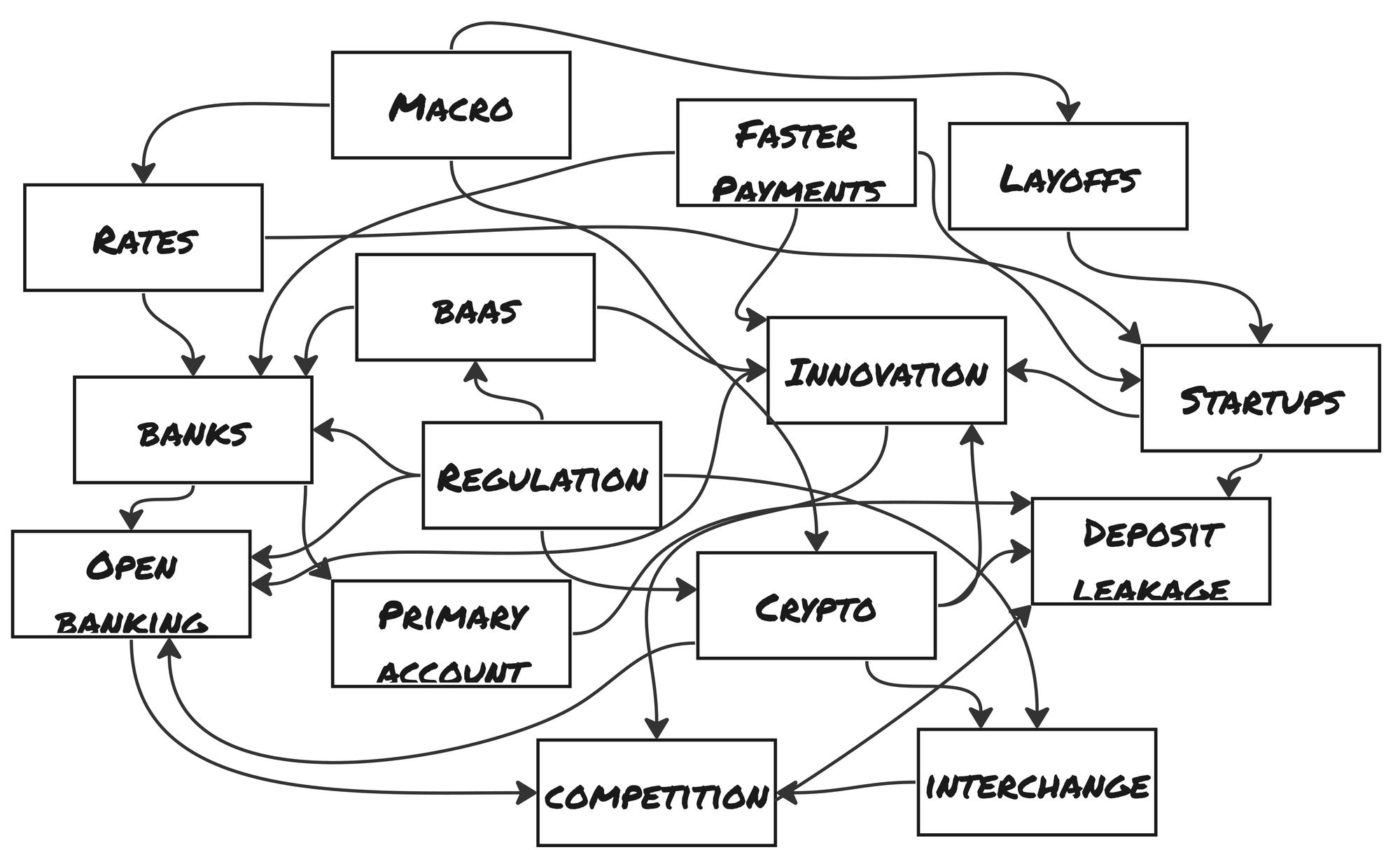

What's consuming fintech mindshare heading into 2023?

One of my favorite things about early-stage investing is the surface area you're exposed to in short periods. After writing Calibrating for a new era of fintech a month ago, I worked on a few things that intersect with some problems and topics that are top of mind across fintech right now. This post highlights some of them. To be clear, this isn't a prediction post.

Although not exhaustive, these are set to consume a lot of mindshare from startups, incumbents, media, and regulators throughout 2023.

