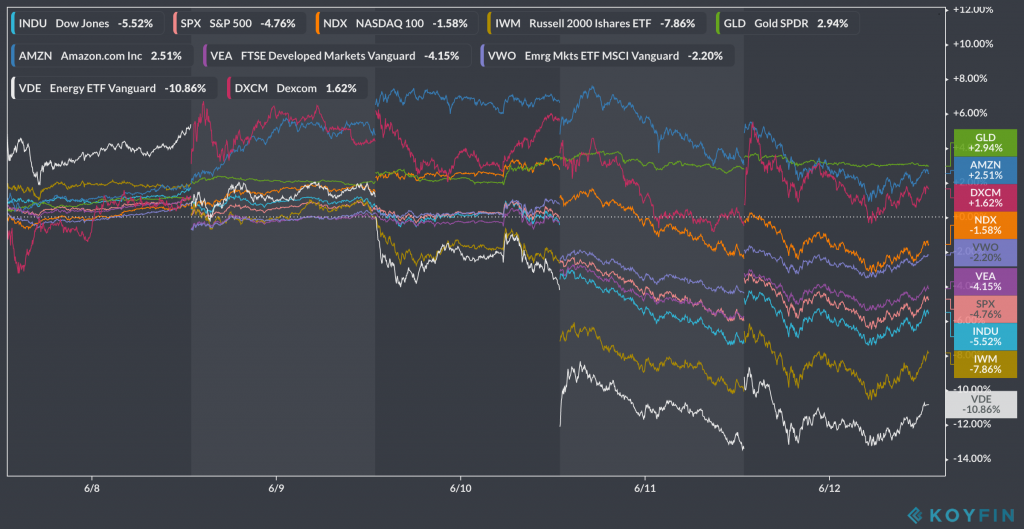

June 11

Thursday. Finally– a bloody stock day! It feels right. It feels rational. The Russell 2k closed down 7.6%, Dow down 6.9%, S&P 500 down 5.8%, and the Nasdaq tumbled 5% from its 10k ATH yesterday to 9,592. The energy and financial sectors bled the most, falling 9.5% and 8.2%. Gold is down .5% and $btc dropped 5%. Why the fall, one might ask? Perhaps it’s the abysmal economy and reality that we have a serious pandemic on our hands that isn’t going anywhere. But one may reply, ‘that’s not news.’ And we land back on the fact that nobody knows shit but rationality often wins out. I’m excited to see what the markets do tomorrow.

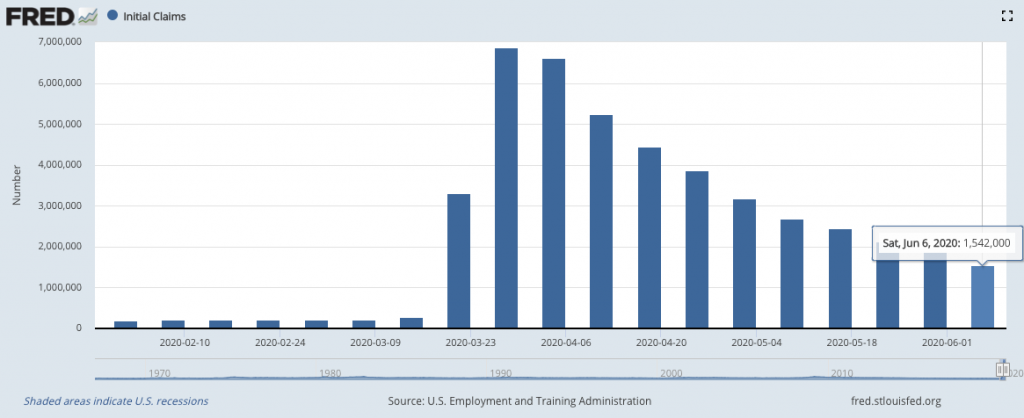

Jobless claims rose another 1.54M. The total for the last 12 weeks is 44M. For context, the entire GFC of 08-09 saw just over 37M. FWIW, it’s the 10th consecutive week of decreasing claims.

I’m all about Andy Slavitt these days when it comes to remaining grounded on Coronavirus. I’m thankful for him since e don’t hear from Dr. Fauci or Dr. Birx frequently (well, ever anymore). This thing is very much as dangerous (and unknown) as in March, despite the administration’s desire for us to forget about it.

Some excerpts from this thread from Andy yesterday:

- 6 months in 400,000 people have died around the world and it is still making its way around the globe.

- There are 2 important measures of an infectious disease— how infectious and the fatality rate. Diseases like Ebola have much higher death rates Measles has much higher infection rates. But COVID-19 has a combination of both that Fauci calls his “worst nightmare.”

- Because we don’t understand how it spreads & have no working vaccine or effective therapies, we have depended on NPIs (#stayhome, social distancing, masks, hand washing, avoiding crowds).

- When this began, this looked like a respiratory virus. Now it appears to impact blood vessels— and travel everywhere to the gut, brain, sinus, kidney, & heart. It can cause dangerous clots & immune system overreactions.

June 12

Friday. Of course, we can’t have a couple down days in a row– nothing can hold stocks down. The Russell 2k closed up 2.5% after dropping 7.6% yesterday. The Dow and S&P 500 closed up 1.9% and 1.3%, and the Nasdaq is back just under 10,000. Real Estate was the leading sector, closing up 3.3% followed by financials at 3%. Here’s how the week looked:

The Real Economic Catastrophe Hasn’t Hit Yet. Just Wait For August. is one of the hot articles making its rounds this week. It uses dramatic language. The title is dramatic. The subtitle is dramatic. Most of the content is dramatic. But guess what? It’s fitting and accurate. It’s reality. “The numbers are grim — but as bad as things look today, they’re on track to get much, much worse. The US economy right now is like a jumbo jet that’s in a steady glide after both its engines flamed out. In about six weeks, it will likely crash into the side of a mountain. What’s kept us in the air so far is an extraordinary government relief effort… The massive interventions that made all this possible will soon come to an end — but the unemployment won’t.” The larger weekly federal unemployment payments will end at the same time evictions are allowed to resume. The savings rate was super high because of stimulus checks going out at the same time that businesses were closed, adding friction to spending. So income will decrease at the same time rents & mortgages come due, and unemployment will remain at record highs. It’s a disaster, and it’s our reality. Oh, and the virus is still here despite it seeming like most of America has forgotten about it.

I miss Dr. Birx.

June 13

Saturday. Get outside.

Bill Brewster (who I love listening to each week on The Acquirers Podcast – Value After Hours) published this sobering thread about his 20-year-old cousin-in-law taking his own life after getting in over his head with options trading with margin. Supposedly his account showed him owing $700k. Unfortunately, there’s a lot of bad examples out there today in the investing world, like Dave Portnoy (founder of Barstool Sports) and better known today as ‘DDTG: Davey Day Trader Global.’ Services such as Robinhood have helped make investing more accessible and even game-like, which can be both good and bad. Investing isn’t a game even if DDTG says so and is entertaining to follow. He’s a millionaire (unlike you), and he makes more money from eyeballs than from trading. You aren’t DDTG. Laugh at him, but don’t try to be him. There’s a lot of great investing advice out there– start here if needed. But be careful and always try to understand someone’s intentions and incentives before you decide to act like them or take their advice. Most folks in finance are salesmen. As Bill wrote, “But here’s the truth. AND PLEASE PAY ATTENTION TO THIS IF YOU’RE YOUNG. The markets are bananas right now. It’s not the time for amateurs. Really really pay attention to position sizing. Stay away from exotic instruments like options and futures.”

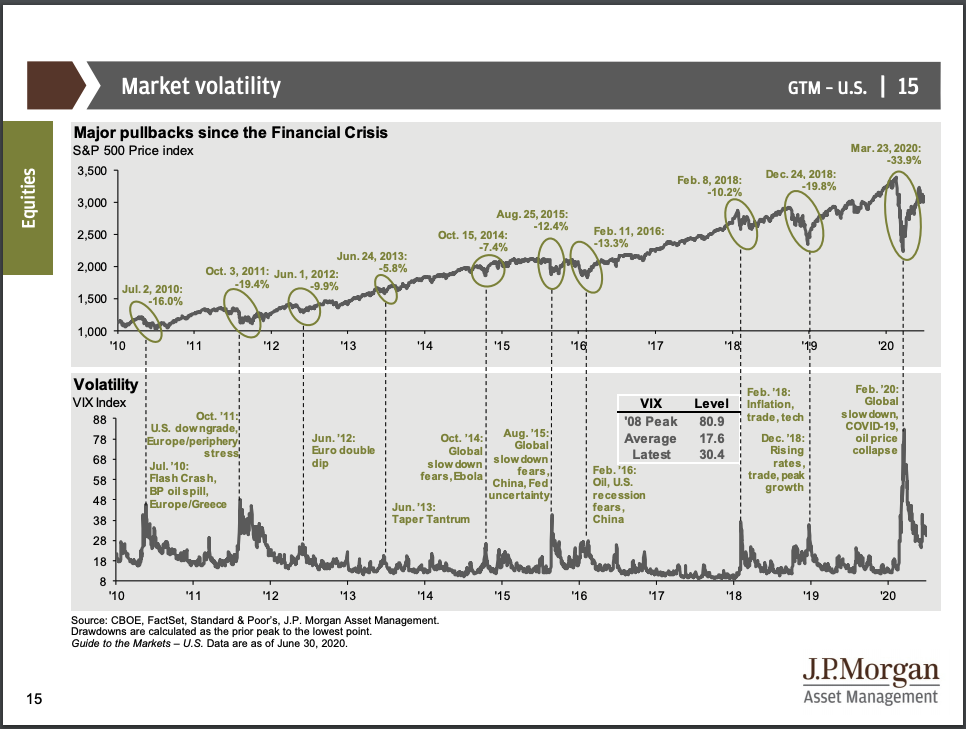

Ben Carlson published Is This The Most Volatile Year Ever? “There have been 26 daily moves of 3% or more. In the previous 7 years, there were just 8 moves of 3% or more in total. Right now we’re basically on pace with 2008 from when you look at the magnitude of the daily swings that year… The bursting of the dot-com bubble didn’t come close and the 1973-1974 bear market was calm by today’s standards.”

Dr. Howard Luks published Masks Prevent The Spread of COVID19… the Evidence Is In. Go out or turn on the TV, and you’ll undoubtedly see some or sometimes most people without masks on while out and about in public. Some people don’t believe in their effectiveness, while others are just assholes. Here’s an excellent example of someone who is just an asshole. Anyway, read the article. It explains the differences between mask types (cloth, surgical, N95, etc.), why we have mask-wearing disparity and recognizes the lack of a consistent message amongst federal government agencies, local agencies, and public figures. While much is still unknown, it’s widely accepted that, at a minimum, wearing a mask sets an excellent example for others. Be part of the solution than part of the problem. Good masks are tough to find. Check out Joola Medical masks (we ordered a box, and despite not knowing the exact effectiveness, wearing them certainly puts us on the solution side of society than the problematic side). “If you are out and about and cannot maintain a six-foot distance from people around you, then you should wear a mask. Anytime you are indoors around others, you should wear a mask. If you are sick, then you should be wearing a mask at all times in your home as well. If you are sick, you should NOT be going outside. Again, you are protecting others from your germs.”

June 15

Monday. Futures gapped down last night, remained in negative territory for most of the day, and then turned positive in the afternoon. $VIX was over 40 at one point this morning. But somehow, for some reason, the Russell 2k closed up 2.3%, Nasdaq up 1.4%, and the S&P 500 closed up .8%.

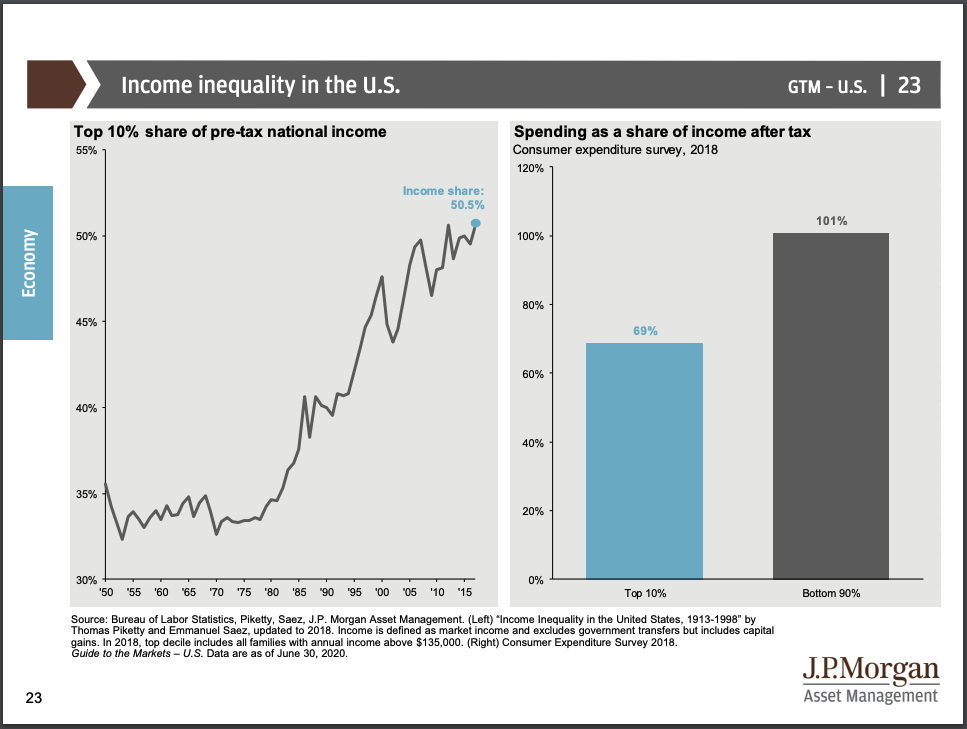

The latest wknd notes from Eric Peters is out: The deeper we dig into inequality, the more likely will be calls to abolish capitalism. He touches on Thursday’s equity plunge and all else that went on. “Some blamed signs of a viral resurgence, though that had swirled for days. Others blamed Millennials whose day-trading resembles the dot.com mania. And a few blamed General Milley, America’s top-ranking general, who apologized for joining the President on his ill-fated march to St. John’s Church. You see, the generals have turned their backs on Trump over his response to demonstrators. The NFL has too; its commissioner apologized for having opposed taking a knee. Even NASCAR banned the Confederate Flag. And as Trump’s re-election prospects tanked, expectations for a dramatic restructuring of America’s economy soared. Efforts to rebalance the division of profits between capital and labor is demanded by a riotous Main Street. But this terrifies Wall Street, which has worked for years with Republicans, Democrats, CEOs and the Fed to extract an ever-increasing share of national prosperity for those who control capital. This imbalance is central to today’s tumult.”

“There’s no denying that there is an orgy of speculation going on in certain areas of the stock market.” Hahaha– such a perfect summation of what we’re seeing in parts of the market by Michael Batnick in his opening to Who’s Driving the Stock Market?

Never Hertz to Ask by Alex Danco is the best post I’ve read recently. “There is a third kind of bubble, and it’s happening spectacularly right now. If the first kind of bubble is ‘everyone thinks the future will be the same’, and the second kind is ‘everyone thinks the future will be different’, the third kind is ‘everyone thinks the future doesn’t matter.’ Millennials have real paychecks to spend, and stock trading fees have all gone to zero. Trading has become gaming… The stock picking day traders are having their cultural moment, led by Dave Portnoy and an army of shitposters.” He then proceeds to explain r/wallstreetbets and eventually dovetails into the recent action on Hertz’s stock (which skyrocketed 577% from June 3 to June 8– Oh, and Hertz is in bankruptcy). “This generation of day traders is hooked on harder drugs than in the 90s, and the internet is absolutely why.”

Charles Schwab released their 2020 Mid-Year Outlook last week. I found the most noteworthy part to be their succinct list of “potential risks to the market’s rising expectation of a rapid recovery.”

- “A slowdown in the pace of recovery as some restrictions linger, evidenced by the still stringent lockdowns in many major countries.

- A second virus wave resulting in another official lockdown or an unofficial behavior shift, where people no longer feel safe to leaving their homes.

- A return to the U.S.-China trade war as rhetoric spills over, undermining the hard won Phase One trade deal from mid-January.

- Ongoing civil unrest may weigh on the confidence of consumers and their spending, the largest driver of the economy.

- An above-average summer hurricane/typhoon season (along with other natural disasters) that could damage coastal areas, and slow their recovery.

- There are likely plenty of additional concerns besides those listed above. The start of new economic cycles are usually vulnerable and subject to risks.”

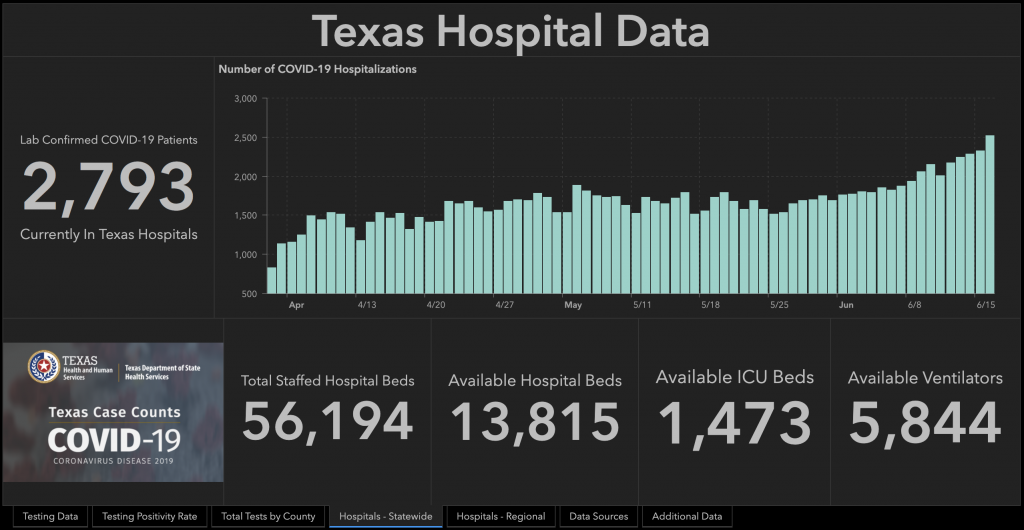

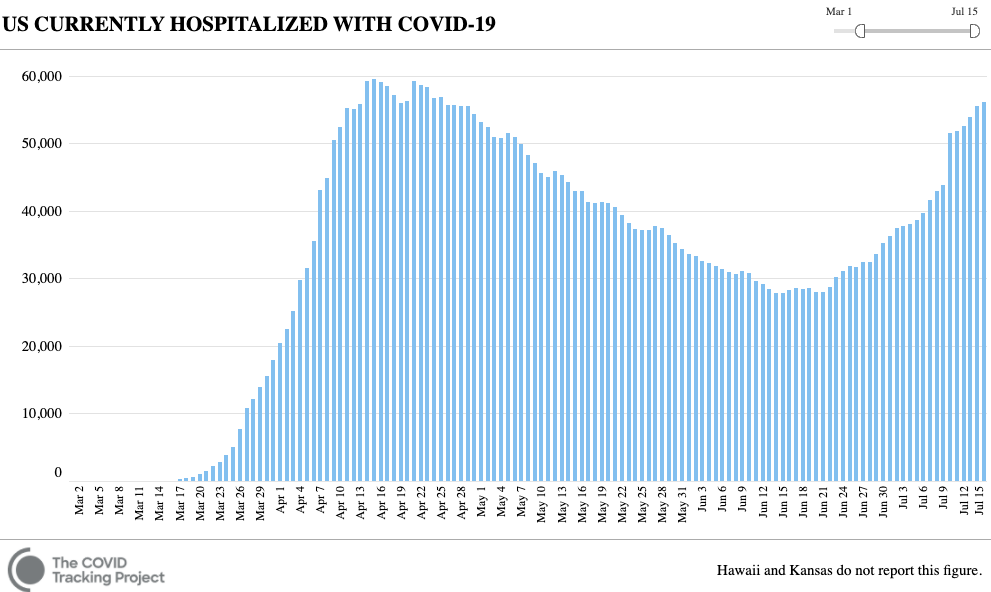

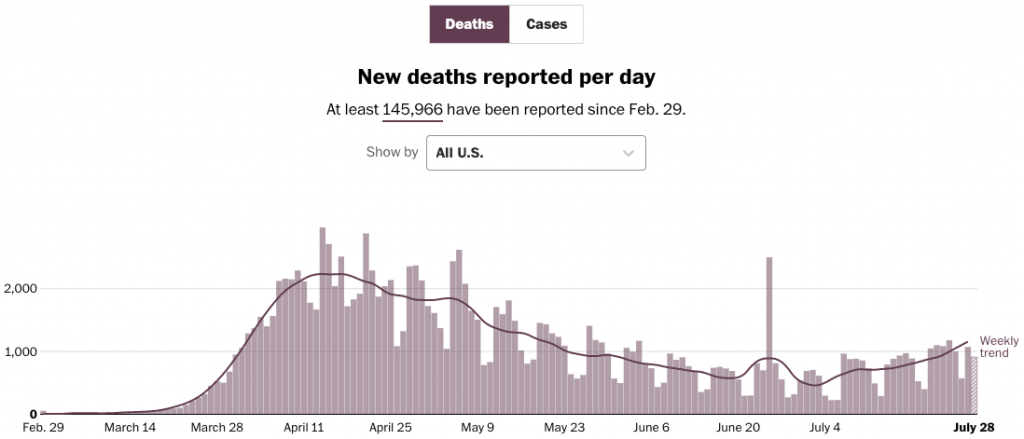

Charlie Bilello of Compound Advisors posted a very informative, easy to understand set of questions and answers in COVID-19 Q & A. I think #8 & #9 are the most important regarding active monitoring: “Hospital admissions are perhaps the best metric as they are a leading indicator of deaths and are not greatly influenced by the amount of testing. On that front, we’ve seen a continued downtrend in the US overall, with total hospitalizations today at their lowest level since April 4. We are all hoping this trend continues in the coming weeks and months… The states that were hit hardest are showing the biggest improvements and skewing the data overall. New York, for example, has reported a decline in hospitalizations for 61 consecutive days, from a peak of 18,825 to the current level of 1,734. Meanwhile, at least 12 states have shown an increase in hospitalizations since Memorial Day. While nowhere near the levels in New York at its peak, hospitalizations in Texas and Arizona are at new highs and should be monitored more closely going forward.”

There’s a new Florida Coronavirus Dashboard available, thanks to Rebekah Jones (the woman who maintained Florida’s original dashboard but was supposedly fired). I appreciate her and donated to help support her efforts.

NPR published White House Coronavirus Testing Czar To Stand Down. “Adm. Brett Giroir told a meeting of the Presidential Advisory Council on HIV/AIDS that he will be “demobilized” from his role overseeing coronavirus testing at FEMA in a few weeks and going back to his regular post at the Department of Health and Human Services.” I’m not clued in enough to know if this is a good or bad thing with any certainty, but it doesn’t feel comforting. I miss watching him, Dr. Fauci, and Dr. Birx conduct Coronavirus Taskforce media briefings.

June 16

Tuesday. Equities closed positive for the 3rd trading day in a row. The Russell 2k led major indexes, closing up 2.4%, followed by both the Dow and S&P 500 up about 2%. Energy was the leading sector, closing up 2.9%.

