Some Fintech things

Here’s what this post will cover:

- My Career

- A bit on Fintech & the industry over the past 10 years

- Hot areas in Fintech

A Decade in Fintech

My last 10ish Years

My career began at Bill Me Later in 2007. BML was a pioneer in the online transactional credit space and was acquired by PayPal in 2009 (the offering is very much alive and well today– branded ‘PayPal Credit’). My time at BML and PayPal was extremely formative. I was exposed to an entirely new world. One that included product management, product development, marketing, e-commerce, and incredible people. BML bucked all of the startup stereotypes. It was a hell of a first job.

I left in 2011 to join Millennial Media. MM started around the time of the iPhone launch in 2007 and became the leading independent mobile advertising company, competing with heavyweights AdMob and Quattro/iAd. I left my comfortable job at PayPal because of exactly that– I was getting comfortable. I wanted to experience life in a different organization with different people. I saw hypergrowth up close and personal and met some fantastic people. I’m happy I decided to leave a comfortable place for a new experience. That’s always a little scary. I learned a lot about product development in a fast-paced environment and gained experience in a set of new disciplines that I wasn’t previously exposed to, like sales and account management.

With that being said, I learned that I really didn’t enjoy working on things that I couldn’t find relatable on a daily basis. Although ad networks are interesting, complex, and vital to digital ecosystems, I wasn’t passionate enough to want to spend much more time in the space.

I went back to PayPal two years later. Although I technically worked there before, the environment was completely different than the one I left a few years before. I got to own a distributed product development team and be a part of a huge international project including hundreds of people, 3 countries, and tight deadlines. As tough and frustrating the environment was, I’m thankful for the experience and was proud of what we accomplished. If you’ve read my blog or follow me on Twitter, you know how often I preach about the value of gaining experience inside both large and small orgs.

Two years later came Blispay– a seed-stage, pre-product startup with a dream team. Joining was a no-brainer due to the low perceived risk. My framework:

- Career Risk

- Market Risk

- Technical Risk

- Execution/Operational Risk

We were a B2B2C company focused on helping omnichannel SMBs grow by offering their consumers a credit product that was essentially a mix between a BNPL offering & an everyday cashback card. We instantly decisioned consumers, instantly issued, and gave 6 months of no payments, no interest on purchases of $199+, and 2% cash back on all purchases. If you’re scratching your head then just take this away: we were a point of sale lending startup. We used to say that Blispay was for your laptop and your lattes as a consumer. We helped businesses sell more without charging them anything. It was an amazing experience that I’ll cherish forever, despite the exit coming earlier and falling shorter than we hoped for.

Startups are hard. And lending startups are really, really hard.

Alliance Data Systems acquired us after four years. The ending of the Blispay years and being acquired was challenging to process. I wrote a bit about it in this 2019 reflection post, and later in a post titled, Finding your mojo post Acqui-hire. It was apparent relatively early that many of my colleagues and I wouldn’t be spending the rest of our careers at ADS. It’s not exactly a company any of us would have proactively applied to for various reasons. With that said, it allowed me to exercise some professional muscles that I hadn’t needed to use while at Blispay, and my team was tasked with building something vital to their future. We delivered on that, and I’m proud to leave knowing the impact our work could end up having on the company. COVID is a headwind to their business, and our work will directly enable them to better compete in an increasingly digital world.

Fintech’s last 10ish Years

None of these existed prior to 2009 🤯:

Stripe, Square, Shop Pay, Venmo, Zelle, TransferWise, Remitly, Branch, Brex, Robinhood, Simple, Chime, Current, Varo, BlueVine, Apple Card, Marcus, Very Good Security, True Accord, Afterpay, Affirm, Carta, Coinbase, Gemini, Bitcoin, Ethereum, Fundrise, Personal Capital, Wealthfront, Betterment, SoFi, Plaid, Opendoor, Figure, Nova Credit, [Jared… take a deep breath…ok … keep going], Privacy.com, Rally Rd., GumRoad, Upstart, LendUp, Alloy, SentiLink, Marqeta, Finix, Dwil, nCino, Mambu, SynapseFI, Mercury, Unit, Modern Treasury, Lendflow, Root Insurance, Bond, Azlo, BankMobile, Joust Bank, Airwallex, Novo, Mantl… the list goes on.