- Direct deposit & leakage

- BaaS

- Limiting credit card interchange

- Section 1033

- Faster payment systems

- Crypto

- Macro

Direct Deposit & Leakage

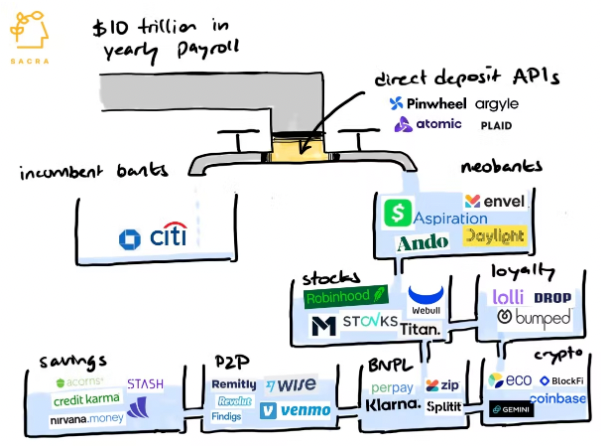

Every consumer bank and fintech service wants to be the primary account – the place where workers deposit their paychecks. They get to hold the idle cash, cross-sell products, and likely earn the interchange on card spend. Paying more than $500 to acquire a consumer is usually worth it given the lifetime value can easily exceed $4,000. And it's often double that for businesses.

Although it's not usually too hard to switch, the friction is high enough that most rarely do. With that said, it's getting easier. Customers are becoming more savvy and aware of their options. Since trillions of dollars are deposited each year, even small percentage changes in leakage will impact customer acquisition and lifetime value dynamics, making this a fast-growing problem for everyone relying on their sticky depositors. Although not a new problem, it's a fast growing problem. Sunil Sachdev, Head of Fintech at Fiserv, recently said, "serious amounts of money and mindshare are flowing from financial institutions to fintechs every day, including many that didn't exist a few years ago." They're helping banks better understand what's happening in their debit accounts and where customers are moving their money. Balance sheet leakage data shows that banks need to keep wallet share and gain mindshare.

Obvious drivers of leakage:

- Plain ol' competition. "Everything is fintech." There are more options available to customers than ever before.

- This BCG/QED report states, "regional banks are encountering a particularly difficult environment, as they must compete against both the disruptors and against larger national banks. Over the past three years, their share of new checking accounts has fallen from 26% to 21%. Moreover, they are faced with an aging customer base that is, on average, four years older than for national banks, and seven years older than for digital banks. Customer satisfaction is often poor; net promoter scores of the six largest regional banks range from a high of 39 to a low of -63."

- Alex Johnson wrote, "the traditional deposit account has been dynamited by fintech."

- Ron Shevlin said, "checking accounts have become paycheck motels."

FIs can see the outflows growing. And they see Coinbase expanding to offer products like debit cards of their own. Conversely, the Robinhood's of the world have to deal with leakage as well. Nobody is safe. In the future, you'll need to keep customers engaged and happy to keep funds on your platform. - Direct deposit switching & splitting. New services are making it easier than ever to split and/or redirect direct deposits. We'll eventually question the definition of "primary account." So far, data suggests older millennials are most likely to split, which could signal that this amount will grow as they age and could apply to younger people over time. This is significant because this is the population that banks want to be in a position to cross-sell products like mortgages and auto loans, given this population will be the highest earners with also the highest expenses.

Combatting leakage and redirection may take several forms. Finding ways for customers to remain engaged instead of seeming like a one-trick pony with a commoditized service is critical.

Loyalty and engagement plays like card-linked offers were an early form of this which has seemingly become ubiquitous across major card issuers. The next iteration may be what Sunil & Fiserv call programmable payments. "A programmable payments platform enables people to present the same card at every point of purchase – either physically or digitally – and yet gives them the option to pay through a variety of accounts and assets." An example here is Wedge. They're bringing this functionality to financial institutions so they can offer it to existing customers. It should help with that thing called retention as well as mindshare. This will enable them to easily provide Robinhood-like investing capabilities, and novel spending features like choosing to spend equities or crypto at the point of sale to take advantage of gains. Customers will eventually swipe/dip/tap their current debit card and choose to automate which asset is used to settle various types of purchases. Suddenly, a vanilla community bank can offer modern features that the hottest fintech companies don't even offer yet while combatting leakage, growing mindshare, and holding onto more fiat.