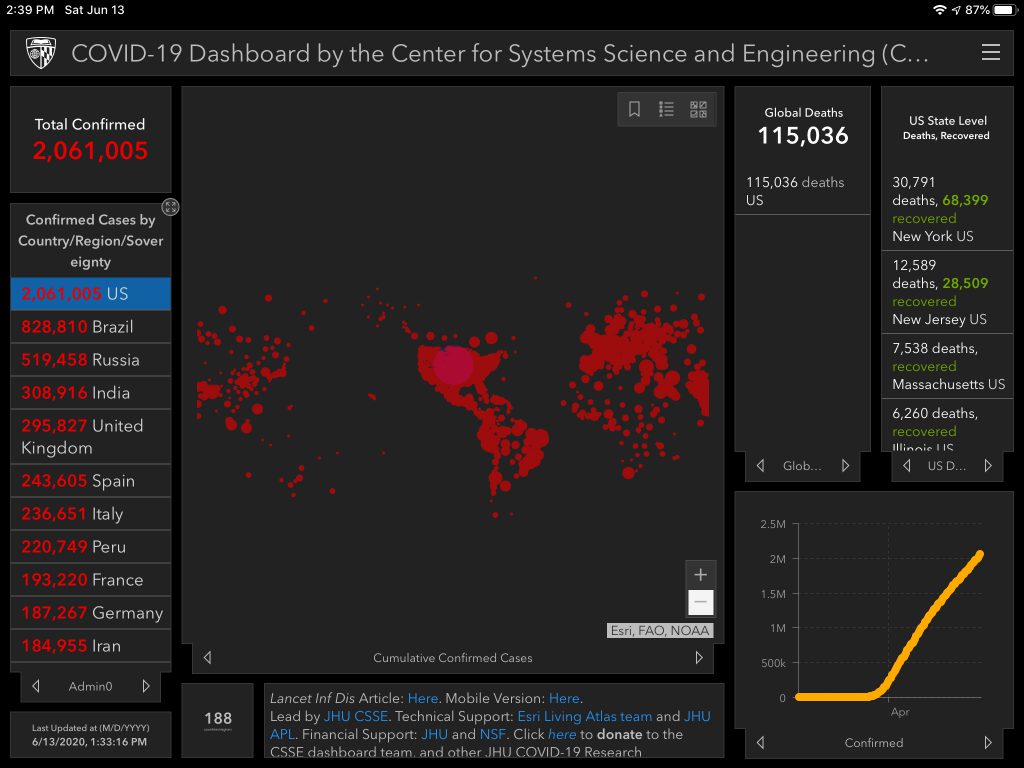

Check out this big bounce in retail sales. 17.7% pop for May. Shouldn’t be so surprising though. Savings & income were up in the prior month but spending was suppressed. Guess what happens as you reopen? People spend. Clothing store spending rebounded 188%, furniture 89%, electronics 50%.

Jay Powell spoke today, again… Here’s his testimony: Semiannual Policy Report to the Congress. Here’s the summary: the economy is bleak, it’s unfair, we’re keeping rates near zero, and we’ll use all of our tools to support the recovery.

I wrote a new blog post: 5x there, 10x to go. Not much to do with this page aside from the fact that I call attention to the lack of a credible news source for situations like Coronavirus.

June 17

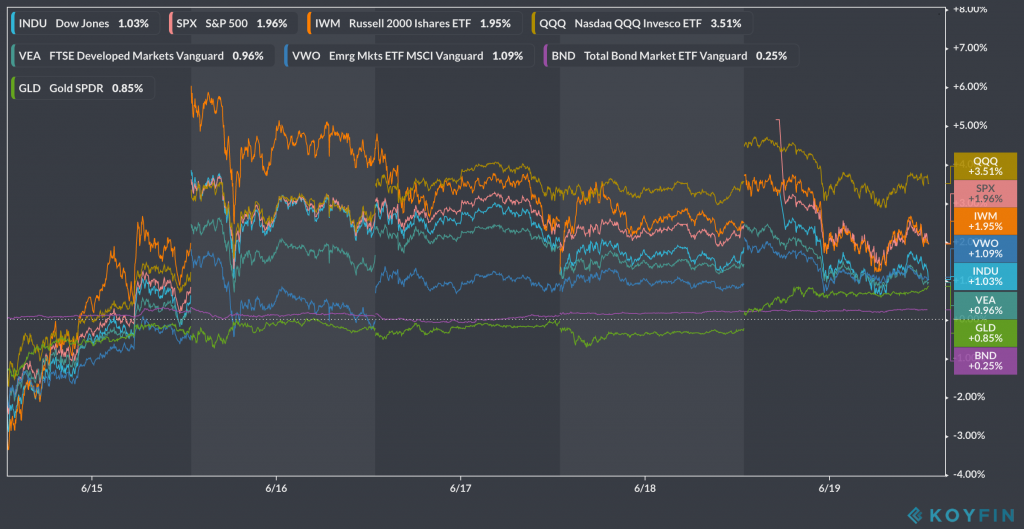

Wednesday. The Nasdaq is the only major index that closed green today, up .38%. Both the S&P 500 and Dow teetered positive to negative to positive, before ultimately closing down .34% and .65%. The Russell 2k was red all day, closing down 1.85%. Here’s the MTD chart now that we’re halfway through May:

My wife published Remembering my Dad on Father’s Day, since he died 3 years ago today, his birthday would have been tomorrow, and Father’s Day is coming up. It’s a good reminder to tune out the markets and scary news sometimes and focus on the simple things. Remember, no matter how shitty something is, it could always be worse. Get some time outside… observe nature. Be grateful for what you’ve got.

I came across “Risk-On” And Digital Antibodies by Semil Shah and his comment, “My #1 source on COVID-19 is Don McNeil from The New York Times.” I’m glad I did, as I’m seemingly on a never-ending journey to find credible, trustworthy sources for the latest on COVID-19.

North Carolina reported their highest day of COVID-19 hospitalizations (846 patients). Texas, too, with 2,793 patients currently hospitalized, according to the TX dashboard. I wish Florida exposed a hospitalization chart.

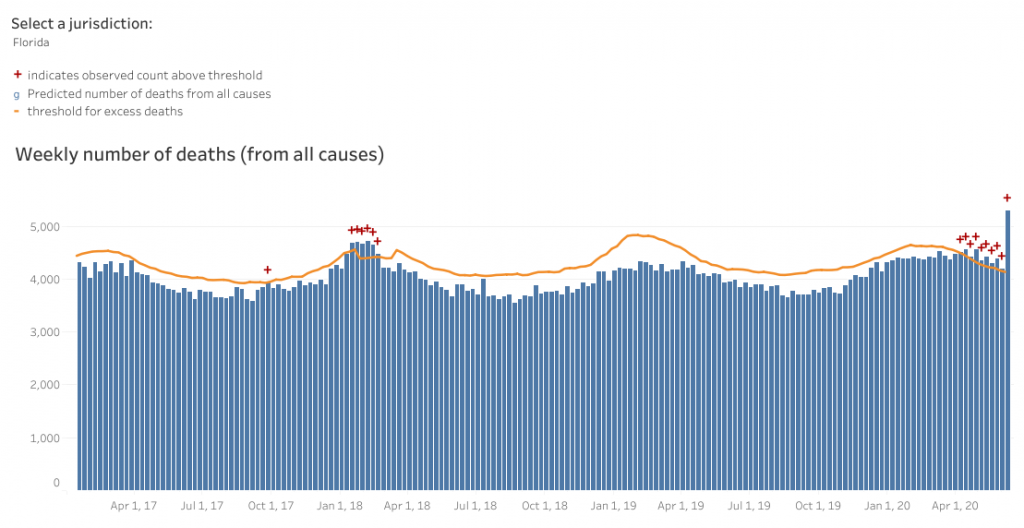

It’s starting to feel like Florida is getting worse. It felt scary here at first (especially during that Spring Break week), but then it seemed like things were under control for a long time for whatever reason(s). The biggest concern has been with the reporting. But for the first time, it’s hitting close to home because a couple of employees at my wife’s office tested positive after getting low-grade fevers a few days ago. And outbreak stories are popping up more and more (like this one), and reports of increased pneumonia deaths in FL haven’t let up over the past few months. Is there really an increase in pneumonia deaths, or should they be counted as COVID?

I haven’t found reliable hospitalization numbers, which are crucial to understanding how dire the situation may be in an area. I wish we had them, but the best we have is positivity rates, which increased this week.

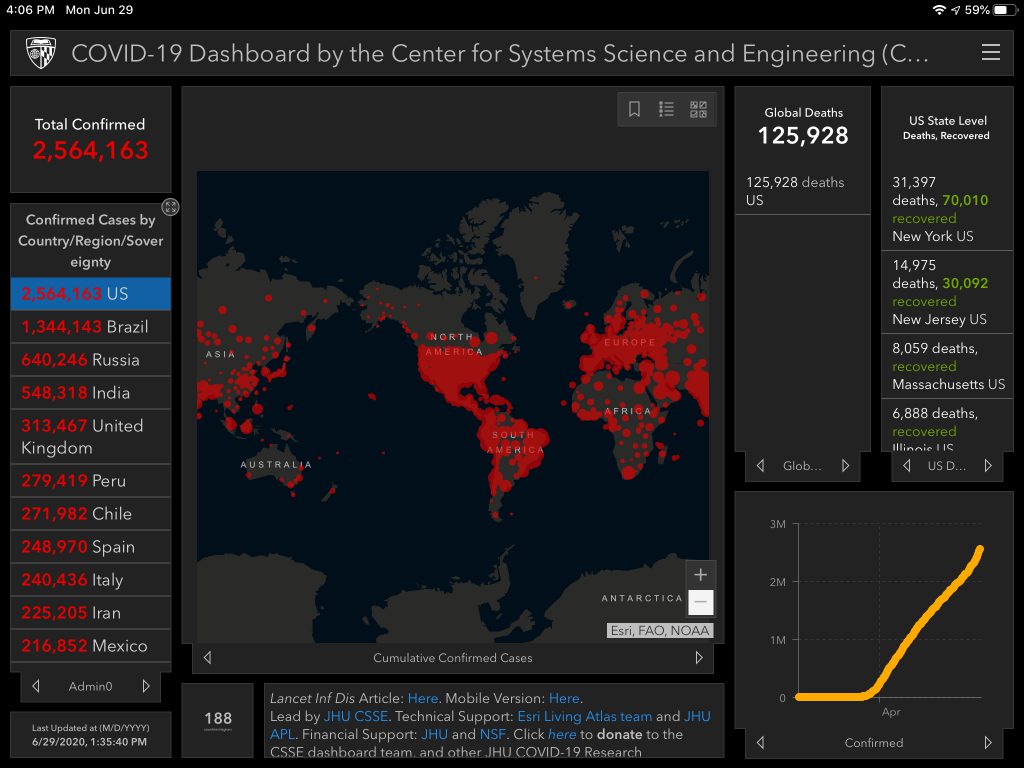

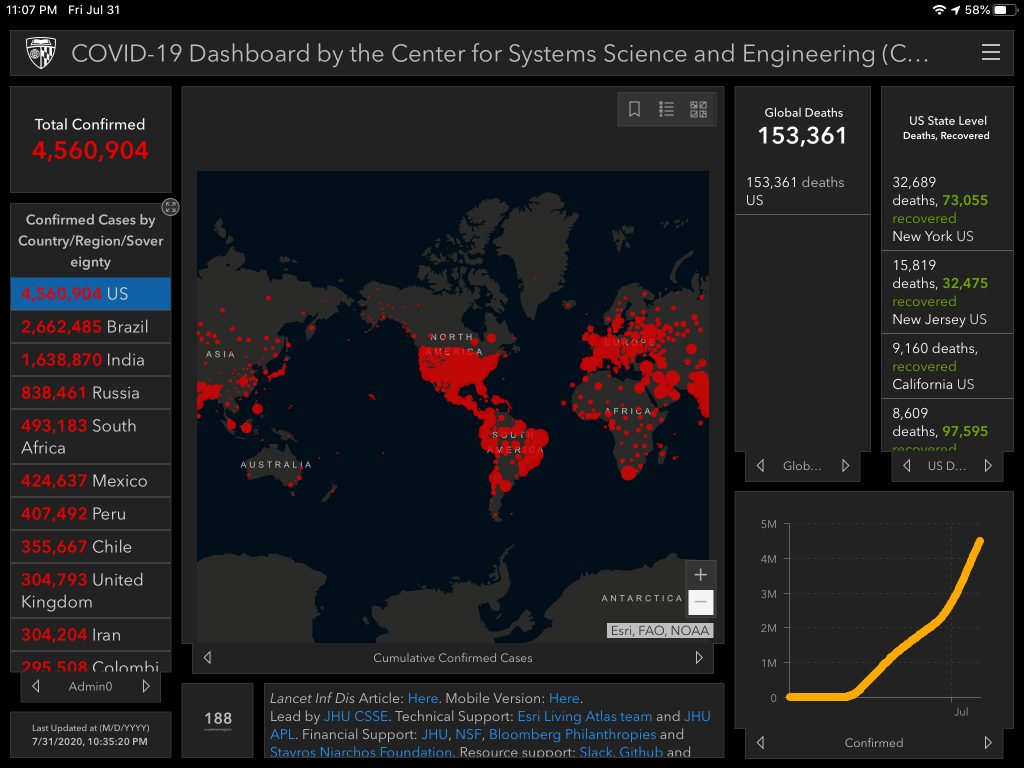

Shoutout to the JHU Coronavirus Resource Center, and WSJ Coronavirus page, and their Florida timeline.

Nonetheless, having workers at my wife’s office get sick means it’s hitting closer to home now. I mean, it’s not surprising– they’re a pediatric practice. They see well and sick kids and conduct COVID-19 testing. I guess it was bound to happen eventually. And while our household never let our guard down, we know most people have, including friends and family. Most of them never saw the virus. It never hit close to home for most people. Personally, I luckily only know one person who passed away and one person who was very sick. I suspect most people don’t know anyone at all who was severely affected. But I think it’s going to start hitting closer to home for more people than ever. I hope those who have rushed out to live their pre-COVID-cautious life begin to slow down.

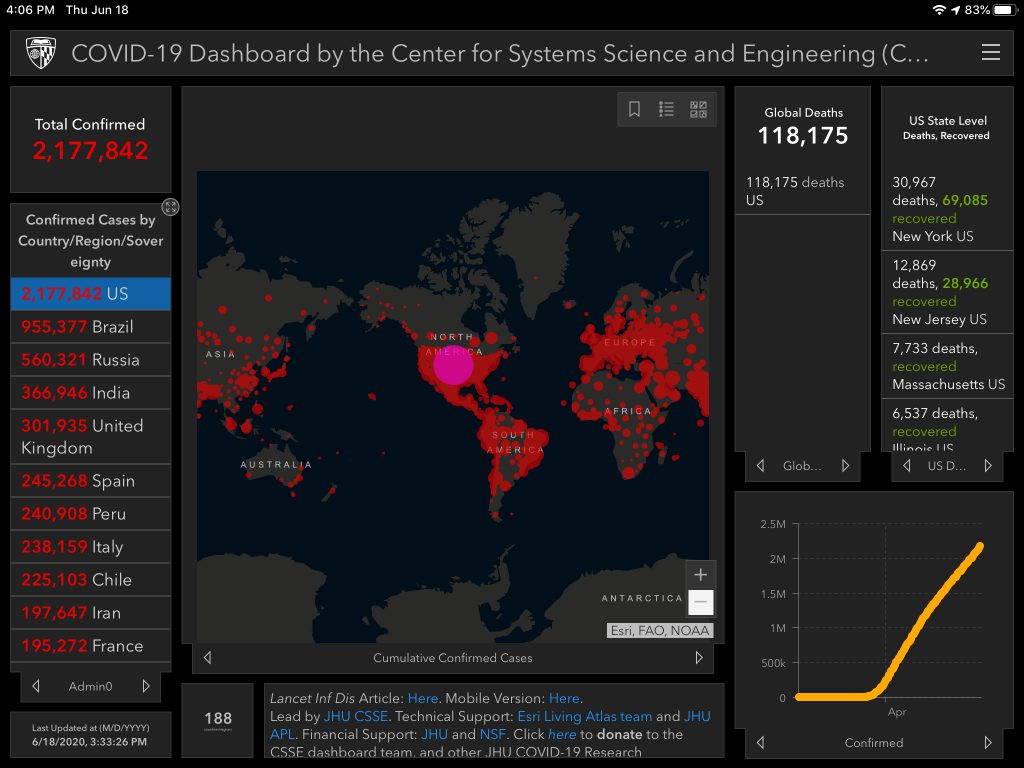

June 18

Thursday. The S&P 500 and Russell 2k were basically flat and the Nasdaq closed up .33%. Energy was the leading sector, closing up 1.3%.

Jobless claims rose another 1.5M. The total for the last 13 weeks is 45.7M. For context, the entire GFC of 08-09 saw just over 37M.

Crescat Capital published Crescat Turns Activist On Gold to explain that “The US stock market should not be trading anywhere close to the multiples it is today given the enormity of the macro events that have already unfolded this year.” Their macro posts are always thought-provoking to read. “Markets driven by euphoria never end well. The US stock market today is in la-la land. It is discounting a new expansion phase of the economy at the same time as a major recession has only just begun. Since the March lows, investors have turned overwhelmingly bullish. They are trusting that central banks’ liquidity will miraculously create economic growth rather than just temporarily ease the pain of declining gross domestic incomes and crushing debt burdens. This delusional thinking is induced by the intense but short acting dopamine response to Fed money printing but completely ignores how business cycles work. Government money printing has failed miserably, repeatedly, throughout history at eliminating recessions and frequently coincides with some of the worst downturns. Today, it is a major symptom of a severe recession if not a depression… Brutal bear markets and recessions begin from record asset valuation bubbles and debt imbalances, and that is the case again this time. In our analysis, the current downturn has only just started and has much further to play out. Economic downturns are rarely halted and reversed by government intervention so early in the process. They must play out to bring the necessary creative destruction that sets the stage for a new economic expansion and bull market.”

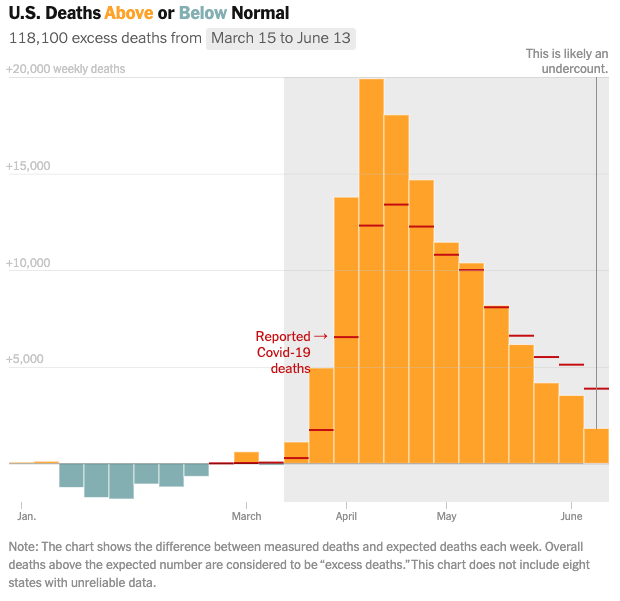

Oh, shit. I noticed a wild spike in this CDC chart: weekly number of deaths (all causes) in Florida:

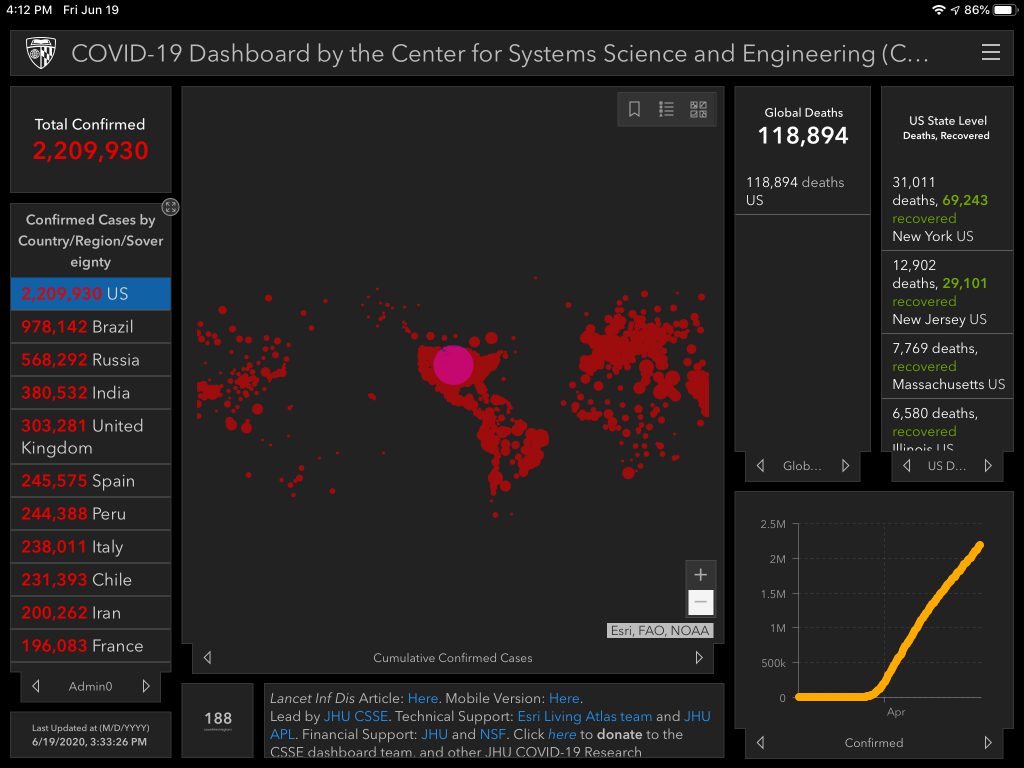

June 19

Friday. The S&P 500 and Russell 2k both closed down a little over .5% while the Dow closed down .8%. Health Care was the leading sector, closing up 1%. I did a good amount of selling this week. The stronger the rally, the more seldom the pullbacks, the more confident I am in my decision to convert more equities to cash. This rally certainly turned me into less of an indexer and more of a market timer than I ever imagined. Here’s the weekly snapshot:

Howard Marks & Oaktree published The Anatomy of a Rally. As usual, it’s beautifully written. The purpose of this one was to put the current rally into perspective. I’m sharing excerpts here for my benefit (to quickly glance at in the future), but readers should take the time to read his memo instead of just these excerpts.

- “The world is combatting the greatest pandemic in a century and the worst economic contraction of the last 80+ years. And yet the stock market – supposedly a gauge of current conditions and a barometer regarding the future – was able to compile a record advance and nearly recapture an all-time high that had been achieved at a time when the economy was humming, the outlook was rosy, and the risk of a pandemic hadn’t registered. How could that be?” He named ~23 potential reasons for the recent recovery, dubbed the “optimistic possibilities.” He then concluded that many investors had chosen ‘yes’ to the question, “can the Fed keep buying debt forever, and can its doing so keep asset prices up forever?” Then he named ~10 negatives to counter the optimistic possibilities and questioned if a rally from the lows makes sense. Howard thinks that there is reason to believe that a rally made sense, but not necessarily the degree to which markets snapped back.