There are huge problems to be solved that many outside our space could never even fathom. There’s been tremendous progress but there’s still tremendous opportunity. I learn about a new one every day. For example, my friend Ritchie just told me about Mantl, a fellow Techstars co. They helped solve a problem for Radius Bank and now they’re killing it. One of the coolest things about fintech is that while many of us could compete in ways, we can also learn a lot from each other and find ways to work together. The problem space is massive.

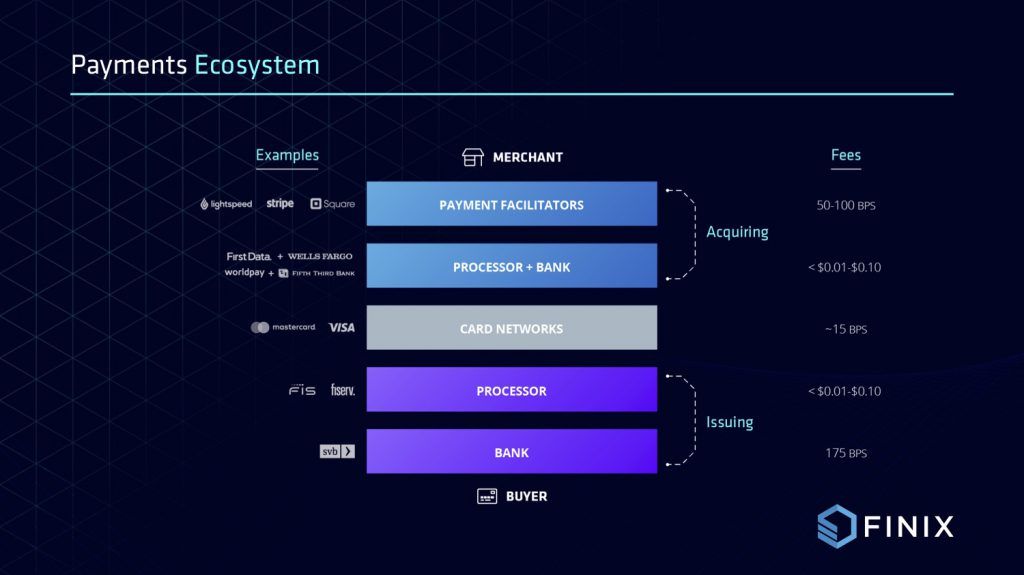

The complexity of the payments ecosystem makes for endless opportunities.

Even these didn’t exist: ZenBusiness, BigCommerce, WooCommerce, Fiverr, Handy, Toptal, Boatsetter, Toast, Slice, DoorDash, VitusVet, Funnel, the Durbin amendment, COVID-19…

Consumers are benefitting, businesses are benefitting, and it’s still early innings (I hate baseball, but, whatever).

Fintech Today, and in the Future

Fintech isn’t new.

But Fintech’s having a moment.

It’s nearly memeable!

Just today I learned that BaaSGoat is a thing, because, why not 🤷♀️

Fintech News

The sheer amount of announcements and fresh news outlets is a direct reflection of the rapid pace of development in the space. And it’s not slowing down. Here are some headlines from just the past couple of days:

- Google signs up six more partners for its digital banking platform coming to Google Pay

- Jobber partners with Stripe to activate financing and instant payouts for home service businesses

- Intuit launches QuickBooks Cash accounts for small biz

- ZenBusiness buys Joust

- BankMobile Technologies, a Subsidiary of Customers Bank, and Megalith Financial Acquisition Corp. Agree to Combine to Bring a Digital Banking Platform to the Public Market under the New Name BM Technologies

- Global Payments Joins Forces with AWS to Deliver the Future of Payments

- Mobile bank Current launches a points rewards program for debit card users

And here are just a few of the recent opinion articles, reports, and interviews:

- Fintech Scales Vertical SaaS

- Banking as a Service: reimagining financial services with modular banking

- Embedded Lending

- Finance As A Service (FaaS)— Tech Stack for Modern Finance Teams

- How Payments Fintech Is Using Banking As A Service To Drive Growth

- Uber’s Departure From Financial Services: A Speed Bump On The Path To Embedded Finance

- Shopify & Embedded Finance, Part 1: Analyzing Shop Pay’s Flywheel

- The Financialization of Everything

- FIS’ Nicole Jass on helping SMBs with new products and features during this crisis

Fintech News Sources

I remember when we just had a few sources to go to. TechCrunch, PYMNTS, First Annapolis, Ron Shevlin, and Jordan McKee.

Now we have a lot more:

- a16z Fintech. Soo much greatness. Alex Rampell, Angela Strange, Seema Amble, Rex, and others.

- 11:FS newsletter, podcast, blog, and Twitter. Their latest report on BaaS is 🔥 (h/t Will White & Cokie). Sam Maule, Simon Taylor, and others.

- ARK Invest newsletter, podcast, and analysts like Max, George, and Yassine.

- This Week In Fintech newsletter by Nik Milanovic.

- Fintech Today newsletter and Twitter by Ian Kar and Cokie Hasiotis.

- FT Partners newsletter and Twitter.

- Tearsheet newsletters, podcast, and Twitter.

- Breaking Banks podcast.

Hot Areas/Trends

Here’s where much of the action and opportunities are.

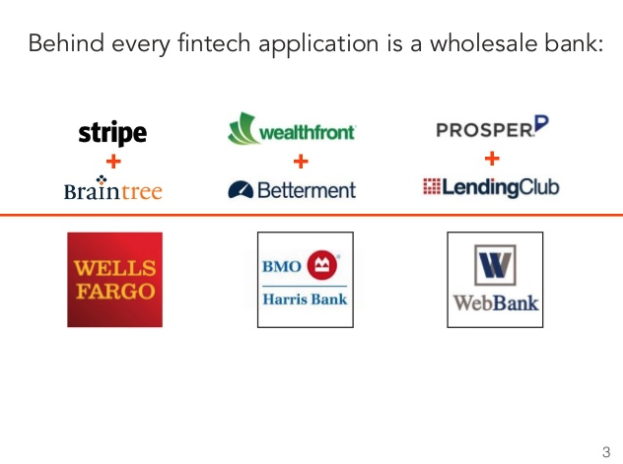

Embedded Finance

I don’t actually love the term because its popularity significantly lagged its existence. In a way, Fintech and Embedded Finance go hand in hand. They always have. I actually think most Fintech is a form of Embedded Finance. Financial services have long required partnerships and the compiling of building blocks from different companies or services to form an actual working thing of value. Financial services have always been built on top of a foundation of mutualistic relationships. And as we all know, non-financial companies all have financial components. They’ve always needed the ability to store and move money in and out.