Reading material:

- Bain: The Future of Banking

- Bank Director: Direct Deposits

- Fintech Takes: Payroll Data + Fintech

- Sacra: The APIs funding $10t to neobanks

- Fintech Takes: Hands-on-the-Wheel Money

- Fintech Takes: The Gentrification of Deposits

- Fiserv: Understanding Programmable Payments

- Fiserv: 2022 Fintech Trends for Financial Institutions

- Bankrate: Consumers stick with the same checking account for an average of 17 years

- The Financial Brand: Why Digital Banks Win the War for Banking Relationships

- BCG/QED: White Paper Matchmaker, Make Me a Match Best practices in bank-fintech partnerships

BaaS

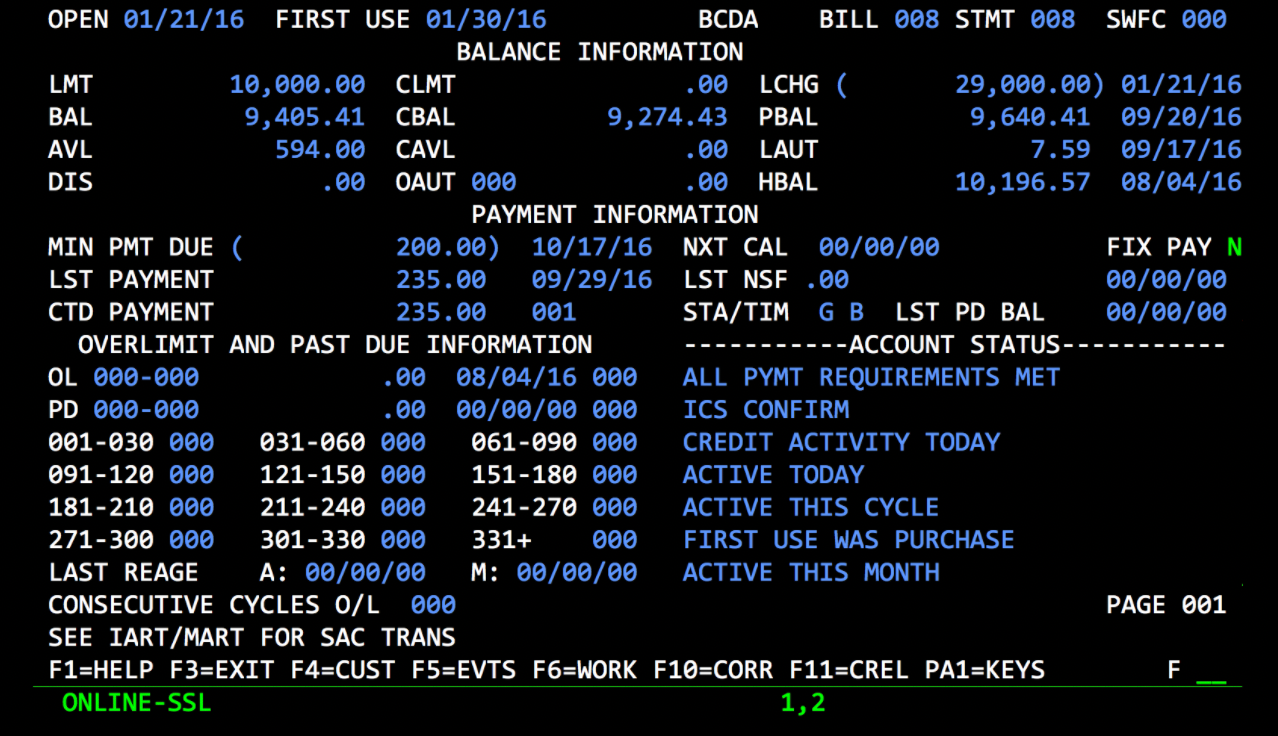

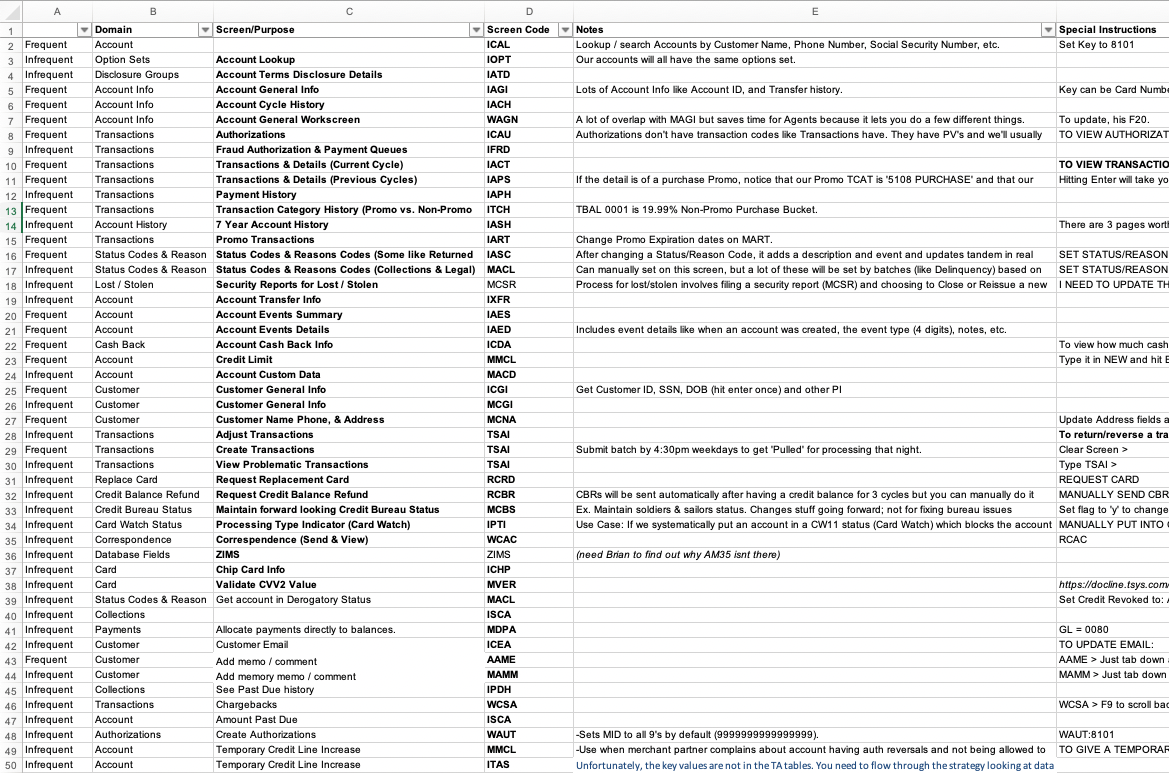