- “Thus far in 2020, the swing from flawless to hopeless and back has taken place in record time. The challenge is to figure out what was justified and what was aberration.”

- “All I know is that a lot of smart, experienced investors concluded that asset prices had become too high for the fundamentals. Time will tell.”

- “They lead me to conclude that the powerful rally we’ve seen has been built on optimism; has incorporated positive expectations and overlooked potential negatives; and has been driven largely by the Fed’s injections of liquidity and the Treasury’s stimulus payments, which investors assume will bridge to a fundamental recovery and be free from highly negative second-order consequences. A bounce from the depressed levels of late March was warranted at some point, but it came surprisingly early and quickly went incredibly far.”

- “In other words, the fundamental outlook may be positive on balance, but with listed security prices where they are, the odds aren’t in investors’ favor.”

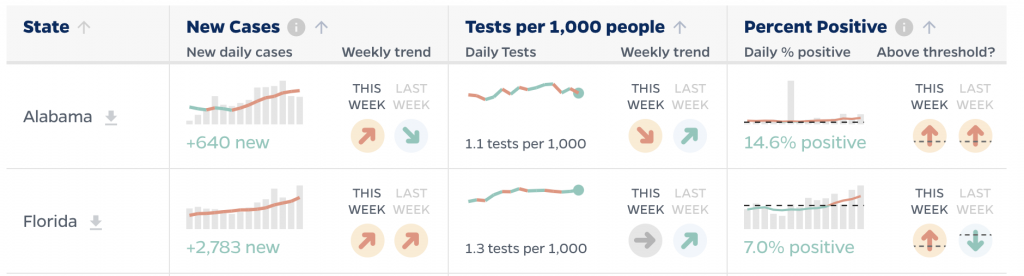

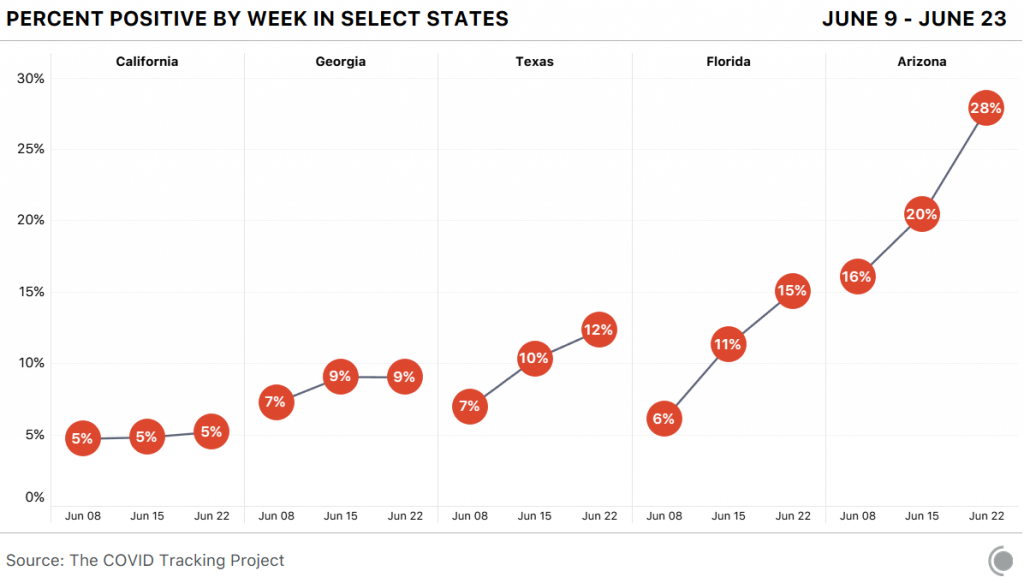

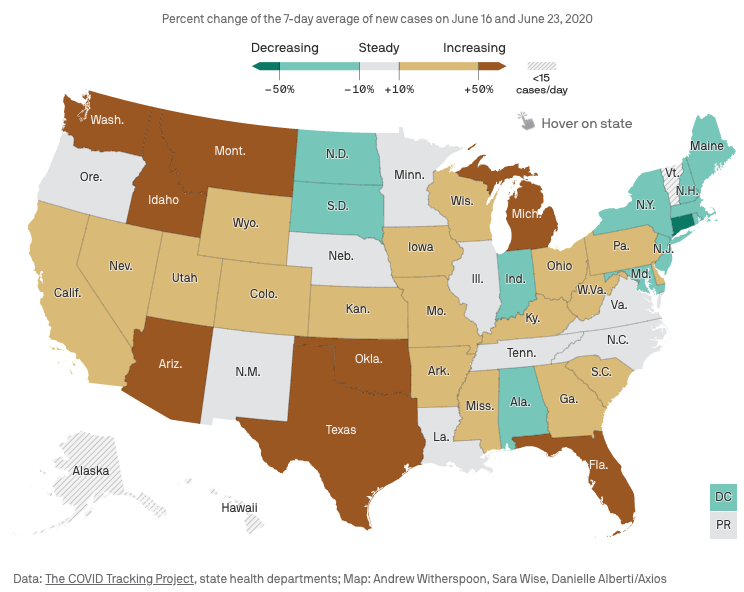

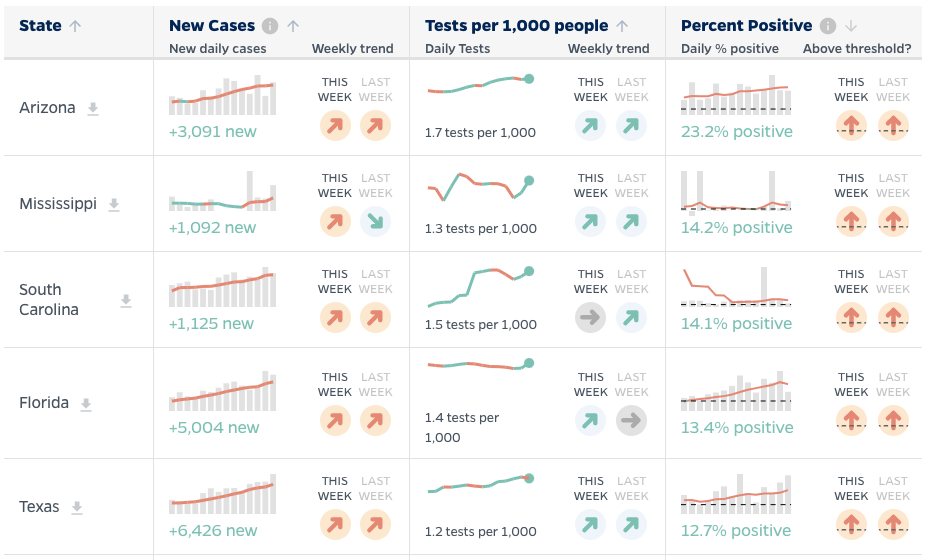

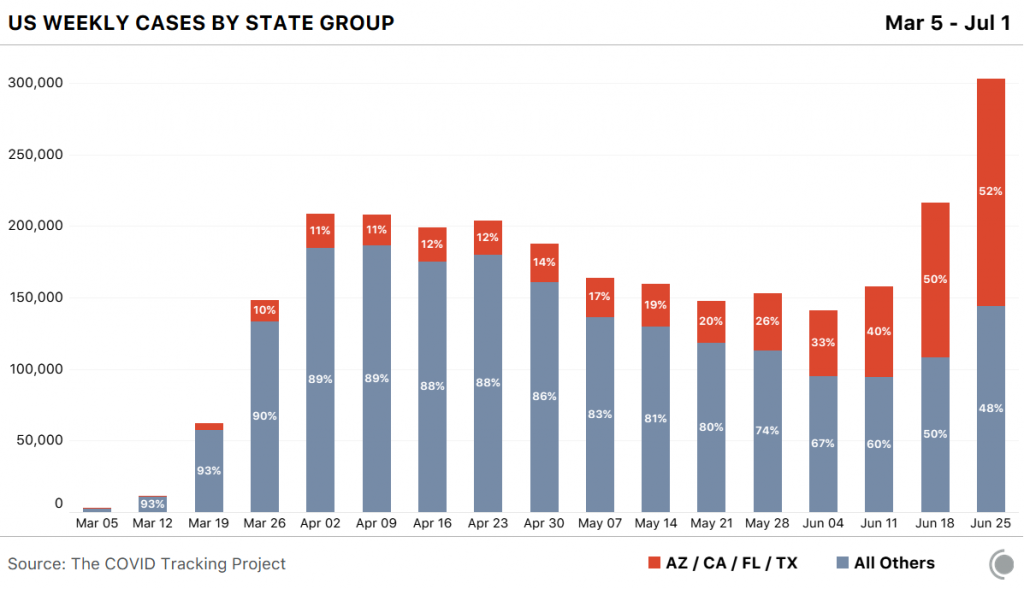

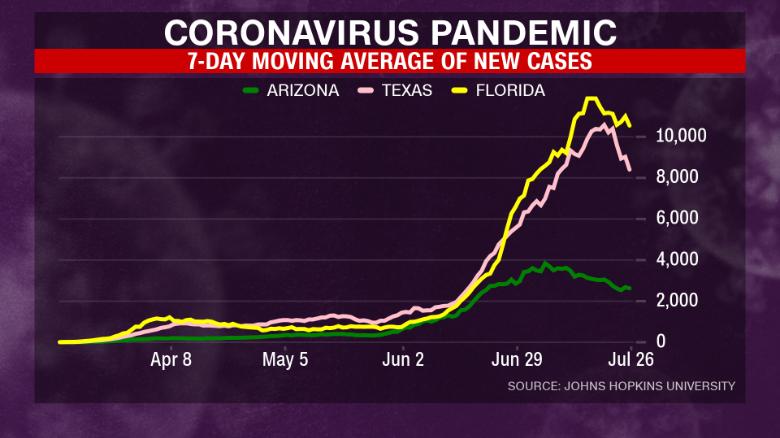

The latest weekly update from the COVID-19 Tracking Project is out: The Regional Gap Widens. “As cases and hospitalizations continue to drop in the early Northeast epicenters, they are rising—in some areas quite sharply—in the South and West… Since Memorial Day, Texas has seen an 84 percent rise in COVID-19 hospitalizations; in Arizona, hospitalizations have risen 90 percent over the same period. Against the background of rising cases and positivity rates, no US state has yet re-imposed restrictions on businesses or gatherings. Since May 20, all 50 states began the process of phased reopening plans. So far, only Oregon has halted further reopening until their state-level data improves.”

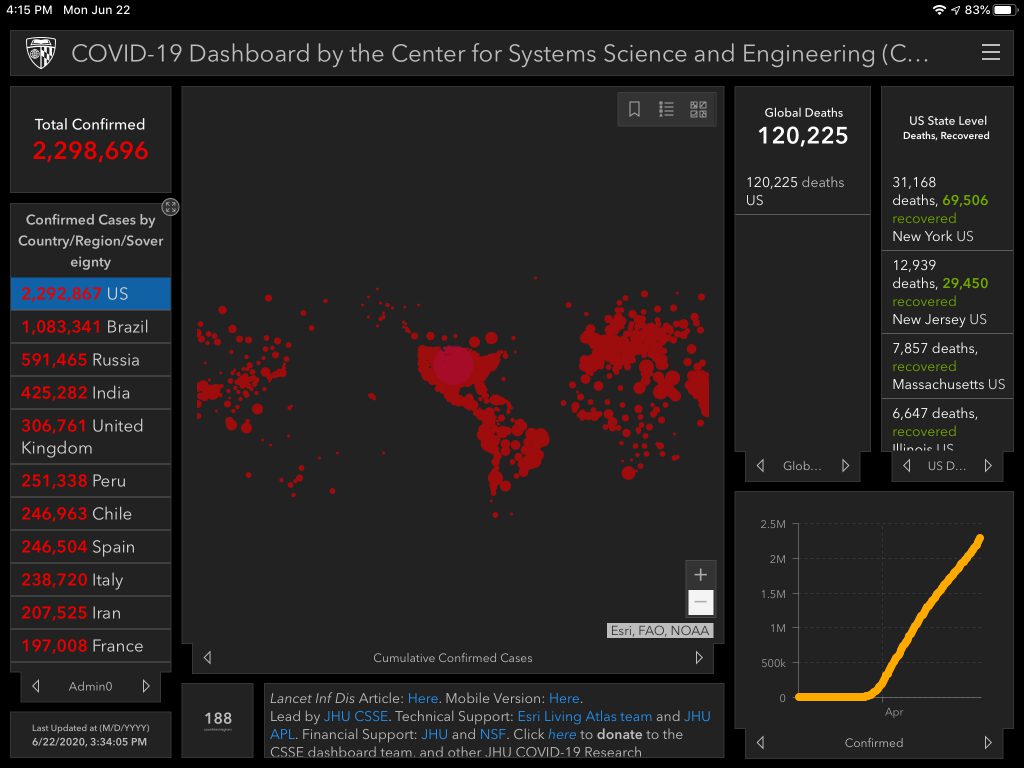

June 22

Monday. Major indexes were red for most of the morning but, of course, eventually turned green. It’s almost as if Asia and institutional money may be selling after-hours, and then retail here in the US is buying in the afternoon. I have no idea if that’s what’s happening, but it seems plausible given how many days open red but turn green. The Nasdaq and Russell 2k both closed up about 1%, followed by the S&P 500, up .66%. The Nasdaq 100 hit another ATH and is up 30% over the last 12 months, and +16% in 2020.

The latest wknd notes from Eric Peters is out: The Investor Trap. Always fun and thought-provoking. An excerpt: “‘Unless players are essentially in a bubble – insulated from the community and they are tested nearly every day – it would be very hard to see how football is able to be played this fall,’ announced Dr. Fauci. America’s fans sighed, tired of sacrifice, torn, desperate to return to a less bizarre existence. ‘The world is in a new and dangerous phase,’ said WHO Director-General Tedros. ‘Many people are understandably fed up with being at home. Countries are understandably eager to open up their societies and economies. But the virus is still spreading fast,’ he explained, attempting to refocus the world’s 7.8bln humans onto a common enemy. But Tedros has lost credibility in America. We no longer seem to want a common enemy now that we have one another to fight, and the election season is only just beginning…”

Bathroom Risk isn’t something enough people appropriately respect. Check out Can a toilet promote virus transmission? “Blocking the path of fecal-oral transmission, which occurs commonly in toilet usage, is of fundamental importance in suppressing the spread of viruses.” I think public bathrooms across the country and the globe will eventually change forever from this. “…flushing a toilet can cause violent turbulence, which will aid large-scale spread of viruses present in the toilet bowl.” Putting a toilet lid down before flushing is one of the most important things to do, but many public bathroom toilets don’t have lids. Next time you go out to a restaurant, or work, or anywhere else, keep the bathroom in mind in addition to hand hygiene, mask-wear, and physical distancing. Tl;dr, COVID lives in shit, and shit flies around a room when flushed.

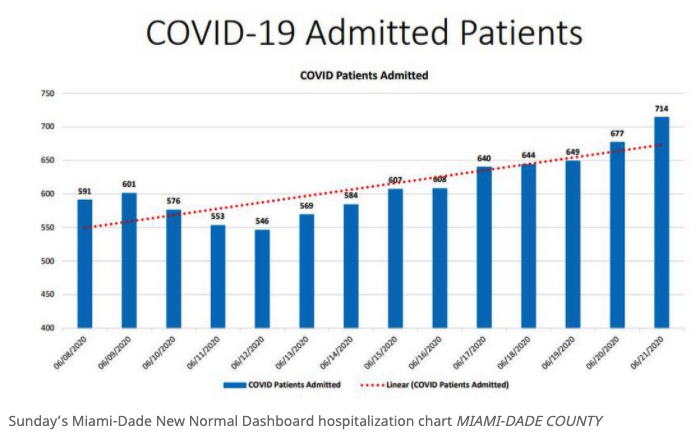

Florida doesn’t publish statewide COVID hospitalization numbers, but it turns out that Miami shares their county hospitalizations (hospitals self-report to the county):

June 23

Tuesday. Some overnight shenanigans, including a flash dip, made way for yet another green day. Because, 2020, right? The Nasdaq closed up .74%, Dow up .5%, and both the S&P 500 and Russell 2k closed up by about .4%. The only trading activity I did today was to initiate a withdrawal from my low risk (2 out of 10) portfolio with one of the popular robo-advisors that we’ve invested with since 2015. I’ve been making small withdrawals for the past 12 months, and at this rate, may end up just closing the account relatively soon. By the way, this isn’t a knock against the robos at all. I think they play an important role for a particular group of investors.

I took a minute to jot down a few things that are entirely up in the air right now. It’s essential not to lose track of all that is uncertain while being blinded by the ballooning stock market.

- What will school look like in the fall?

- How about college?

- Are certain people susceptible to infection, while others aren’t?

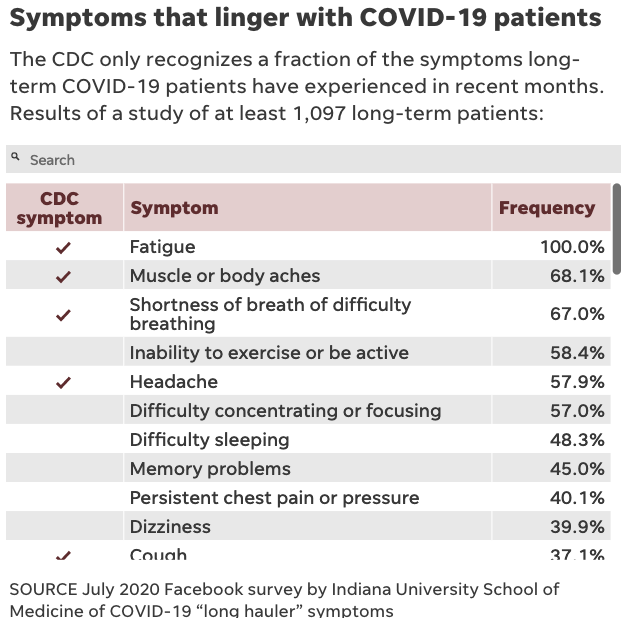

- Long term harm from infection?

- Reinfection?

- US-China trade & relations?

- Oh, and financial/economic things like bankruptcies, unemployment, and mortgage health?

One of my new favorites, Erin Bromage, wrote an important opinion piece: People in their 20s and 30s are spreading the virus. “We see this trend play out in the testing results. However, if the virus continues to burn through this age group, with their increased mobility and their importance within the essential workforce, it will only be a matter of time before we see their infections spark an inferno of sickness and death in vulnerable populations… I fear it is only a matter of time, however, before the virus finds its way into a household or a workplace where people more susceptible to poorer outcomes from infection can be found… We need to focus more effort in fully characterizing their role in asymptomatic and pre-symptomatic infection transmission chains. One of the many reasons this is especially important is that universities are going to reopen in varying degrees of capacity in the fall, which will place the embers of youthful infections in classrooms with the tinder of age — and I don’t see that ending well.”

I asked for more Dr. Fauci, and today, we got a little bit of Dr. Fauci. He and other health experts testified before a House committee on the coronavirus response by the administration. I don’t think we learned anything new that we didn’t know before, but it’s reassuring seeing and hearing from him nonetheless. Among other things, he highlighted the importance of the next few weeks in regards to Florida, Texas, and Arizona– all of which are seeing cases surge. Dr. Redfield added a reminder of how important flu vaccination will be in the upcoming season. It will save lives. Don’t be an asshole– vaccinate.

June 24

Wednesday. Unlike yesterday, markets didn’t only open red, but they closed red too. The Russell 2k bled the most, closing down 3.45%. The S&P 500, Dow, and Nasdaq closed down between 2.2% and 2.6%. Energy declined more than any other sector at -5.5%. Emerging and developed international markets behaved like the US today. No trades for me. Quite frankly, I’m just hoping for a lot more red days. It’ll be interesting to see if we can actually get a 2nd in a row tomorrow.

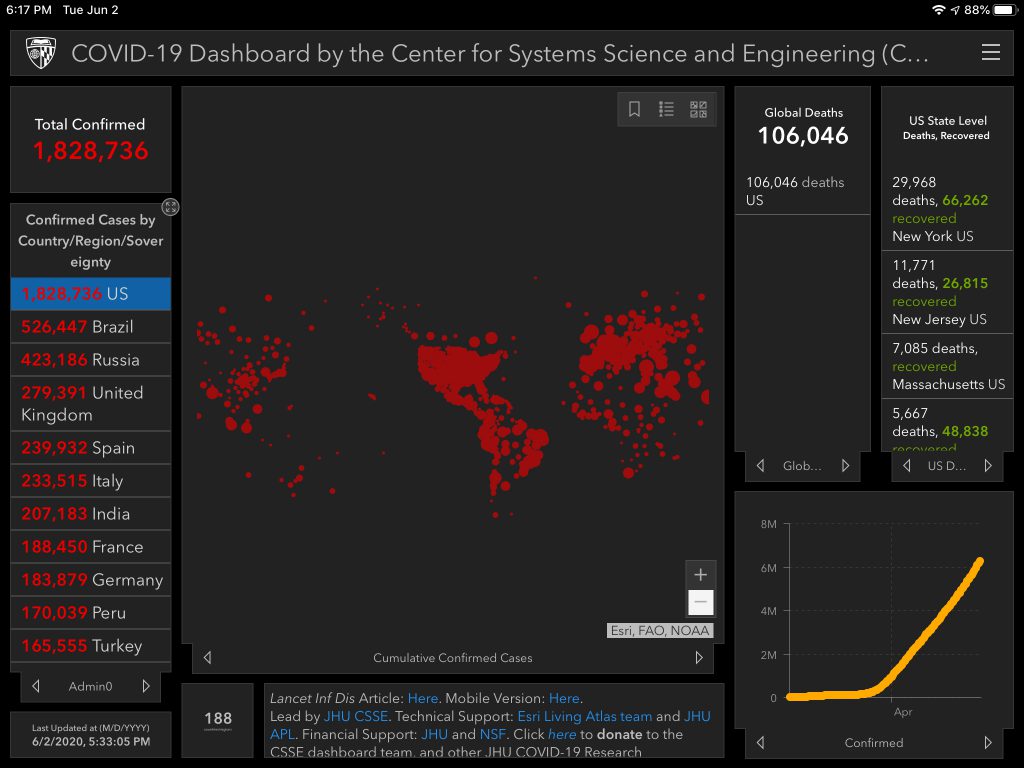

Bloomberg Law shared that 13 US companies sought bankruptcy protection last week. Total filings for the first half of 2020 are already at 117, the most since the first half of 2009. GNC is today’s big-name filing.