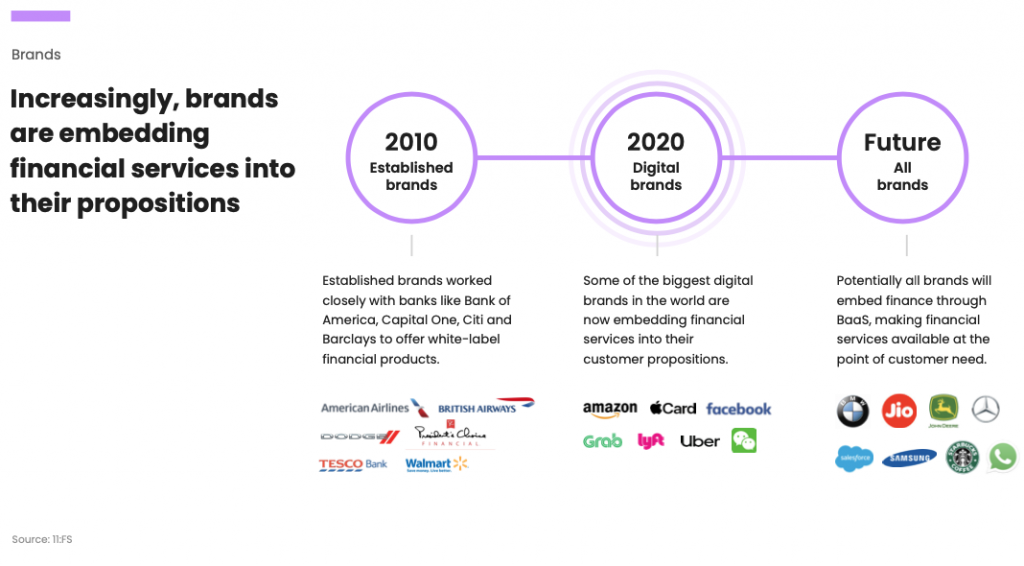

Nonetheless, the phrase ‘Embedded Finance’ is picking up speed and has made way for the phrase, “everything is fintech.” Check out Disrupting Financial Services– Every Company will be a Fintech Company from a16z’s Angela Strange. BaaS and other service-based components in the stack are key enablers of modern embedded financial services.

Embedded Finance is all about leveraging a partner to your benefit, to your customers benefit, and often, to the benefit of at least one other party too. Party A brings the fintech, and Party B brings the distribution– a network filled with thousands of Party C’s. Those in the network benefit from the fintech, the network operator benefits by the network benefitting, and the fintech operator benefits from the growth. Often times, the fintech operator is actually built on top of one or many other services, which is why I said that at least one other party often benefits as well (Party D, E, F, etc.). It’s actually a beautiful thing.

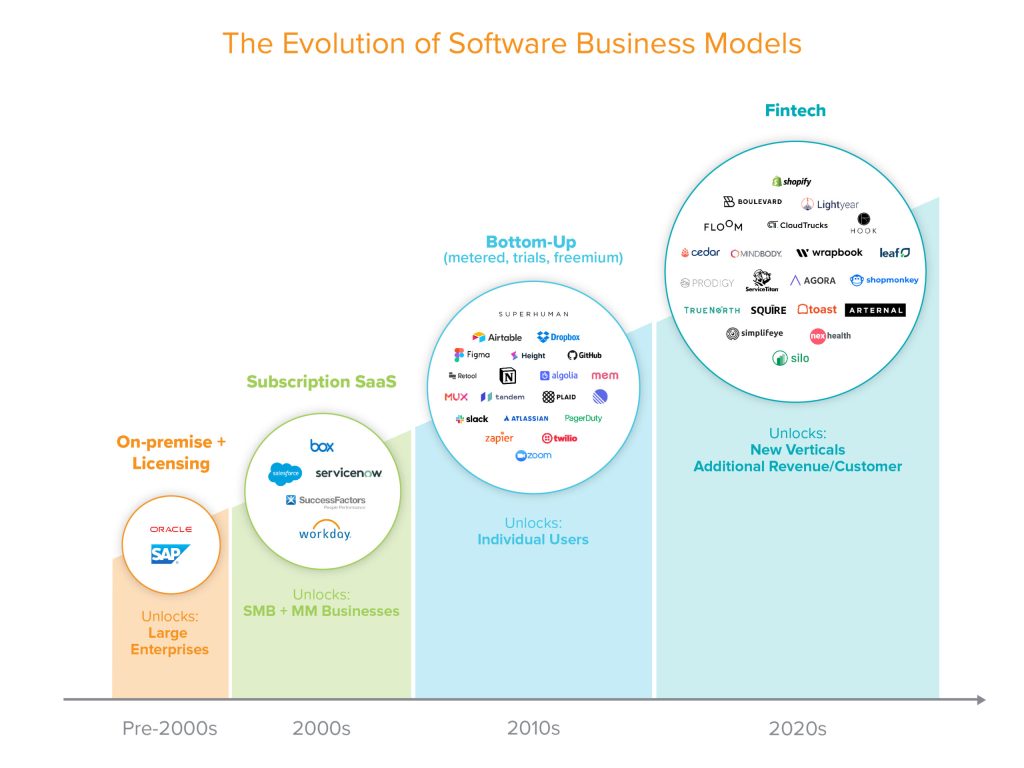

Software business models are evolving. Fintech isn’t only evolving with them but can serve as a flywheel to accelerate evolution. Angela wrote, “Embedding fintech (rather than just reselling) improves margins and makes the product stickier.”