We had to build Blispay the old school route in 2015 – similar to Bill Me Later a decade before. We partnered with one of the Utah sponsor bank and integrated directly with TSYS. I basically lived in green screens and an associated cheat sheet I created. Here's some testing I was doing on a colleague's account (👋 Christine).

We stacked the founding team with experienced product, engineering, legal, compliance, finance, risk, and ops folks. It took a village.

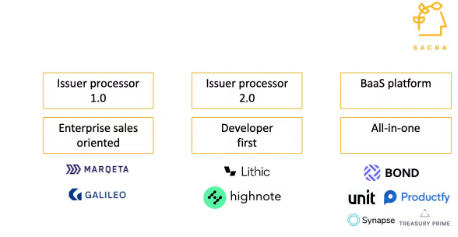

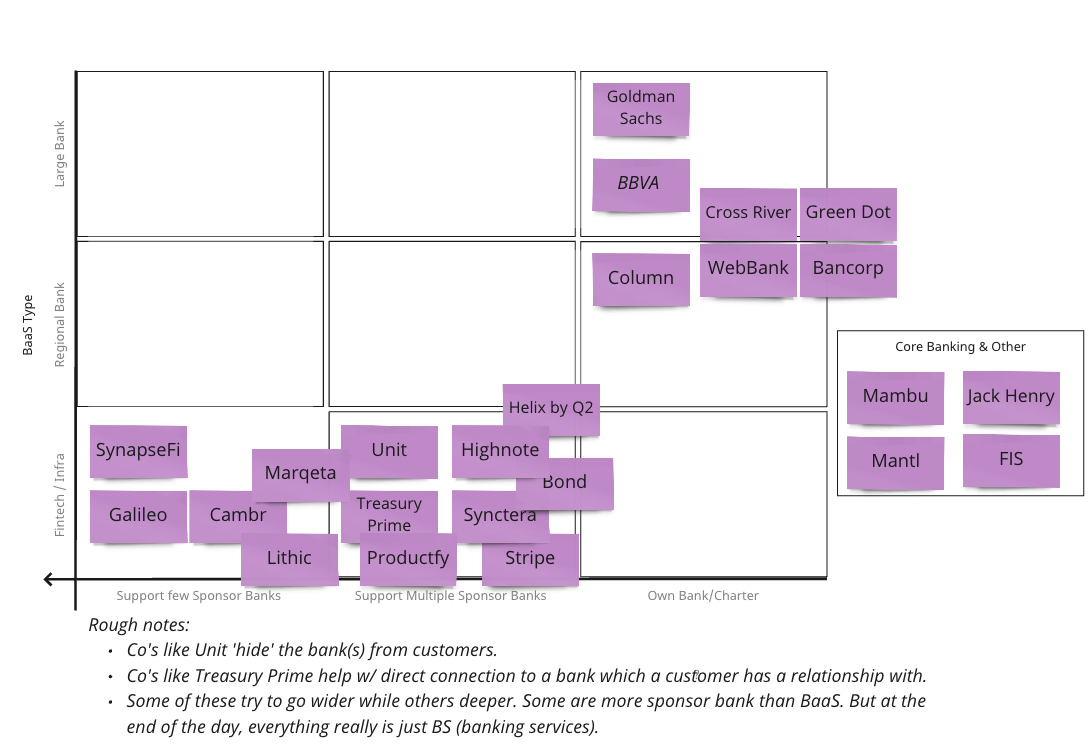

It's a little simpler to get started these days. There are all-in-one offerings from the likes of Unit and Treasury Prime, as well as targeted solutions like Highnote and Lithic.