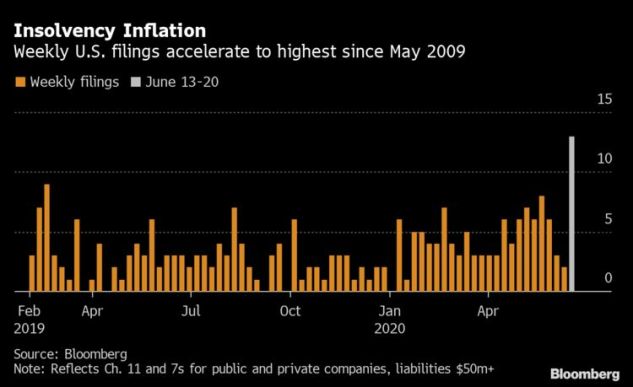

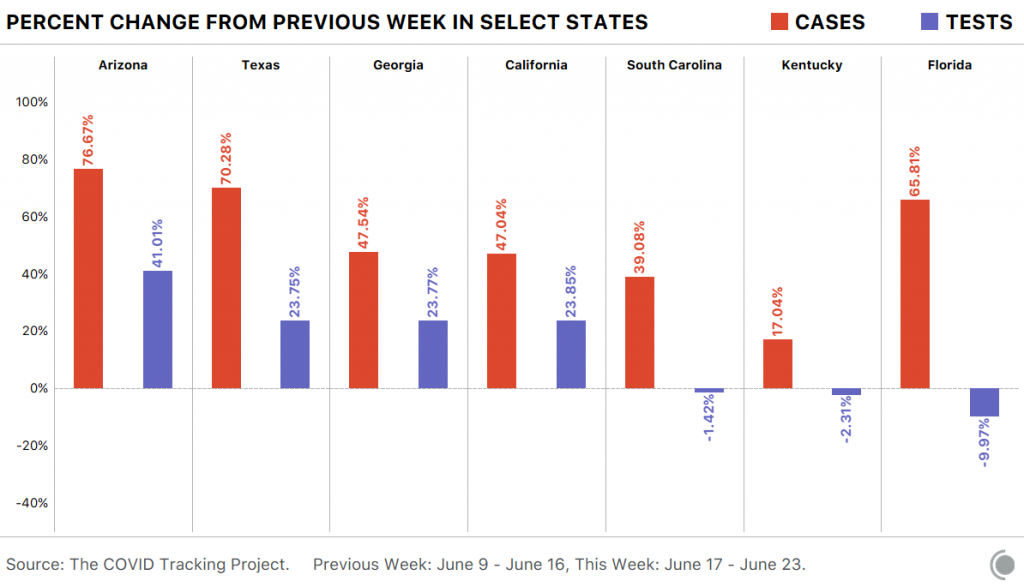

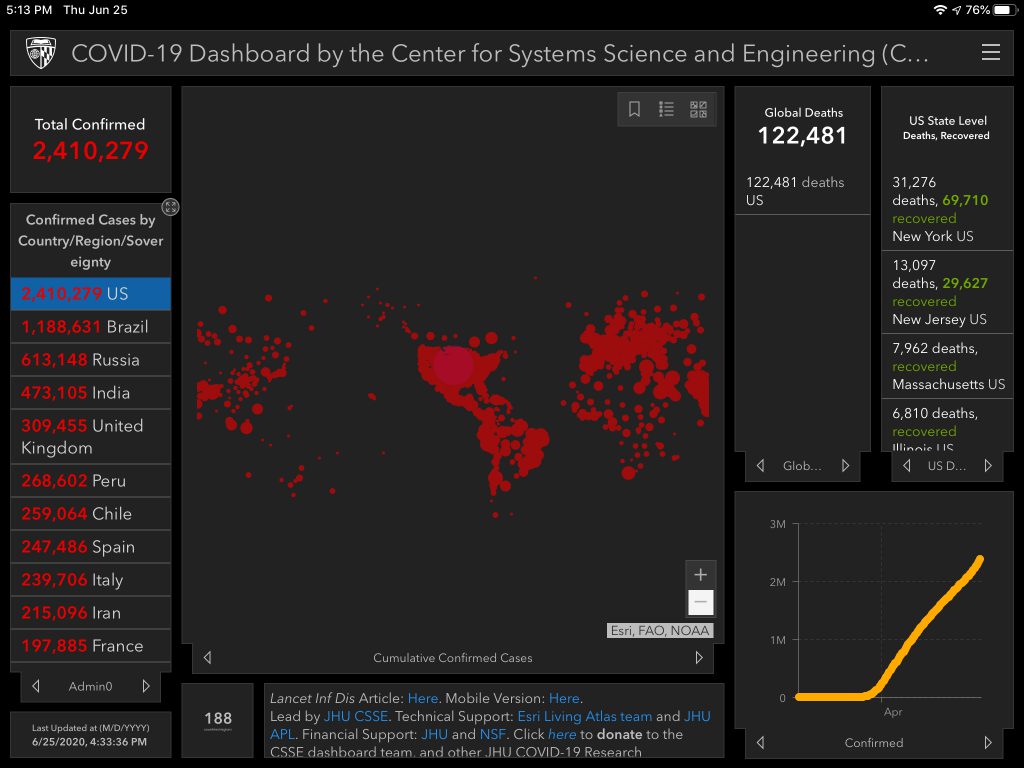

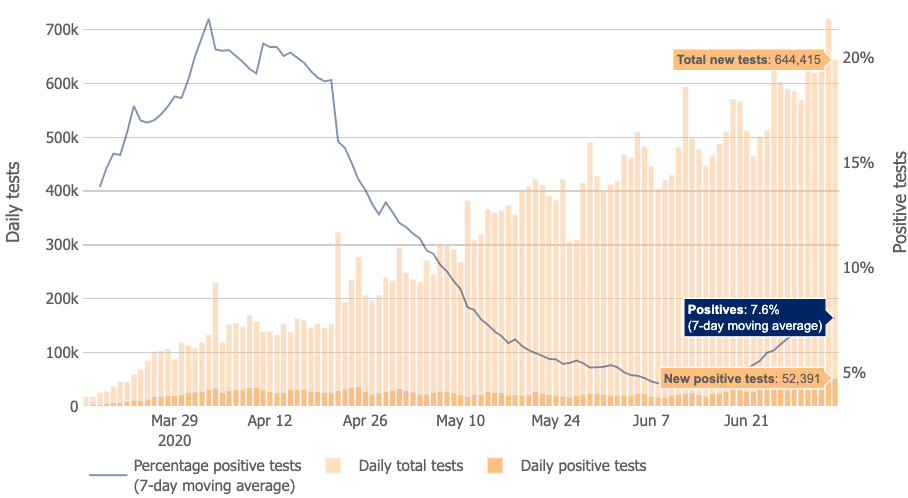

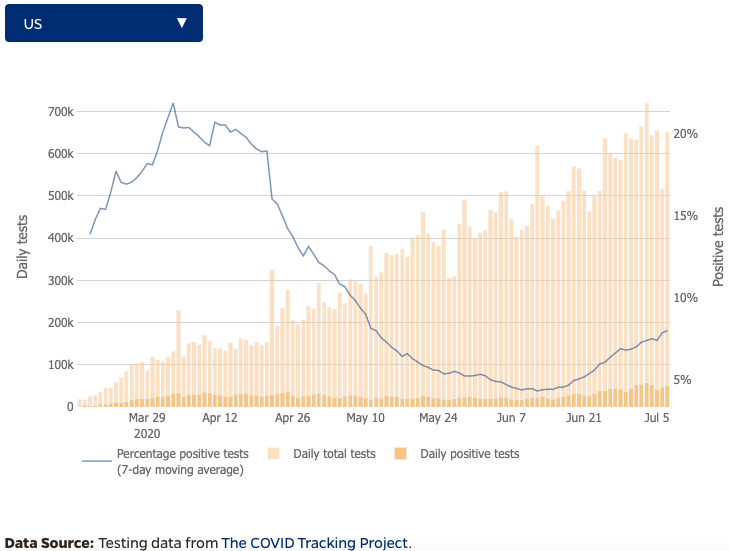

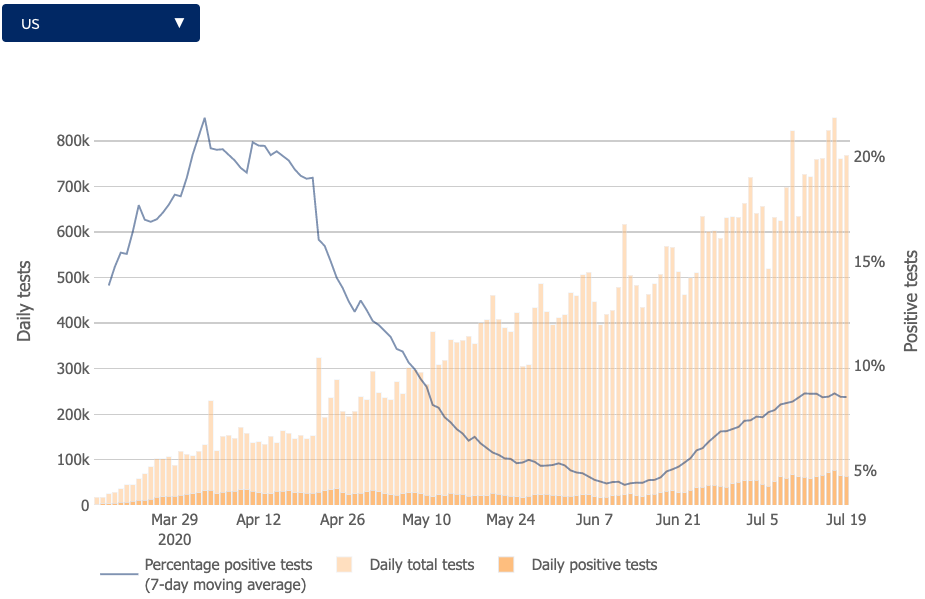

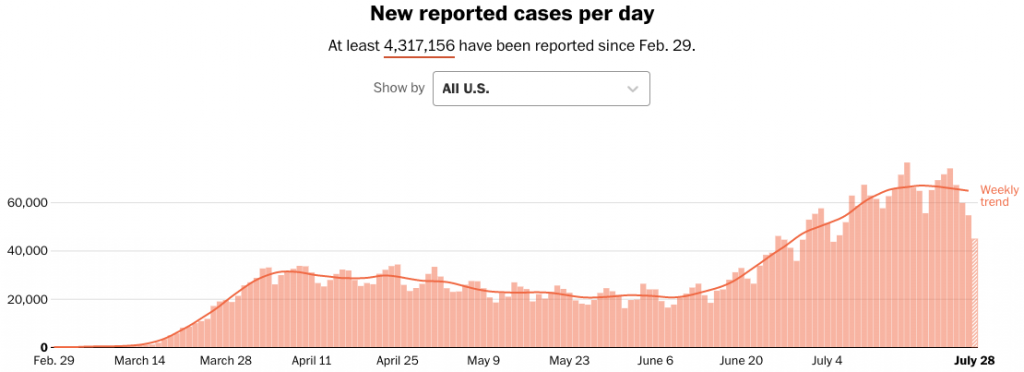

Today was a new single day COVID case record. You may notice that I don’t report much on case counts in this series because I think it’s often misused. The media loves to write headlines like, “State Xyz now has 100,000 cases!”– as if that tells anyone anything useful and doesn’t just drum up fear. But it’s worth highlighting today’s record case count number because The COVID Tracking Project published It’s Not Just Testing. The weekly positivity rate for some states is ballooning, which means the increase in cases isn’t directly attributed to an increase in testing (check out Arizona).

This view is useful too. Oh goodie, look at Florida where testing has decreased about 10% while cases jumped 65%. “Florida’s rising cases, we can conclude, have nothing to do with expanded testing.”

“Given the high percent-positive rates and the degree to which case counts have outpaced tests in Arizona, Florida, and Texas, we interpret the case counts as indicators of sharply worsening outbreaks. In California and Georgia, where percent-positive rates remain relatively steady, the numbers are more difficult to interpret, but we’ll be watching them closely over the coming weeks.”

June 25

Thursday. Nope– can’t get 2 red days in a row. The S&P 500, Nasdaq, and Dow all closed up by about 1.1%. The Russell 2k closed up a little higher at 1.7%.

Jobless claims rose another 1.48M. The total for the last 14 weeks is 47M. For context, the entire GFC of 08-09 saw just over 37M.

Is the U.S. Headed Toward an Eviction Crisis? is an alarming article by Urban Footprint. “Across the country, nearly 7 million households could face eviction without government financial assistance. These are heavily rent-burdened households that have likely experienced job loss as a result of the COVID-19 crisis. This level of displacement would be unparalleled in U.S. history and carries the potential to destabilize communities for years to come. Closing this rent gap will cost between $16.2 and $31.8 billion over six months… Unemployment has disproportionately impacted rent-burdened households in the US, which are two times more likely than the average renter to experience job loss… Federal unemployment insurance is set to expire on July 31, and the path back to pre-COVID economic activity and employment levels is unpredictable at best. This leaves the fate of many renters and communities in the balance.”

Axios published Change in new COVID-19 cases in the past week showing “the coronavirus pandemic is getting dramatically worse in almost every corner of the U.S.”

June 26

Friday. Red! It didn’t happen two days in a row, but major indexes bled enough two of the last three days to close negative for the week– which is rational given the state of the universe. The Dow closed down 2.84%, Nasdaq down 2.6%, and the S&P 500 and Russell 2k both closed down 2.4%. Gold and Silver are both up on the day. Communications and Financials closed down 4.4%. Here’s a weekly:

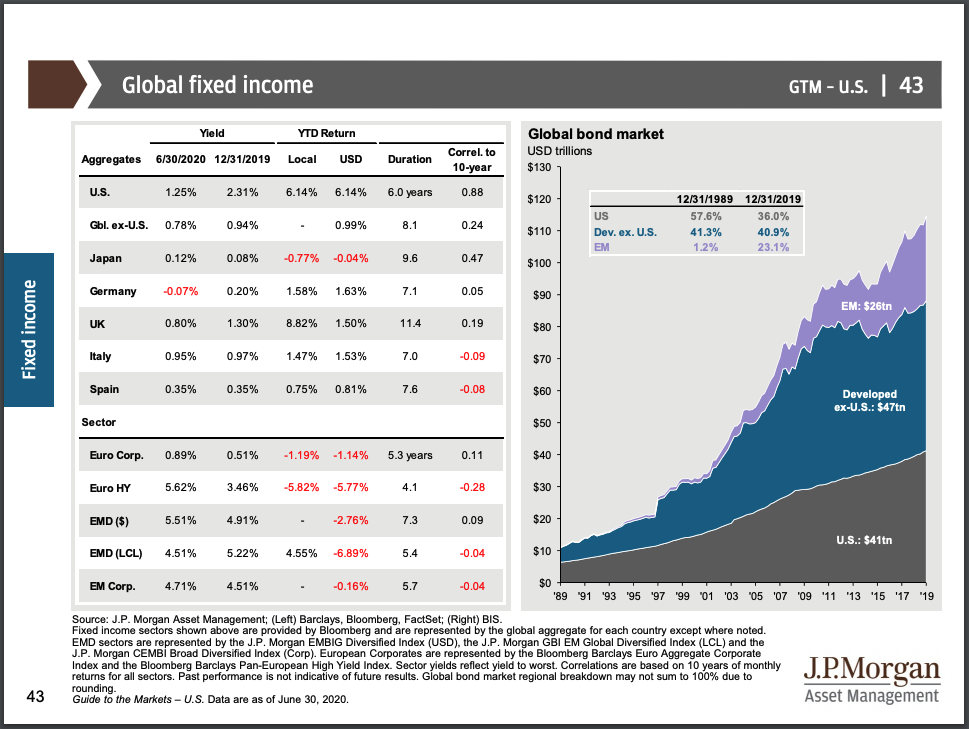

The Federal Reserve is capping bank dividends and buybacks following an annual stress test. “The Fed added a ‘sensitivity’ analysis to its stress tests in which the central bank modeled the impact of a V-shaped, U-shaped, or W-shaped recovery with varying peak unemployment rates and peak-to-trough GDP changes.” They determined, “several financial institutions would reach minimum capital requirements set by the Fed under U and W-shaped recoveries.” I don’t think there’s anything too alarming here. In fact, quite the opposite. Banks are well prepared for a period of economic weakness, especially compared to 2008.

It seems to me like the majority of Americans believe (and the markets are pricing in) that there’s an 80%+ chance an effective vaccine will be available this year. And I think that’s preposterous. There’s never been a Coronavirus vaccine before and it’s already the end of June. Realistically, a 15% chance of an effective vaccine being widely available this year seems more reasonable, a 40% chance in 2021, and a 45% chance in 2022 or some year thereafter. My point is, there’s no guarantee we’ll have one in the next 12 months but it seems most people take it as a given that we will. And if/when there is one, then what? We party like it’s 2019? No. The virus can change, fast. The effectiveness of the vaccine can wane, fast. We still don’t know anything about immunity or reinfection (well, my friend tossed a theory my way suggesting the government knows a lot more than they’re sharing but that’s beside the point). COVID-19 is the new normal going forward. People, businesses, and markets need to recognize that likelihood and stop longing for the way things used to be. Embrace reality.

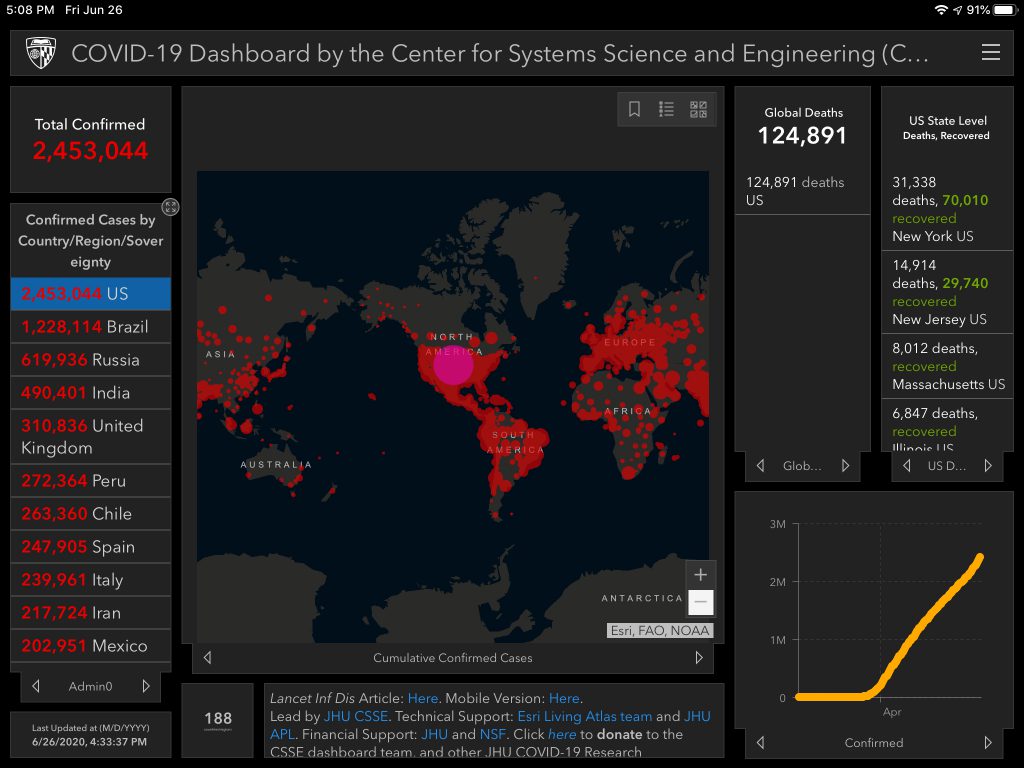

The virus isn’t going away. It never did. This isn’t a second wave. I can’t help but think this is just the beginning of the reopening/re-closing/reopening cycle that will persist for a long time.

- 11 states have paused or begun to roll back reopening plans.

- Texas is rolling back reopening efforts since its positivity rate is exceeding 10%. Elective surgeries have to be postponed at hospitals, Houston, San Antonio, Dallas, and Austin. Large outdoor gatherings now require local government approval, and in-dining restaurant capacity is capped at 50%.

- Florida has banned on-site alcohol consumption to try to cut down on groups congregating.

- California Governor Newsom is reinstating some area stay-at-home orders.

The Coronavirus Taskforce held a media briefing today for the first time in 2 months. They had to publicly address the current outbreaks in states with surging case counts and surging positivity rates. Listen to Dr. Fauci when he says, “You have a societal responsibility…If we want to end this outbreak…we have got to realize we are part of the process…We are either be part of the solution or part of the problem.”

Here’s a shot at states with surging positivity rates thanks to JHU Coronavirus Resource Center:

On May 12th, I identified five days since the saga began that felt like major shifts in sentiment. And I think today is the 6th. On May 12th, I wrote, “The global death count is almost at 300,000. It seems like there’s a rush to prematurely reopen, unsafely. New models are projecting 135,000 US deaths by August… There’s no way we won’t see positive cases, hospitalizations, and death rates accelerate in a few weeks in response to this reopening act. It seems like most states completely disregarded the task force guidelines for reopening… Fauci warned of the serious consequences of reopening too quickly. It feels like today will be a day we look back on and say, ‘that’s when people ran out because they took reopening to mean the virus isn’t a threat anymore, and that’s when a lot of people contracted or spread the virus.'”

Well, look where we are less than two months later.

June 28

Saturday. No market-related commentary from me as I attempt to rest my brain, alongside the markets. But I can’t help but feel like they’re not asleep… it feels like chaos is brewing and volatility will be picking up in July.