Said differently by Don Richard, “Embedded fintech should also be called embedded distribution.” The great team at Finix helps us visualize the evolution specific to payments.

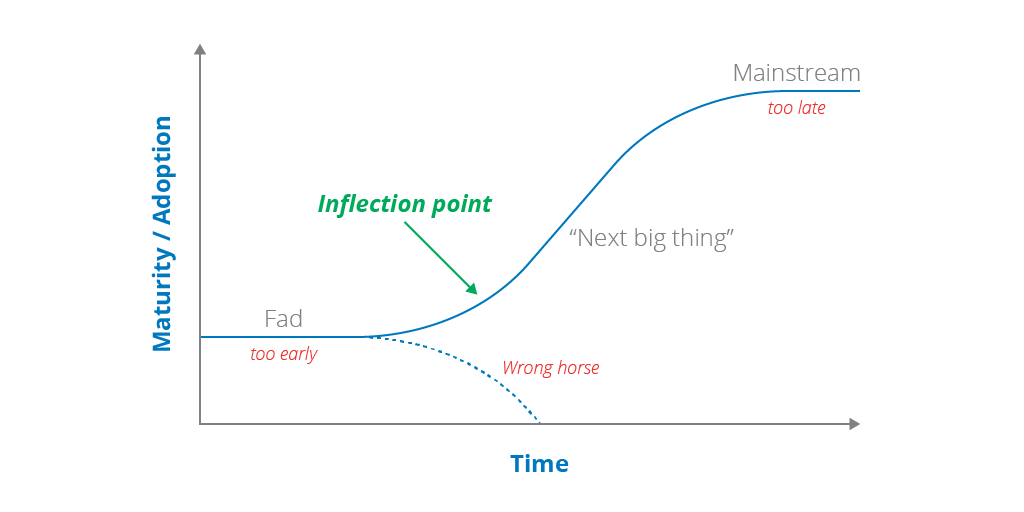

It seems like we’re near the inflection point for modern embedded finance (h/t Dempsey). It’s mostly due to the “possible maturation of platform technologies.” But also “emerging behaviors from generational shifts” as demonstrated by the beloved flagship example of Uber making the rider and payment experience near-frictionless.

BaaS (Banking as a Service)

This 11:FS report is the holy grail. There’s no additional color for me to provide. 11:FS crushed it, and I have a ton I need to learn about the current offerings.