Banking-as-a-Service (BaaS) became popular because of an abundance of opportunity for faster, innovative fintech and non-fintech companies to bring great financial products to market, and demand from durbin-exempt [smaller] banks to create new revenue streams while growing through the efforts of others. As Alex Johnson highlighted in this post, it's a cost-effective distribution strategy.

Similar to the direct deposit & leakage section, BaaS isn't new. But heading into 2023, a few topics will consume a lot of mindshare around it.

- Business model & design. The big question here is which model makes the most sense for each party in the long term? Some observations & questions:

- Jackie Reses led the acquisition of Lead Bank.

- William and Annie Hockey acquired Northern California National Bank (now Column).

- Lending Club acquired Radius Bank, giving it business model flexibility with promising results.

- SoFi acquired Golden Pacific Bancorp, and similarly has extra flexibility and benefits like lower funding costs, and deposits to capture NIM with promising results so far.

- Will fintech products that reach scale graduate off of BaaS middleware providers and go straight to banks eventually?

- Many of the most valuable public companies in the US are actual banks. Therefore, is being a bank critical to break out as a financial services provider?

- Will tech-forward, progressive banks bolster their own capabilities so they can support fintech programs directly without relying on a BaaS middleman?

- This Coatue report posits that "balance sheets are necessary evils," implying they're necessary for the sake of sustainability (thanks to more float revenue and better unit economics) but evil because they come with lower multiples.

- Following m2020, Simon Taylor wrote, "the killer line of the show for me came from the president of a partner bank who said, 'everyone who doesn't have a balance sheet just realized their cost of funds is too high to have any scale.' Banks will always have the lowest cost of funds, but the market for the past two decades distorted that with ultra-low interest rates." - Regulatory pressure. Jason Mikula summarized the early signs of increasing scrutiny on bank-fintech relationships in July. Chatter has only picked up since then.

- The OCC & Blue Ridge agreement came out in August.

- Various rumors have been swirling around Column.

- The CFPB shared they'll be "supervising entities that may be fast-growing or are in markets outside the existing nonbank supervision program – nonbanks whose activities the CFPB has reasonable cause to determine pose risks to consumers."

- The OCC's Michael Hsu recently expressed concerns that the complex relationship between banks and non-banks via BaaS will lead to "a severe problem or even a crisis... Banks have done a commendable job of rebuilding trust since the 2008 crisis. Their financial buffers and risk management capabilities have improved dramatically. Notwithstanding, trust is sensitive to surprise. And the evolution of bank-fintech arrangements in the era of digitalization is giving rise to new opportunities for surprises... . The technology business model is very different from the banking business model. (LTV/CAC is different than NIM, for instance.) What is the dynamic between the two business models? Do they lead to healthy competition resulting in better products and services and more resilience at better prices for customers? Or do they lead to a race to the bottom with pressure to cut compliance corners and to monetize user data in novel ways? Perhaps both? In the lead up to the 2008 financial crisis, the failure to understand these dynamics between traditional and shadow banking created a massive blind spot for the industry and regulatory community."

Increased compliance requirements will lead to significantly higher costs for everyone. It's likely to result in fewer market participants in the short term, although the clarity could eventually lead to more in the distant future. After all, we probably don't need 20 BaaS providers, and not every bank is technically and culturally capable of being a good sponsor bank. I'd even say that not every startup that wants to offer financial services should be able to. There should be some barriers to entry and many of the concerns are valid. This is a complex area and will surely be an area that consumes a lot of mindshare over the next year.

Reading material:

- Fintech Brain Food: M2020 impressions

- Coatue: Fintech and the Pursuit of the Prize

- Popular sponsor banks for fintech programs

- Workweek: Does the OCC know what BaaS is?

- Fintech Takes: Breaking Down Banking as a Service

- Fintech Business Weekly: Did OCC Scrutiny of Column Drive Brex to Dump SMBs?

- Fintech Business Weekly: As Regulatory Scrutiny of BaaS Grows, Rumors Swirl

- Sacra: Fintech Fastlane: The Unit Economics of the Banking-as-a-Service Toll Road

- Sacra: Banking-as-a-Service: Monetization, Competition, and Growth in the Fintech Fastlane

- The Financial Brand: What the Federal Crackdown on Bank+Fintech 'BaaS' Partnerships Means

- Fintech Business Weekly: With Blue Ridge's OCC Agreement, BaaS 'Rumors' Spill Into Public View

- Treasury prime: To Avoid Hitting a Regulatory Wall, Don’t Offload Compliance to a BaaS Provider

- Fintech Business Weekly: Evolve's Problematic Partners: Bankruptcies, Regulatory Actions, Abrupt Shutdowns

Limiting Credit Card Interchange

PayPal bought a company I worked at called Bill Me Later in 2008, when eBay still owned them. It was BNPL before that term was coined. Offering on-us credit to eBay customers was an incredible opportunity, and it enabled them to cut down on credit card interchange expenses.