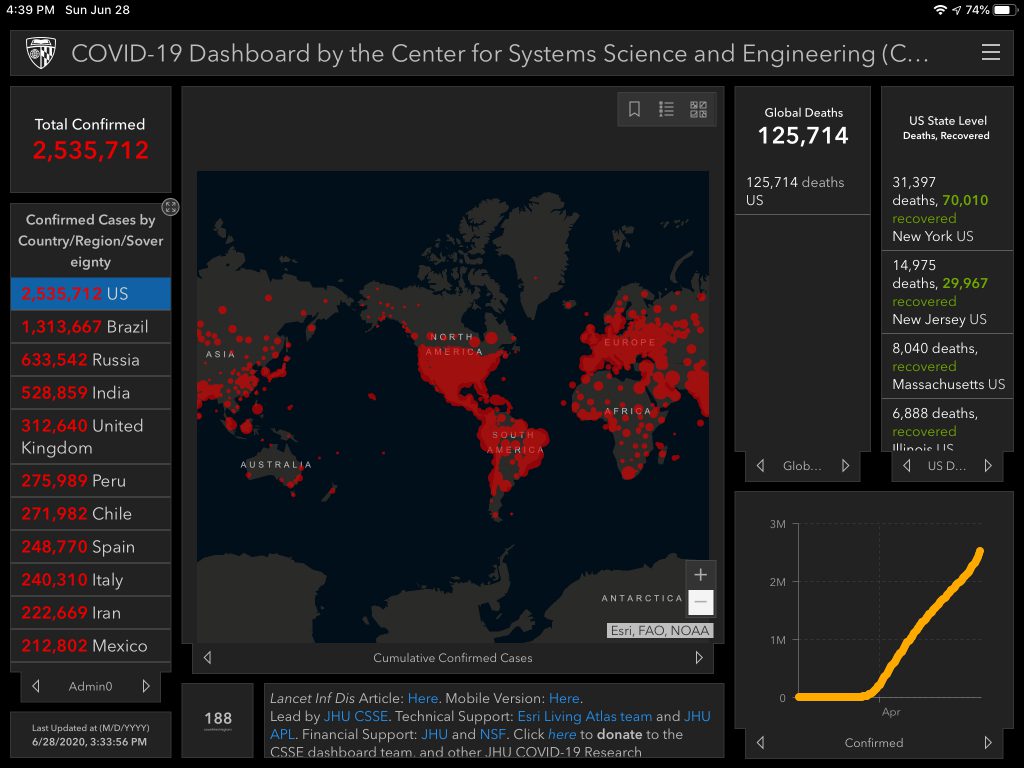

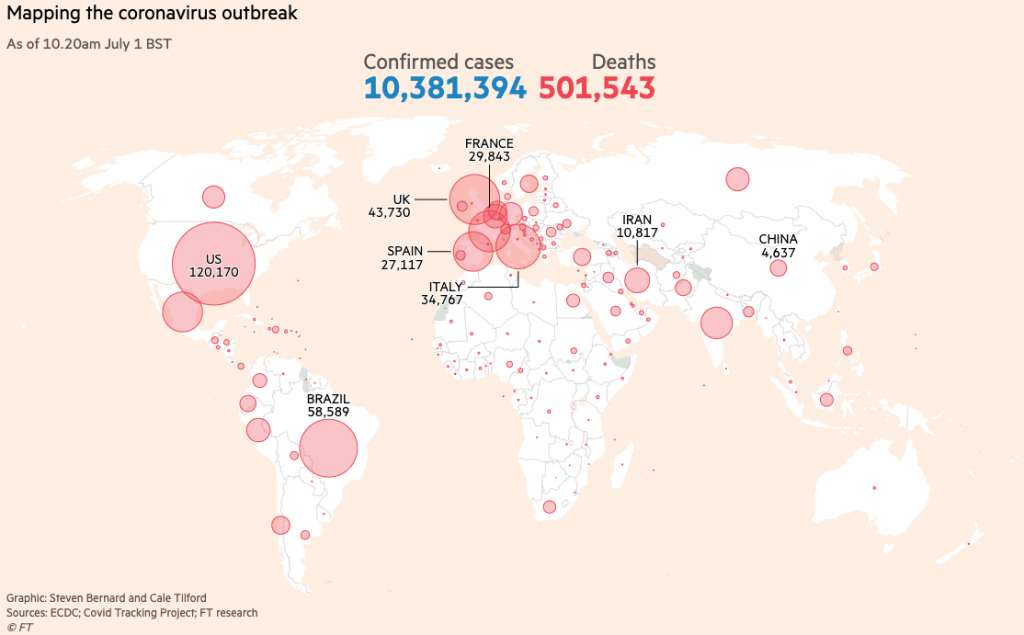

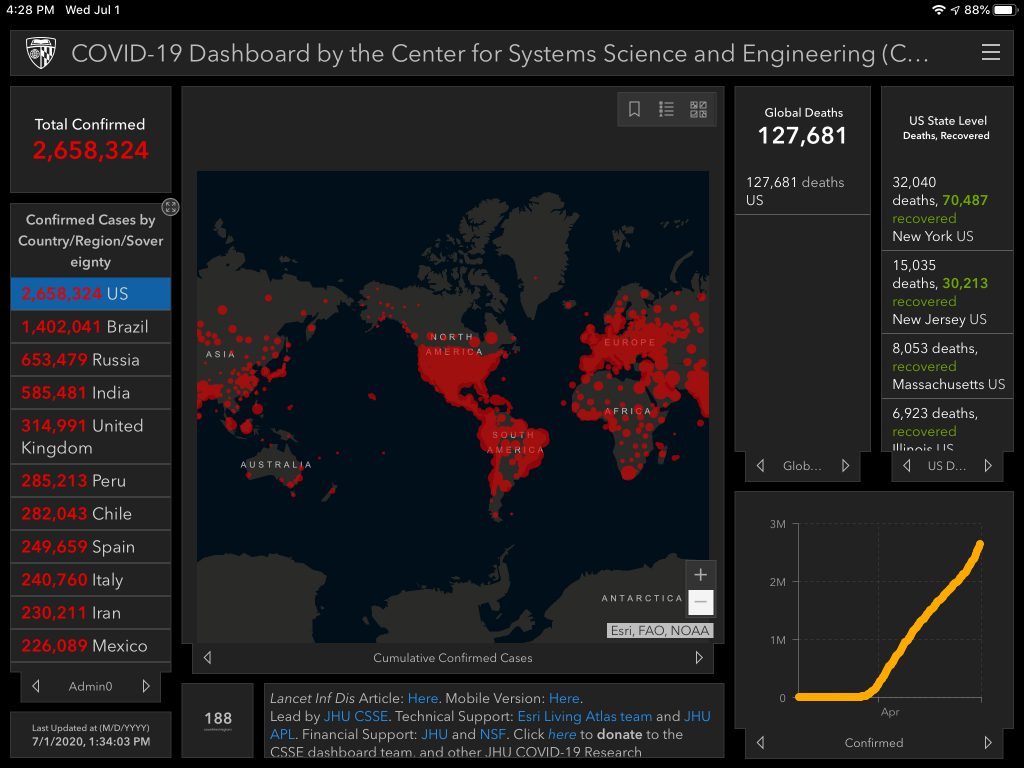

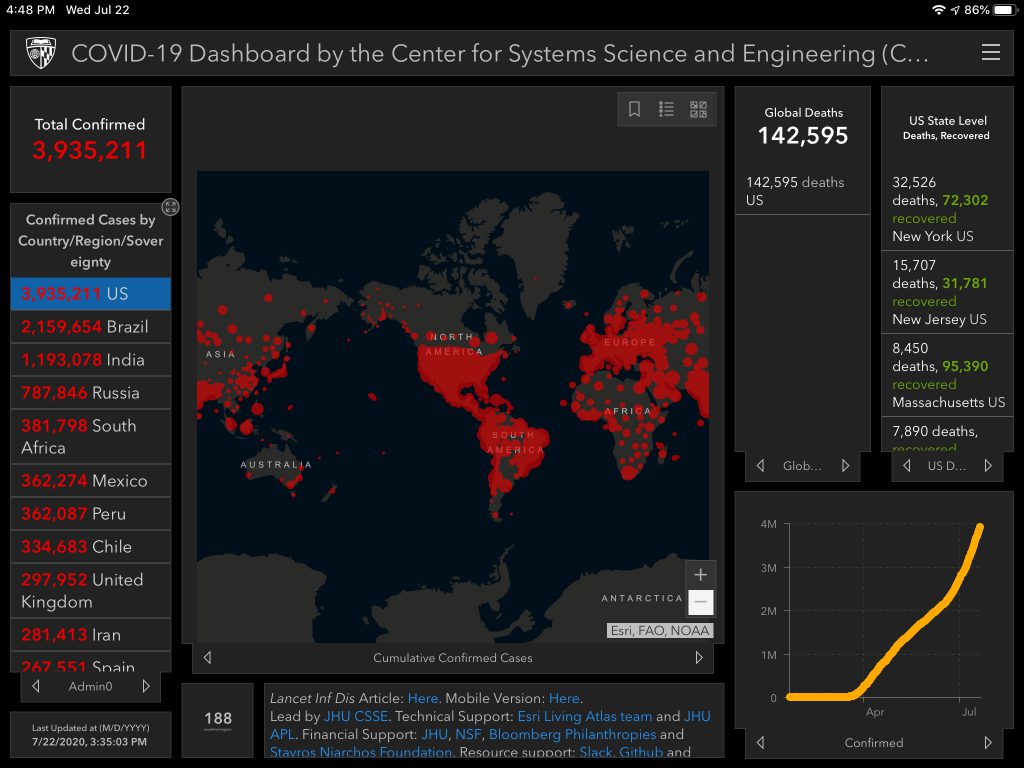

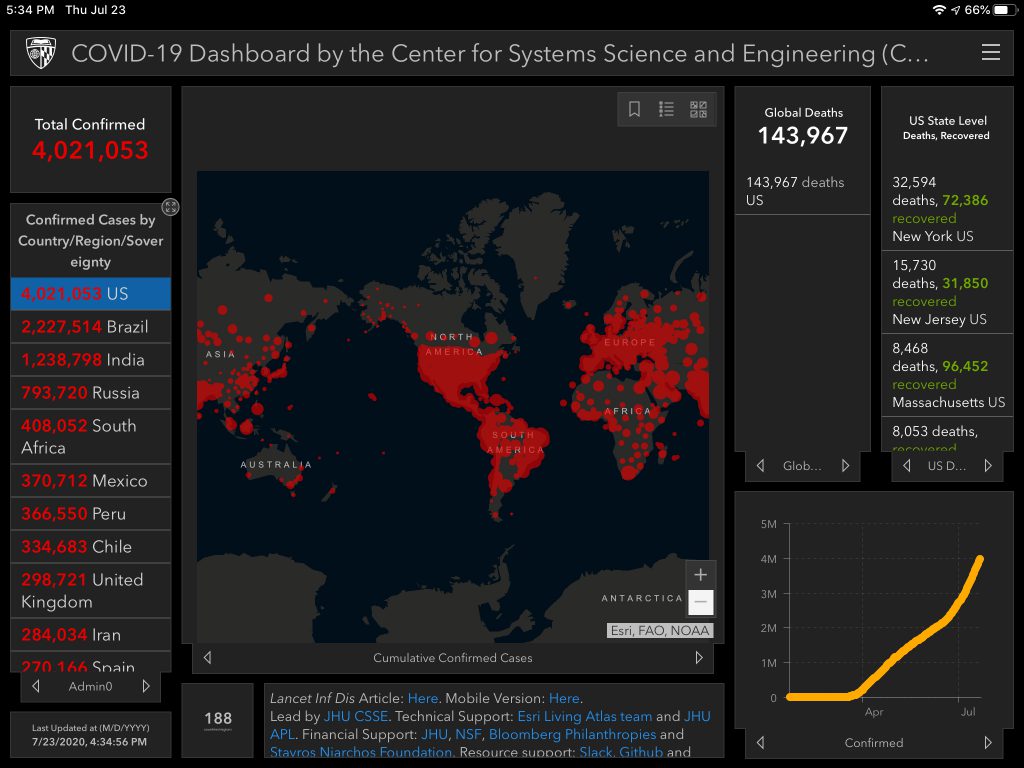

The 500,000th global COVID-19 death will be reported today. More than 10M are reportedly infected, and the real number is likely much higher than that. Meanwhile, here in the US, we’ll probably be setting new infection count records most days going forward. 40,000 cases were reported on Friday alone. And as I wrote earlier in the week, the increase in cases isn’t just due to an increase in testing in every state. Health and Human Services Secretary Alex Azar warned on CNN’s “State of the Union” Sunday that the “window is closing” for the U.S. to take action and get the coronavirus under control, calling the current state of the outbreak a “very, very serious situation.”

Back on March 31st (when there were just 3,810 US Covid-19 deaths) I wrote, “What I’d say is that watching Dr. Fauci and Dr. Birx tell us to expect at least 100,000 deaths is like watching the radar of a raging hurricane brewing 2 miles off the coast, and the eye is likely to head right for us. And it’s too late to escape. Too late to prepare any further. It’s coming. It’s sad and scary.” And here we are 3 months later, and it feels the same now as it did then.

June 29

Monday. All green. The Russell 2k and Dow both closed up over 2.3% and the S&P 500 and Nasdaq both closed up over 1.2%. Industrials led, up 3.2% on the day.

The latest wknd notes from Eric Peters is out: Wall Street Is Way Bigger Than The Economy. He’s become my favorite writer right now aside from Howard Marks. An excerpt: “The Fed learned after the GFC that money is a mystery, and for reasons they could barely grasp, it behaved in opposition to their understanding. The more they printed the less it moved, which was the opposite of what would have happened in 1977. As its quantity expanded, its velocity slowed, inflation declined. The Fed also learned that there was no material cost of maintaining easy policy, though of course, they view the world through the narrow scope of their mandate. But there’s always a price to pay, and the Fed had trapped itself… A transition has begun. They have always happened and forever will. In the forty-three years since the 1977 Reform Act, the Fed has had relatively simple marching orders; maximum employment, stable prices, and moderate long-term interest rates. It chose to interpret this mandate and execute it in a way that dramatically increased America’s debt and leverage while suppressing economic and market volatility. But humanity is neither simple nor stable. As the decades passed, complexity and volatility leaked into those places the Fed avoided, and gathered strength, the pressure built, quietly. For reasons we’ll never fully understand, this complexity and volatility have recently begun to manifest in highly consequential ways. Politically, socially, geopolitically. We’re toppling monuments, overturning cultural foundations, canceling treaties, challenging institutions. The Fed will not be spared. How this affects policy, we don’t yet know. But the fiscal/monetary coordination we see emerging, illustrates one of many possible paths… For as long as the Fed has been suppressing volatility, globalization fueled investment in increased production that capped inflation, pressured wages, and boosted profit margins – widening inequality across the developed world. The combined forces of monetary accommodation and globalization produced powerful recoveries from every recession.”

One of the biggest stories of the weekend (and potentially the year), is the Fed program for corporate bonds. A list of 750 companies (available here) was released yesterday whose corporate bonds will be purchased by the Fed. This is in addition to ~$430M from 86 companies that have already been purchased. The list of 750 includes Apple and Walmart while the list of 86 includes Microsoft and AT&T. It basically built a bond index. Most of this is way over my head but like others, I wonder how the central bank buying bonds from Apple helps people? Lyall Taylor provided this answer: “The point is not to help these companies, but to force the prior owners of the bonds who sell to the Fed to invest elsewhere and take more risk, pushing down rates & credit spreads & raising stock prices, thus increasing capital available for other businesses to hire & invest.”

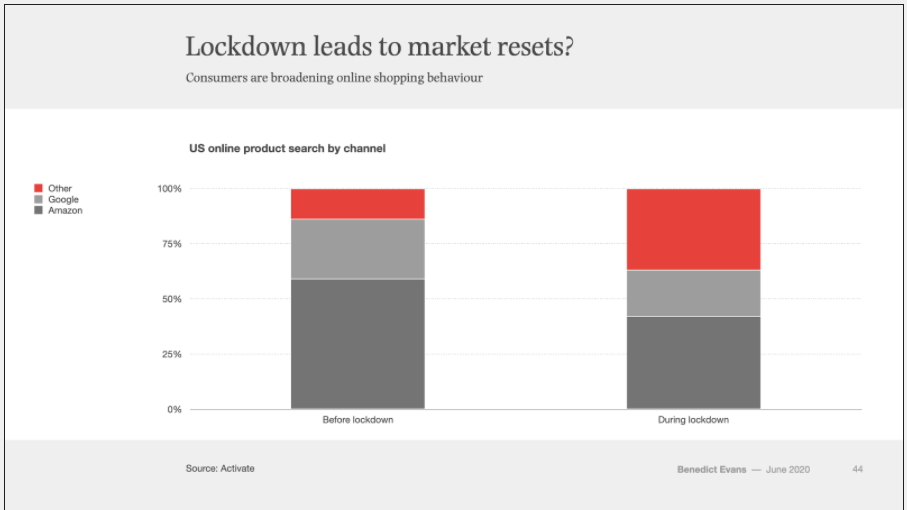

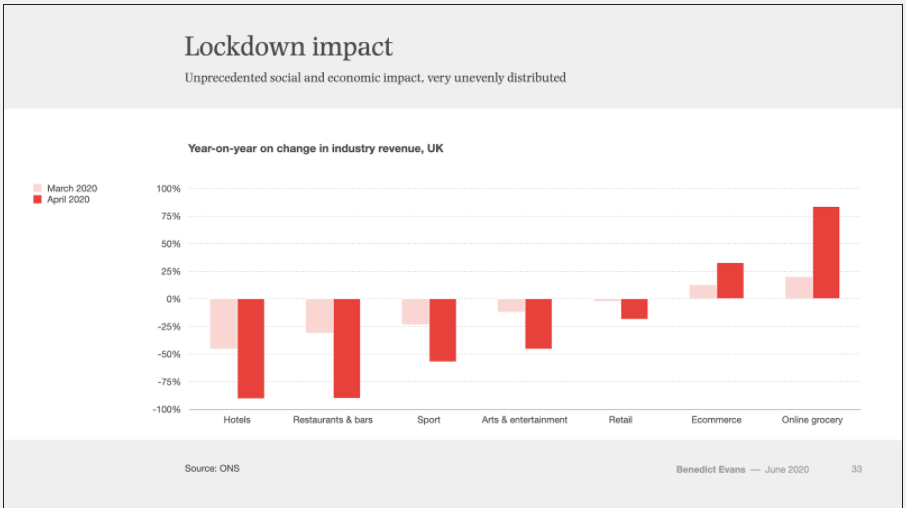

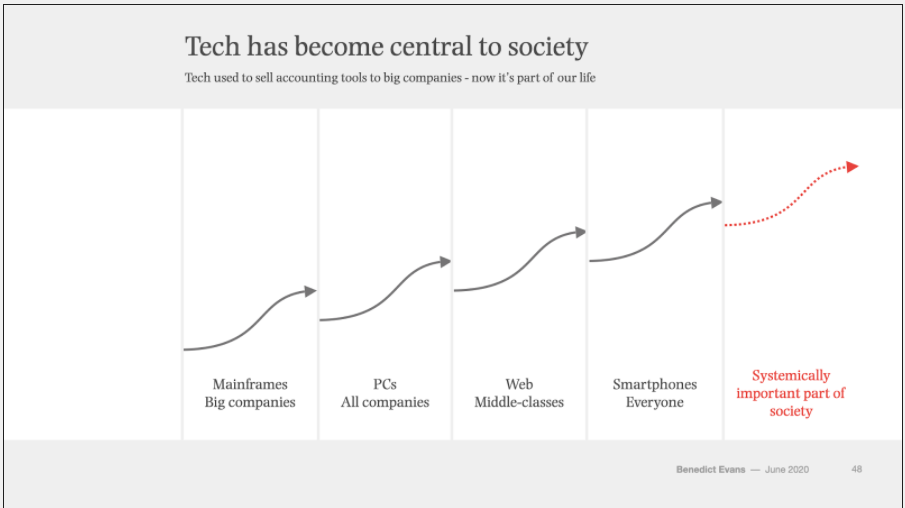

Benedict Evans published another one of his awesome presentations: Summer update: Tech and the new normal. Here are a few key slides:

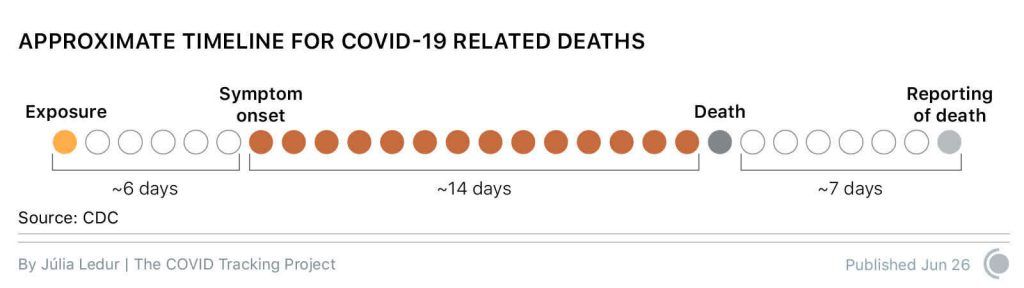

The COVID Tracking Project published Why Changing COVID-19 Demographics in the US Make Death Trends Harder to Understand to help shed attention on an increasingly important issue: “What we only partly understand is how an infection rate that seems to be skewing younger will affect the death toll in surging regional outbreaks.” Dr. Natalie Dean suggested three possible explanations. At the end of the day, like most things with the virus, we still don’t know much for sure. We need more time. But as we answer more with time, we’ll likely accelerate the rate at which we’re asking questions too. This thing is here for good, so it’s time to get used to our new normal.

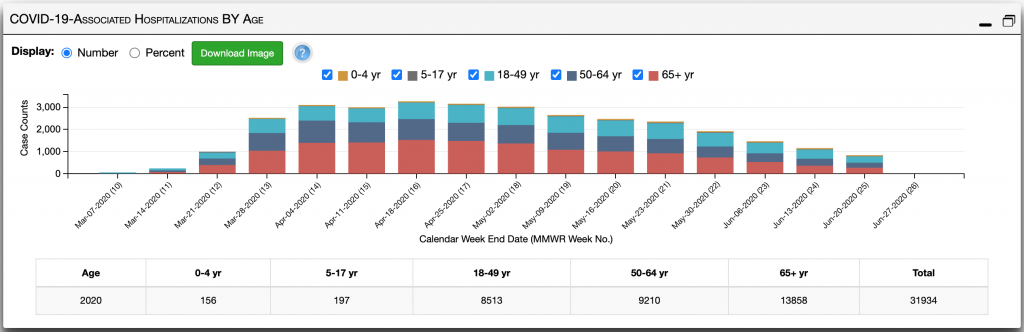

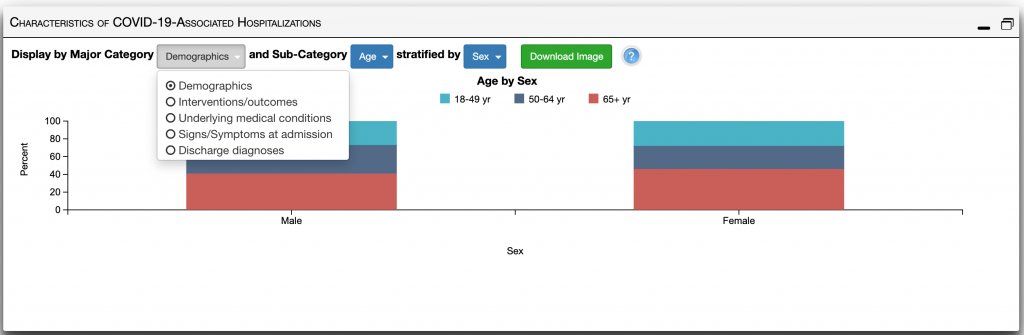

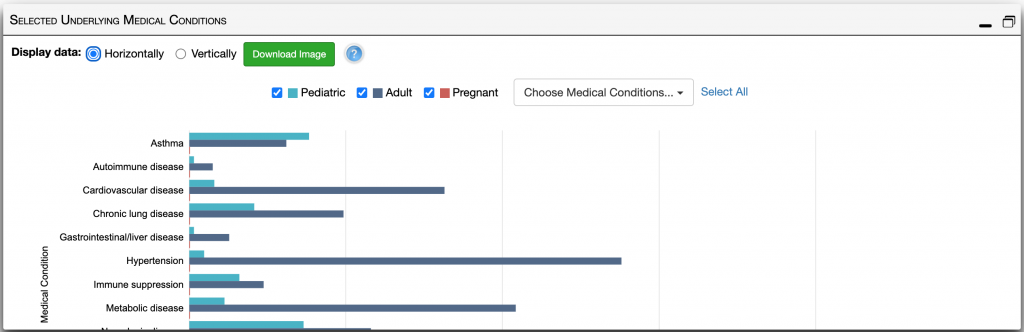

That article also brought attention to a new data source I hadn’t seen before: COVID-NET – A Weekly Summary of US COVID-19 Hospitalization Data. Note that although it’s detailed, it’s just a sampling. It only includes ~150 hospitals from 14 states. In addition to the dashboard, the CDC publishes a weekly summary too.