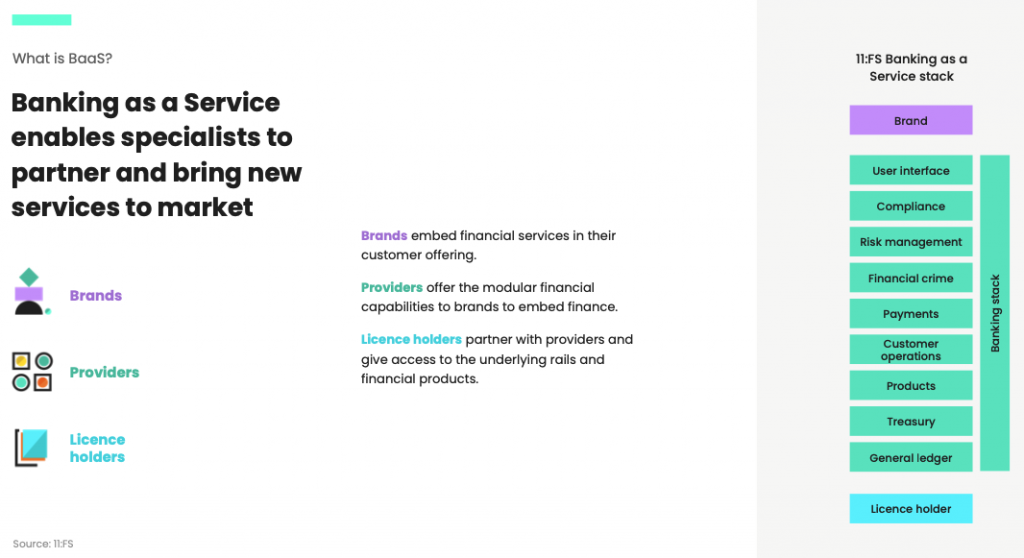

“Banking as a Service (BaaS) is the provision of complete banking processes (such as loans, payments or deposit accounts) as a service using an existing licensed bank’s secure and regulated infrastructure with modern API-driven platforms.”

Similar to what Angela highlighted above, here’s what the stack looks like:

Here’s the evolution towards everything and everyone becoming fintech:

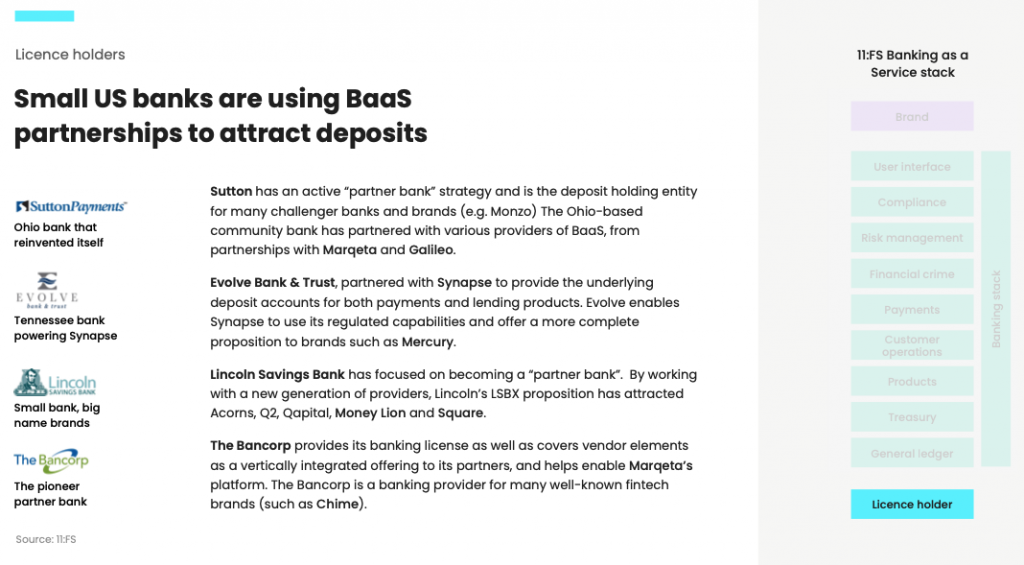

Here’s an example of what I meant when I said Party D, E, F, etc. benefit too:

Marketplaces & Platforms

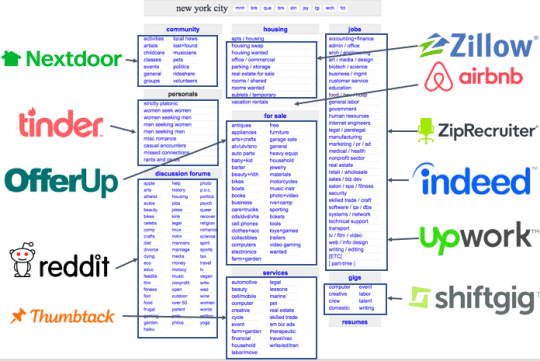

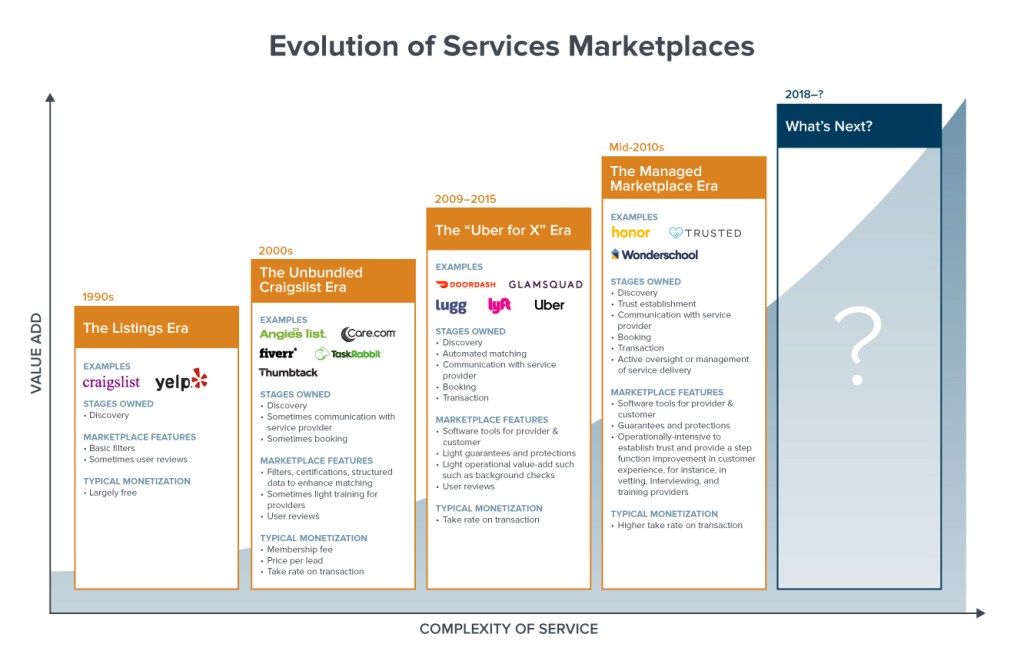

I still get a kick out of transacting on a marketplace like eBay or Swappa. Buying and selling to someone across the country or world is just one of those magical digital experiences. One of my favorite things about marketplaces is that they [usually] help to level the playing field, and I’m a fan of anyone or anything that helps create opportunities for those who need help doing so. They also make for amazing businesses at scale that can last a very, very long time. Look at Craigslist and eBay. Platforms are here to stay but are evolving– they’re being unbundled as explained by a16z in articles such as Platforms vs Verticals and the Next Great Unbundling.

New opportunities are emerging every year.

Neo / Challenger Banks

What’s the difference? Amanda James details this for us in Neo Bank Vs Challenger Bank:

- “Neo banks do not have a brick-and-mortar physical structure at all. Challenger Banks, though small in size, are physically present.

- Neo banks do not have a banking license but rely on a partner bank to operate. A Challenger bank has a full banking license to operate the full suite of banking operations.

- Neo banks tend to focus on a particular customer segment like SMEs, but Challenger banks cover the entire gamut of banking operations.”

We obviously have far more neo banks here in the US than challenger banks (is Varo the only one? Will Square Financial Services count?).

At least a dozen neo banks have been born here in the US in the last decade. Simple is a crowd favorite and was the pioneer of consumer neo banks.

Although not exactly relevant to the neo bank topic, it’s worth noting that leveraging a sponsor bank to offer financial services isn’t new. For example, Bill Me Later had been doing it since the early 2000s with banks like CIT Bank and WebBank.

One of the best things about neo banks is they’ve upped the table-stakes for a banking experience, especially for consumers. It appears like there’s been a lot more neo bank action on the consumer side than the business side in the past few years. Maybe this is because PayPal has been so dominant for so long. Historically, startups have led the neo bank charge powered by progressive, innovative banks. But large tech companies have been watching and will be getting involved. Google just announced their upcoming entrance. Never underestimate the power and value of distribution.

Crypto

Of course it needs to be mentioned. It's here. It's real. It's not going away. It's just getting going.

Why Fintech is a great area to focus

- It's easy to find things that are useful, interesting, and relatable/relevant.

- Abundant learning opportunities.

- Great people with many valuable networks. Many of whom are mission driven.

- Solid mix of conventional & non-conventional opportunities.

- Lifestyle and Quality of life (I love Remote work).

- Proper risk/reward profiles.