We continue to see moves by various companies to build and grow closed-loop networks to cut out the card networks. There's...

- The rise of BNPL.

- Various faster payment systems.

- Block with Square, Cash App, Cash App Pay, and Afterpay.

- Wedge enabling a bank to deploy a line of credit to their debit card holders.

- Chase making moves like acquiring Renovite & Figg, which could lead towards enabling direct payments between their accountholders and merchants.

Regulation is also set to play a role in limiting credit card interchange. Durbin 2.0, The Credit Card Competition Act, is intended to promote competition in the credit card processing market, where small businesses generally lack power. It ultimately intends to cut down on card acceptance fees for SMBs. With that said, interchange usually pays for card rewards. Churning isn't as fun as it used to be to begin with, and could get much more boring going forward. However, Costanoa's own, Mike Albang, will undoubtedly find a way to make the most of what's available.

Reading material:

- BAI: What's next if 'Durbin 2.0' becomes law?

- Jareau: Square & the Holy Grail of Payments

- NFIB: Credit Card Competition Act Explained

- The Financial Brand: Durbin 2.0 Threat: Banks & Credit Unions Brace for Significant Impact

- Forbes: The Durbin Amendment Will Imperil Security And Innovation In The Credit Card Market

Section 1033

CFPB Director Rohit Chopra made an announcement at m2020 a few weeks back – "This week, the CFPB will launch the process to activate a dormant authority under section 1033 of the Consumer Financial Protection Act... While not explicitly an open banking or open finance rule, the rule will move us closer to it, by obligating financial institutions to share consumer data upon consumer request, empowering people to break up with banks that provide bad service, and unleashing more market competition. If successful, it will also reduce the ability for incumbents to build moats and for middlemen to serve as gatekeepers. It will provide big advantages to those who provide the best products, service quality, and rates."

"Open finance" is the ability for a customer to connect the financial information in their accounts to other services. It should increase competition amongst providers and optionality for consumers. I'm shocked the crypto industry hasn't noticed yet given the end goal and language Chopra uses such as, "A decentralized, open ecosystem will yield the most benefits for creators and consumers alike."

This ultimately has wide-reaching impacts and will continue to take a while to play out (having been on hold since Dodd-Frank passed in 2010). They hope to finalize the rules by 2024 so as new information is released throughout 2023, industry participants will indeed be paying close attention.

Reading material:

- CFPB issues Section 1033 SBREFA outline

- Workweek: How to Survive Open Banking

- Workweek: Observations from Money20/20

- Fintech Law TL;DR: Open (the) Banking (Floodgates)

- CFPB: Director Chopra’s Prepared Remarks at Money 20/20

- Protocol: How fintech got banks to come around on open banking

Faster Payments

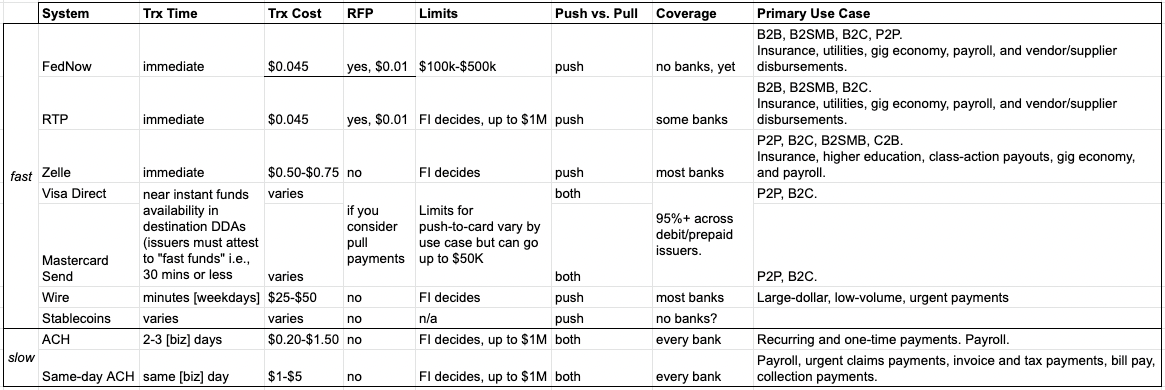

I recently wrote a post titled, Faster payments with FedNow, given the growth of real-time payment systems and the launch of FedNow nearing. It highlights RTP, FedNow, Zelle, Visa Direct, Mastercard Send, Stablecoins, ACH, and Same-Day ACH.