June 30

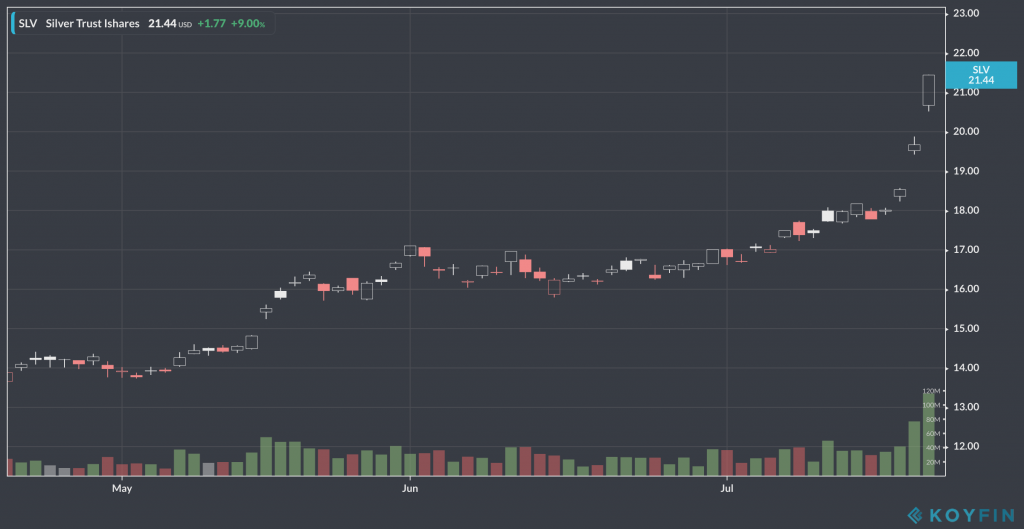

Tuesday. Last day of Q2 and the halfway point of the shitshow that is 2020. Markets were Green today… and Gollldddddd. The Nasdaq led, closing up 1.87%. The S&P 500 and Russell 2k both closed up more than 1.4%, and the Dow closed up .84%. I think this quarter had to be one of the strongest of all time. Gold continued it’s run by climbing above $1,800/oz for the first time since 2011.

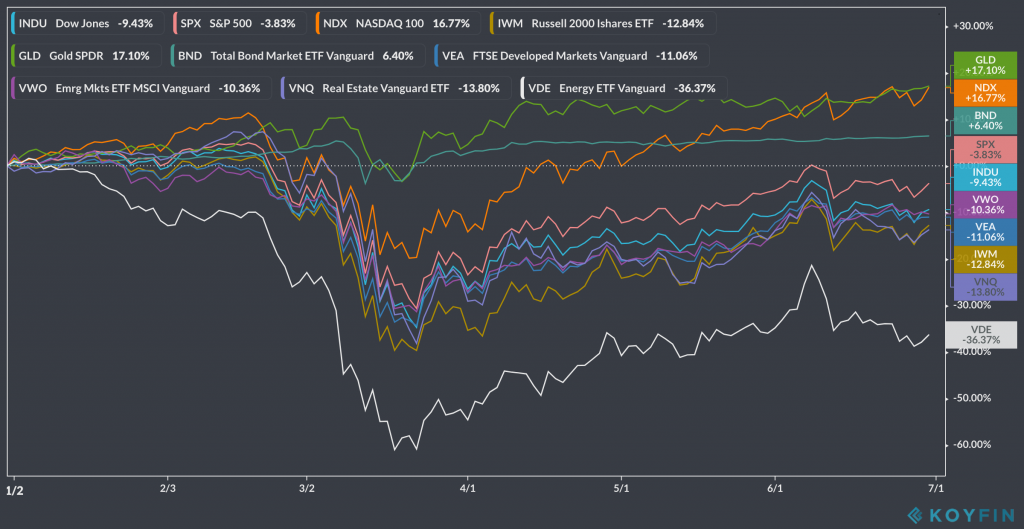

Here’s a look at the year so far:

Treasury Secretary Steven Mnuchin and Fed Chairman Jerome Powell testified before the House Financial Services Committee today on their agencies’ response to the pandemic. Here’s Powell’s testimony, and here’s Mnuchin’s testimony. Usual story– these are extremely uncertain times, a full recovery is unlikely any time soon, and they’re committing “to do what we can to provide stability, to ensure that the recovery will be as strong as possible, and to limit lasting damage to the economy.”

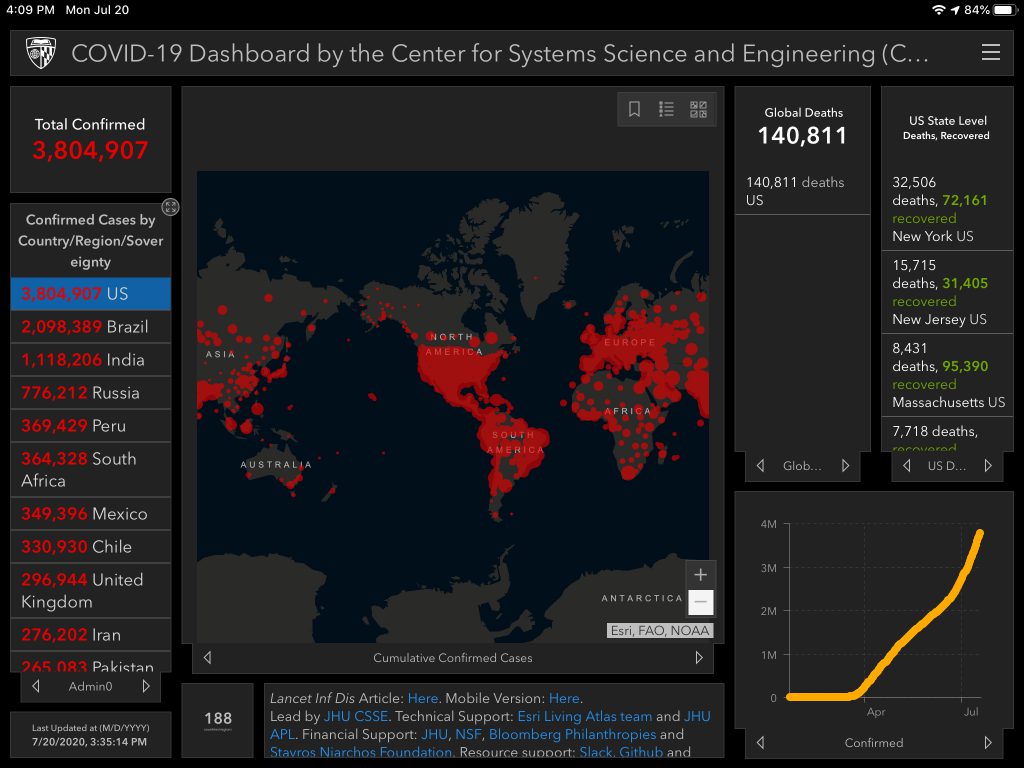

The Senate Health, Education, Labor, and Pensions Committee held a hearing on the efforts to contain COVID-19, and more specifically, the topic of going back to school and work. Dr. Fauci shared the reality of the situation: “When you have an outbreak in one part of the country, even though in other parts of the country they’re doing well, they are vulnerable. We can’t just focus on those areas that are having the surge. It puts the entire country at risk. We are now having 40,000+ new cases a day. I would not be surprised if we go up to 100,000 a day if this does not turn around.” The usual topics were discussed. The importance of masks, surging case counts, and the fact that getting kids back in school is important but complicated.

July

July 1

Wednesday. First day of Q3. Mixed-market today. The Nasdaq and S&P 500 were both green, closing up .95% and .5% while the Russell 2k and Dow were red, closing down .97% and .3%. Real Estate was the leading sector at +2.7% and Energy bled the most, closing down 2.5%.

Bason Asset Management published a succinct Q2 2020 Market Recap. As they say, it was one for the history books. $SPX dropped 20% in Q1 and was followed by a 20% rebound in Q2 (get it, 20-20). As for my own portfolio, it’s now comprised of over 37% cash & alternatives. -14% is the most I was ever down this year (on March 23), compared to US Stocks $VTI which dipped to -31%. I know I slept a lot better at night than I would have at -30%+, and I’m still up YTD by +8.5%.

One of my favorite writers, Eric Cinnamond at Palm Valley Capital Management, published Monetizing Cats and Dogs. His essays are always thought-provoking and informative. An excerpt: “In our opinion, the combination of a 0% Fed funds rate, along with the trillions of dollars created to purchase assets, has been an explosive accelerant in inflating bond and stock prices. It’s clear to us, these policies have caused the rich to get richer, while those without financial assets have not benefited proportionately. In effect, by maintaining financial stability, we believe the Federal Reserve has inflated social instability… With an unlimited balance sheet, the Federal Reserve, in theory, can inflate and set the price of anything. How far and how long can these policies be maintained, we’re not certain. However, as wealth inequality grows, we believe the secret of its origin will ultimately be revealed to the general public and will be increasingly difficult to defend. At that time, if the financial markets haven’t taken away the Federal Reserve’s ability to control asset prices, we’re confident voters will find a way.”

I published my June Health Review this morning and forgot to write that I published a new post, Corporate Card Product Strategy Example, on Sunday. Gotta keep the mind and body healthy!

Colleges are beginning to announce their plans. Yale plans on requiring testing students upon arrival, and every week of the semester, as well as offering a liberal 1-year absence program. Wellesley plans on doing things like testing students every 2-3 days in their first 2 weeks on campus, cutting on-campus attendance in half, and having 1 student per dorm room. UMass Amherst plans on conducting most classes remotely. They said this regarding tuition: “The cost to provide instruction (faculty salaries, advising, etc.) does not change based on the mode of instruction. In some cases, the cost of providing remote instruction is actually higher than in person, as a result of the technological resources required. Students will be provided the same resources and support services, such as the Learning Resource Center and academic advising, regardless of modality.”

Here’s a shot of the states with the biggest increases in cases over the last week thanks to The Washington Post Coronavirus page:

Shiiiiit, look at the rising positivity rate (thanks to JHU Coronavirus Resource Center). It’s above 16% now in FL and at 7% across the country.

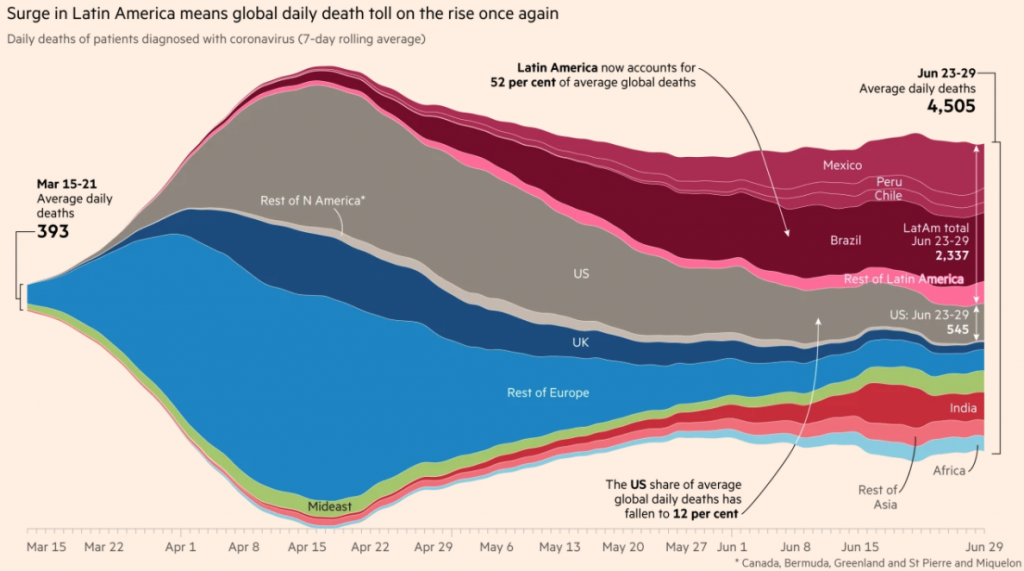

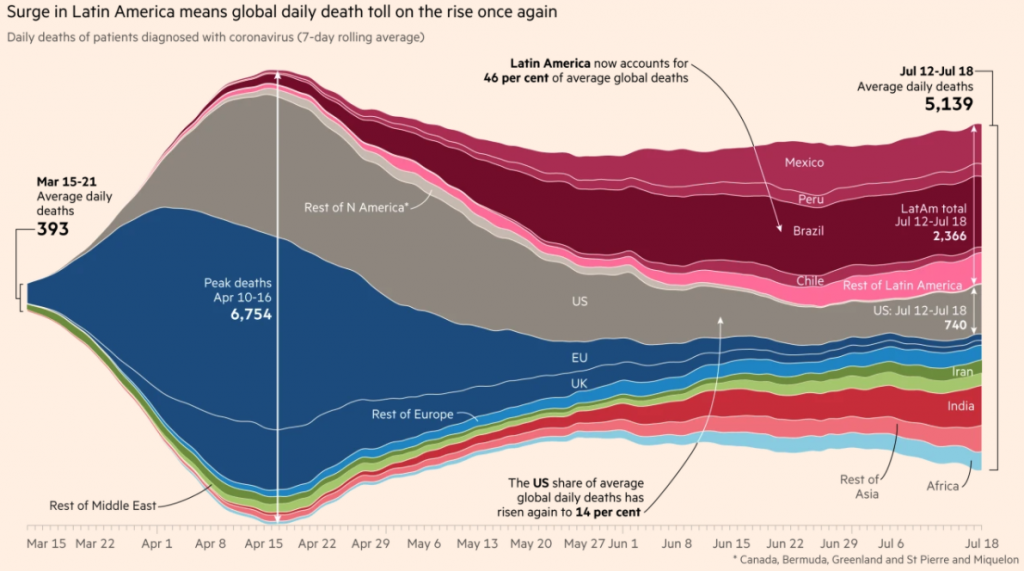

Here’s a sad, macro shot of deaths across the world (thanks to FT.com):

July 2

Thursday. Last trading day of the week. Another day and another week of rallying. The S&P 500 was positive every day this week. It closed up .45% today. The Nasdaq closed up .52%, and the Russell 2k and Dow both closed up a little higher than .3%.

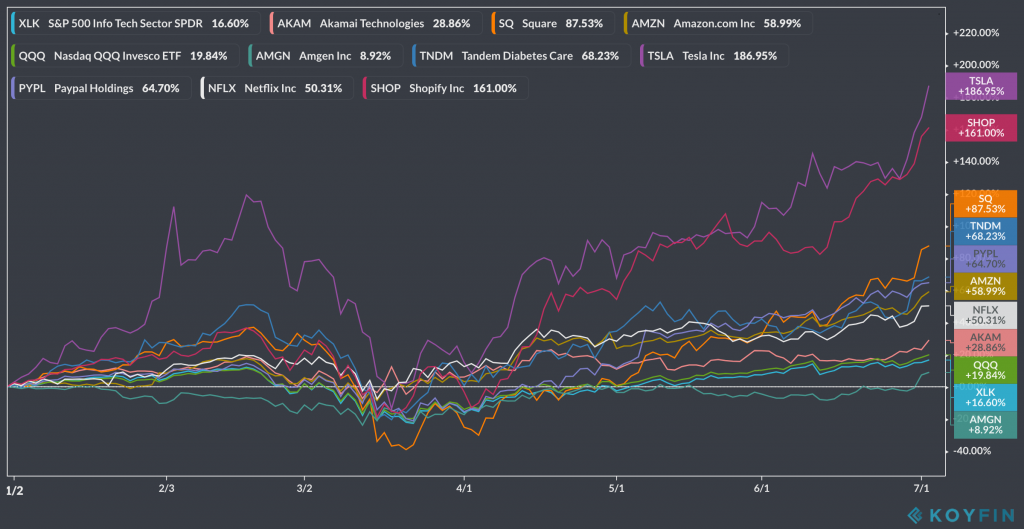

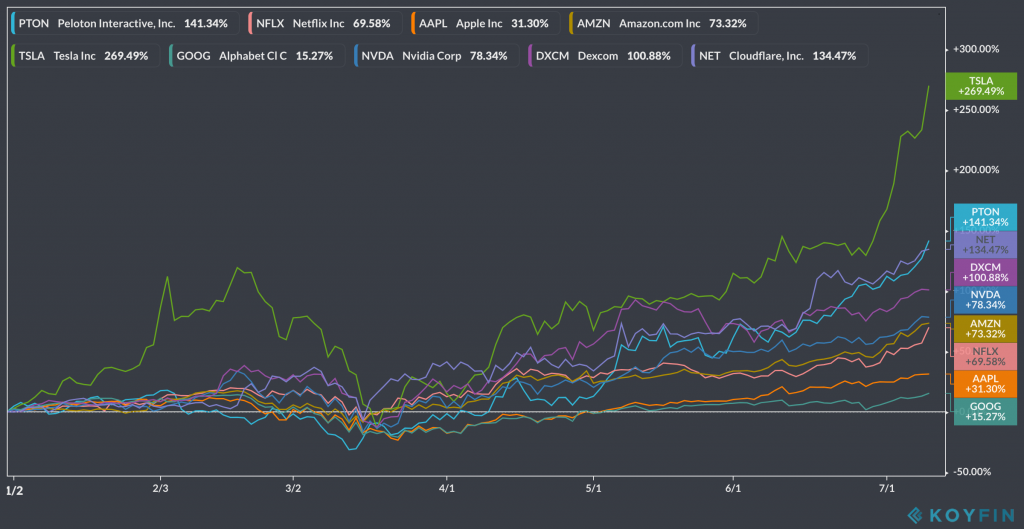

Jaw-dropping price action. Look at some of the tickers hitting highs today. YTD: $TSLA +187%, $SHOP +161%, $SQ +88%. $AMZN has almost doubled from March 23rd to nearly $3,000 😮

Jobless claims rose another 1.43M. The total for the last 15 weeks is 48M. For context, the entire GFC of 08-09 saw just over 37M.

Fundrise published First half of 2020 performance analysis. “In short, over the first six months of the year, Fundrise net platform returns have averaged approximately +2.41% in comparison to -4.91% for stocks, as measured by the Vanguard Total Stock Market ETF (VTI) and -15.00% for public REITs, as measured by the Vanguard Real Estate ETF (VNQ)… we’ve actually seen demand for our apartment properties increase during this time, driving continued growth in rental income, as more and more individuals choose to move to Sunbelt cities like Orlando, Jacksonville, Tampa, Charlotte, Dallas, or Nashville… Additionally, unlike many public REITs, whose portfolios are concentrated in high-end apartments in gateway cities such as New York, Chicago, Boston, and San Francisco, our focus has almost exclusively been on reasonably-priced apartments in high-growth cities, from the Southeast through Texas to Los Angeles. As a result, whereas the largest apartment REITs are now seeing rents falling as young knowledge workers decamp from these high-density, high-cost central business districts (-5.7% in San Francisco and -3.6% in Boston from March to June, according to CoStar), we’ve seen rent growth across the portfolio with the ten apartment communities purchased in 2019 achieving average rent growth (as measured by gross property income or GPR) of 5.88% from January through May 2020… As any of our more seasoned investors are now well aware, we try to live by the advice of legendary value investors like Warren Buffett and Seth Klarman, perhaps best paraphrased by the words, ‘Take care of the downside, and the upside will take care of itself.’ And given how broadly and deeply this pandemic has disrupted our lives in such a short period of time, we have a hard time believing that some extended and unpredictable consequences will not manifest themselves in the coming months or years.”

Today’s edition of The Most Ridiculous Shit features this story: Alabama students attend ‘COVID-19 parties,’ gamble on who gets sick first. A city council member testified that “They put money in a pot and they try to get COVID. Whoever gets COVID first gets the pot.”

July 3

Friday. Markets are closed for the holiday weekend.

JPMorgan published 3Q 2020 Guide to Markets. I’m included 6 of the 72 slides below:

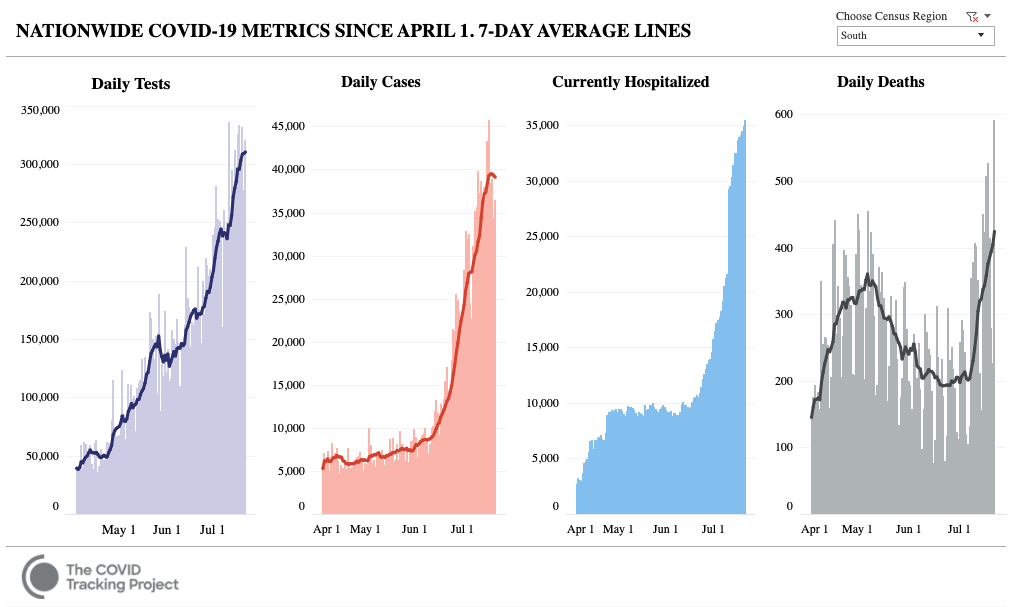

The latest weekly update from the COVID-19 Tracking Project is out: Across the US, Outbreaks are Catching Fire. “In the regions with the worst outbreaks, testing is rising quickly, but the positivity rates—how many tests come back positive for COVID-19 out of all tests performed—have also continued to rise, with the South cresting 11 percent and the West over 8 percent positive. In the Midwest, the percent-positive rate is also slowly rising. In the Northeast, where all COVID-19 metrics have been improving since the early outbreak’s peak in mid-April, the percent-positive rate has stopped falling, though it remains at levels that indicate the virus has been effectively suppressed by months of communal and individual interventions.” And for some great news (considered great given the state of the country): “Florida has agreed to begin reporting the number of patients currently hospitalized with COVID-19 in the next few days, and we will finally have a number that covers roughly 98% of the U.S. population.”

July 5

Sunday. Independence Day was yesterday. We spent about 7 hours trying to prevent my dog from having a heart attack. Today ends a week of staycation for my wife (the first time off she’s taken since the pandemic began). It was nice for her to be able to decompress, as well as give her face a break from wearing a mask every day. I took a few days off too to spend with her. We originally had a trip booked to Colorado but obviously had to cancel it. At this point, we can’t imagine traveling or even having guests visit us for another year. This isn’t how we imagined our first year in a new state, but at the end of the day, we’re happy we moved when we did, and we’re glad to be in a home instead of an apartment. It seems like we made a move in 2019 that many others are now contemplating for 2020 and 2021. Also, we know how fortunate we are compared to many others. We’re both employed and healthy– two things that matter most during a financial and health crisis.