FedNow is set to launch in 2023. Despite being very similar, it will likely see more adoption than 5-year-old RTP. Startups like Moov, Modern Treasury, Circle, and Astra are in interesting positions.

Reading material:

- Volante Tech: FedNow is Almost Here

- FIS/Worldpay: The Global Payments Report

- Jared Franklin: Faster Payments with FedNow

Crypto

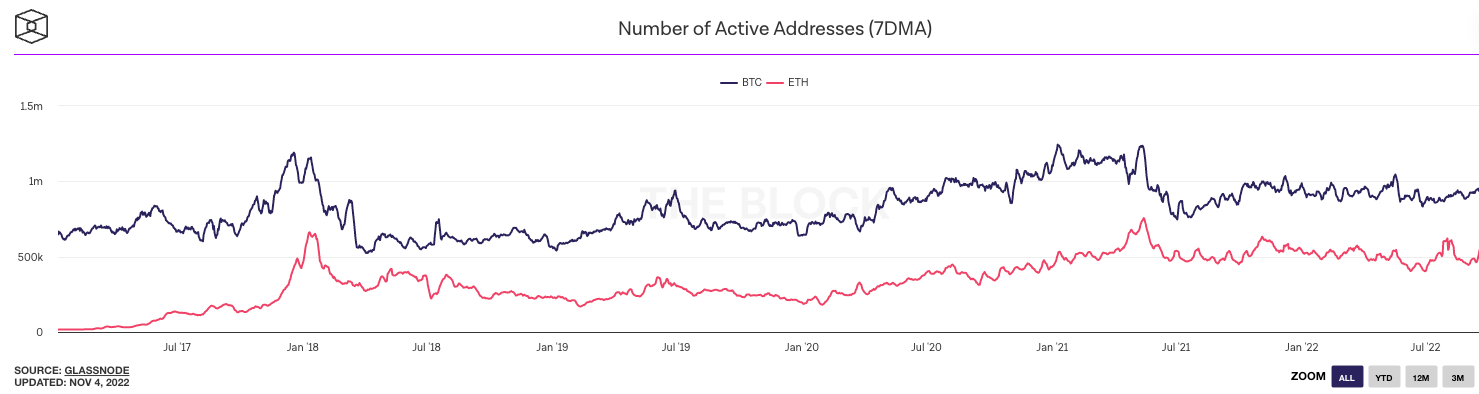

Parts of crypto are a mess. No doubt about it. But it's not right to broadly generalize that all of crypto is. Whether you like it or not... or understand it or not... crypto is here.

Coinbase is one of the most successful fintech companies of all time. Square is investing in it. Plaid is investing in it. Nubank is investing in it. Visa is investing in it. Mastercard is investing in it. Checkout.com's Chief Commercial Officer is evangelizing it. The list goes on.

Crypto is here to stay and will continue growing mindshare throughout 2023.

Reading material:

- The Block: Data

- VanEck: Ethereum Exchange, Beacon Chain, and Smart Contract Supplies

- Fortune: Coinbase seals its rank as the 7th biggest new US listing of all time

- CNBC: Buffett-backed digital bank Nubank to launch its own cryptocurrency in Brazil

- Financial Columnist: Why stablecoins present a 'right side of history' moment for early adopters