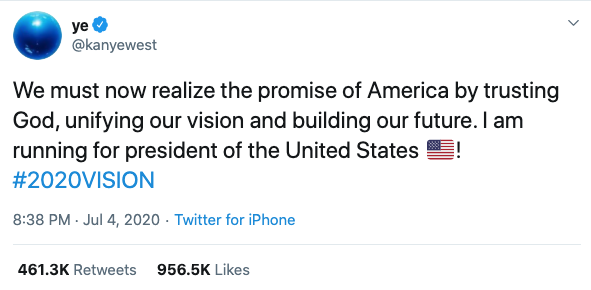

While consoling our dog in the closet, Kanye took to Twitter. Nearly a million likes so far 🤦♂️

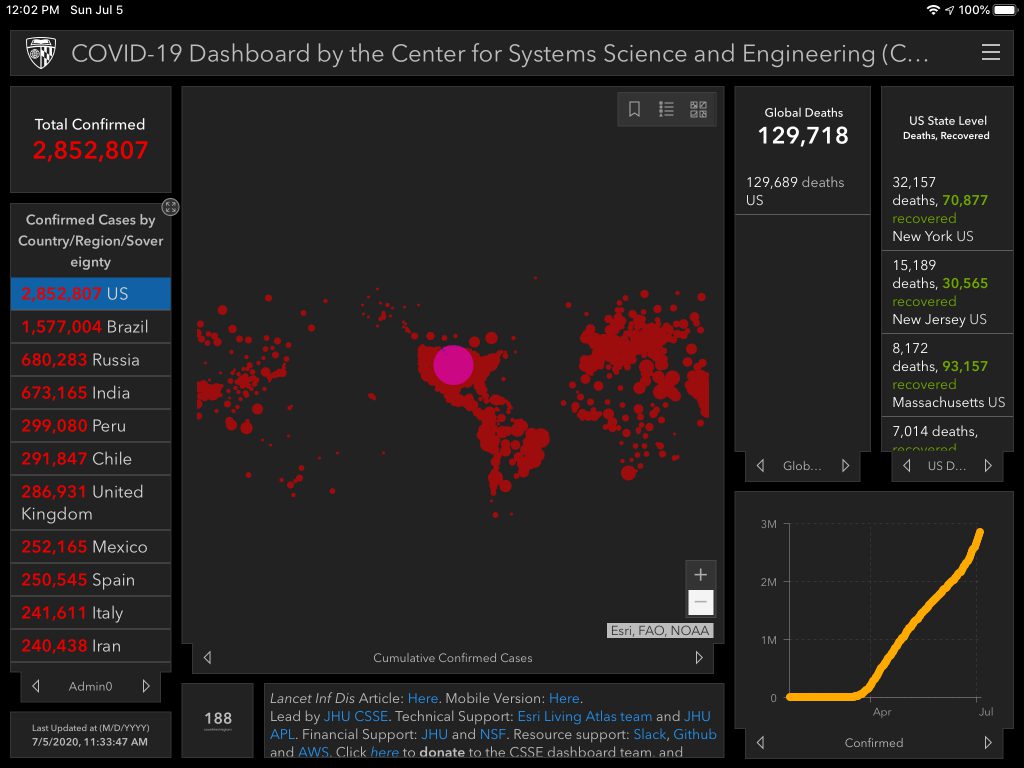

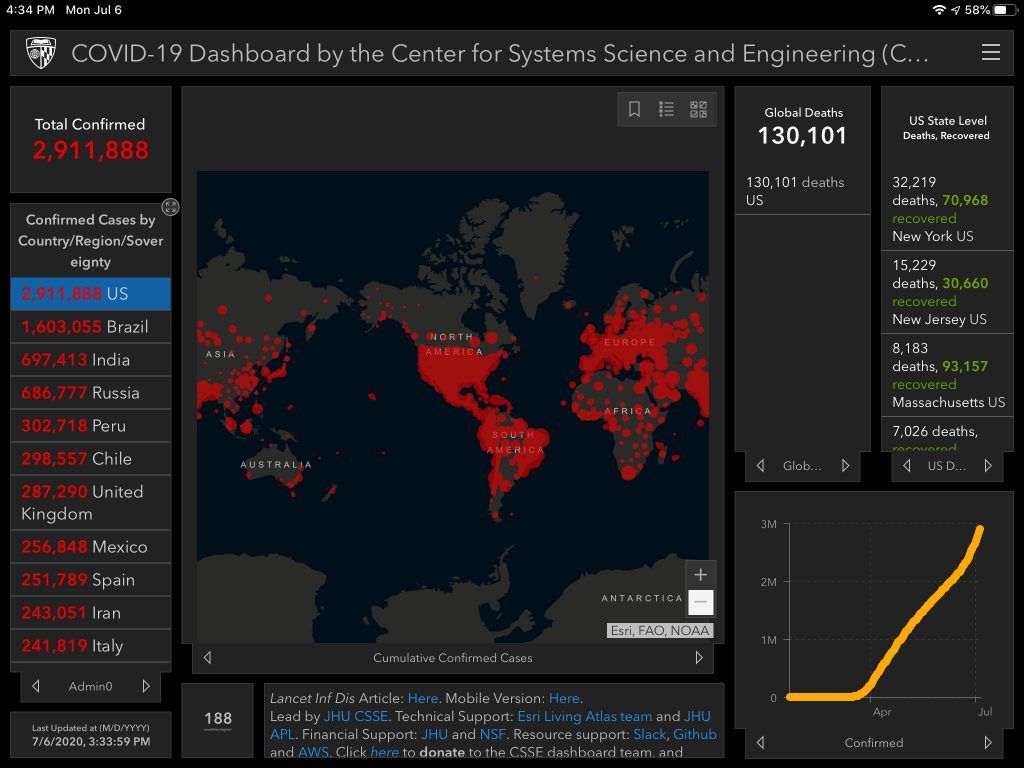

July 1st was the last time I shared the 7-day moving average of the percentage of positive tests. FL was at 16%, and the US was at 7%. 5 days later, FL is at 18.1%, and the US is at 7.6%.

It’s becoming clear that efforts to reopen will resemble a country-wide game of whack-a-mole. By the way, NYC entered Phase 3 of reopening.

July 6

Monday. Another crazy rally day. All green. The Nasdaq closed up 2.2%, Dow up 1.78%, S&P 500 up 1.6%, and the Russell 2k closed up .77%. Emerging markets closed up over 4%, Developed +1.7%, Gold +.7%, and even $btc is up over 2% today. The only red S&P Sector was Utilities at -1.3%. The big names continued their upward ascent. $TSLA shot up 12.5% to $1,371, $MSFT climbed to $210, $SQ mooned ~5% to $119, and $AMZN closed at $3,054. Daily all-time highs are the new norm, for now. I can’t help but continue trimming on days like this, parting with a little bit of $PTON, $KMX, $VEA, $PRNT, $ARKG, $GAN, and $ARKW. My ability to rationalize the market is completely shot. Fortunately, I don’t feel FOMO. It feels good to go against the grain and sell as the rally intensifies.

Today’s edition of College-COVID-Mayhem features Harvard and Princeton. Harvard Plans on conducting all courses online for the 2020-2021 year, allowing up to 40% of students to be on campus, testing students who decide to come on campus every three days, and charging the same tuition as before– ~$50k. To be clear, regardless of who comes on campus, classes will be fully remote. Princeton plans on offering a 10% tuition discount, inviting about half of the students to campus in the Fall (if they want), testing regularly, and also plans on most coursework taking place online. They’ll be inviting 5th-year students and juniors to campus in the fall, and sophomores and seniors in the spring.

To make matters even worse for students, ICE announced that students who fall under certain visas “may not take a full online course load and remain in the United States… The U.S. Department of State will not issue visas to students enrolled in schools and/or programs that are fully online for the fall semester nor will U.S. Customs and Border Protection permit these students to enter the United States.” Such a cluster fuck.

Miami is one of the cities backtracking reopening efforts. The Mayor signed an emergency order to close short-term rentals, party venues, and restaurants aside from takeout/delivery.

Arizona became the 8th state to join the 100,000 case club. And sadly, 89% of their ICU beds are already full according to their dept of health.

July 8

Wednesday. The major indexes closed green. Nasdaq +1.44%, S&P 500 and Russell 2k +.8%, and Dow +.69%. Gold continued it’s ascent, crossing the $1,800 threshold for the first time since 2011.

Today’s edition of College-COVID-Mayhem features: “Harvard University and Massachusetts Institute of Technology sued the Trump administration on Wednesday, seeking to block a new rule that would bar foreign students from remaining in the United States if their universities move all courses online due to the coronavirus pandemic.”

The complicated debate on the reopening of schools is intensifying as the fall nears. Trump took to Twitter: “I disagree with @CDCgov on their very tough & expensive guidelines for opening schools. While they want them open, they are asking schools to do very impractical things. I will be meeting with them!!!”

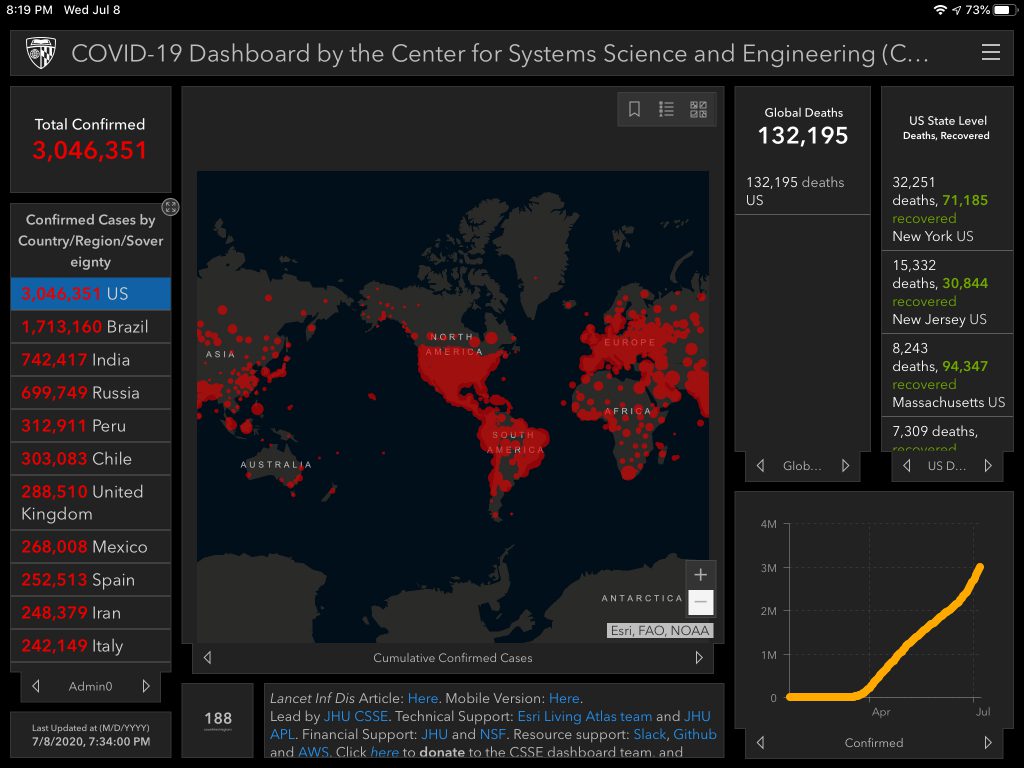

Dr. Fauci was pretty outspoken today, ensuring we stay grounded in reality: “The current state is really not good, in the sense that, as you know, we had been in a situation we were averaging about 20,000 new cases, a day. And then a series of circumstances associated with various states and cities trying to open up in the sense of getting back to some form of normality has led to a situation where we now have record-breaking cases… We are still knee-deep in the first wave of this.”

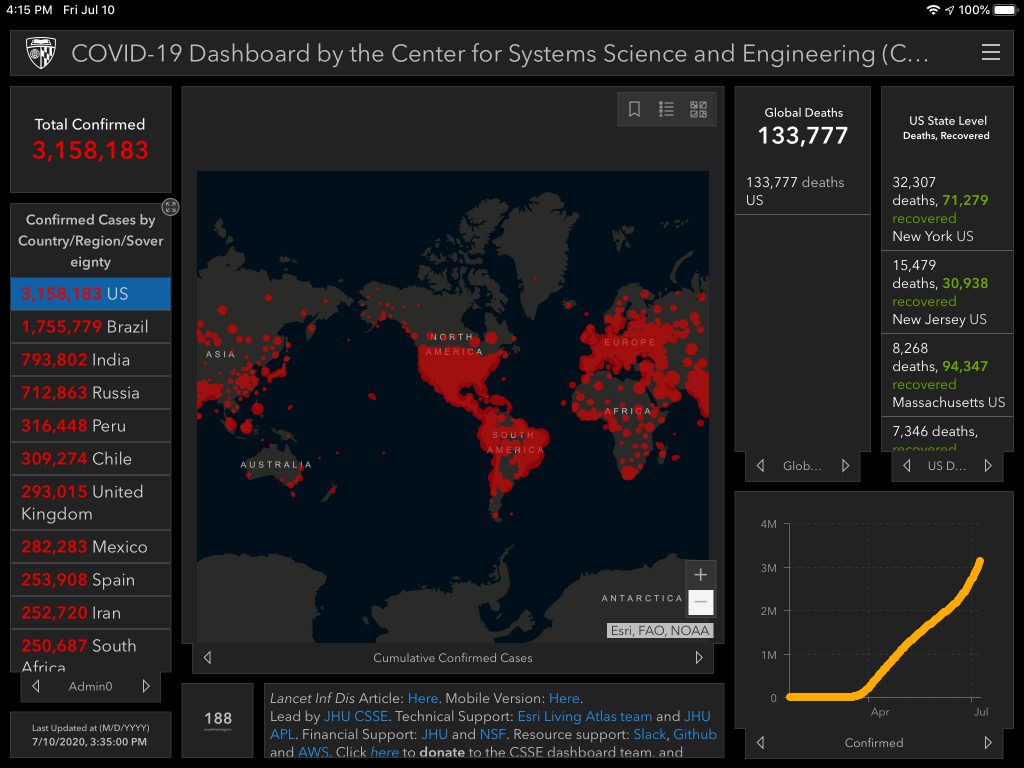

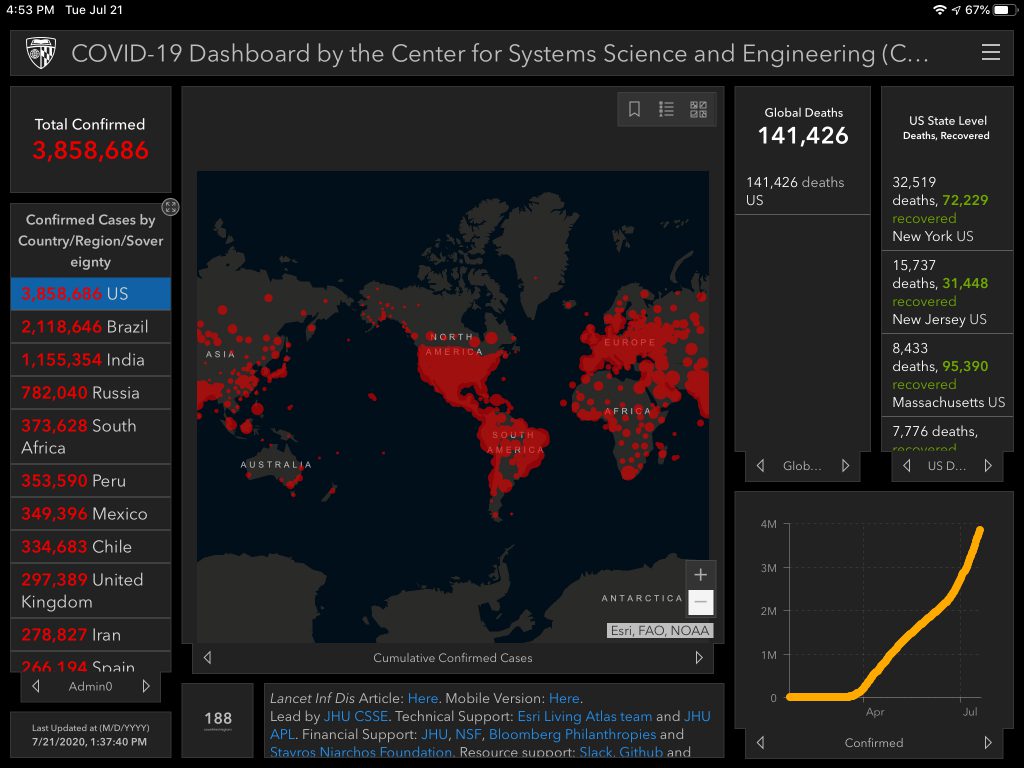

The US crossed 3 million cases today and the positivity rate climbed to 8%.

July 9

Thursday. The Nasdaq set a new record and closed up .53% while other major indexes closed in the red. The Russell 2k bled the most, closing down 1.75%, the Dow closed down 1.39%, and the S&P 500 closed down .56%. Gold was also down slightly but is still above $1,800/oz. Despite some of the major indexes closing in the red, some of the usual tickers marched to all-time highs. One of which is my favorites, $DXCM, which touched $445. $APPL, $MSFT, $SQ, and $AMZN all reached new ATH’s too. Most US sectors closed in the red today, led by Energy, which was down 5%.

Jobless claims rose another 1.31M. The total for the last 16 weeks is ~50M. For context, the entire GFC of 08-09 saw just over 37M.

The COVID Tracking Project published Florida’s COVID-19 Data: What We Know, What’s Wrong, and What’s Missing. The outbreak in Florida is ugly. “With a population of 21 million, Florida now has more new cases per day than any other US state, including two other larger states with major outbreaks, Texas (population 29 million) and California (population 40 million).” The article sheds light on significant issues regarding reporting in Florida, starting with the lack of hospitalization transparency. Florida is one of just three states not publishing the number of COVID-19 hospitalized patients. Florida also isn’t following CDC guidelines by reporting probable cases or probable deaths. The post continues on, highlighting the other reporting issues. It’s very well written. Hopefully, many of the issues are eventually addressed because public trust, health, and policy decisions require it. And hopefully, policy and procedures can be put in place to avoid this reporting shi-tuation when there’s another widespread health crisis in the future.

July 10

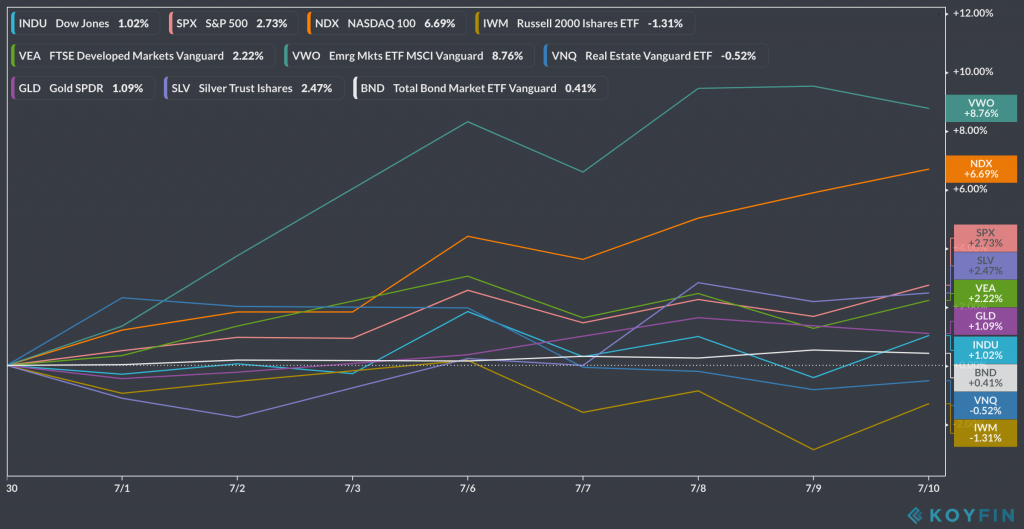

Friday. Another green day. So unsurprisingly, I trimmed. I parted with a tiny bit of $APPL, $DXCM, $YEXT, and $CVS. The Russell 2k led by closing up 1.6%, followed by the Dow up 1.43%, the S&P 500 up 1%, and the Nasdaq up .66%.

Check out this YTD chart of a few stocks that keep flying to ATH’s (Peloton, Cloudflare, Tesla, Nvidia, Netflix, Amazon, Google, and Apple):

Here are a few of the reasons I’ve been selling during this rally and why my portfolio allocation to cash & alts is the highest in my investing life. Ben Graham in The Intelligent Investor:

- The defensive and intelligent investor does what’s unpopular on Wall Street and often does the opposite of what feels right, like buying as prices drop and holding or selling as prices rise.

- The defensive and intelligent investor takes responsibility for ensuring that you never lose most or all of your money.

- Price fluctuations have 1 significant meaning for good investors. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times, forget the price.

Bloomberg published Citadel Securities Says Retail Is 25% of the Market During Peaks. “…retail traders now account for about a fifth of stock-market trading and as much as a quarter on the most active days…Even with the surge in activity, retail investors aren’t likely to be driving the market overall… Retail is clearly a significant force, but they’re not going to be the ones that are solely able to drive valuation or market levels.”

Bloomberg also published Covid-19 Is Bankrupting American Companies at a Relentless Pace. “The vast bulk, though, are small and medium-sized businesses scattered across the country. Their downfall might not normally garner much attention, but it does underscore the full extent of the damage Covid-19 has inflicted on the economy.” Here’s a subset in descending order by size and by date:

Arizona, California, Montana and South Dakota reached record highs for their seven-day average of new deaths.