Macro

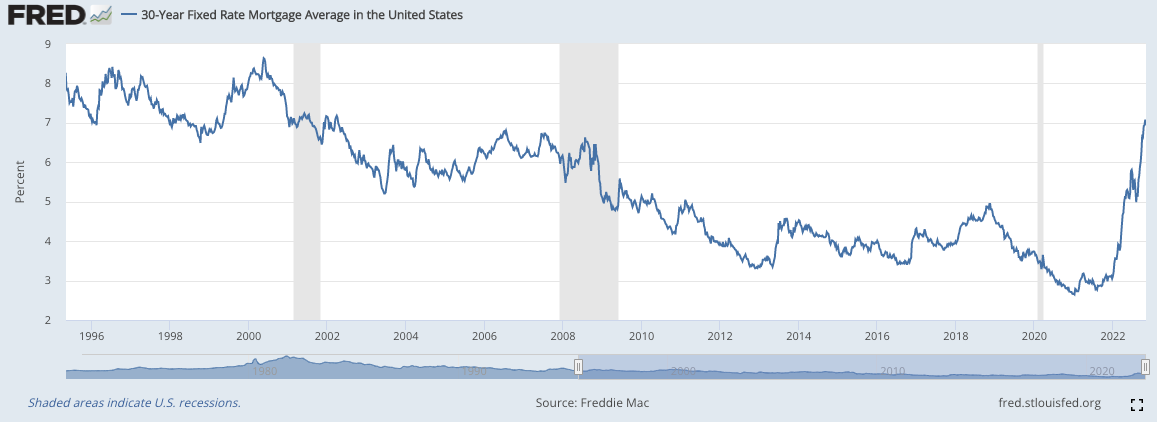

As Deloitte highlights, "the global economy is in a fragile and fractious state." This week alone, we've seen layoffs at fintech darlings like Chime, Stripe, and Opendoor. Interest rates are rising rather rapidly. In just the last 12 months, 30yr fixed mortgage rates went from under 3% to ~7%, the highest in 20 years.

This has implications for everyone, including fintech startups that only know a low-interest rate (aka free money) environment. Funding costs rise as interest rates increase. Fintech companies that borrow to lend are in a tougher position now. As for banks, higher rates should result in higher net interest income, but they need to worry about leakage and a weaker consumer due to inflation and lower savings rates.

The ever-changing macro environment will surely consume a lot of mindshare throughout 2023.

Reading material:

- FRED: Fed Funds Effective Rate

- Deloitte: 2023 banking and capital markets outlook

- FRED: 30-year Fixed Rate Mortgage Average in the US

- Forbes: How Higher Interest Rates May Upend The Fintech Business Model

- Coatue: Fintech and the Pursuit of the Prize: Who Stands to Win Over the Next Decade?

- The Financial Brand: Deposit Strategies Must Be Revised Before Funds Exit for Higher Rates

Conclusion

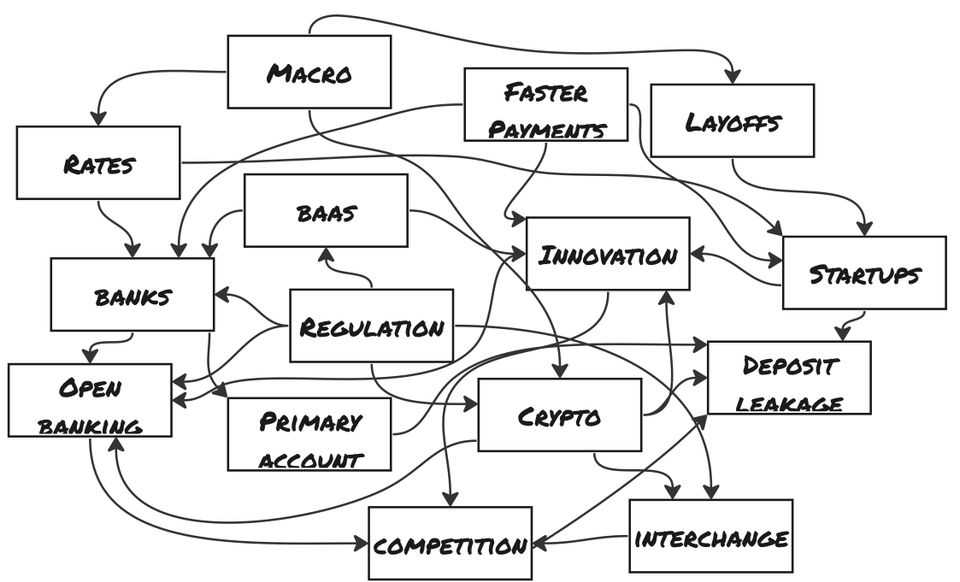

It's remarkable how connected everything is. Higher interest rates and a more challenging macro environment have resulted in layoffs across many fintech companies. Talent with great experience hitting the market should result in more founders starting companies. Leveraging BaaS, faster payment systems, and tailwinds with open banking should result in more competitive products coming to the market. New, faster payment systems, and regulations to decrease interchange could result in new payment products and behaviors.... you can go on and on in various directions with this. Block alone has implemented faster payment methods, crypto, frictionless direct deposit switching, has a global BNPL provider and an ILC. More products will result in even more leakage.

When reflecting on the areas highlighted in this post, I'm excited about the future for both consumers and businesses from an innovation standpoint (of course, I'm sympathetic to the hardships the macro environment creates). There will be a great deal of opportunity for talented entrepreneurs to create meaningful products and companies over the next few years. Customers are savvier than ever and have proven to be willing to adopt newer services. Businesses of all kinds are competing in newer areas and trying to make their products as sticky as possible. More fintech giants will likely be birthed in the 2020-2030 vintage than 2010-2020, with even more sustainable models.

DM me on Twitter or LinkedIn if you want to school me on anything I got wrong, or am missing, about potential product and startup ideas or just to say hi 👋.