July 12

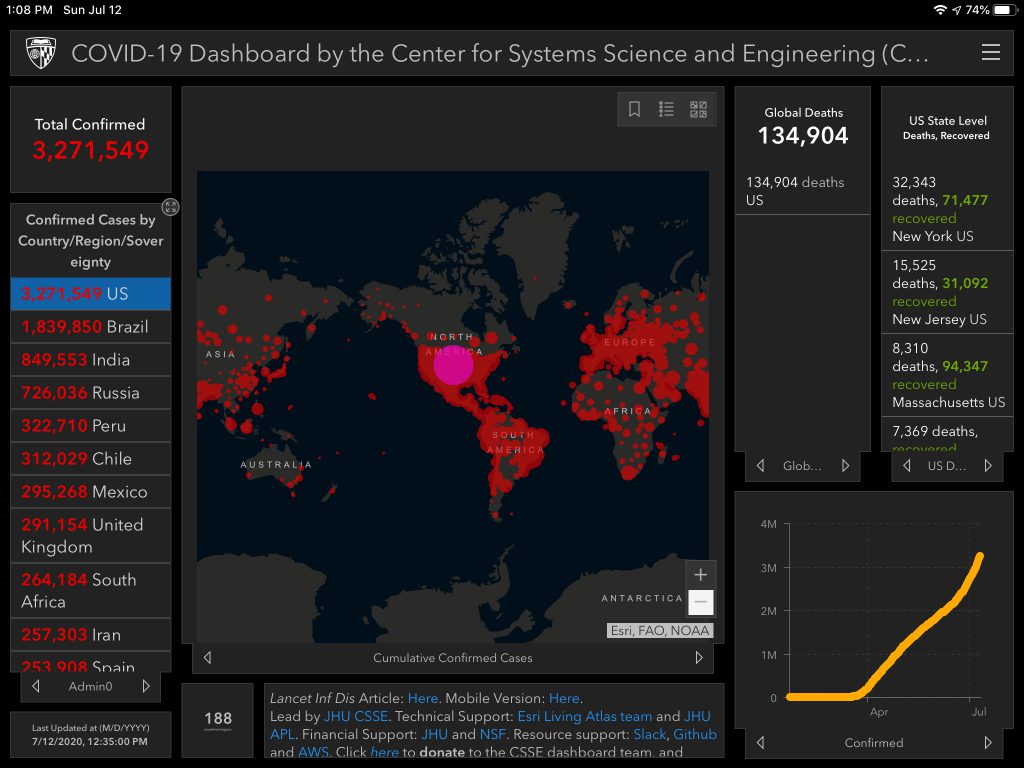

Sunday. Here’s a look at the MTD chart:

I enjoyed listening to Bill Miller of Miller Value Partners on the latest Masters in Business with Barry Ritholtz today. They covered a lot of ground, from philosophy to Bitcoin, to the path to new all-time highs. An excerpt from around minute 50, where Barry asks Bill for his opinion on the Feds actions: “…I think people forget about why we have a Fed in the first place. Why we have a Fed in the first place is we had recurrent banking crises and crashes and severe recessions or short depressions throughout the 19th century, and we needed instead of a central clearing house which was the way the banking system worked, was to have a lender of last resort similar to what the Bank of England was. And you know, that worked out OK, I’d say, and I think it’s working out so much better now because we know a lot more now about how that stuff works. And I still think that people fundamentally misunderstand the power of the Fed even though there’s that famous line,’ Don’t Fight the Fed,’ but underestimate the power of it and how it fits into the overall economy… I don’t have a dogmatic view about whether we’re going to have inflation or not. All I know is we don’t have inflation now, and we’re not going to have inflation in the next year or two. After that, who knows? But I do think that the Fed did exactly the right thing, which is why the stock market bottomed as quickly as it did and it moved much much faster this time than it did before, but it moved much faster now because it understood from before [from the housing crisis] what the consequences were of moving slowly. So I think the interesting thing now is that chairman Powell has said they will not increase rates until they’re convinced we’re on a sustainable growth path… You’re looking at a case where interest rates are going to be very, very low, and no competition at all for equities for several years, and I think that leads you to the view that if the economy is then going to grow, then you need to be long equities. Again, it’s not going to be a straight line, but what we’re doing right now is following the 2009 playbook… I can’t predict the market, but that appears to be the direction that things are going right now. It wouldn’t surprise me if the overall market hit new highs sometimes late this year or sometime next year. If the economy is coming back faster, and there’s not going to be any inflation, and the Fed’s not going to raise rates, and we can have a new high in GDP by the first quarter of next year, I can’t see any reason why the market can’t be at an all-time high then.”

I was finally able to push past my previous 60-minute Peloton PR of 611kj to 652kj for 20.3 miles. Gotta stay healthy!

Aaron Levie succinctly summarized the current state of COVID in America:

The US now has over 3.2 million confirmed cases, accounting for ~1% of the US population. On the one hand, that sounds like a tiny amount. On the other, it’s a lot. Think about groups that make up that same number of people here. That’s more than the total number of registered nurses or farmers in the US (each = ~2.6M). More than the active-duty military and reserves (~2.2M). It’s about equal to the number of public school teachers (~3.2M) in the country. We’re talking about a huge number here, and it’s highly likely that the actual number is significantly higher.

July 13

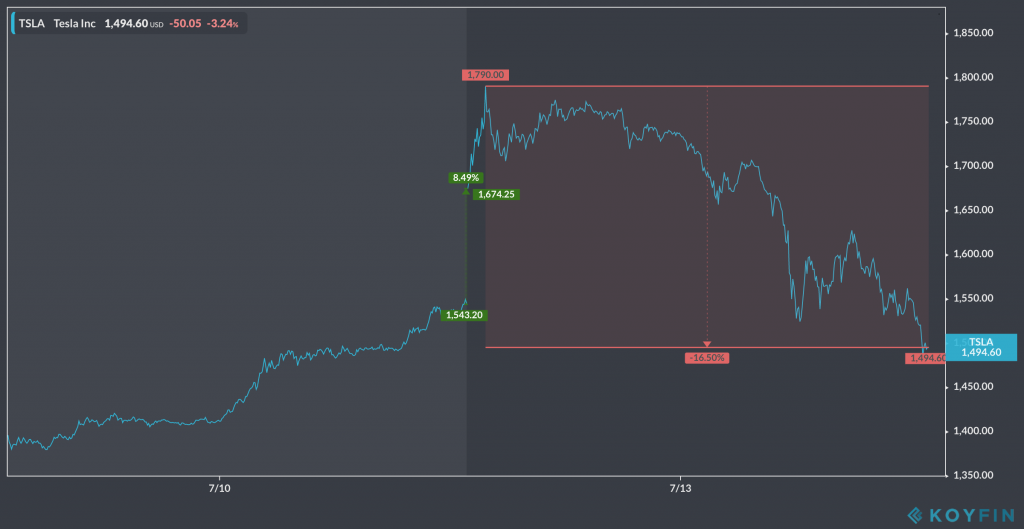

Monday. Markets were wild today. The bull powered forward, until about 2:00 pm. High flying stocks like Tesla continued their ascent to new ATH’s until the sharp afternoon reversal. The Nasdaq closed down 2.13%, Russell 2k -1%, S&P 500 -.94%. The Dow and Gold closed slightly in the green. Tech was the biggest bleeding sector, closing -2.1%.

The Tesla charts are just ridiculous. It gapped up over 8% to open, climbed another 7%, and then tumbled over 16% to close the day down 3%.

After a few weekends of poor entertainment picks (aka bad movies or shows on Netflix and Amazon Prime), we’re starting to wonder how Hollywood’s doing? What will be getting released in 12 months for us to watch? Fortunately, we started a new show (well, it’s from 2014) yesterday that looks promising– Halt and Catch Fire. Luckily it has 4 seasons so it should keep us entertained for a couple of weeks.

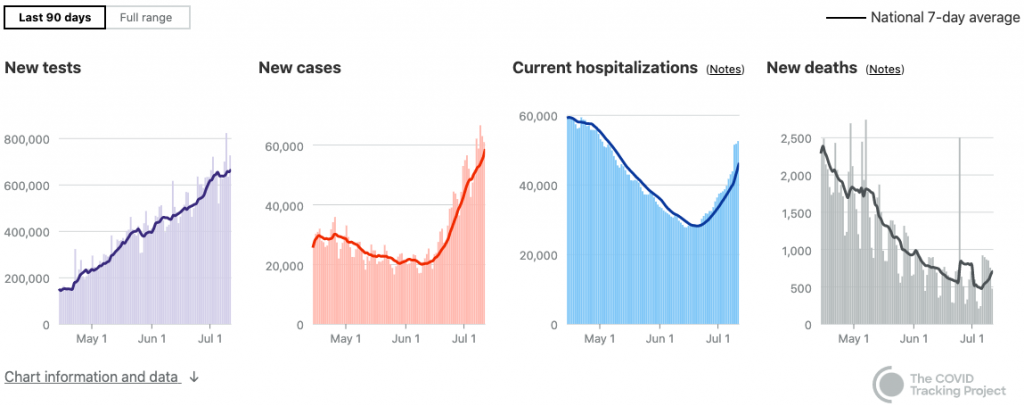

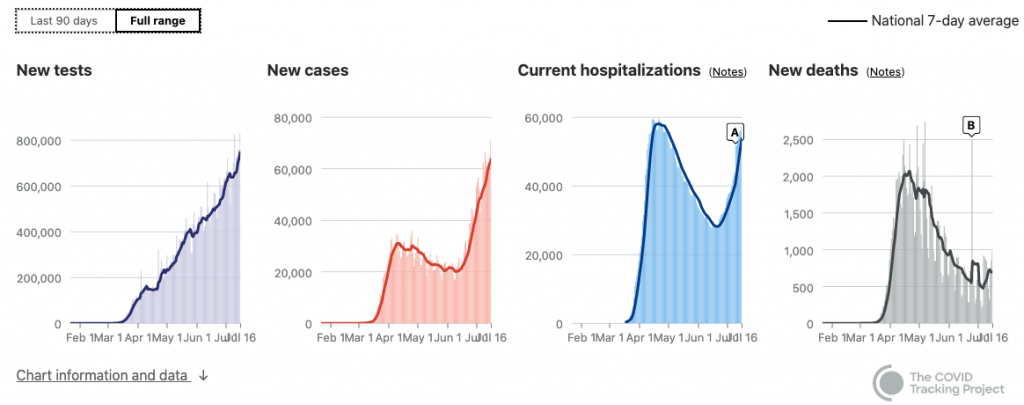

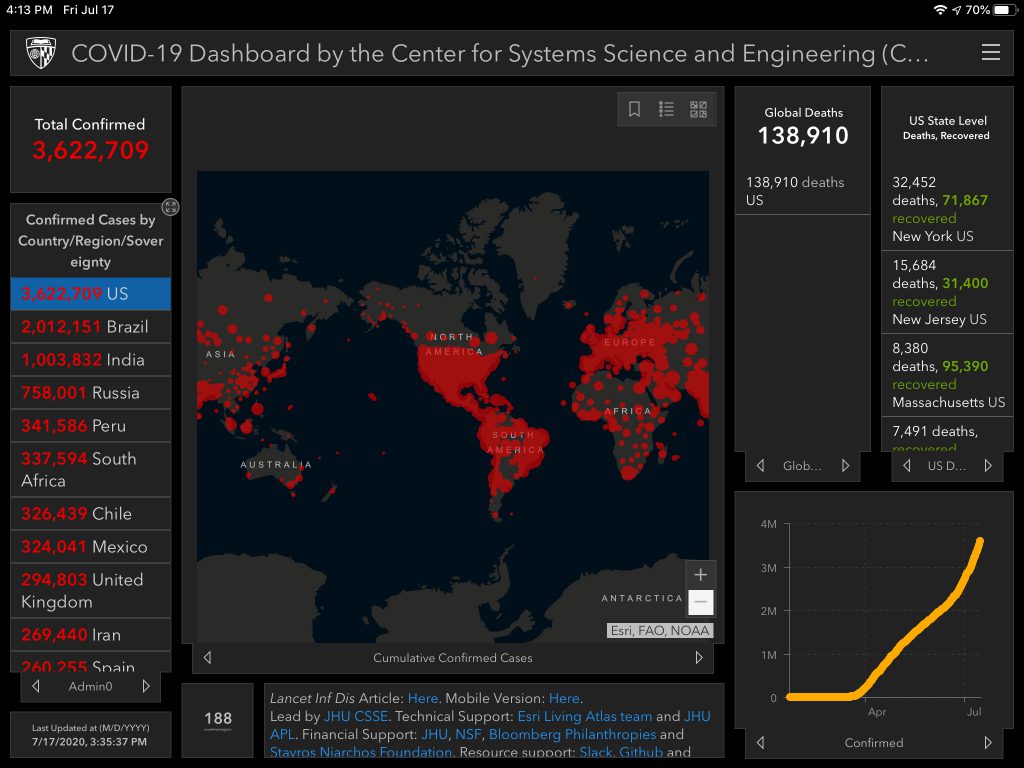

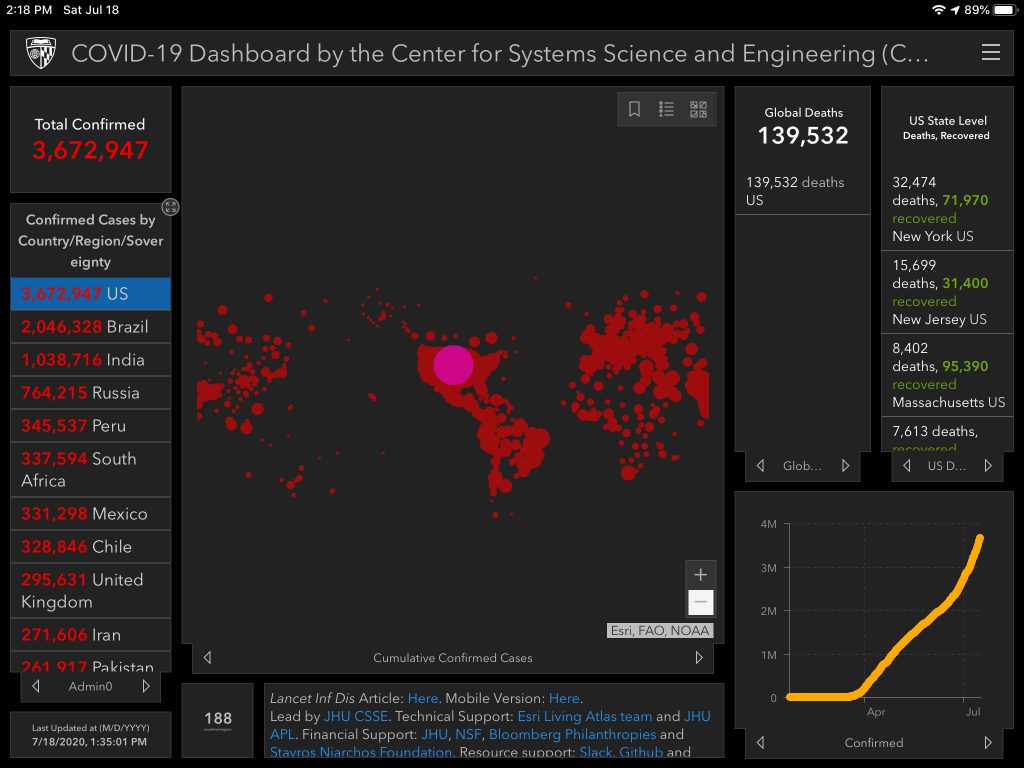

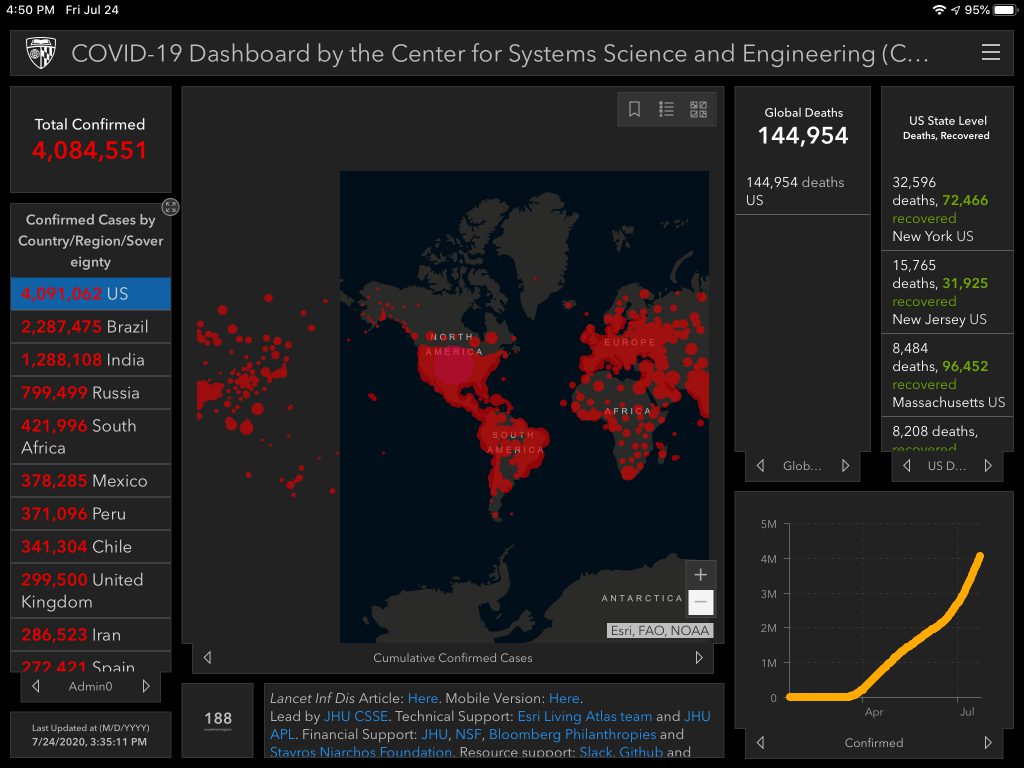

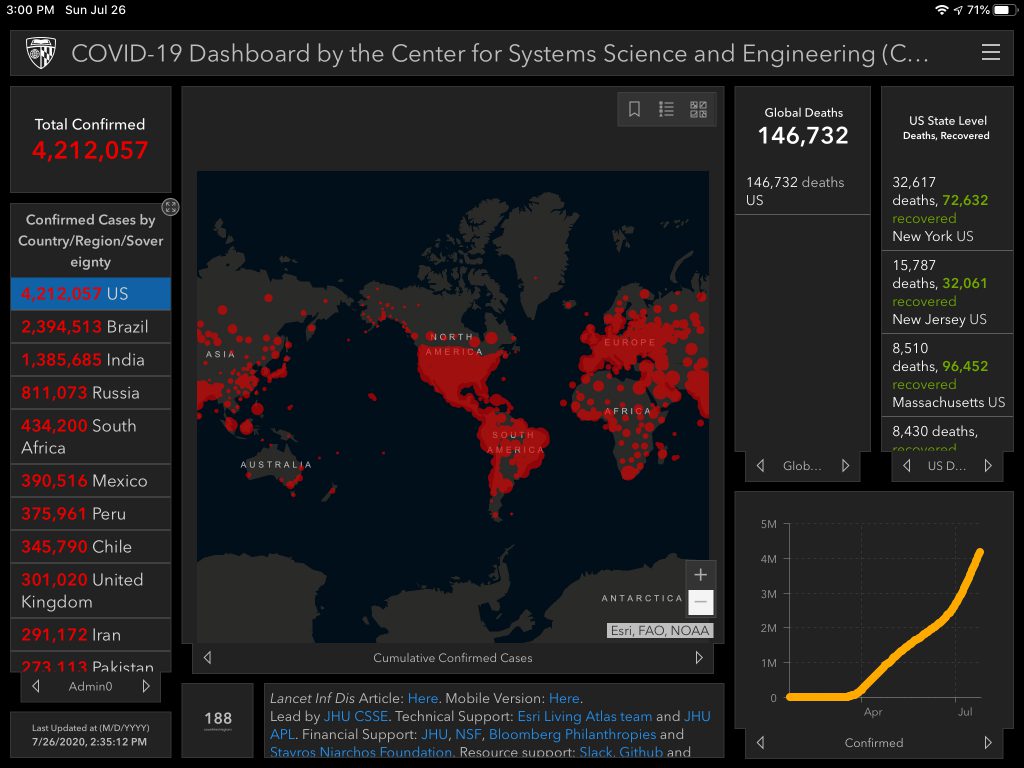

Here’s a look at the last 90 day totals of key COVID metrics for the US:

Dr. Lilian Abbo (an infectious diseases specialist from the University of Miami Health System) said, “We need the community to understand, we’re not trying to give you trouble (with these guidelines and regulations). Miami is now the epicenter of the pandemic. Where Wuhan was months ago, that’s where we are, and we really need your help.”

July 14

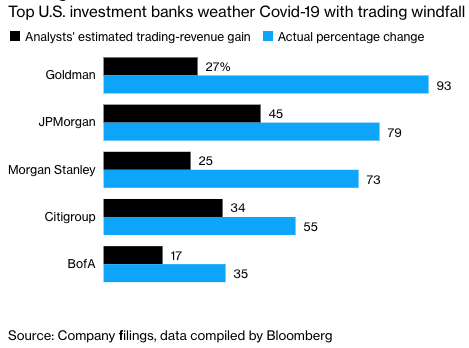

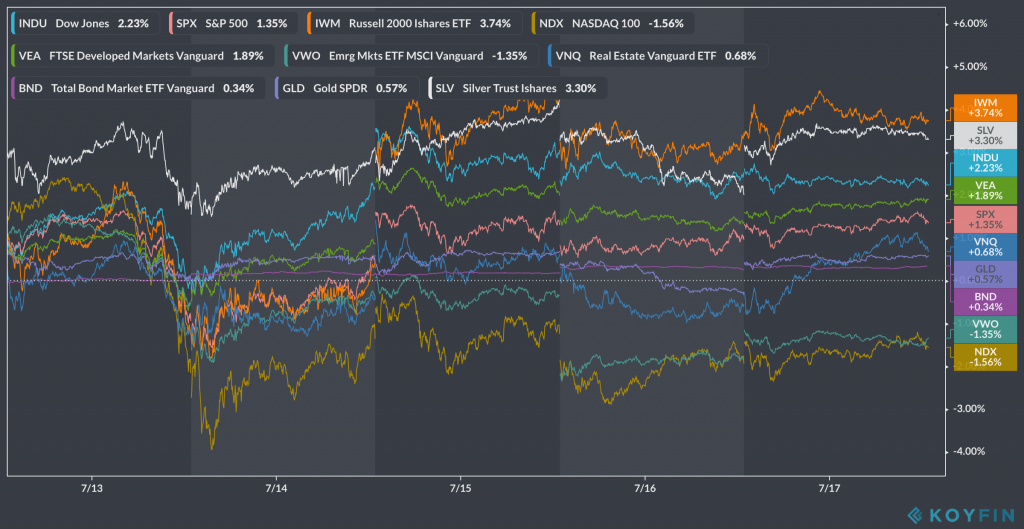

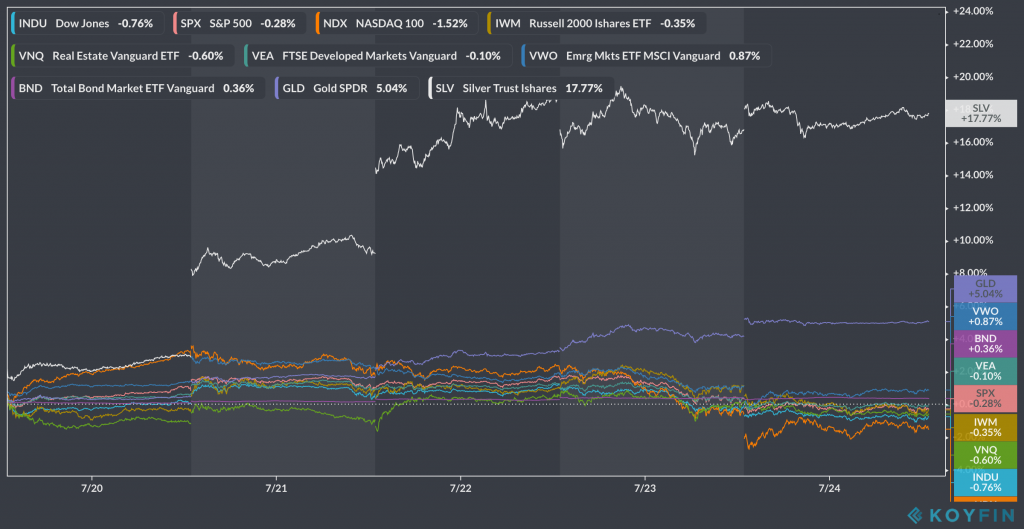

Tuesday. Shaky start to an eventual green close. The Dow led, closing up 2.1% followed by the S&P 500 +1.34%, Russell 2k +1.2%, and Nasdaq +.94%. Every S&P 500 sector closed green. Energy led, closing up 2.6%, with Financials trailing the most, but still positive at +.6%. Banks began reporting Q2 earnings today.